CAVA has gotten torched over the last six months - since May 2025, its stock price has dropped 39.3% to $49.75 per share. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in CAVA, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free for active Edge members.

Why Is CAVA Not Exciting?

Even though the stock has become cheaper, we're cautious about CAVA. Here are three reasons there are better opportunities than CAVA and a stock we'd rather own.

1. Weak Operating Margin Could Cause Trouble

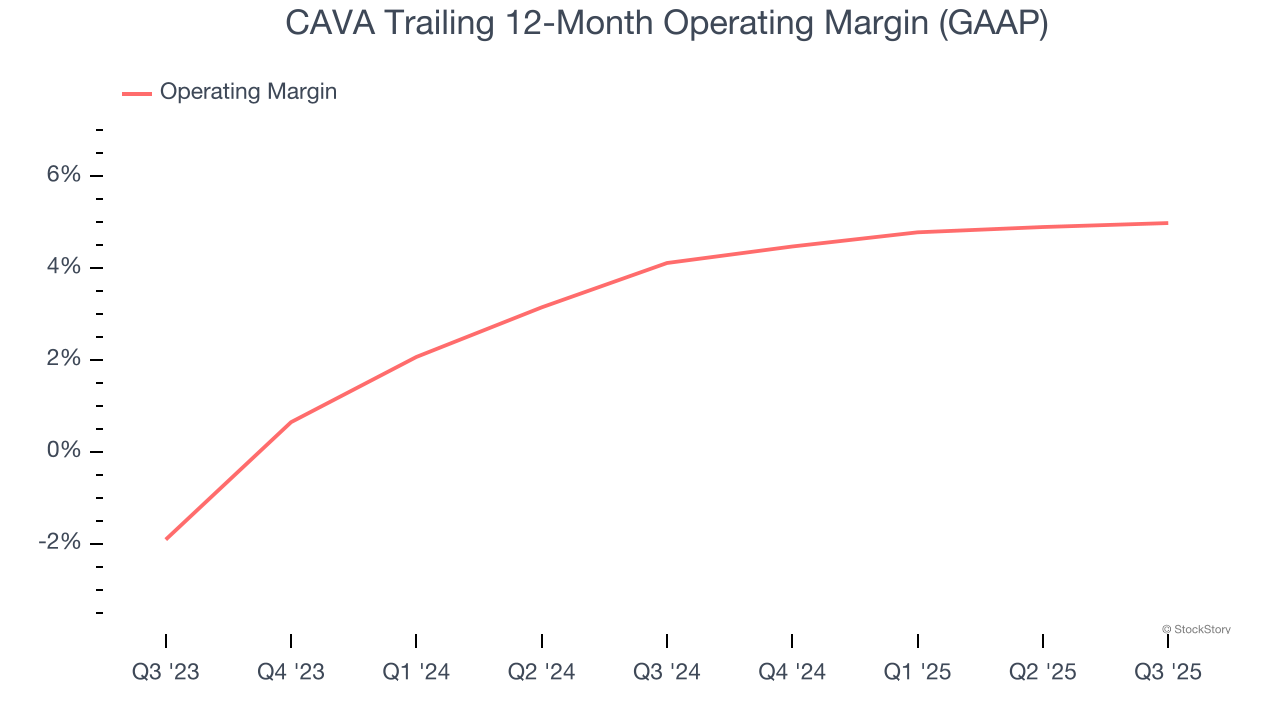

Operating margin is a key profitability metric because it accounts for all expenses keeping the business in motion, including food costs, wages, rent, advertising, and other administrative costs.

CAVA’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 4.6% over the last two years. This profitability was lousy for a restaurant business and caused by its suboptimal cost structure.

2. EPS Trending Down

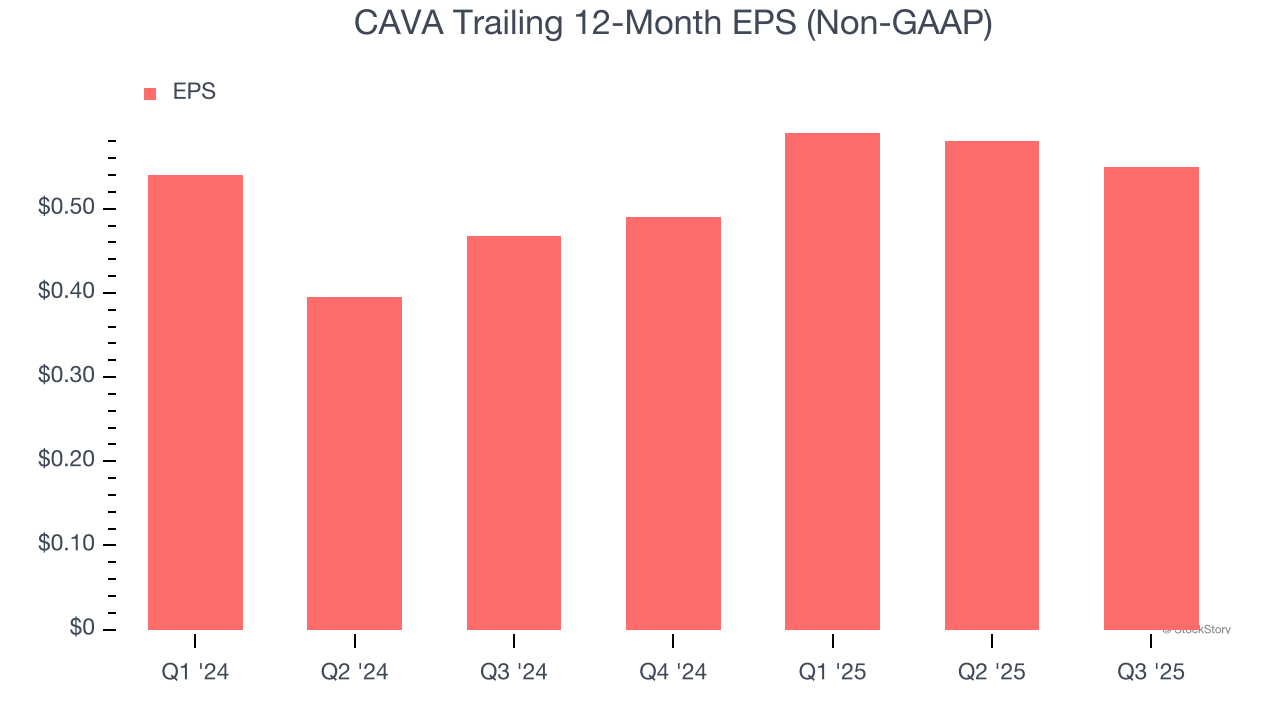

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

CAVA’s full-year EPS dropped 33.7%, or 15.6% annually, over the last two years. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

CAVA’s five-year average ROIC was negative 5.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the restaurant sector.

Final Judgment

CAVA’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 86.4× forward P/E (or $49.75 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better stocks to buy right now. We’d suggest looking at one of Charlie Munger’s all-time favorite businesses.

Stocks We Like More Than CAVA

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.