Over the past six months, Abercrombie and Fitch’s shares (currently trading at $71.63) have posted a disappointing 8.4% loss, well below the S&P 500’s 16.9% gain. This might have investors contemplating their next move.

Following the pullback, is now a good time to buy ANF? Find out in our full research report, it’s free for active Edge members.

Why Does Abercrombie and Fitch Spark Debate?

Founded as an outdoor and sporting brand, Abercrombie & Fitch (NYSE: ANF) evolved to become a specialty retailer that sells its own brand of fashionable clothing to young adults.

Two Things to Like:

1. Surging Same-Store Sales Show Increasing Demand

Same-store sales is an industry measure of whether revenue is growing at existing stores, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Abercrombie and Fitch has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 13.5%.

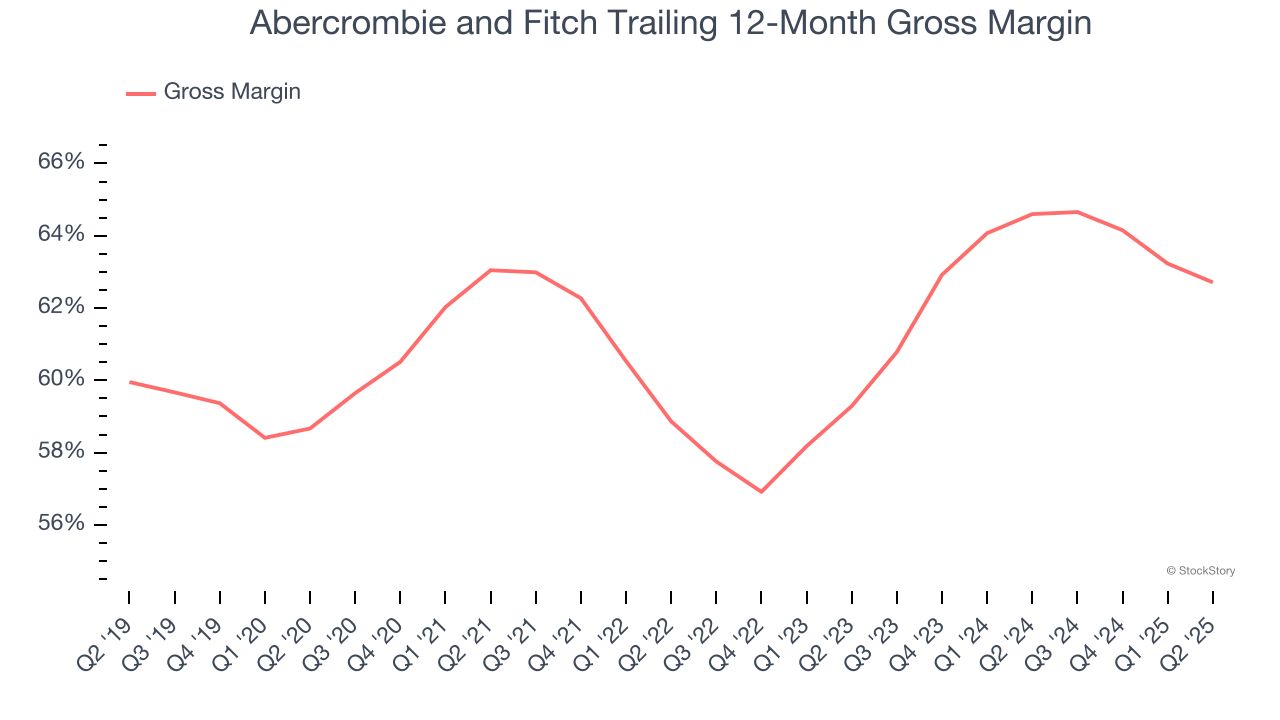

2. Elite Gross Margin Powers Best-In-Class Business Model

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Abercrombie and Fitch has best-in-class unit economics for a retailer, enabling it to invest in areas such as marketing and talent to grow its brand. As you can see below, it averaged an elite 63.6% gross margin over the last two years. That means Abercrombie and Fitch only paid its suppliers $36.39 for every $100 in revenue.

One Reason to be Careful:

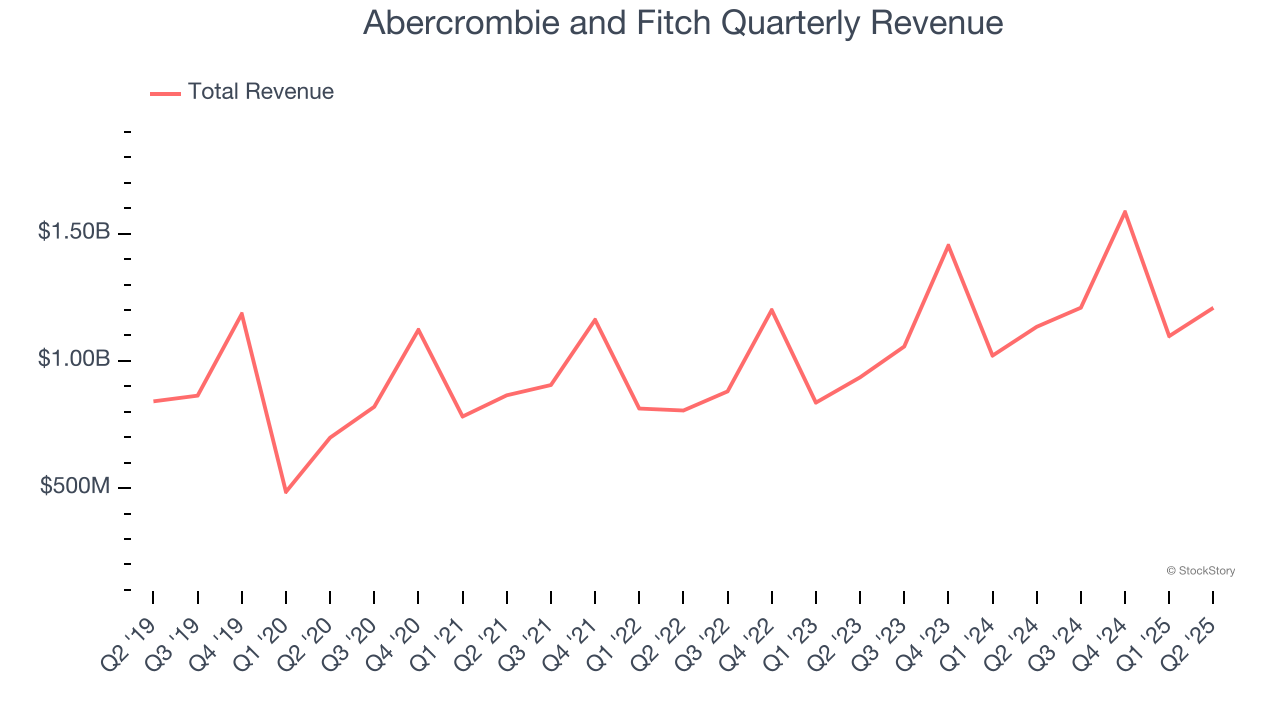

Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Abercrombie and Fitch’s 6% annualized revenue growth over the last six years was tepid. This wasn’t a great result compared to the rest of the consumer retail sector, but there are still things to like about Abercrombie and Fitch.

Final Judgment

Abercrombie and Fitch’s merits more than compensate for its flaws. With the recent decline, the stock trades at 7.3× forward P/E (or $71.63 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free for active Edge members .

High-Quality Stocks for All Market Conditions

Fresh US-China trade tensions just tanked stocks—but strong bank earnings are fueling a sharp rebound. Don’t miss the bounce.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.