Financial services company Equitable Holdings (NYSE: EQH) fell short of the markets revenue expectations in Q3 CY2025, with sales falling 61.6% year on year to $1.45 billion. Its non-GAAP profit of $1.48 per share was 8.5% below analysts’ consensus estimates.

Is now the time to buy Equitable Holdings? Find out by accessing our full research report, it’s free for active Edge members.

Equitable Holdings (EQH) Q3 CY2025 Highlights:

Company Overview

Tracing its roots back to 1859 as one of America's oldest financial institutions, Equitable Holdings (NYSE: EQH) provides retirement planning, asset management, and life insurance products through its two main franchises, Equitable and AllianceBernstein.

Revenue Growth

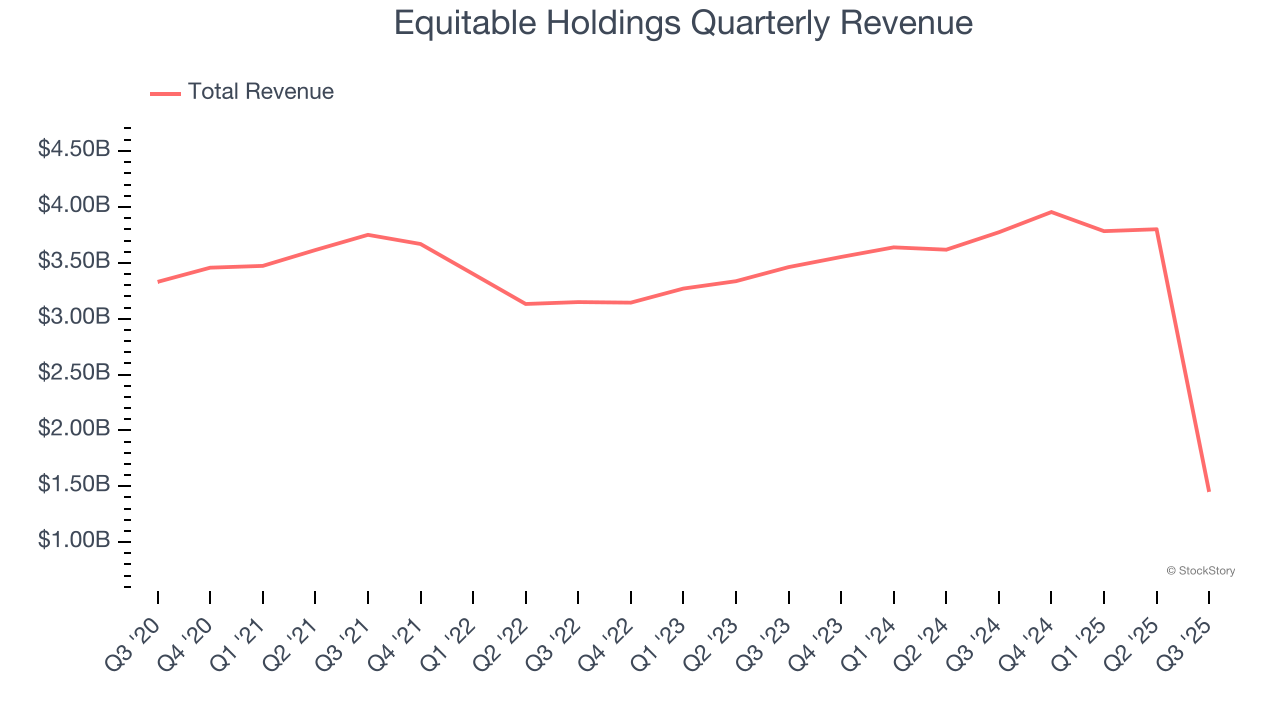

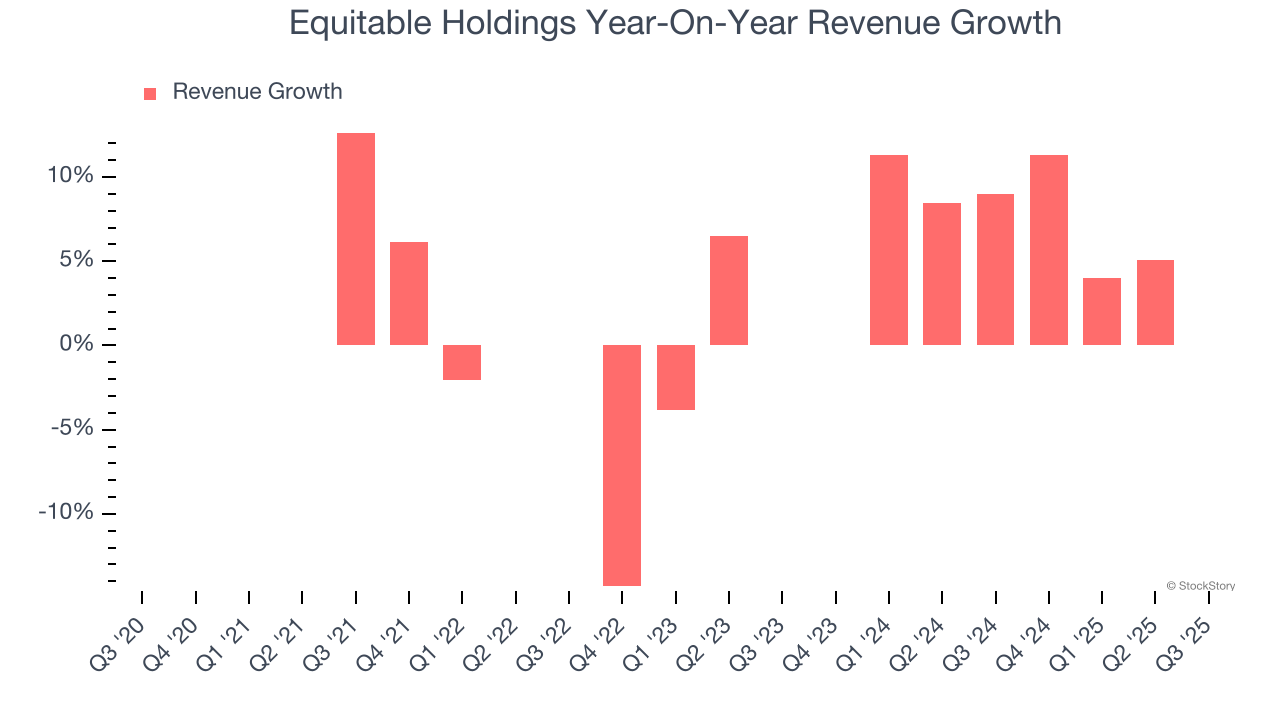

In general, insurance companies earn revenue from three primary sources. The first is the core insurance business itself, often called underwriting and represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services. Unfortunately, Equitable Holdings struggled to consistently increase demand as its $12.99 billion of revenue for the trailing 12 months was close to its revenue five years ago. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Just like its five-year trend, Equitable Holdings’s revenue over the last two years was flat, suggesting it is in a slump.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Equitable Holdings missed Wall Street’s estimates and reported a rather uninspiring 61.6% year-on-year revenue decline, generating $1.45 billion of revenue.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Key Takeaways from Equitable Holdings’s Q3 Results

We struggled to find many positives in these results. Its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 1.6% to $48.11 immediately following the results.

Equitable Holdings didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.