Industrial construction and maintenance company Matrix Service (NASDAQ: MTRX) reported Q3 CY2025 results beating Wall Street’s revenue expectations, with sales up 28% year on year to $211.9 million. The company’s full-year revenue guidance of $900 million at the midpoint came in 0.8% above analysts’ estimates. Its non-GAAP loss of $0.01 per share was $0.03 below analysts’ consensus estimates.

Is now the time to buy Matrix Service? Find out by accessing our full research report, it’s free for active Edge members.

Matrix Service (MTRX) Q3 CY2025 Highlights:

- Revenue: $211.9 million vs analyst estimates of $206.7 million (28% year-on-year growth, 2.5% beat)

- Adjusted EPS: -$0.01 vs analyst estimates of $0.02 ($0.03 miss)

- Adjusted EBITDA: $2.46 million vs analyst estimates of $4.5 million (1.2% margin, 45.3% miss)

- The company reconfirmed its revenue guidance for the full year of $900 million at the midpoint

- Operating Margin: -2.6%, up from -6.5% in the same quarter last year

- Free Cash Flow was -$27.91 million, down from $9.97 million in the same quarter last year

- Backlog: $1.16 billion at quarter end

- Market Capitalization: $428.6 million

“We delivered improved first quarter results, reflecting disciplined execution across an expanding base of projects in our Storage & Terminal Solutions and Utility & Power Infrastructure segments,” said John Hewitt, President and Chief Executive Officer.

Company Overview

Founded in Oklahoma, Matrix Service (NASDAQ: MTRX) provides engineering, fabrication, construction, and maintenance services primarily to the energy and industrial markets.

Revenue Growth

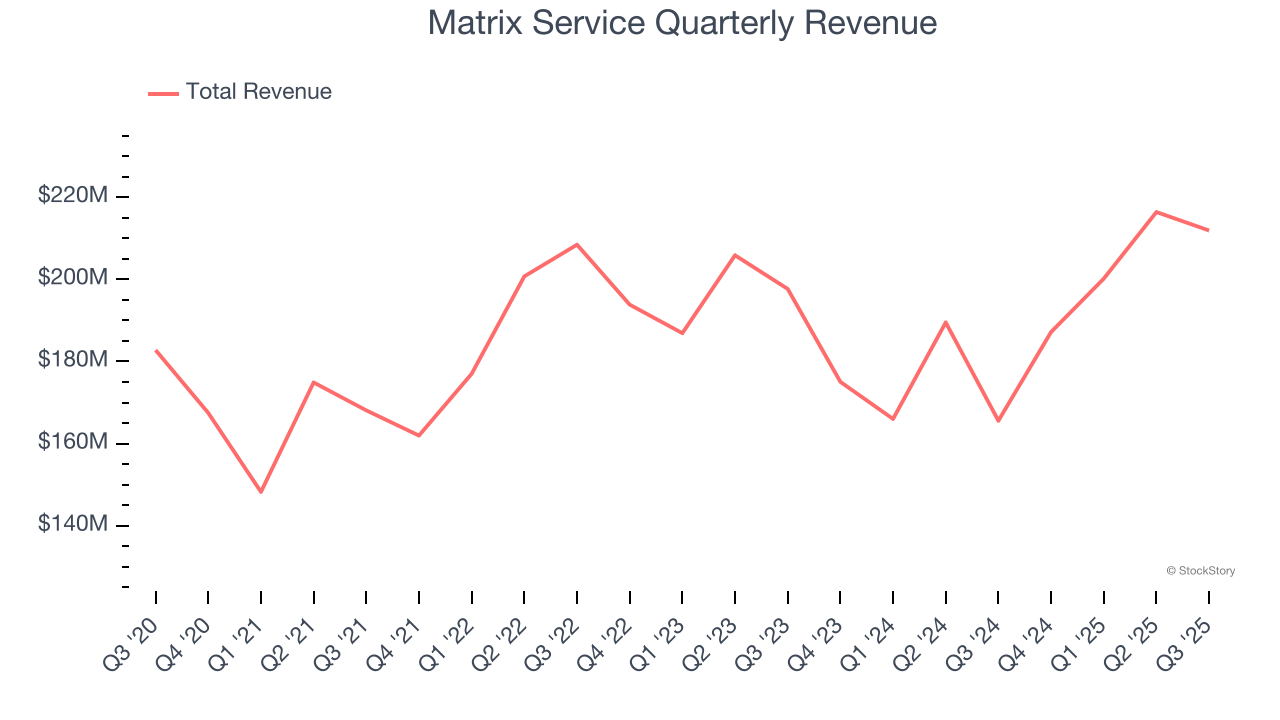

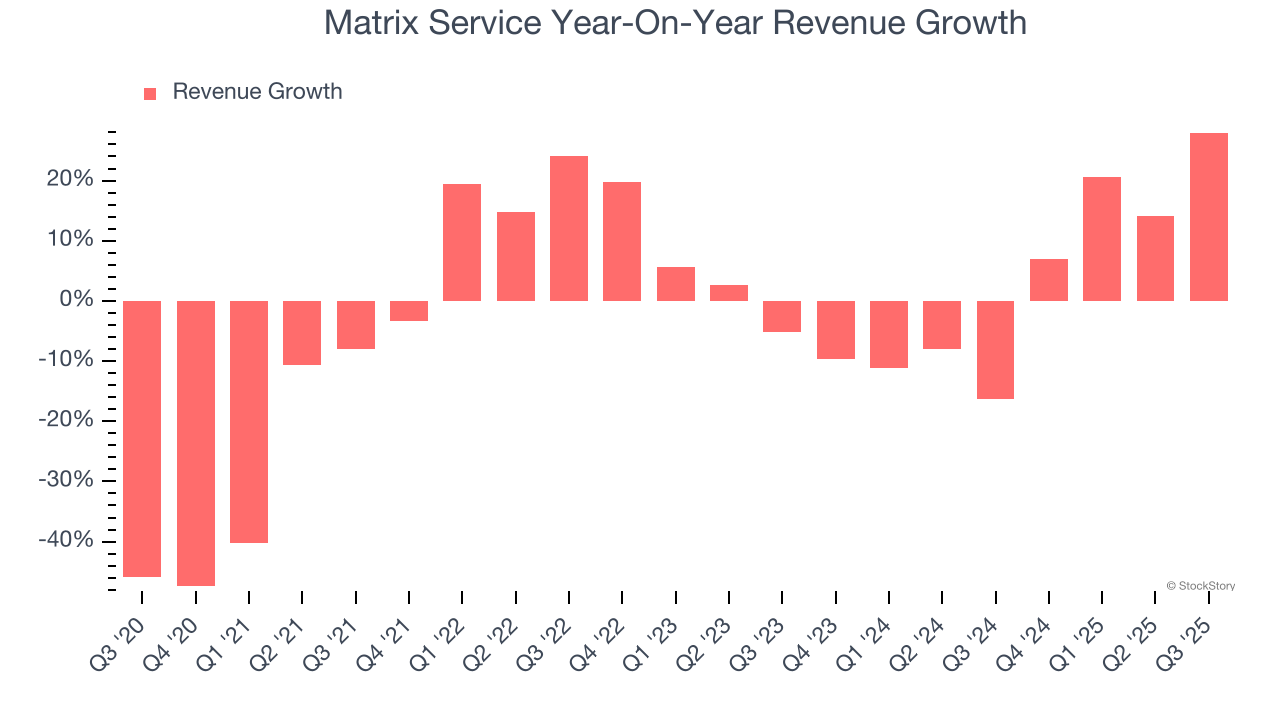

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Matrix Service’s demand was weak over the last five years as its sales fell at a 2.9% annual rate. This wasn’t a great result and suggests it’s a lower quality business.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Matrix Service’s annualized revenue growth of 2% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, Matrix Service reported robust year-on-year revenue growth of 28%, and its $211.9 million of revenue topped Wall Street estimates by 2.5%.

Looking ahead, sell-side analysts expect revenue to grow 11.8% over the next 12 months, an improvement versus the last two years. This projection is noteworthy and indicates its newer products and services will catalyze better top-line performance.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

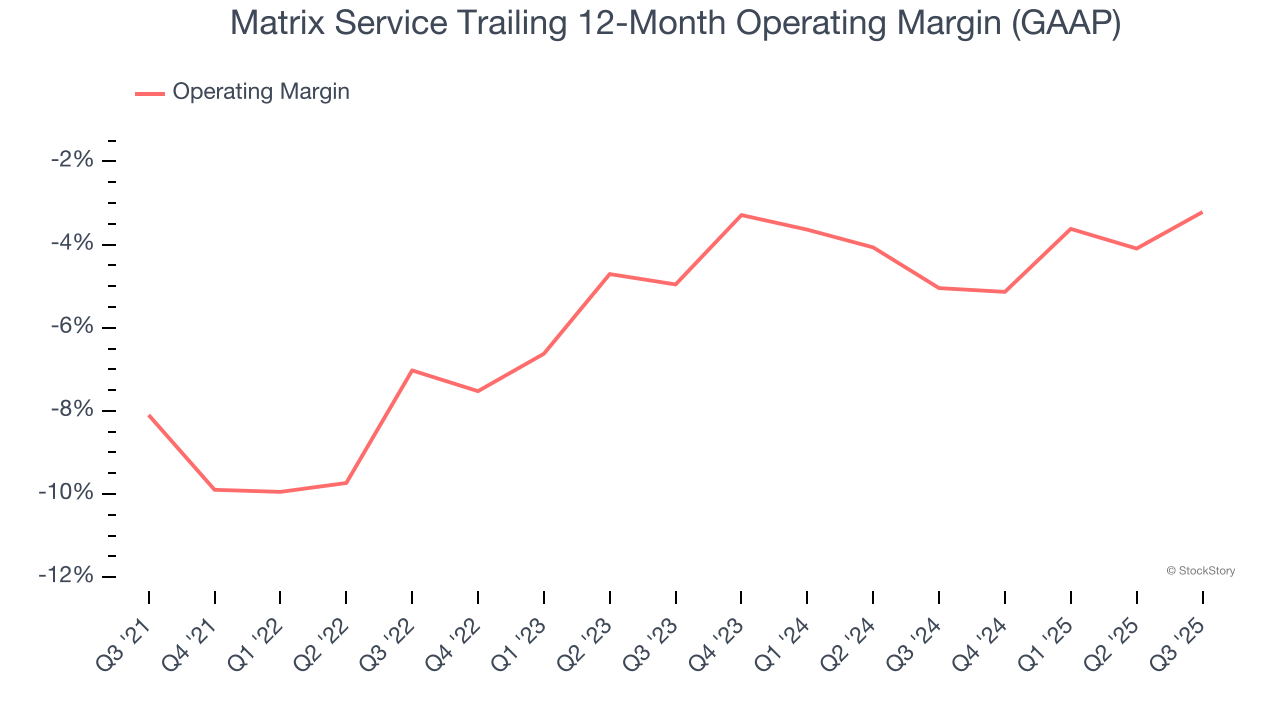

Matrix Service’s high expenses have contributed to an average operating margin of negative 5.6% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Matrix Service’s operating margin rose by 4.9 percentage points over the last five years. Still, it will take much more for the company to reach long-term profitability.

This quarter, Matrix Service generated a negative 2.6% operating margin. The company's consistent lack of profits raise a flag.

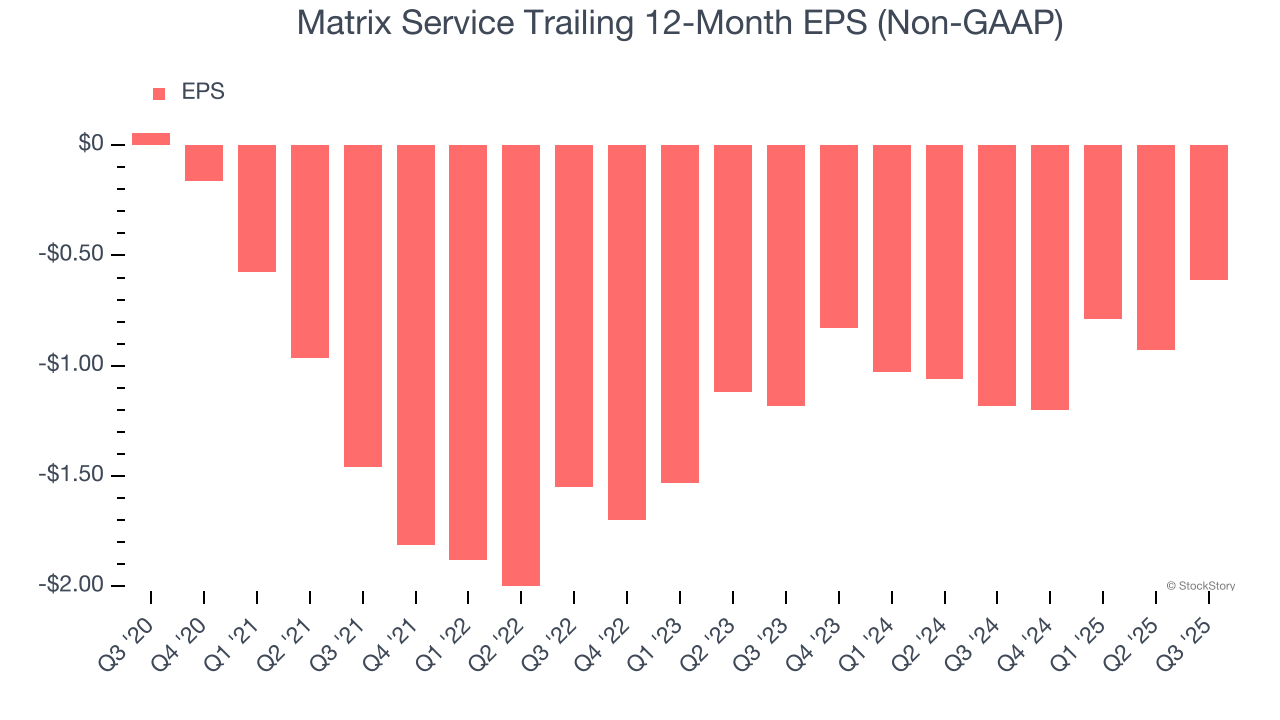

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Matrix Service, its EPS declined by 66.3% annually over the last five years, more than its revenue. However, its operating margin actually improved during this time, telling us that non-fundamental factors such as interest expenses and taxes affected its ultimate earnings.

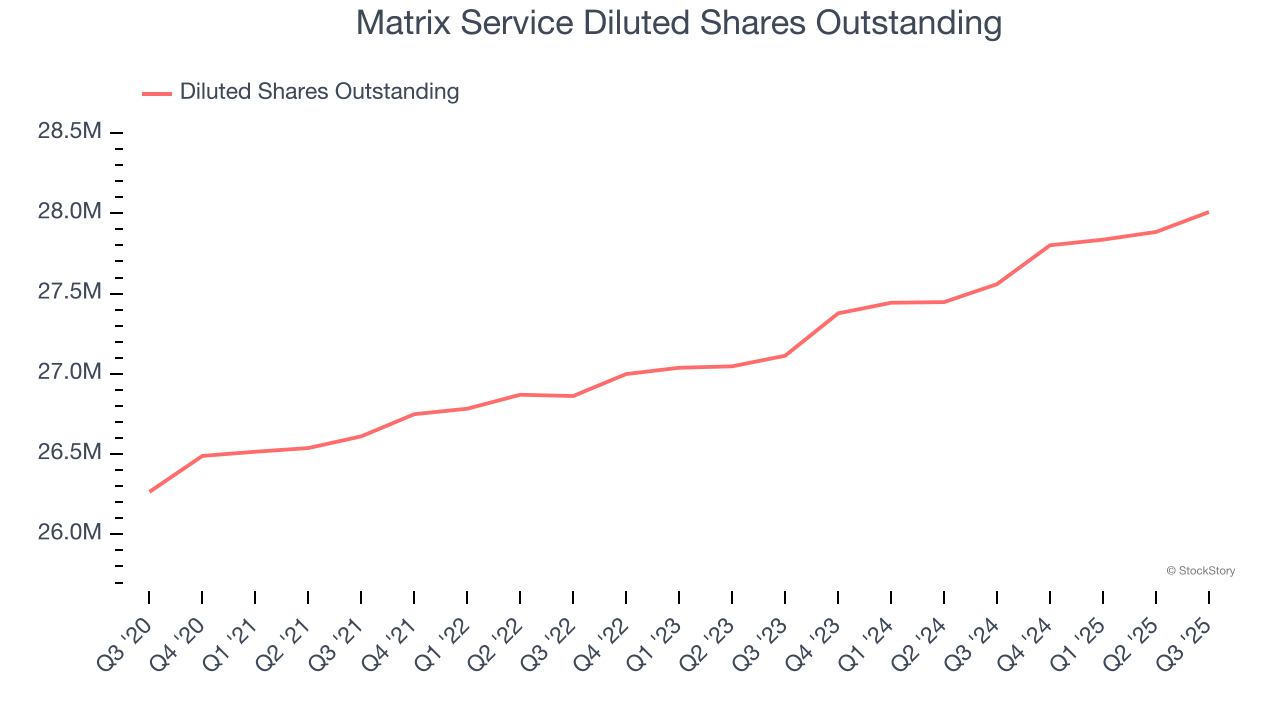

Diving into the nuances of Matrix Service’s earnings can give us a better understanding of its performance. A five-year view shows Matrix Service has diluted its shareholders, growing its share count by 6.6%. This dilution overshadowed its increased operational efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Matrix Service, its two-year annual EPS growth of 28.1% was higher than its five-year trend. Its improving earnings is an encouraging data point, but a caveat is that its EPS is still in the red.

In Q3, Matrix Service reported adjusted EPS of negative $0.01, up from negative $0.33 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from Matrix Service’s Q3 Results

We enjoyed seeing Matrix Service beat analysts’ revenue expectations this quarter. We were also glad its full-year revenue guidance slightly exceeded Wall Street’s estimates. On the other hand, its EBITDA missed and its EPS was in line with Wall Street’s estimates. Overall, this quarter was mixed. The stock remained flat at $15.60 immediately following the results.

Big picture, is Matrix Service a buy here and now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.