Debt recovery company Encore Capital Group (NASDAQ: ECPG) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 25.4% year on year to $460.4 million. Its GAAP profit of $3.17 per share was 60.1% above analysts’ consensus estimates.

Is now the time to buy Encore Capital Group? Find out by accessing our full research report, it’s free for active Edge members.

Encore Capital Group (ECPG) Q3 CY2025 Highlights:

“Encore delivered another quarter of strong performance in Q3 as our industry leadership and operational improvement become increasingly evident in our results,” said Ashish Masih, President and Chief Executive Officer.

Company Overview

Operating in the often misunderstood world of debt collection since 1999, Encore Capital Group (NASDAQ: ECPG) purchases portfolios of defaulted consumer debt at deep discounts and works with individuals to recover these obligations while helping them toward financial recovery.

Revenue Growth

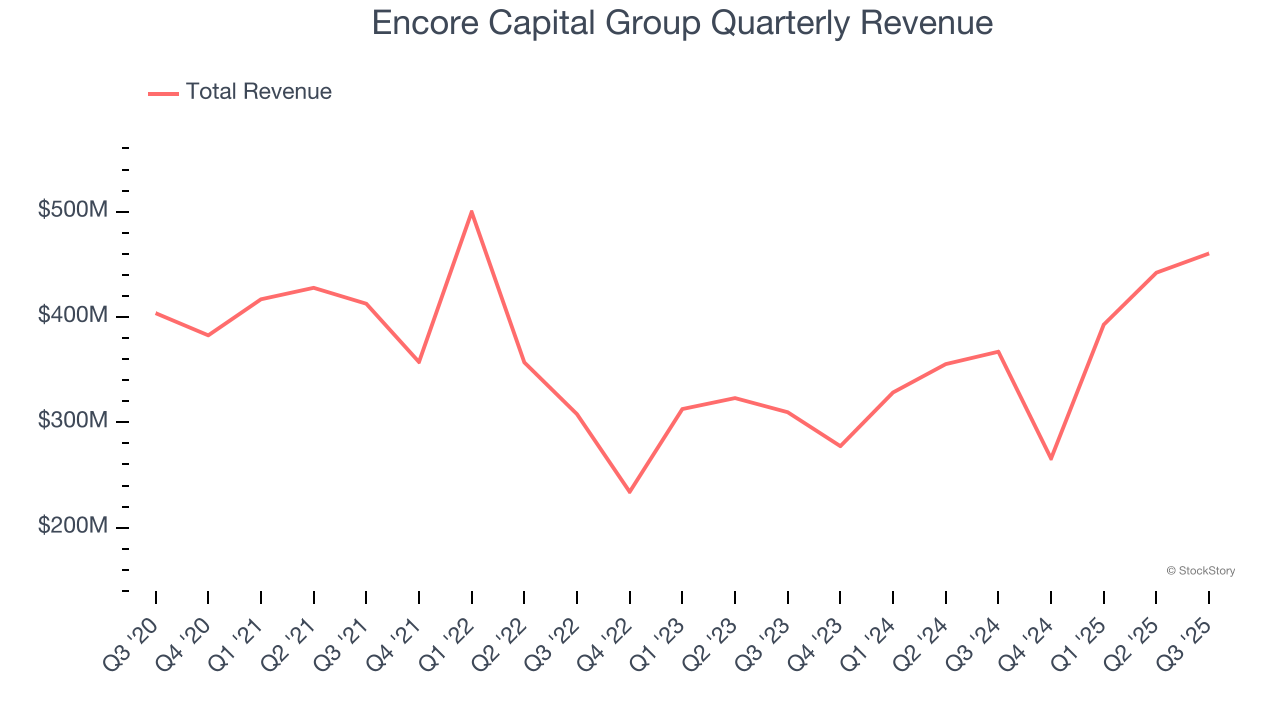

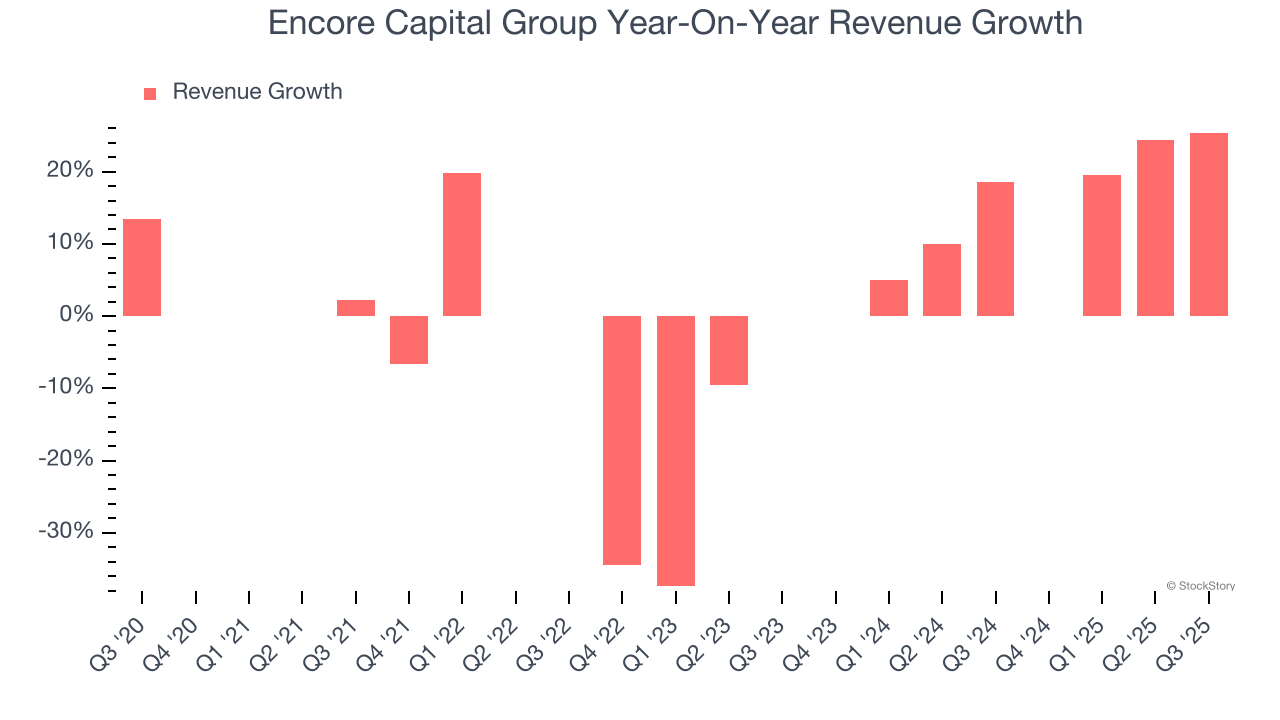

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Encore Capital Group grew its revenue at a weak 1.3% compounded annual growth rate. This was below our standards and is a tough starting point for our analysis.

Long-term growth is the most important, but within financials, a half-decade historical view may miss recent interest rate changes and market returns. Encore Capital Group’s annualized revenue growth of 15% over the last two years is above its five-year trend, suggesting its demand recently accelerated.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Encore Capital Group reported robust year-on-year revenue growth of 25.4%, and its $460.4 million of revenue topped Wall Street estimates by 11.9%.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Key Takeaways from Encore Capital Group’s Q3 Results

It was good to see Encore Capital Group beat analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 10.9% to $47.50 immediately following the results.

Encore Capital Group may have had a good quarter, but does that mean you should invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.