Geospatial technology provider Trimble (NASDAQ: TRMB) announced better-than-expected revenue in Q3 CY2025, with sales up 2.9% year on year to $901.2 million. Guidance for next quarter’s revenue was better than expected at $947 million at the midpoint, 1.4% above analysts’ estimates. Its non-GAAP profit of $0.81 per share was 13% above analysts’ consensus estimates.

Is now the time to buy Trimble? Find out by accessing our full research report, it’s free for active Edge members.

Trimble (TRMB) Q3 CY2025 Highlights:

- Revenue: $901.2 million vs analyst estimates of $870.6 million (2.9% year-on-year growth, 3.5% beat)

- Adjusted EPS: $0.81 vs analyst estimates of $0.72 (13% beat)

- Adjusted EBITDA: $269.4 million vs analyst estimates of $240.3 million (29.9% margin, 12.1% beat)

- Revenue Guidance for Q4 CY2025 is $947 million at the midpoint, above analyst estimates of $933.5 million

- Management raised its full-year Adjusted EPS guidance to $3.08 at the midpoint, a 3.4% increase

- Operating Margin: 16.7%, up from 13.3% in the same quarter last year

- Free Cash Flow Margin: 12.9%, up from 10.1% in the same quarter last year

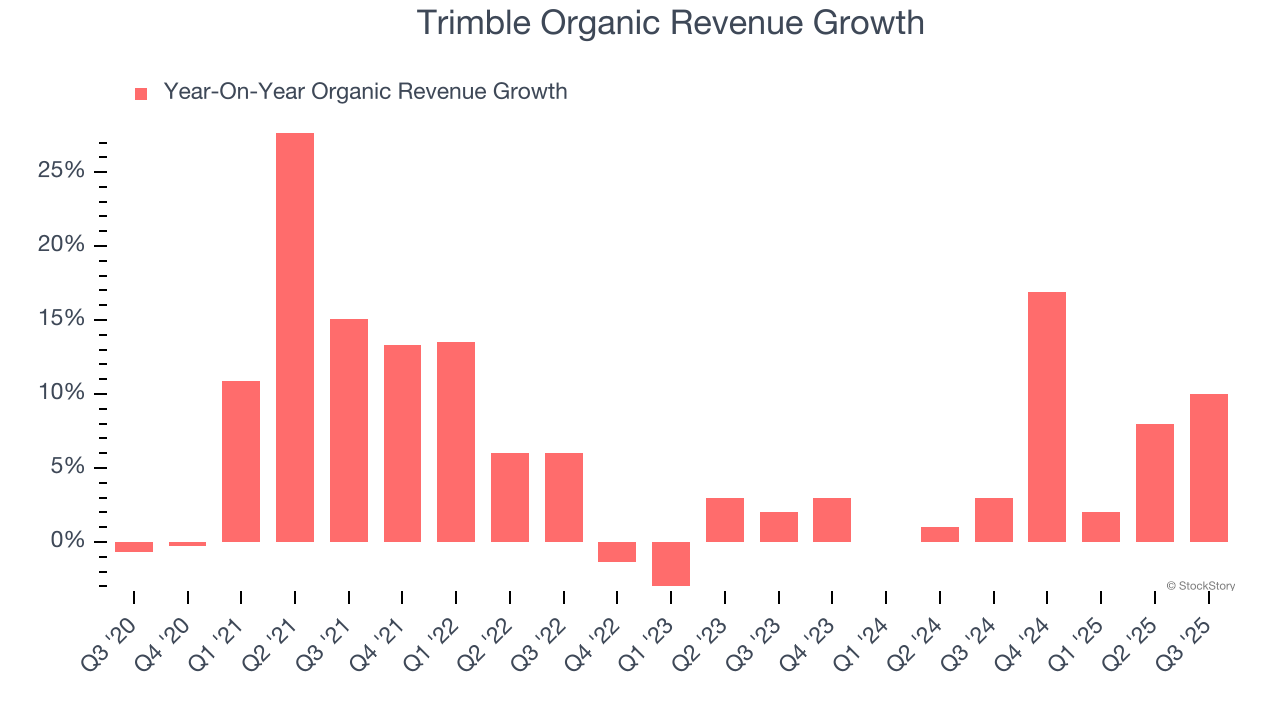

- Organic Revenue rose 10% year on year vs analyst estimates of 5% growth (497.4 basis point beat)

- Market Capitalization: $18.7 billion

Company Overview

Playing a role in the construction of the Paris Grand, Trimble (NASDAQ: TRMB) offers geospatial devices and technology to the agriculture, construction, transportation, and logistics industries.

Revenue Growth

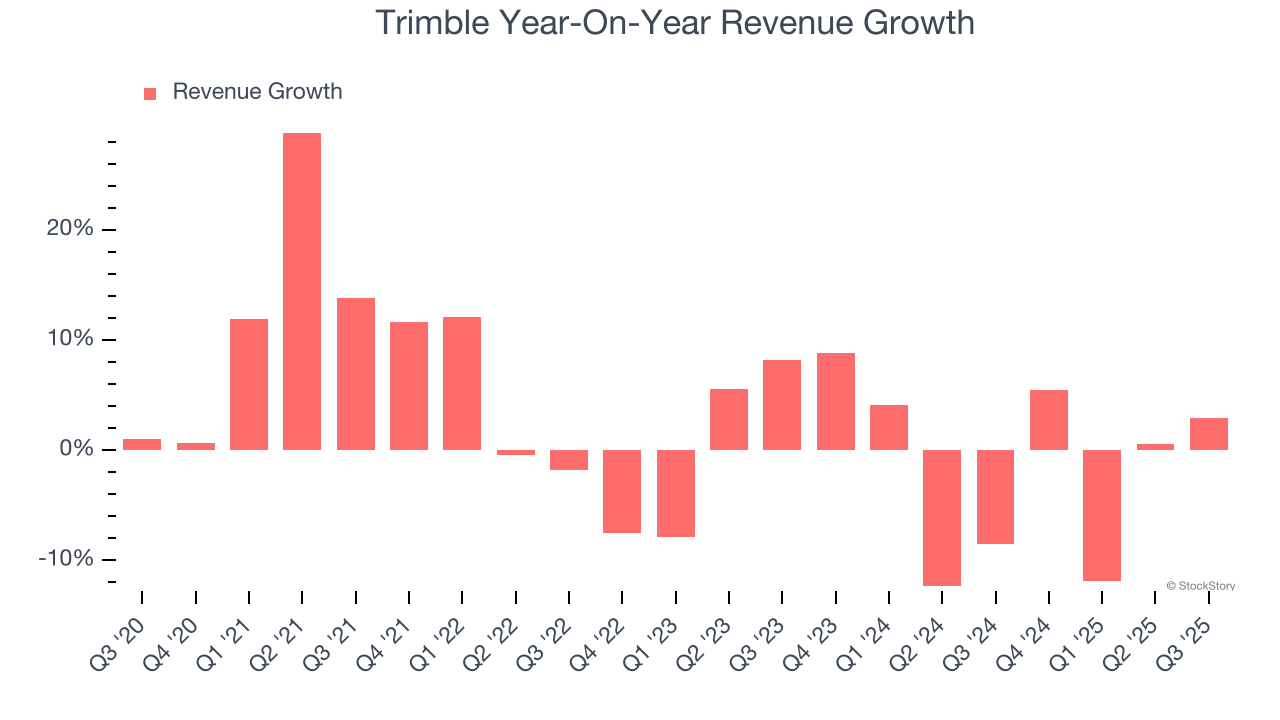

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Trimble’s 2.8% annualized revenue growth over the last five years was sluggish. This fell short of our benchmarks and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Trimble’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.7% annually.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, Trimble’s organic revenue averaged 5.5% year-on-year growth. Because this number is better than its two-year revenue growth, we can see that some mixture of divestitures and foreign exchange rates dampened its headline results.

This quarter, Trimble reported modest year-on-year revenue growth of 2.9% but beat Wall Street’s estimates by 3.5%. Company management is currently guiding for a 3.7% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 1.6% over the next 12 months. While this projection suggests its newer products and services will catalyze better top-line performance, it is still below average for the sector.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Operating Margin

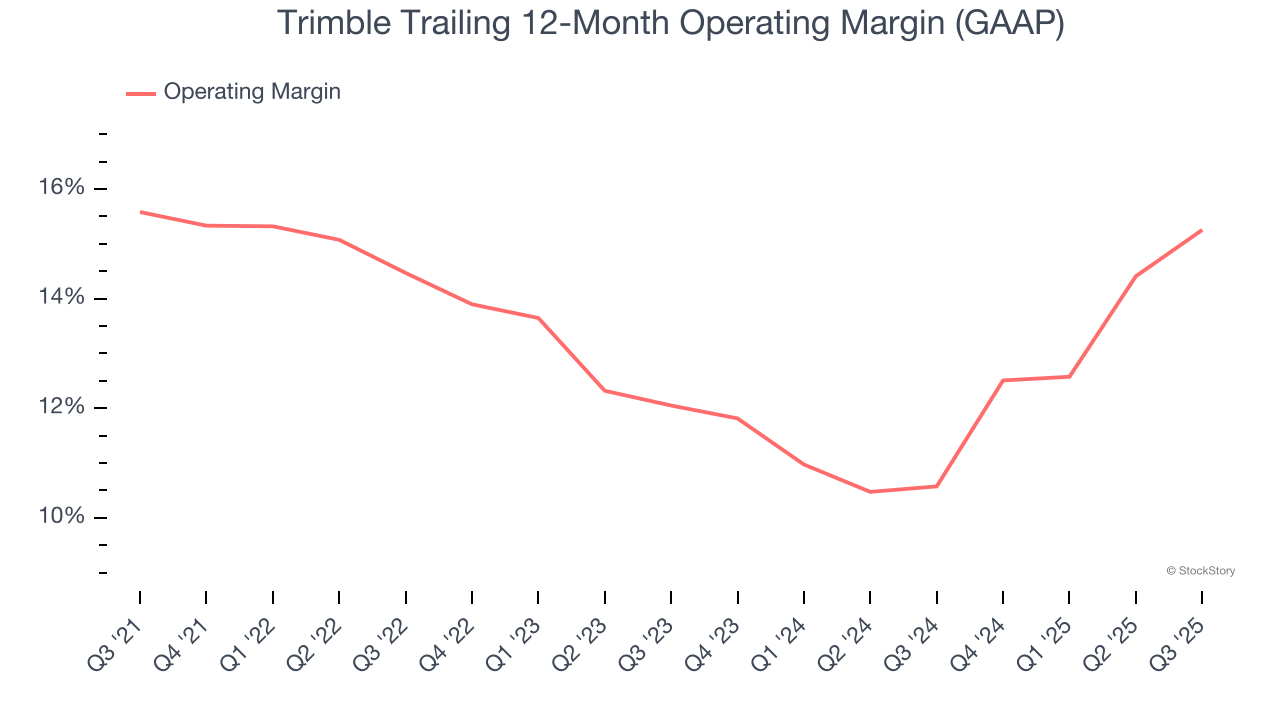

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Trimble’s operating margin has been trending up over the last 12 months and averaged 13.6% over the last five years. On top of that, its profitability was top-notch for an industrials business, showing it’s an well-run company with an efficient cost structure. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Looking at the trend in its profitability, Trimble’s operating margin might fluctuated slightly but has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Trimble generated an operating margin profit margin of 16.7%, up 3.4 percentage points year on year. The increase was encouraging, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

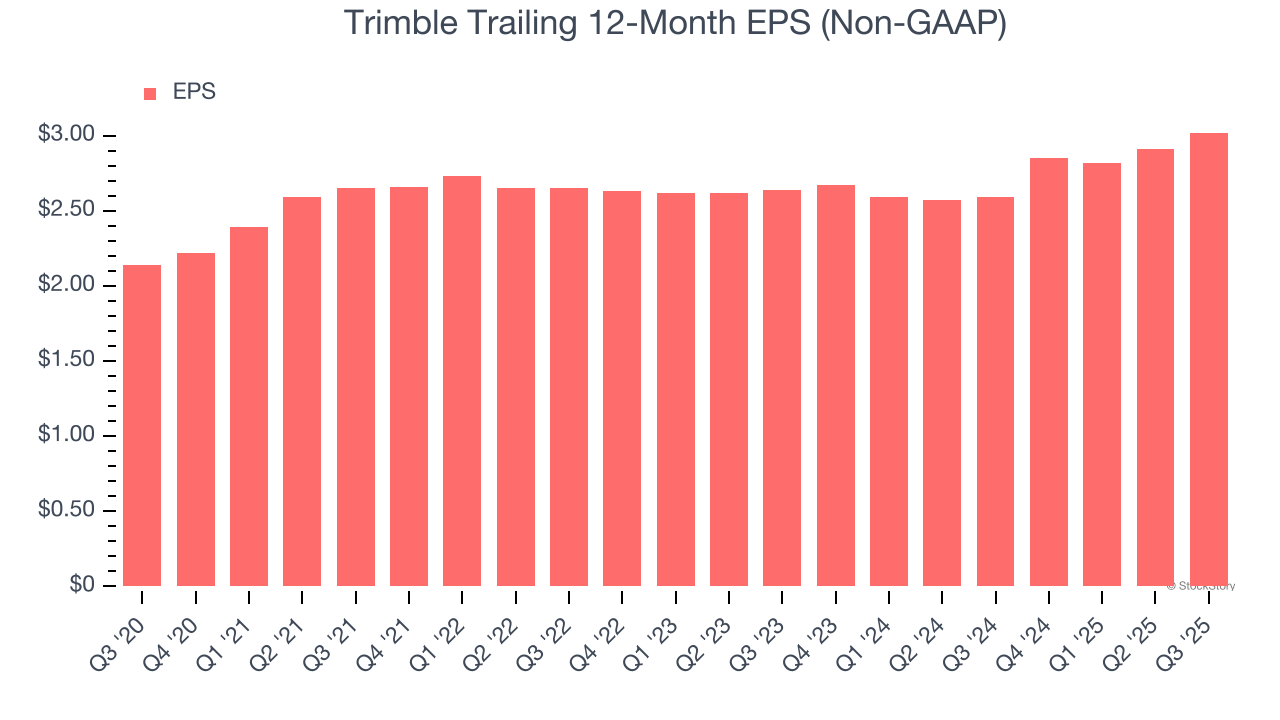

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Trimble’s EPS grew at an unimpressive 7.1% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 2.8% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

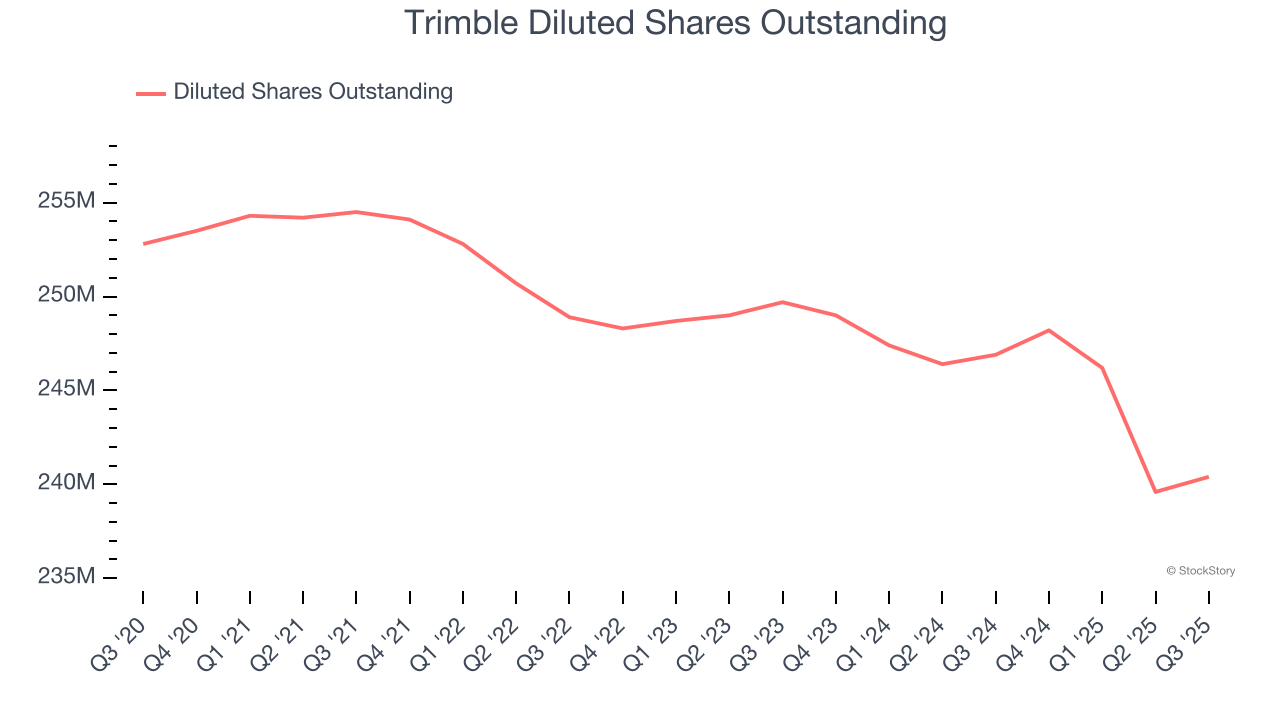

Diving into the nuances of Trimble’s earnings can give us a better understanding of its performance. A five-year view shows that Trimble has repurchased its stock, shrinking its share count by 4.9%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Trimble, its two-year annual EPS growth of 7% is similar to its five-year trend, implying stable earnings.

In Q3, Trimble reported adjusted EPS of $0.81, up from $0.70 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Trimble’s full-year EPS of $3.02 to grow 8.4%.

Key Takeaways from Trimble’s Q3 Results

We were impressed by how significantly Trimble blew past analysts’ organic revenue expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 4.6% to $82.19 immediately following the results.

Sure, Trimble had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.