Telehealth company Hims & Hers Health (NYSE: HIMS) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 49.2% year on year to $599 million. On the other hand, next quarter’s revenue guidance of $615 million was less impressive, coming in 2.6% below analysts’ estimates. Its GAAP profit of $0.06 per share was 43.7% below analysts’ consensus estimates.

Is now the time to buy Hims & Hers Health? Find out by accessing our full research report, it’s free for active Edge members.

Hims & Hers Health (HIMS) Q3 CY2025 Highlights:

- Revenue: $599 million vs analyst estimates of $579.6 million (49.2% year-on-year growth, 3.3% beat)

- EPS (GAAP): $0.06 vs analyst expectations of $0.11 (43.7% miss)

- Adjusted EBITDA: $78.37 million vs analyst estimates of $68.04 million (13.1% margin, 15.2% beat)

- Revenue Guidance for Q4 CY2025 is $615 million at the midpoint, below analyst estimates of $631.6 million

- EBITDA guidance for the full year is $312 million at the midpoint, below analyst estimates of $316.9 million

- Operating Margin: 2%, down from 5.6% in the same quarter last year

- Free Cash Flow Margin: 13.2%, down from 19.8% in the same quarter last year

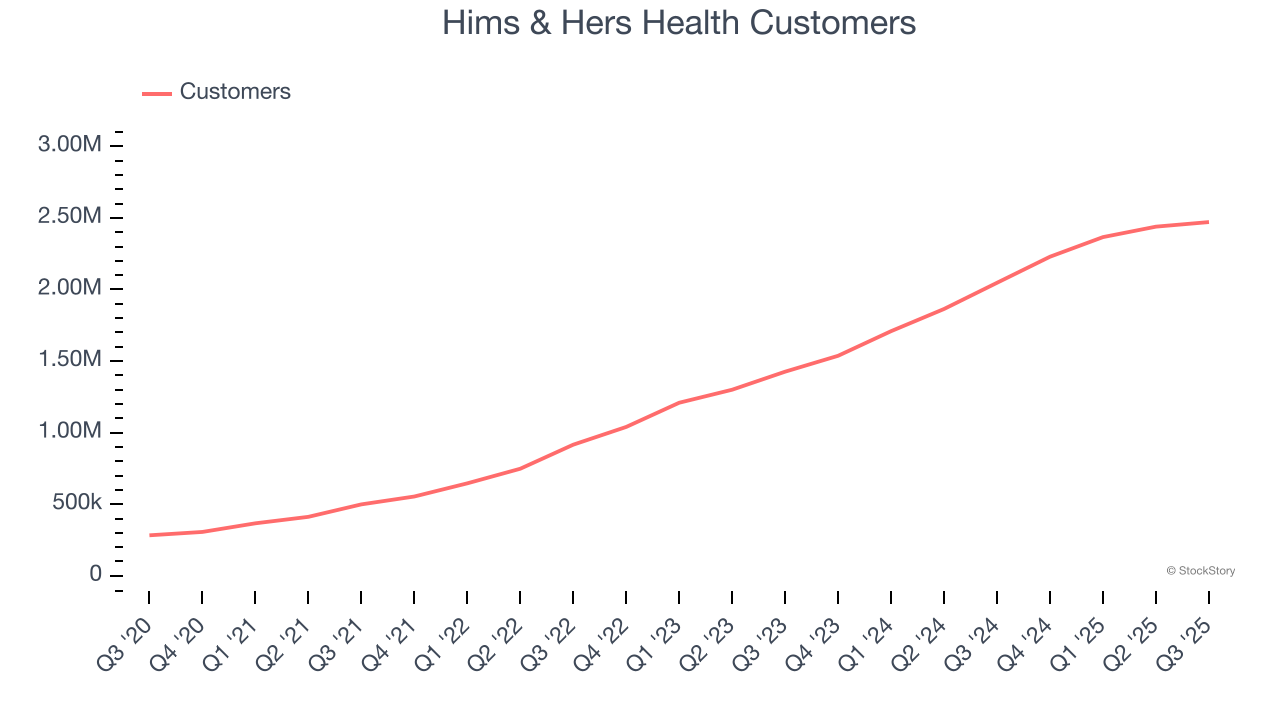

- Customers: 2.47 million, up from 2.44 million in the previous quarter

- Market Capitalization: $10.27 billion

“This quarter we continued to prove that our vision of helping tens of millions of people around the world access best-in-class, personalized care, from the comfort of their own home is more real than ever. We’re building a platform that gets more personal, more proactive, and resonates with more people as we scale,” said Andrew Dudum, co-founder and CEO.

Company Overview

Originally launched with a focus on stigmatized conditions like hair loss and sexual health, Hims & Hers Health (NYSE: HIMS) operates a consumer-focused telehealth platform that connects patients with healthcare providers for prescriptions and wellness products.

Revenue Growth

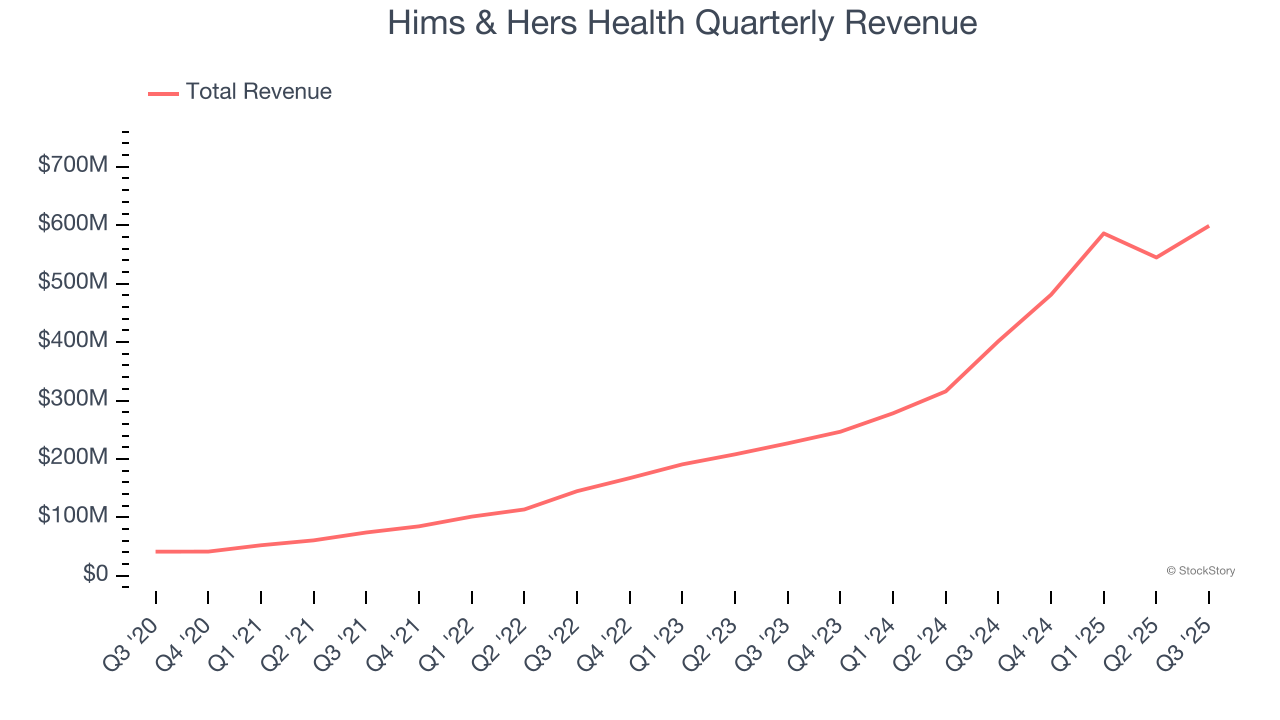

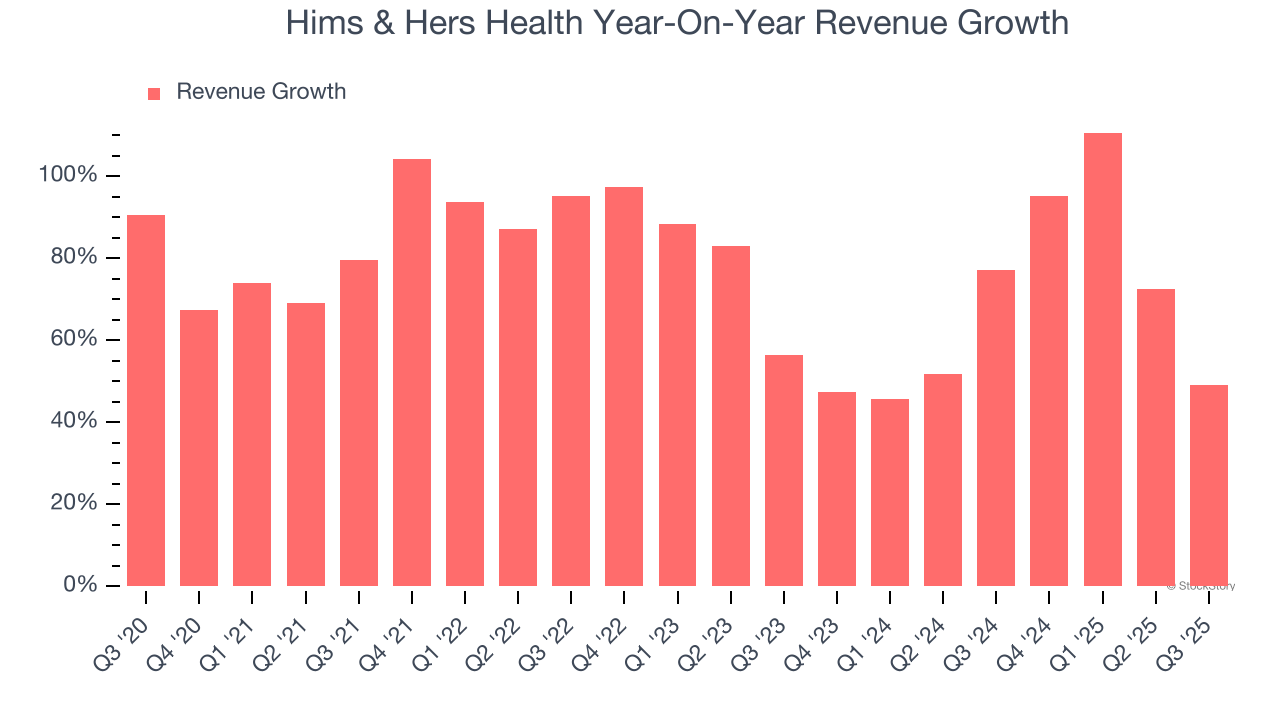

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Luckily, Hims & Hers Health’s sales grew at an incredible 75.7% compounded annual growth rate over the last five years. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Hims & Hers Health’s annualized revenue growth of 67% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

We can better understand the company’s revenue dynamics by analyzing its number of customers, which reached 2.47 million in the latest quarter. Over the last two years, Hims & Hers Health’s customer base averaged 38.9% year-on-year growth. Because this number is lower than its revenue growth, we can see the average customer spent more money each year on the company’s products and services.

This quarter, Hims & Hers Health reported magnificent year-on-year revenue growth of 49.2%, and its $599 million of revenue beat Wall Street’s estimates by 3.3%. Company management is currently guiding for a 27.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 21.1% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and indicates the market is forecasting success for its products and services.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

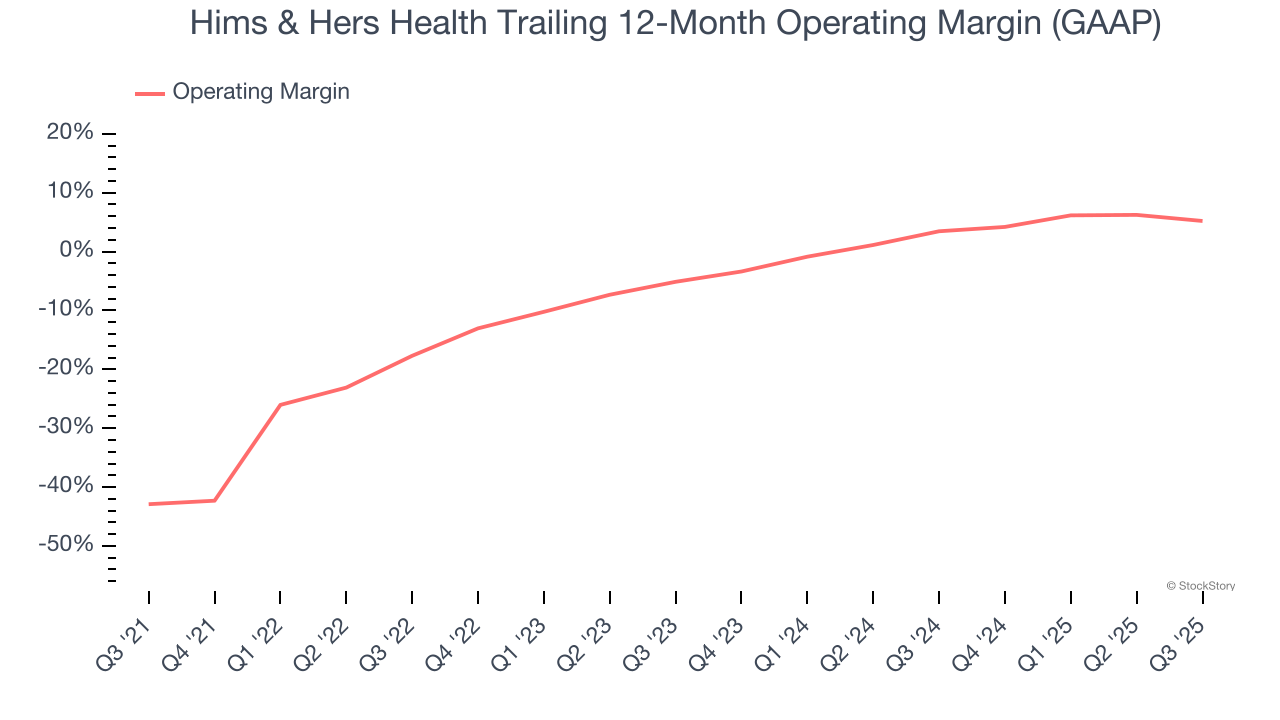

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Although Hims & Hers Health was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 1.2% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Hims & Hers Health’s operating margin rose by 48.1 percentage points over the last five years, as its sales growth gave it operating leverage. Zooming in on its more recent performance, we can see the company’s trajectory is intact as its margin has also increased by 10.3 percentage points on a two-year basis. These data points are very encouraging and show momentum is on its side.

In Q3, Hims & Hers Health generated an operating margin profit margin of 2%, down 3.6 percentage points year on year. This contraction shows it was less efficient because its expenses grew faster than its revenue.

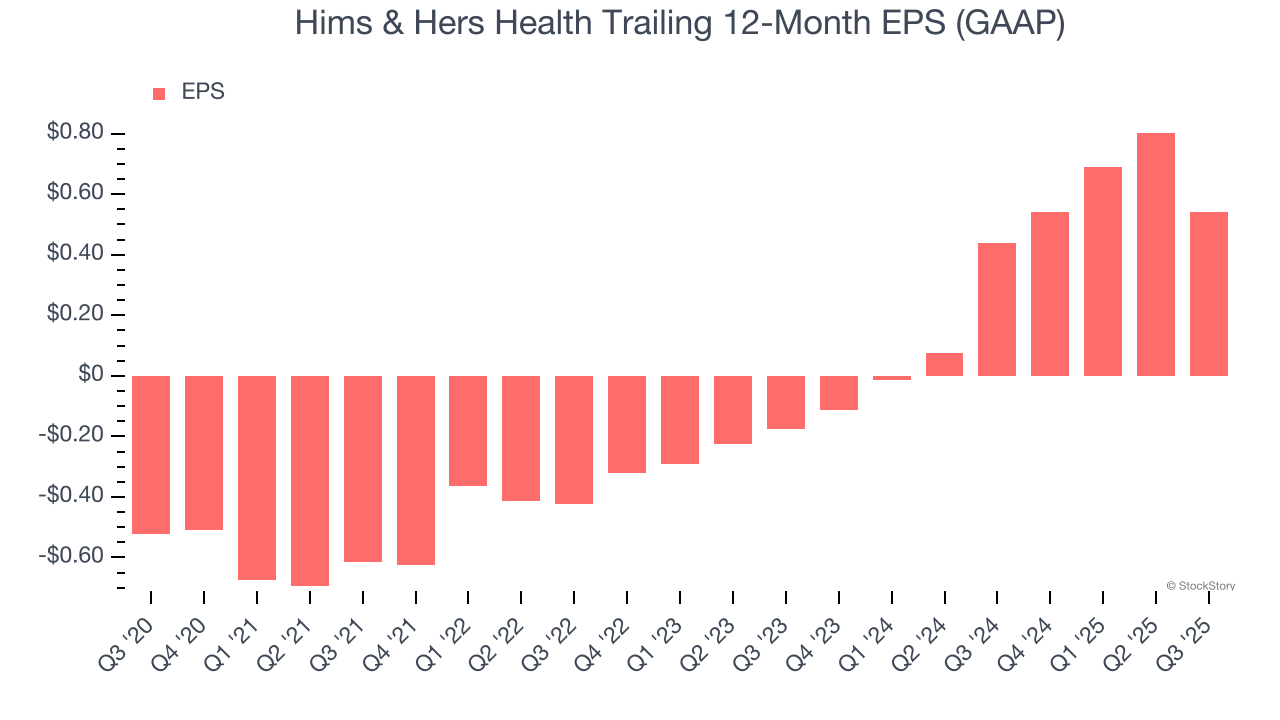

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Hims & Hers Health’s full-year EPS flipped from negative to positive over the last five years. This is a good sign and shows it’s at an inflection point.

In Q3, Hims & Hers Health reported EPS of $0.06, down from $0.32 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Hims & Hers Health’s full-year EPS of $0.54 to grow 42.4%.

Key Takeaways from Hims & Hers Health’s Q3 Results

We enjoyed seeing Hims & Hers Health beat analysts’ revenue expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its EPS fell short of Wall Street’s estimates. Overall, this was a mixed quarter. The stock traded up 3.9% to $46.11 immediately after reporting.

Big picture, is Hims & Hers Health a buy here and now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.