Business development company Capital Southwest (NASDAQ: CSWC) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 16.9% year on year to $56.95 million. Its GAAP profit of $0.44 per share was 22.3% below analysts’ consensus estimates.

Is now the time to buy Capital Southwest? Find out by accessing our full research report, it’s free for active Edge members.

Capital Southwest (CSWC) Q3 CY2025 Highlights:

In commenting on the Company’s results, Michael Sarner, President and Chief Executive Officer, stated, “The September quarter was an incredibly active quarter on the origination front for Capital Southwest, with approximately $245 million of originations in seven new and ten existing portfolio companies. Additionally, we have continued to successfully harvest realized gains with the exit of one equity investment this quarter, increasing our undistributable taxable income balance to $1.13 per share. During the quarter, the Board of Directors again declared a regular monthly dividend of $0.1934 for each of October, November and December 2025 and a quarterly supplemental dividend of $0.06 to be paid in December 2025. On the capitalization front, we successfully raised $350 million at 5.950% in our inaugural index-eligible unsecured bond transaction. Subsequent to quarter end, we used a portion of the proceeds from this issuance to redeem both our October 2026 Notes and August 2028 Notes. Importantly, there was no make-whole premium due on either of our note redemptions. We also continued to efficiently raise equity capital during the quarter, raising approximately $40 million through our Equity ATM Program. Additionally, SBIC II received an initial leverage commitment from the SBA for $40 million.”

Company Overview

Originally founded in 1961 as a venture capital investor that helped launch Texas Instruments, Capital Southwest (NASDAQ: CSWC) is a business development company that provides debt and equity financing to middle-market companies primarily in the United States.

Revenue Growth

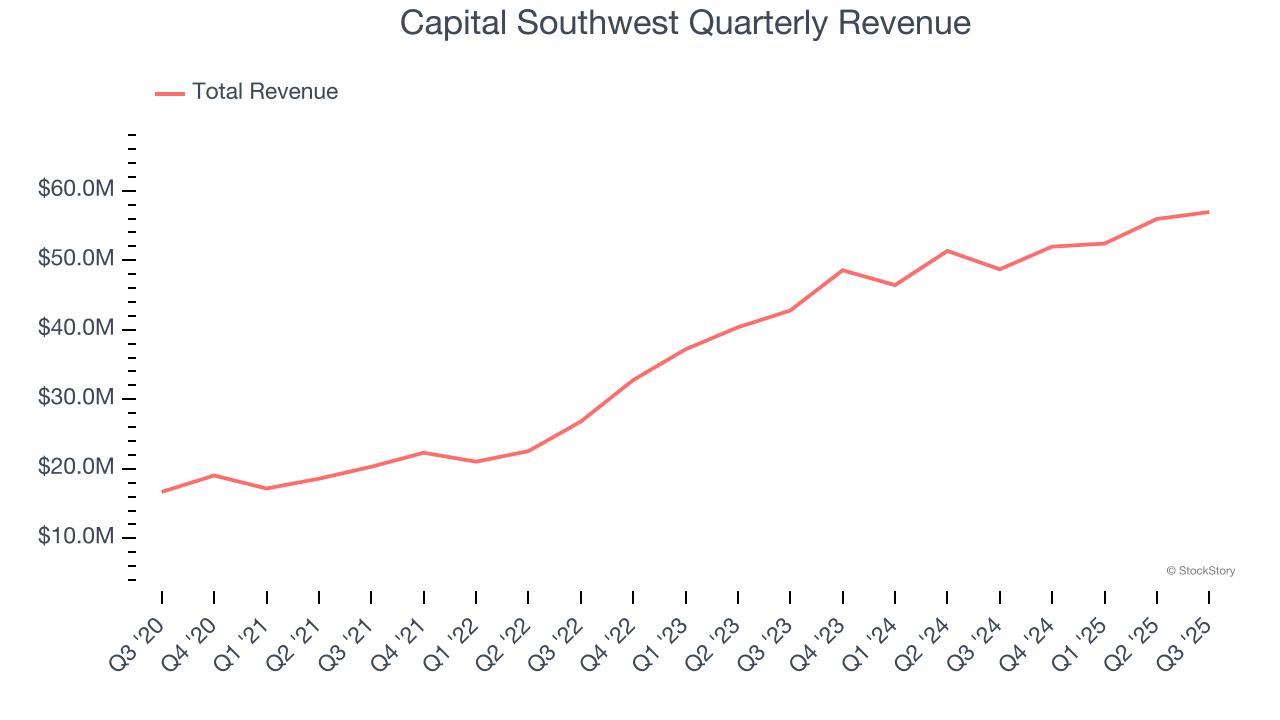

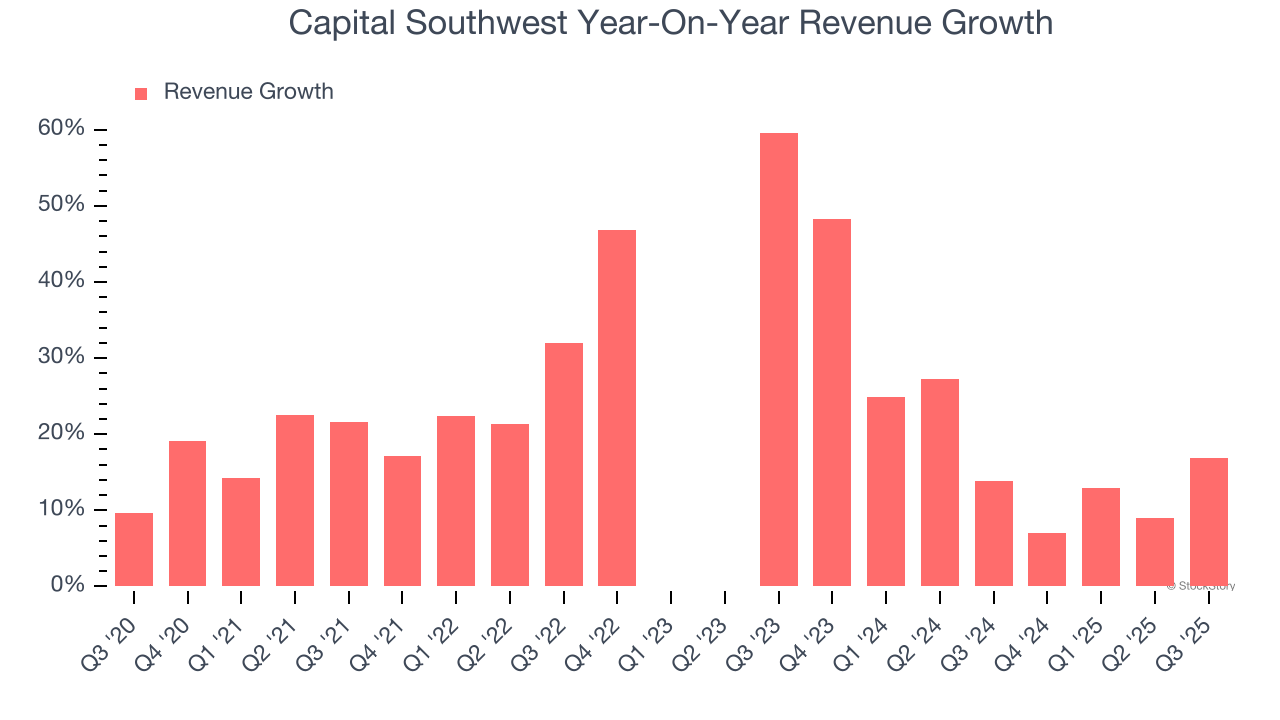

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Thankfully, Capital Southwest’s 28.1% annualized revenue growth over the last five years was incredible. Its growth beat the average financials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Capital Southwest’s annualized revenue growth of 19.1% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Capital Southwest reported year-on-year revenue growth of 16.9%, and its $56.95 million of revenue exceeded Wall Street’s estimates by 2.2%.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Key Takeaways from Capital Southwest’s Q3 Results

It was encouraging to see Capital Southwest beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed. Overall, this was a mixed quarter. The stock remained flat at $20.58 immediately following the results.

Is Capital Southwest an attractive investment opportunity right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.