Cloud software provider Upland Software (NASDAQ: UPLD) reported Q3 CY2025 results exceeding the market’s revenue expectations, but sales fell by 24.2% year on year to $50.53 million. On the other hand, next quarter’s revenue guidance of $49.4 million was less impressive, coming in 2.7% below analysts’ estimates. Its non-GAAP profit of $0.30 per share was 73.1% above analysts’ consensus estimates.

Is now the time to buy Upland Software? Find out by accessing our full research report, it’s free for active Edge members.

Upland Software (UPLD) Q3 CY2025 Highlights:

- Revenue: $50.53 million vs analyst estimates of $49.91 million (24.2% year-on-year decline, 1.2% beat)

- Adjusted EPS: $0.30 vs analyst estimates of $0.17 (73.1% beat)

- Adjusted EBITDA: $16.03 million vs analyst estimates of $15.96 million (31.7% margin, in line)

- Revenue Guidance for Q4 CY2025 is $49.4 million at the midpoint, below analyst estimates of $50.79 million

- EBITDA guidance for the full year is $58 million at the midpoint, below analyst estimates of $58.82 million

- Operating Margin: 10.6%, up from -5% in the same quarter last year

- Free Cash Flow Margin: 13.2%, up from 5% in the previous quarter

- Market Capitalization: $55.24 million

"With our Q3 results, we are pleased to report continued positive core organic growth, and a significant expansion of our Adjusted EBITDA margin,” said Jack McDonald, Upland’s Chairman and Chief Executive Officer.

Company Overview

Operating under the mantra "land and expand," Upland Software (NASDAQ: UPLD) provides cloud-based applications that help organizations manage projects, workflows, and digital transformation across various business functions.

Revenue Growth

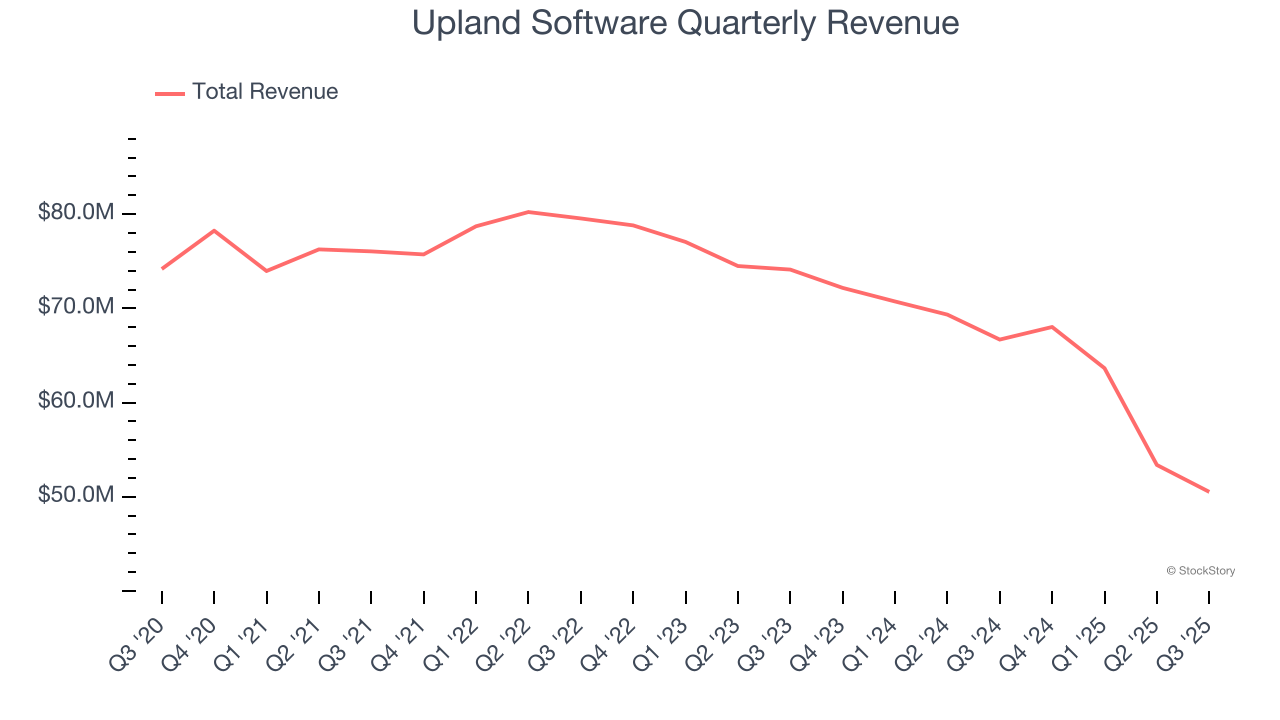

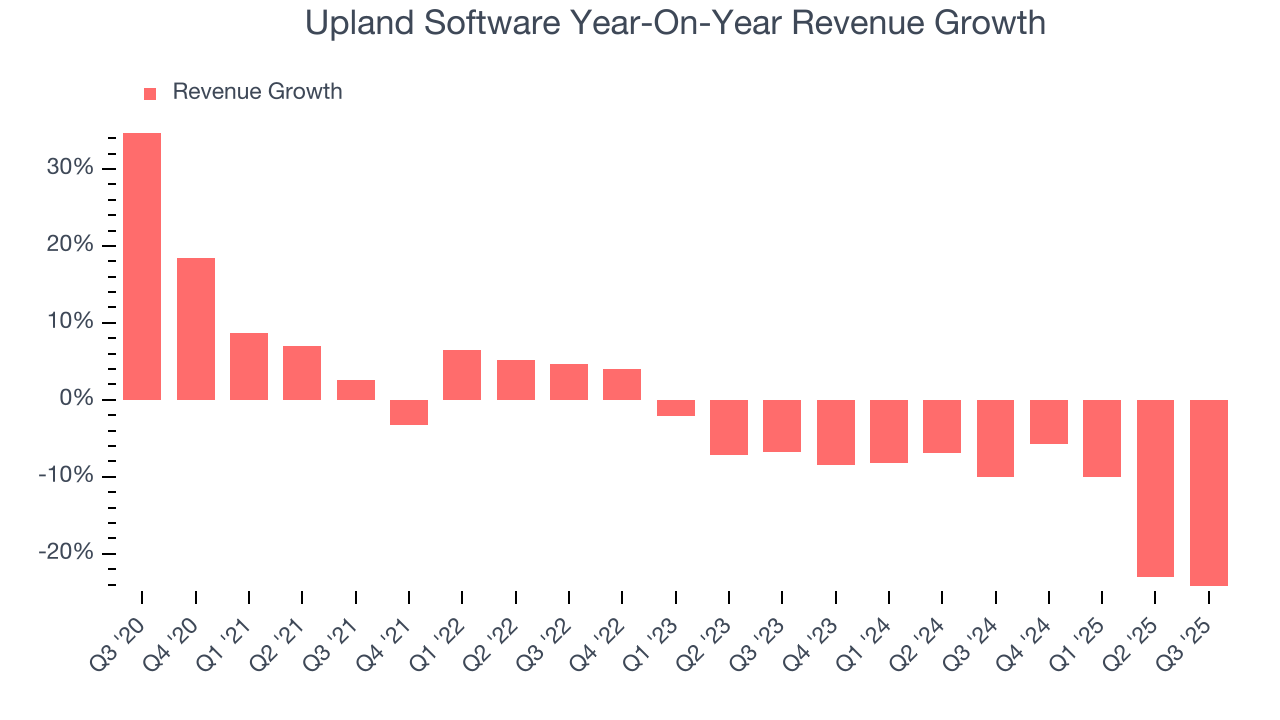

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Upland Software struggled to consistently generate demand over the last five years as its sales dropped at a 3.4% annual rate. This wasn’t a great result and suggests it’s a lower quality business.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Upland Software’s recent performance shows its demand remained suppressed as its revenue has declined by 12% annually over the last two years.

This quarter, Upland Software’s revenue fell by 24.2% year on year to $50.53 million but beat Wall Street’s estimates by 1.2%. Company management is currently guiding for a 27.4% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 13% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and implies its newer products and services will not catalyze better top-line performance yet.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Upland Software is extremely efficient at acquiring new customers, and its CAC payback period checked in at 4.1 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Upland Software’s Q3 Results

It was good to see Upland Software narrowly top analysts’ revenue expectations this quarter. On the other hand, its revenue guidance for next quarter missed and its EBITDA guidance for next quarter fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded up 2.5% to $1.95 immediately after reporting.

So should you invest in Upland Software right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.