Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Repligen (NASDAQ: RGEN) and its peers.

Companies specializing in drug development inputs and services play a crucial role in the pharmaceutical and biotechnology value chain. Essential support for drug discovery, preclinical testing, and manufacturing means stable demand, as pharmaceutical companies often outsource non-core functions with medium to long-term contracts. However, the business model faces high capital requirements, customer concentration, and vulnerability to shifts in biopharma R&D budgets or regulatory frameworks. Looking ahead, the industry will likely enjoy tailwinds such as increasing investment in biologics, cell and gene therapies, and advancements in precision medicine, which drive demand for sophisticated tools and services. There is a growing trend of outsourcing in drug development for nimbleness and cost efficiency, which benefits the industry. On the flip side, potential headwinds include pricing pressures as efforts to contain healthcare costs are always top of mind. An evolving regulatory backdrop could also slow innovation or client activity.

The 7 drug development inputs & services stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 3.1%.

In light of this news, share prices of the companies have held steady as they are up 2% on average since the latest earnings results.

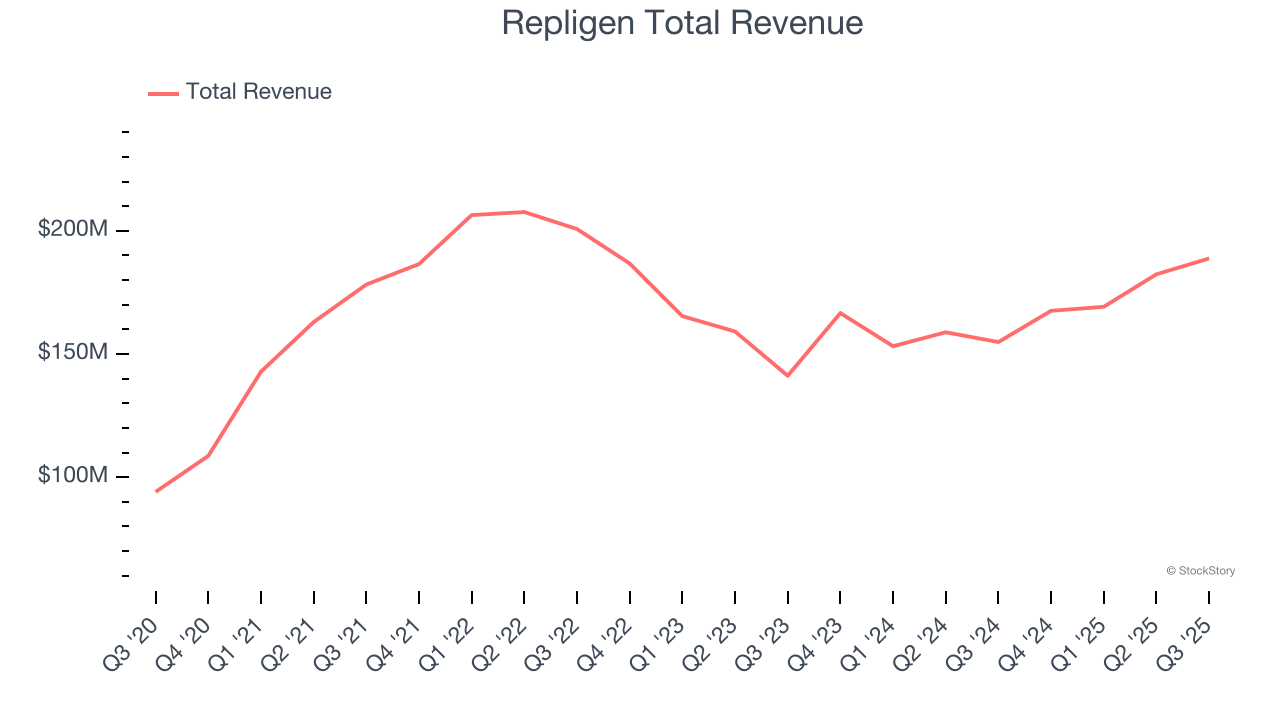

Repligen (NASDAQ: RGEN)

With over 13 strategic acquisitions since 2012 to build its comprehensive bioprocessing portfolio, Repligen (NASDAQ: RGEN) develops and manufactures specialized technologies that improve the efficiency and flexibility of biological drug manufacturing processes.

Repligen reported revenues of $188.8 million, up 21.9% year on year. This print exceeded analysts’ expectations by 3.8%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ organic revenue estimates and a solid beat of analysts’ revenue estimates.

Unsurprisingly, the stock is down 10.1% since reporting and currently trades at $144.50.

Is now the time to buy Repligen? Access our full analysis of the earnings results here, it’s free for active Edge members.

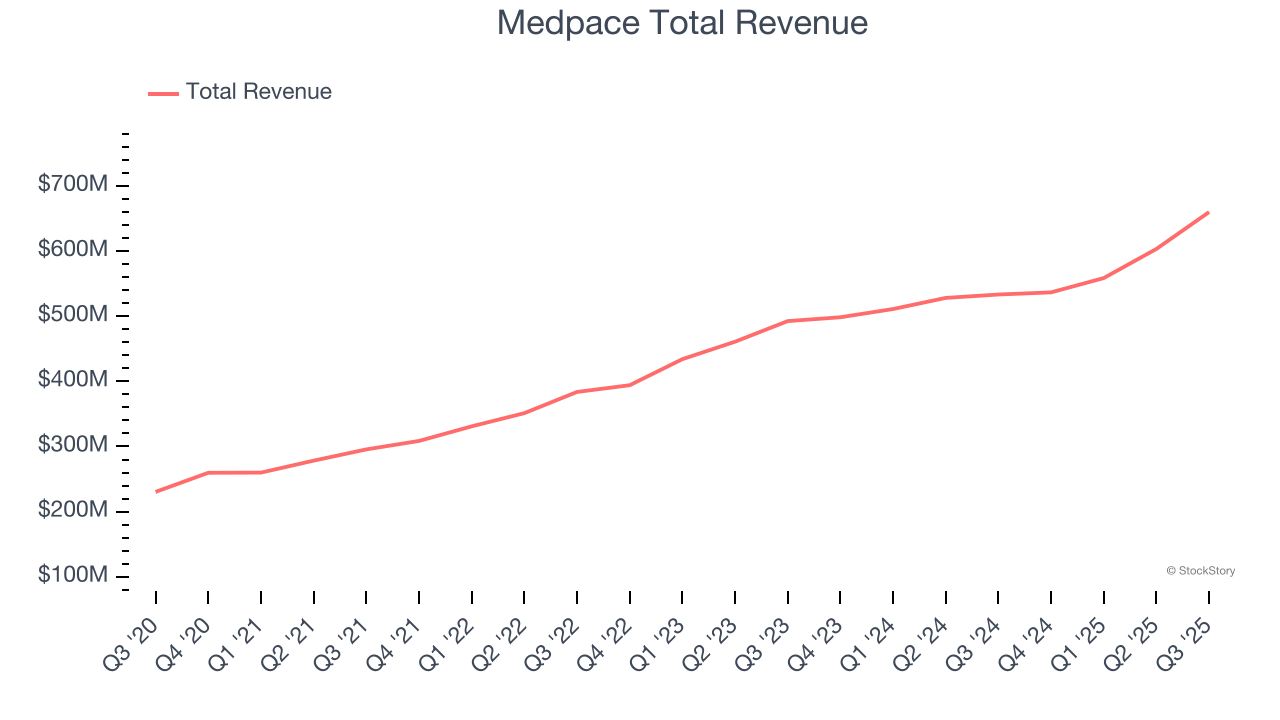

Best Q3: Medpace (NASDAQ: MEDP)

Founded in 1992 as a scientifically-driven alternative to traditional contract research organizations, Medpace (NASDAQ: MEDP) provides outsourced clinical trial management and research services to help pharmaceutical, biotechnology, and medical device companies develop new treatments.

Medpace reported revenues of $659.9 million, up 23.7% year on year, outperforming analysts’ expectations by 2.7%. The business had an exceptional quarter with an impressive beat of analysts’ organic revenue and full-year EPS guidance estimates.

Medpace delivered the fastest revenue growth among its peers. The market seems happy with the results as the stock is up 8.3% since reporting. It currently trades at $593.02.

Is now the time to buy Medpace? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: IQVIA (NYSE: IQV)

Created from the 2016 merger of Quintiles (a clinical research organization) and IMS Health (a healthcare data specialist), IQVIA (NYSE: IQV) provides clinical research services, data analytics, and technology solutions to help pharmaceutical companies develop and market medications more effectively.

IQVIA reported revenues of $4.1 billion, up 5.2% year on year, exceeding analysts’ expectations by 0.5%. Still, it was a mixed quarter because it struggled in other parts of the business.

IQVIA delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 3% since the results and currently trades at $211.

Read our full analysis of IQVIA’s results here.

UFP Technologies (NASDAQ: UFPT)

With expertise dating back to 1963 in specialized materials and precision manufacturing, UFP Technologies (NASDAQ: UFPT) designs and manufactures custom solutions for medical devices, sterile packaging, and other highly engineered products for healthcare and industrial applications.

UFP Technologies reported revenues of $154.6 million, up 6.5% year on year. This print beat analysts’ expectations by 3.3%. Overall, it was a very strong quarter as it also produced a solid beat of analysts’ revenue estimates and a beat of analysts’ EPS estimates.

The stock is up 10% since reporting and currently trades at $219.49.

Read our full, actionable report on UFP Technologies here, it’s free for active Edge members.

West Pharmaceutical Services (NYSE: WST)

Founded in 1923 and serving as a critical link in the pharmaceutical supply chain, West Pharmaceutical Services (NYSE: WST) manufactures specialized packaging, containment systems, and delivery devices for injectable drugs and healthcare products.

West Pharmaceutical Services reported revenues of $804.6 million, up 7.7% year on year. This number surpassed analysts’ expectations by 2.1%. It was a very strong quarter as it also recorded an impressive beat of analysts’ full-year EPS guidance estimates and a beat of analysts’ EPS estimates.

The stock is flat since reporting and currently trades at $275.34.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.