Let’s dig into the relative performance of Wynn Resorts (NASDAQ: WYNN) and its peers as we unravel the now-completed Q3 casino operator earnings season.

Casino operators enjoy limited competition because gambling is a highly regulated industry. These companies can also enjoy healthy margins and profits. Have you ever heard the phrase ‘the house always wins’? Regulation cuts both ways, however, and casinos may face stroke-of-the-pen risk that suddenly limits what they can or can't do and where they can do it. Furthermore, digitization is changing the game, pun intended. Whether it’s online poker or sports betting on your smartphone, innovation is forcing these players to adapt to changing consumer preferences, such as being able to wager anywhere on demand.

The 9 casino operator stocks we track reported a slower Q3. As a group, revenues beat analysts’ consensus estimates by 1.5%.

While some casino operator stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.7% since the latest earnings results.

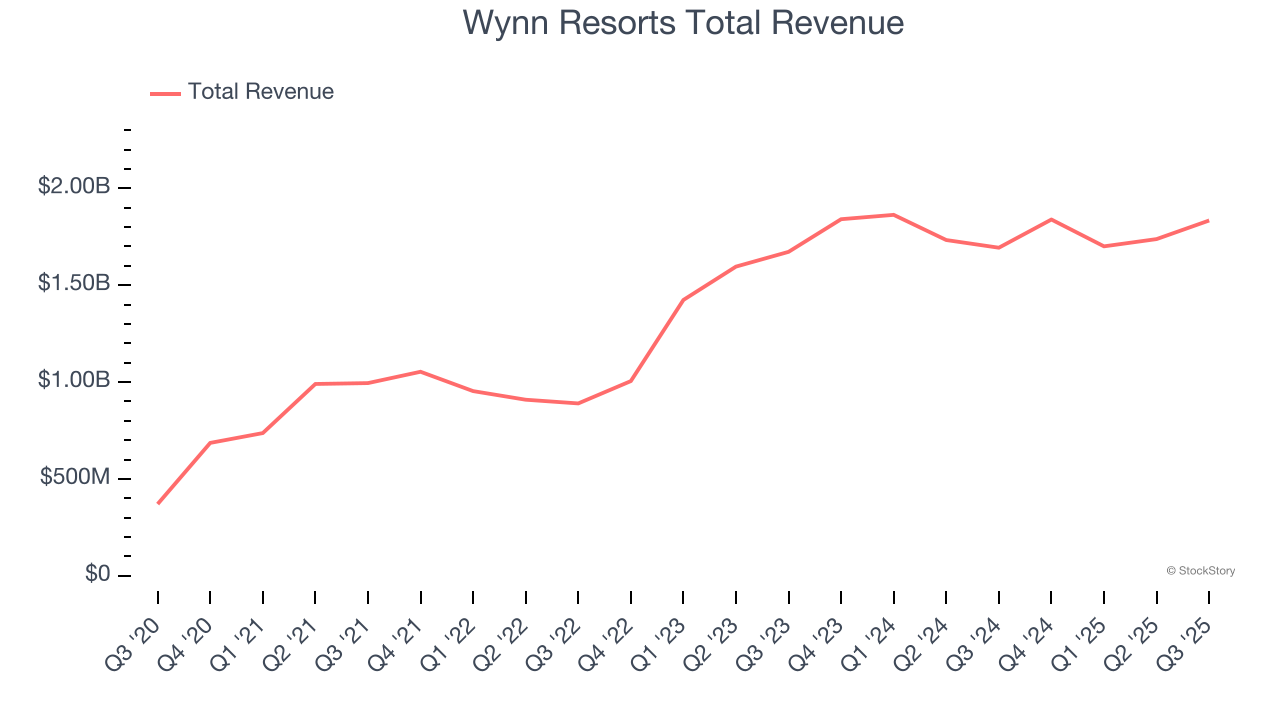

Wynn Resorts (NASDAQ: WYNN)

Founded by the former Mirage Resorts CEO, Wynn Resorts (NASDAQ: WYNN) is a global developer and operator of high-end hotels and casinos, known for its luxurious properties and premium guest services.

Wynn Resorts reported revenues of $1.83 billion, up 8.3% year on year. This print exceeded analysts’ expectations by 3.4%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EPS estimates and a miss of analysts’ Hotel revenue estimates.

"Our third quarter results were marked by impressive EBITDA growth in Macau, and continued outperformance in Las Vegas," said Craig Billings, CEO of Wynn Resorts, Limited.

Wynn Resorts pulled off the fastest revenue growth of the whole group. Still, the market seems discontent with the results. The stock is down 7.1% since reporting and currently trades at $118.38.

Read our full report on Wynn Resorts here, it’s free for active Edge members.

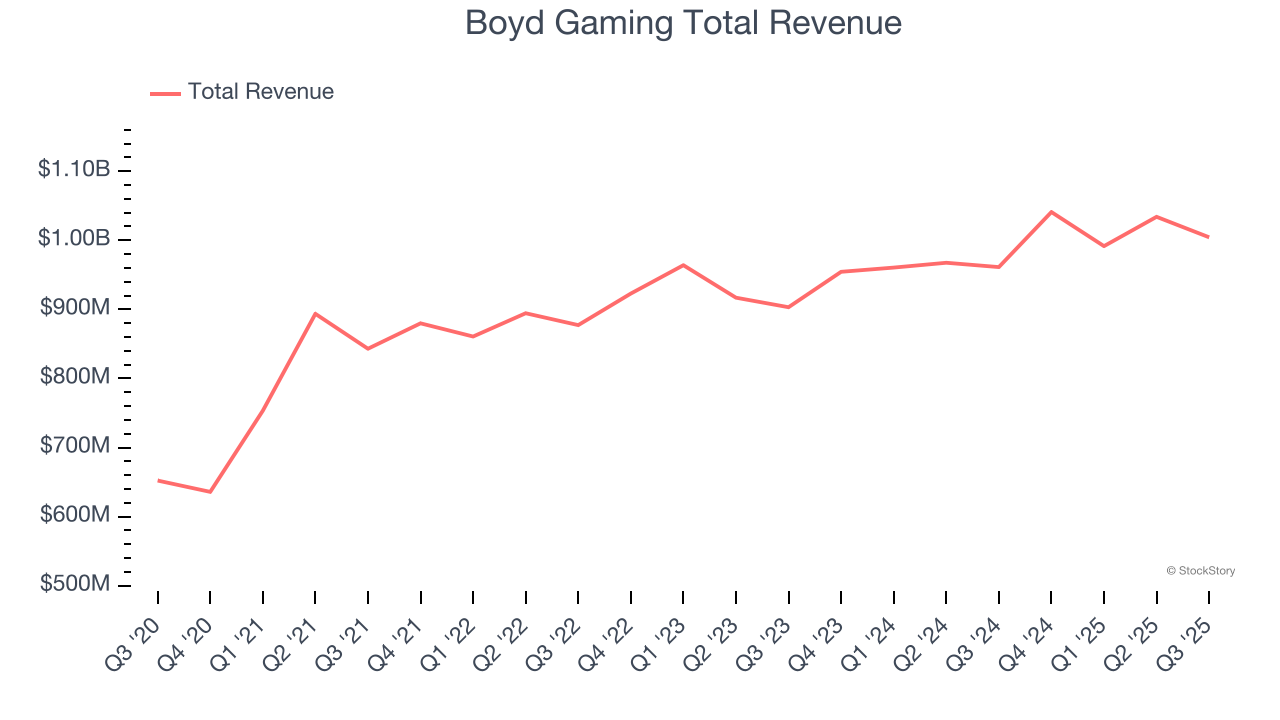

Best Q3: Boyd Gaming (NYSE: BYD)

Run by the Boyd family, Boyd Gaming (NYSE: BYD) is a diversified operator of gaming entertainment properties across the United States, offering casino games, hotel accommodations, and dining.

Boyd Gaming reported revenues of $1.00 billion, up 4.5% year on year, outperforming analysts’ expectations by 15.7%. The business performed better than its peers, but it was unfortunately a mixed quarter with an impressive beat of analysts’ revenue estimates but a significant miss of analysts’ adjusted operating income estimates.

Boyd Gaming achieved the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 7.1% since reporting. It currently trades at $78.95.

Is now the time to buy Boyd Gaming? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: MGM Resorts (NYSE: MGM)

Operating several properties on the Las Vegas Strip, MGM Resorts (NYSE: MGM) is a global hospitality and entertainment company known for its resorts and casinos.

MGM Resorts reported revenues of $4.25 billion, up 1.6% year on year, in line with analysts’ expectations. It was a disappointing quarter as it posted a miss of analysts’ Hotel revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

The stock is flat since the results and currently trades at $31.22.

Read our full analysis of MGM Resorts’s results here.

Bally's (NYSE: BALY)

Headquartered in Providence, Rhode Island, Bally's Corporation (NYSE: BALY) is a diversified global casino-entertainment company that owns and manages casinos, resorts, and online gaming platforms.

Bally's reported revenues of $663.7 million, up 5.4% year on year. This number lagged analysts' expectations by 0.7%. Overall, it was a softer quarter as it also recorded a significant miss of analysts’ adjusted operating income and EPS estimates.

The stock is down 9.8% since reporting and currently trades at $16.77.

Read our full, actionable report on Bally's here, it’s free for active Edge members.

Red Rock Resorts (NASDAQ: RRR)

Founded in 1976, Red Rock Resorts (NASDAQ: RRR) operates a range of casino resorts and entertainment properties, primarily in the Las Vegas metropolitan area.

Red Rock Resorts reported revenues of $475.6 million, up 1.6% year on year. This result missed analysts’ expectations by 0.8%. Taking a step back, it was a mixed quarter as it also produced a beat of analysts’ EPS estimates but a miss of analysts’ Hotel revenue estimates.

The stock is down 7.5% since reporting and currently trades at $54.80.

Read our full, actionable report on Red Rock Resorts here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.