Granite Construction currently trades at $102.54 and has been a dream stock for shareholders. It’s returned 326% since November 2020, blowing past the S&P 500’s 85.8% gain. The company has also beaten the index over the past six months as its stock price is up 17.9%.

Is now still a good time to buy GVA? Or are investors being too optimistic? Find out in our full research report, it’s free for active Edge members.

Why Does Granite Construction Spark Debate?

Having played a role in the construction of the Hoover Dam, Granite Construction (NYSE: GVA) is a provider of infrastructure solutions for roads, bridges, and other projects.

Two Positive Attributes:

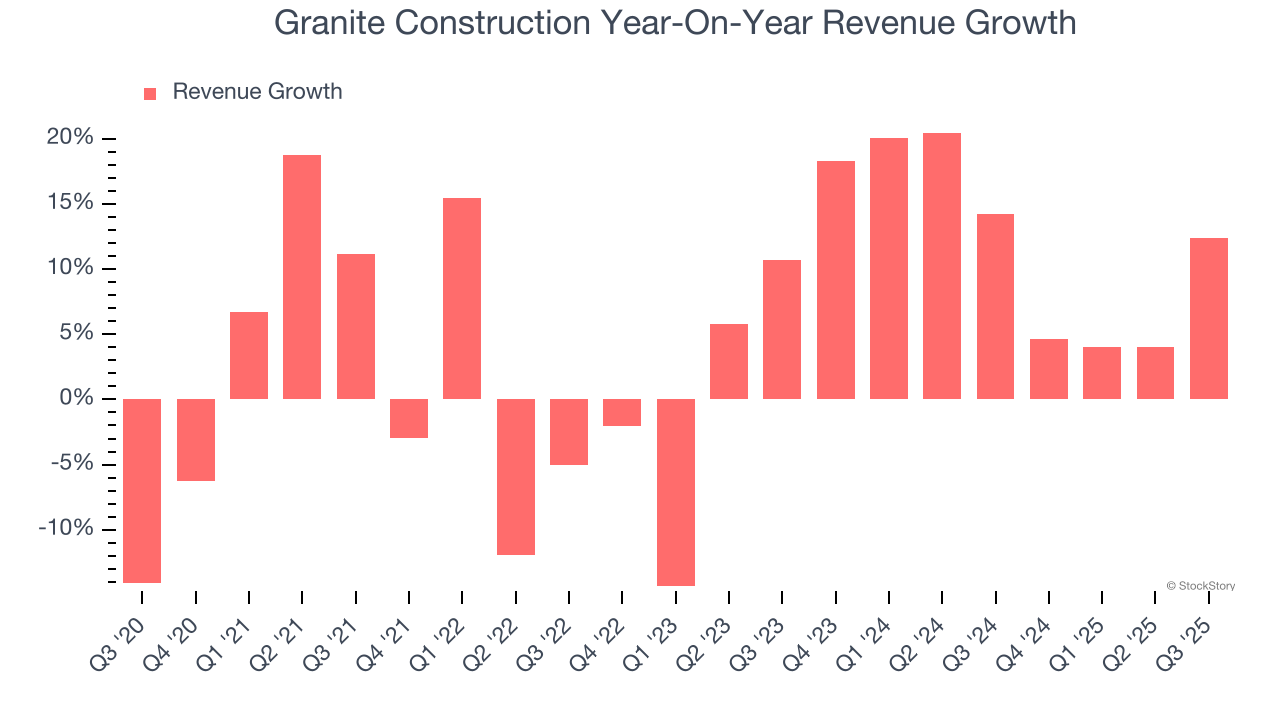

1. Skyrocketing Revenue Shows Strong Momentum

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. Granite Construction’s annualized revenue growth of 12.2% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

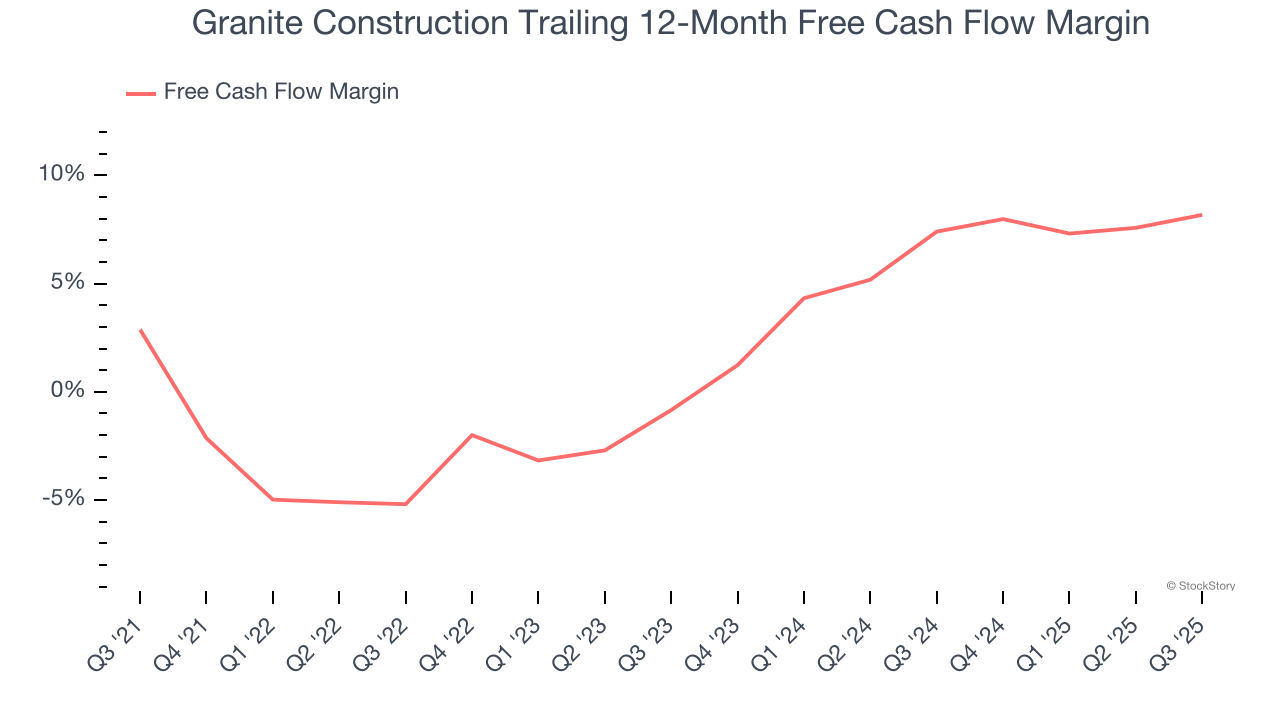

2. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Granite Construction’s margin expanded by 5.3 percentage points over the last five years. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality. Granite Construction’s free cash flow margin for the trailing 12 months was 8.2%.

One Reason to be Careful:

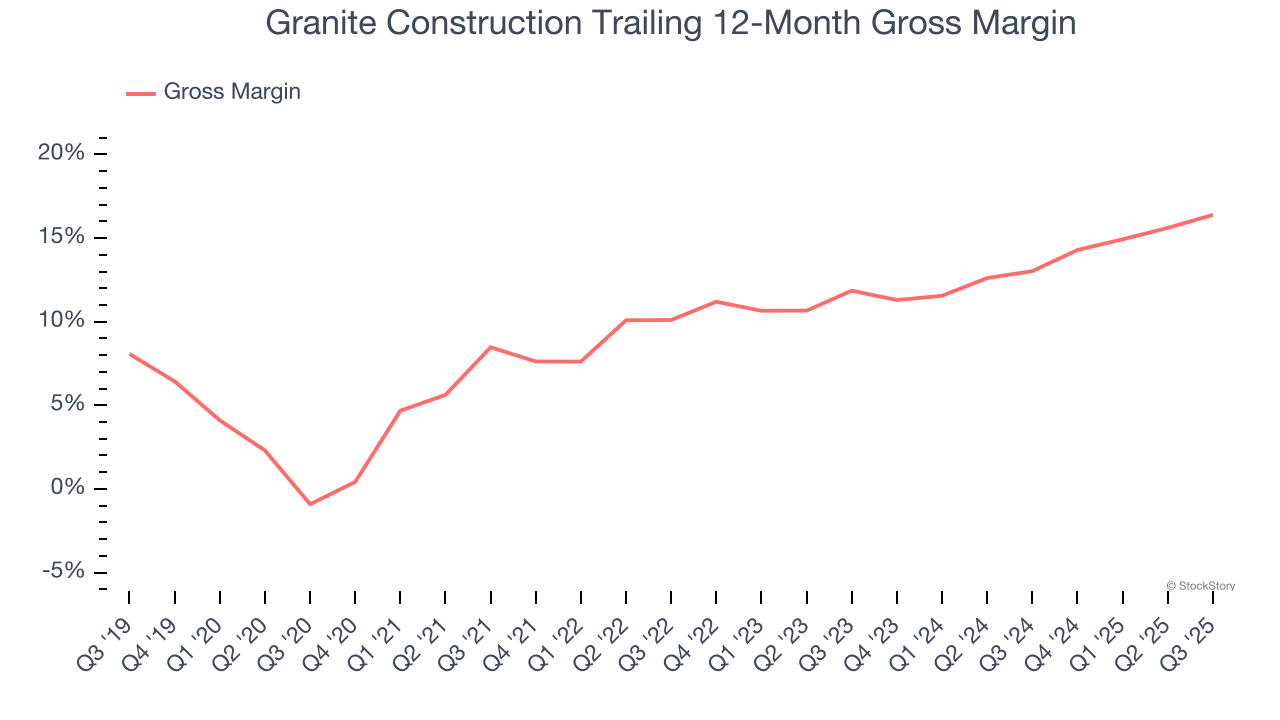

Low Gross Margin Reveals Weak Structural Profitability

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Granite Construction has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 12.2% gross margin over the last five years. Said differently, Granite Construction had to pay a chunky $87.79 to its suppliers for every $100 in revenue.

Final Judgment

Granite Construction’s merits more than compensate for its flaws, and with its shares beating the market recently, the stock trades at 17.3× forward P/E (or $102.54 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.