Low code software development platform provider Appian (Nasdaq: APPN) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 14.7% year on year to $166.7 million. On the other hand, next quarter’s revenue guidance of $163 million was less impressive, coming in 1.8% below analysts’ estimates. Its non-GAAP loss of $0 per share was $0.01 above analysts’ consensus estimates.

Is now the time to buy Appian? Find out by accessing our full research report, it’s free.

Appian (APPN) Q4 CY2024 Highlights:

- Revenue: $166.7 million vs analyst estimates of $164.3 million (14.7% year-on-year growth, 1.5% beat)

- Adjusted EPS: $0 vs analyst estimates of -$0.01 ($0.01 beat)

- Adjusted Operating Income: $18.7 million vs analyst estimates of $4.97 million (11.2% margin, significant beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $682 million at the midpoint, in line with analyst expectations and implying 10.5% growth (vs 13.1% in FY2024)

- Adjusted EPS guidance for the upcoming financial year 2025 is $0.20 at the midpoint, beating analyst estimates by 56.5%

- EBITDA guidance for the upcoming financial year 2025 is $40 million at the midpoint, above analyst estimates of $39.64 million

- Operating Margin: 3%, up from -11.6% in the same quarter last year

- Free Cash Flow was $13.36 million, up from -$8.60 million in the previous quarter

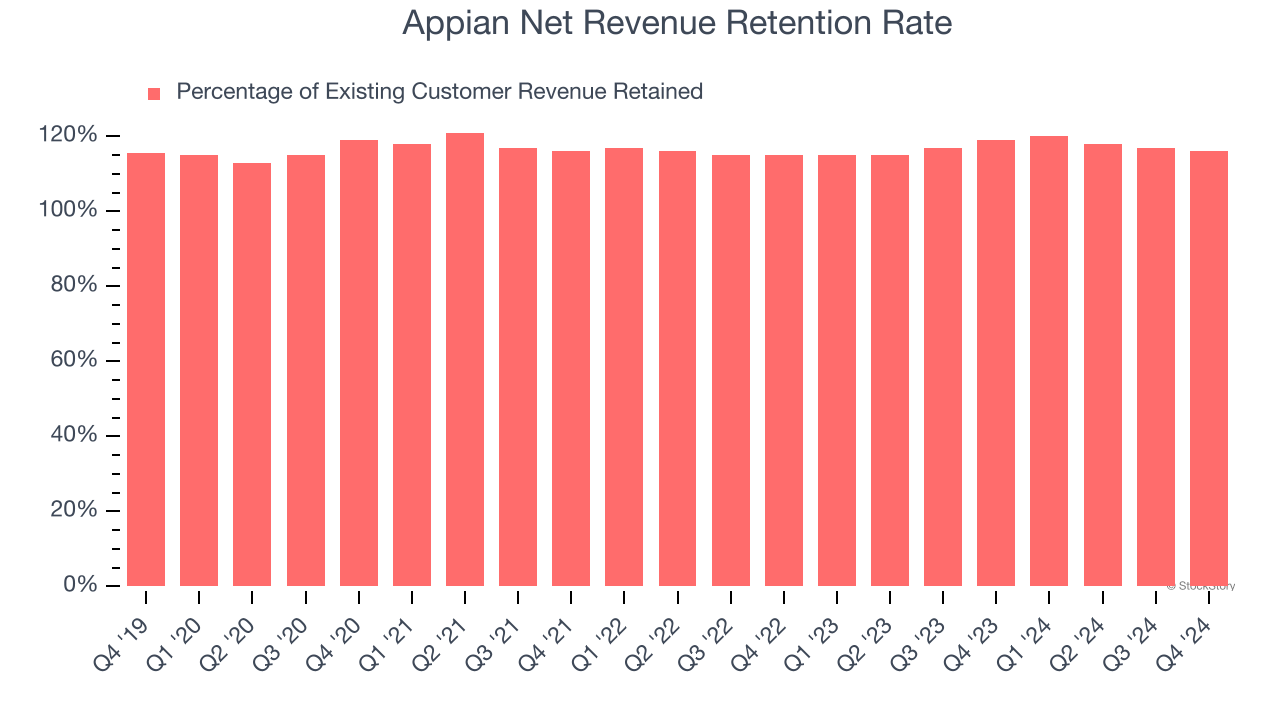

- Net Revenue Retention Rate: 116%, down from 117% in the previous quarter

- Market Capitalization: $2.48 billion

“In 2024, Appian demonstrated its ability to grow with increasing efficiency. We specialize in creating value with AI, by deploying it in a process. While others bring work to AI, we bring AI to work,” said Matt Calkins, CEO & Founder.

Company Overview

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ: APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

Automation Software

The whole purpose of software is to automate tasks to increase productivity. Today, innovative new software techniques, often involving AI and machine learning, are finally allowing automation that has graduated from simple one- or two-step workflows to more complex processes integral to enterprises. The result is surging demand for modern automation software.

Sales Growth

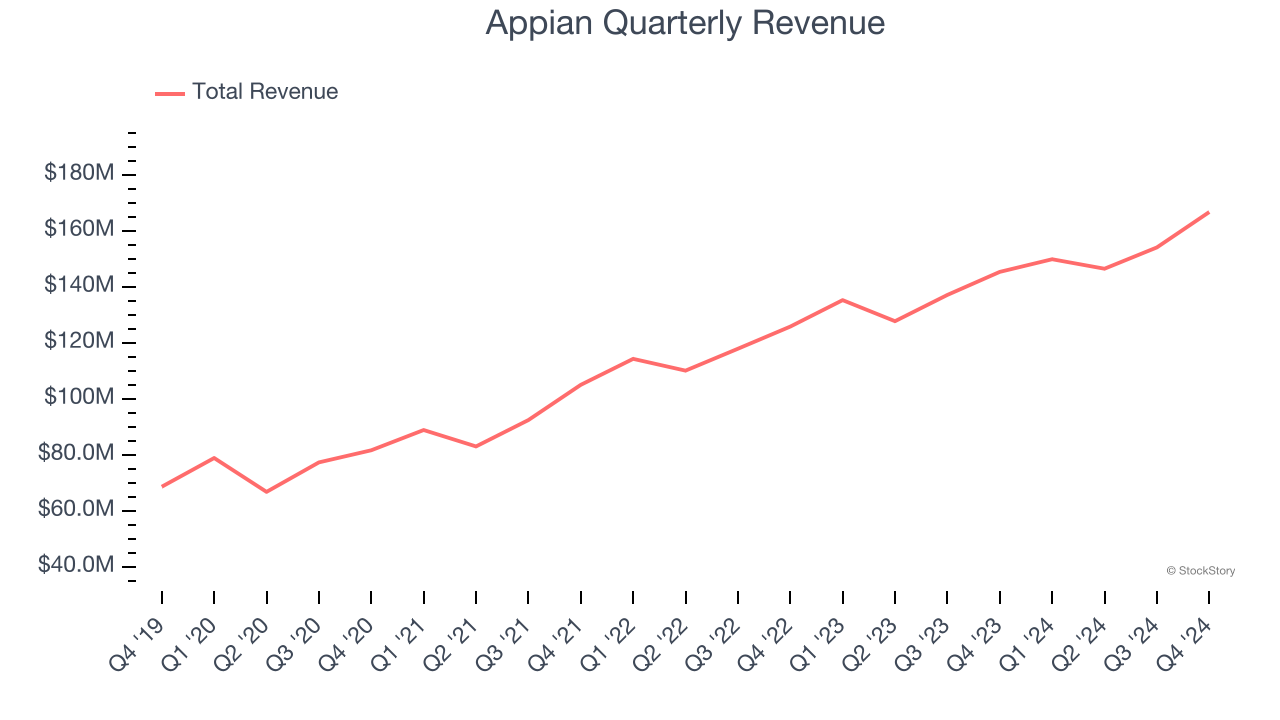

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last three years, Appian grew its sales at a 18.7% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our benchmark for the software sector, which enjoys a number of secular tailwinds.

This quarter, Appian reported year-on-year revenue growth of 14.7%, and its $166.7 million of revenue exceeded Wall Street’s estimates by 1.5%. Company management is currently guiding for a 8.8% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 10.7% over the next 12 months, a deceleration versus the last three years. Still, this projection is above the sector average and indicates the market sees some success for its newer products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Appian’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 118% in Q4. This means Appian would’ve grown its revenue by 17.8% even if it didn’t win any new customers over the last 12 months.

Despite falling over the last year, Appian still has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Key Takeaways from Appian’s Q4 Results

It was great to see Appian beat analysts’ revenue, EPS, and adjusted operating income expectations this quarter. We were also glad its full-year EPS and EBITDA guidance topped Wall Street’s estimates. On the other hand, its revenue guidance for next quarter fell short. Still, this was a solid quarter. The stock traded up 6.5% to $34.19 immediately after reporting.

Big picture, is Appian a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.