Analog chipmaker Microchip Technology (NASDAQ: MCHP) met Wall Streets revenue expectations in Q3 CY2025, but sales fell by 2% year on year to $1.14 billion. On the other hand, next quarter’s revenue guidance of $1.13 billion was less impressive, coming in 4.3% below analysts’ estimates. Its non-GAAP profit of $0.35 per share was 4.9% above analysts’ consensus estimates.

Is now the time to buy Microchip Technology? Find out by accessing our full research report, it’s free for active Edge members.

Microchip Technology (MCHP) Q3 CY2025 Highlights:

- Revenue: $1.14 billion vs analyst estimates of $1.14 billion (2% year-on-year decline, in line)

- Adjusted EPS: $0.35 vs analyst estimates of $0.33 (4.9% beat)

- Adjusted Operating Income: $277.2 million vs analyst estimates of $264.7 million (24.3% margin, 4.7% beat)

- Revenue Guidance for Q4 CY2025 is $1.13 billion at the midpoint, below analyst estimates of $1.18 billion

- Adjusted EPS guidance for Q4 CY2025 is $0.37 at the midpoint, below analyst estimates of $0.39

- Operating Margin: 7.8%, down from 12.6% in the same quarter last year

- Free Cash Flow Margin: 4.5%, up from 2% in the same quarter last year

- Inventory Days Outstanding: 198, down from 213 in the previous quarter

- Market Capitalization: $32.81 billion

Steve Sanghi, Microchip’s CEO and President commented that "Our second quarter results demonstrate continued momentum in our recovery, with net sales of $1.140 billion growing 6% sequentially and above the midpoint of our guidance. The operational improvements we have implemented are translating into meaningful financial progress despite the broader market recovery developing more gradually than anticipated. We believe our operational capabilities position us to outperform as conditions improve."

Company Overview

Spun out from General Instrument in 1987, Microchip Technology (NASDAQ: MCHP) is a leading provider of microcontrollers and integrated circuits used mainly in the automotive world, especially in electric vehicles and their charging devices.

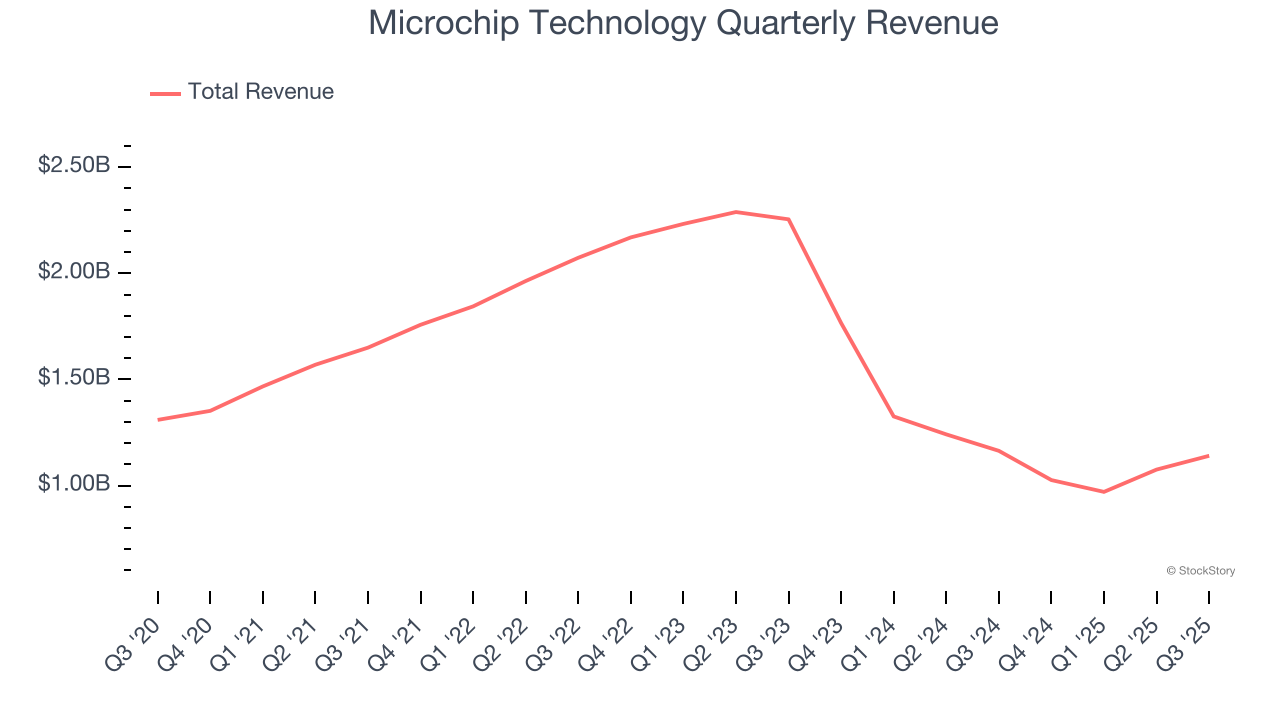

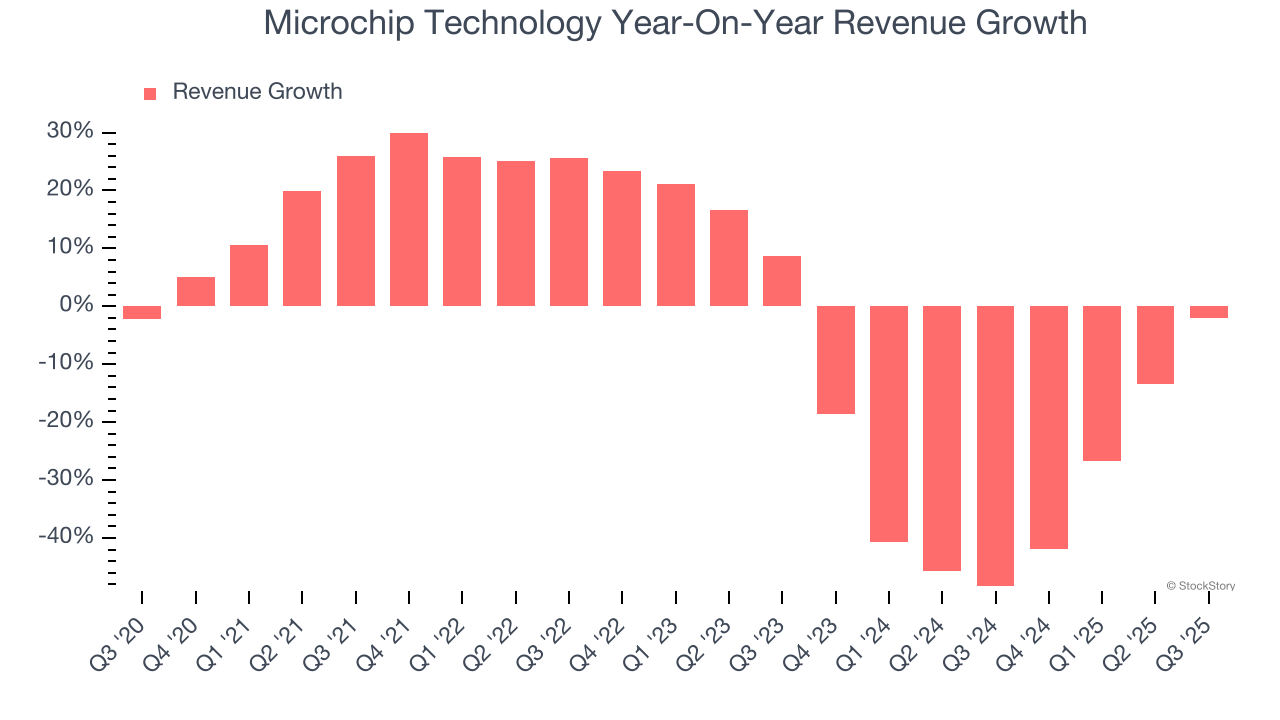

Revenue Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Microchip Technology struggled to consistently generate demand over the last five years as its sales dropped at a 4.2% annual rate. This wasn’t a great result and suggests it’s a lower quality business. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions.

Long-term growth is the most important, but short-term results matter for semiconductors because the rapid pace of technological innovation (Moore's Law) could make yesterday's hit product obsolete today. Microchip Technology’s recent performance shows its demand remained suppressed as its revenue has declined by 31.4% annually over the last two years.

This quarter, Microchip Technology reported a rather uninspiring 2% year-on-year revenue decline to $1.14 billion of revenue, in line with Wall Street’s estimates. Despite meeting estimates, the drop in sales could mean that the current downcycle is deepening. Company management is currently guiding for a 10% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 23% over the next 12 months, an improvement versus the last two years. This projection is admirable and suggests its newer products and services will catalyze better top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

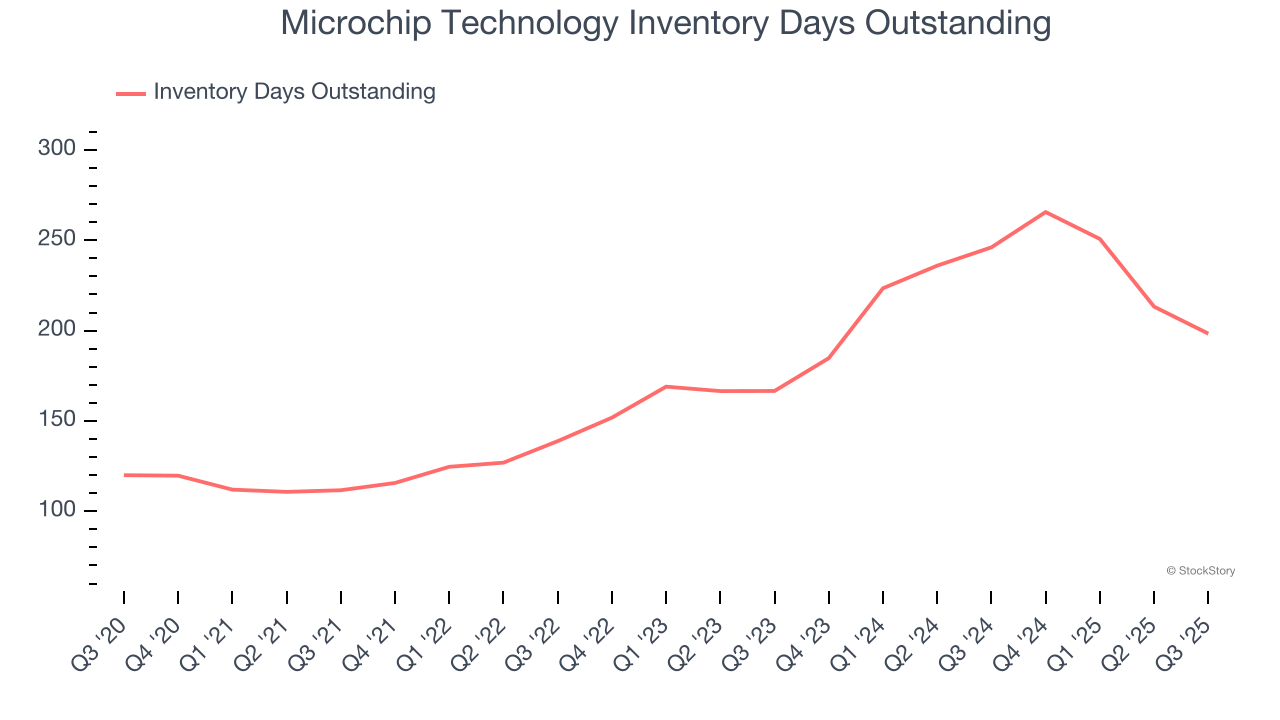

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business’ capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Microchip Technology’s DIO came in at 198, which is 27 days above its five-year average. These numbers suggest that despite the recent decrease, the company’s inventory levels are higher than what we’ve seen in the past.

Key Takeaways from Microchip Technology’s Q3 Results

It was good to see a material improvement in Microchip Technology’s inventory levels. We were also glad its adjusted operating income outperformed Wall Street’s estimates. On the other hand, its revenue and EPS guidance for next quarter both missed, and this is weighing on shares. The stock traded down 6.1% to $55.74 immediately following the results.

Big picture, is Microchip Technology a buy here and now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.