Global payments company Flywire (NASDAQ: FLYW) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 27.6% year on year to $200.1 million. On top of that, next quarter’s revenue guidance ($147 million at the midpoint) was surprisingly good and 3.6% above what analysts were expecting. Its GAAP profit of $0.23 per share was 20.5% above analysts’ consensus estimates.

Is now the time to buy Flywire? Find out by accessing our full research report, it’s free for active Edge members.

Flywire (FLYW) Q3 CY2025 Highlights:

- Revenue: $200.1 million vs analyst estimates of $185.8 million (27.6% year-on-year growth, 7.7% beat)

- EPS (GAAP): $0.23 vs analyst estimates of $0.19 (20.5% beat)

- Adjusted EBITDA: $57.1 million vs analyst estimates of $51.91 million (28.5% margin, 10% beat)

- Revenue Guidance for Q4 CY2025 is $147 million at the midpoint, above analyst estimates of $141.9 million

- Operating Margin: 16.1%, up from 12.9% in the same quarter last year

- Free Cash Flow Margin: 73.7%, up from 16.3% in the previous quarter

- Market Capitalization: $1.64 billion

Company Overview

Initially created to solve the challenges of international student tuition payments, Flywire (NASDAQ: FLYW) provides specialized payment processing and software solutions that help educational institutions, healthcare systems, travel companies, and businesses manage complex payments.

Revenue Growth

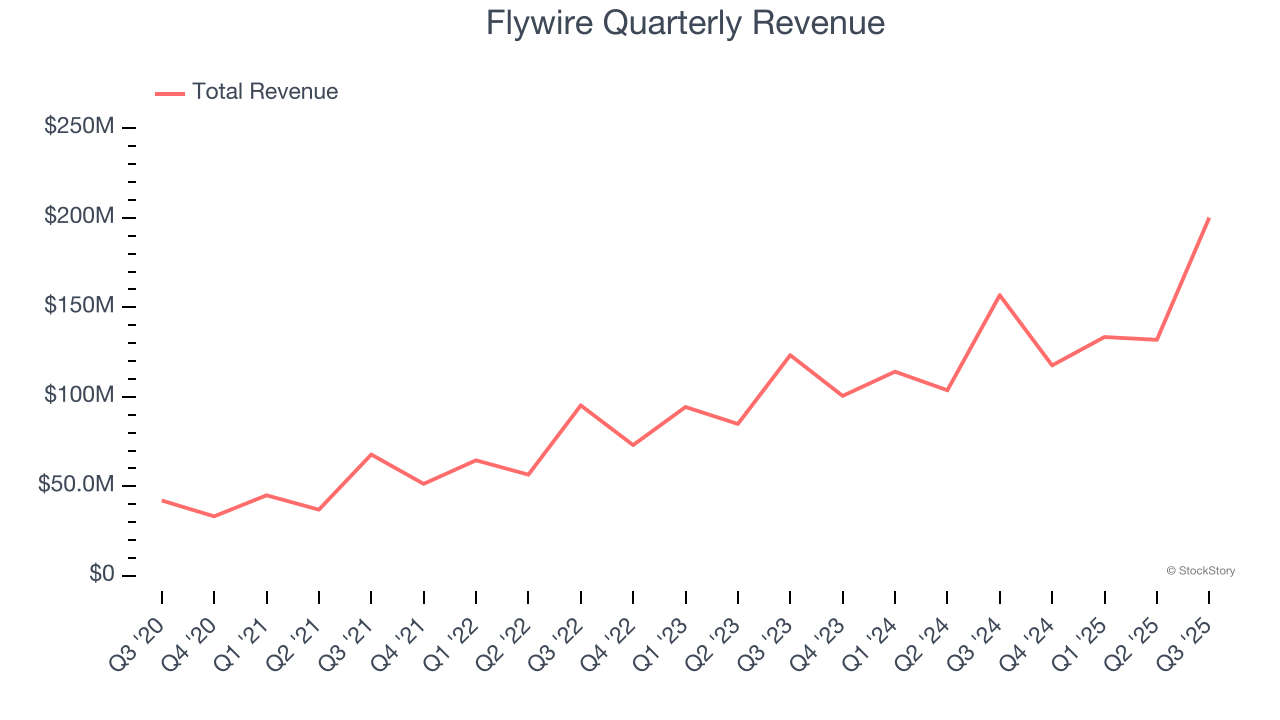

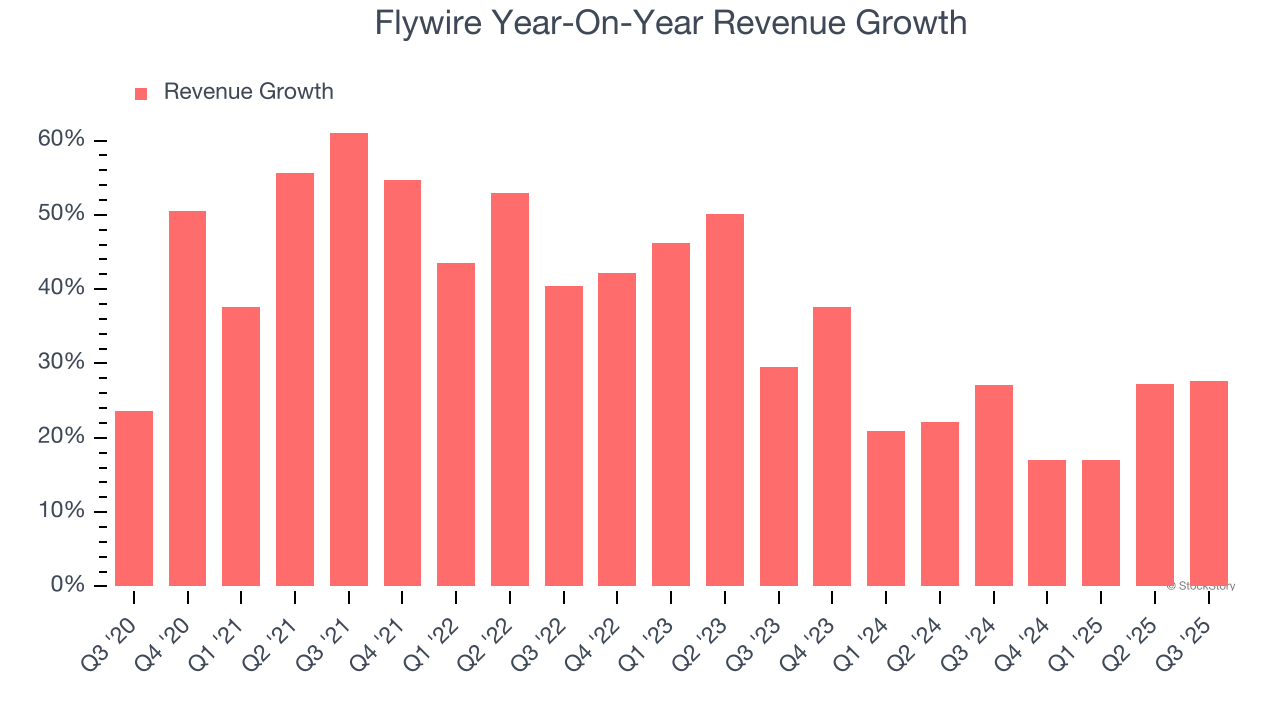

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Flywire’s sales grew at an exceptional 37% compounded annual growth rate over the last five years. Its growth beat the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Flywire’s annualized revenue growth of 24.6% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Flywire reported robust year-on-year revenue growth of 27.6%, and its $200.1 million of revenue topped Wall Street estimates by 7.7%. Company management is currently guiding for a 25% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 14.2% over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Flywire’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a competitive market and must continue investing to grow.

Key Takeaways from Flywire’s Q3 Results

We were impressed by how significantly Flywire blew past analysts’ revenue, EPS, and EBITDA expectations this quarter. We were also glad its revenue guidance for next quarter outperformed Wall Street’s estimates. Zooming out, we think this was a solid print. The stock traded up 12.1% to $15.50 immediately following the results.

Flywire may have had a good quarter, but does that mean you should invest right now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.