3D measurement and imaging company FARO (NASDAQ: FARO) reported Q4 CY2024 results exceeding the market’s revenue expectations, but sales fell by 5.4% year on year to $93.54 million. The company expects next quarter’s revenue to be around $81 million, close to analysts’ estimates. Its non-GAAP profit of $0.50 per share was 25% above analysts’ consensus estimates.

Is now the time to buy FARO? Find out by accessing our full research report, it’s free.

FARO (FARO) Q4 CY2024 Highlights:

- Revenue: $93.54 million vs analyst estimates of $91.4 million (5.4% year-on-year decline, 2.3% beat)

- Adjusted EPS: $0.50 vs analyst estimates of $0.40 ($0.10 beat)

- Adjusted EBITDA: $16.75 million vs analyst estimates of $12.59 million (17.9% margin, $4.2 beat)

- Revenue Guidance for Q1 CY2025 is $81 million at the midpoint, roughly in line with what analysts were expecting

- Adjusted EPS guidance for Q1 CY2025 is $0.20 at the midpoint, above analyst estimates of $0.09

- Operating Margin: 5.1%, up from 2.9% in the same quarter last year

- Free Cash Flow Margin: 13.3%, down from 17.1% in the same quarter last year

- Market Capitalization: $504.3 million

“We are proud to conclude the year with strong momentum, surpassing targets across all of our metrics in the fourth quarter and achieving a decade-high adjusted EBITDA margin of 18% along with our fifth consecutive quarter of positive operating cash flow,” said Peter Lau, President & Chief Executive Officer.

Company Overview

Launched by two PhD students in a garage, FARO (NASDAQ: FARO) provides 3D measurement and imaging systems for the manufacturing, construction, engineering, and public safety industries.

Inspection Instruments

Measurement and inspection instrument companies may enjoy more steady demand because products such as water meters are non-discretionary and mandated for replacement at predictable intervals. In the last decade, digitization and data collection have driven innovation in the space, leading to incremental sales. But like the broader industrials sector, measurement and inspection instrument companies are at the whim of economic cycles. Interest rates, for example, can greatly impact civil, commercial, and residential construction projects that drive demand.

Sales Growth

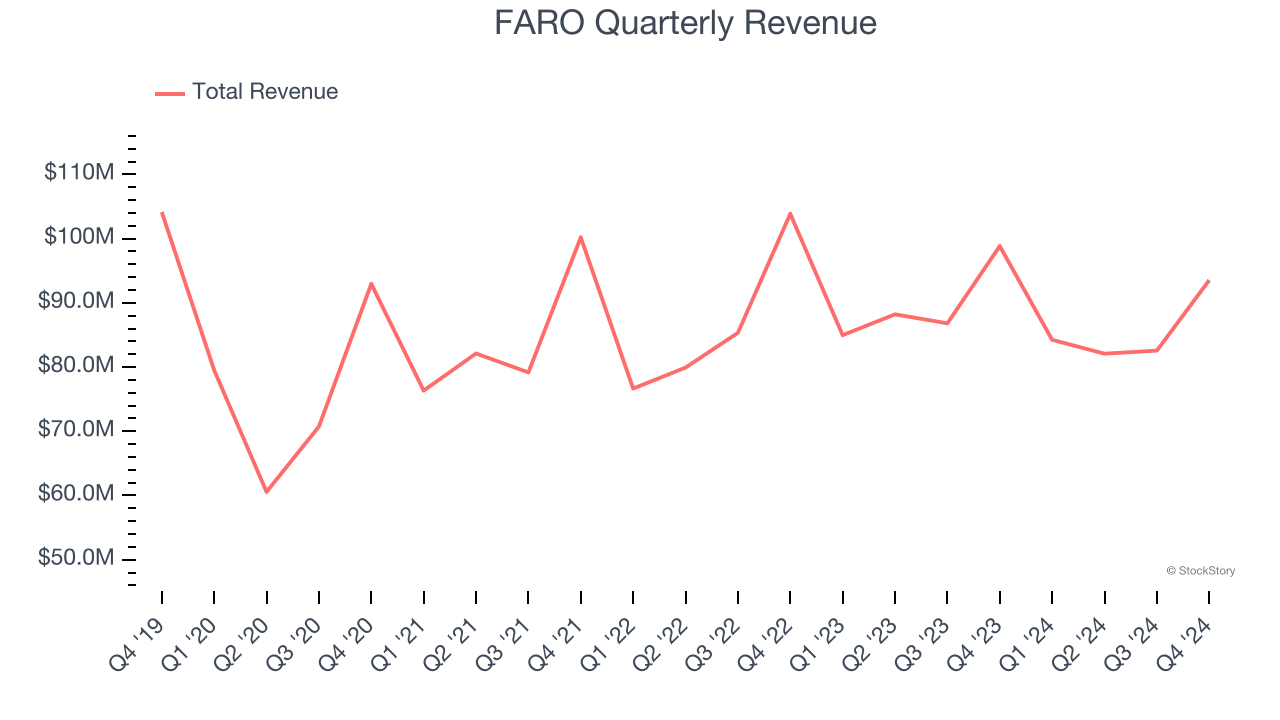

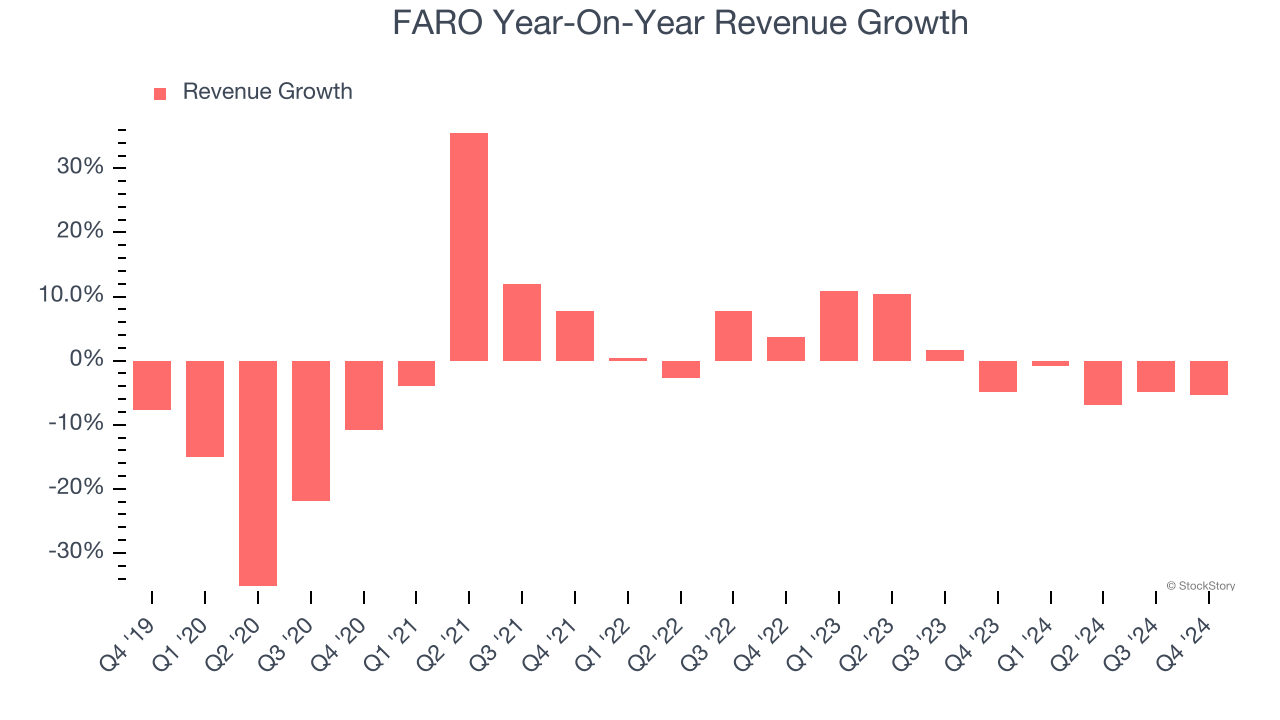

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. FARO’s demand was weak over the last five years as its sales fell at a 2.2% annual rate. This was below our standards and is a sign of poor business quality.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. FARO’s revenue over the last two years was flat, sugggesting its demand was weak but stabilized after its initial drop in sales. We also note many other Inspection Instruments businesses have faced declining sales because of cyclical headwinds. While FARO’s growth wasn’t the best, it did perform better than its peers.

This quarter, FARO’s revenue fell by 5.4% year on year to $93.54 million but beat Wall Street’s estimates by 2.3%. Company management is currently guiding for a 3.9% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months. While this projection suggests its newer products and services will spur better top-line performance, it is still below the sector average.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

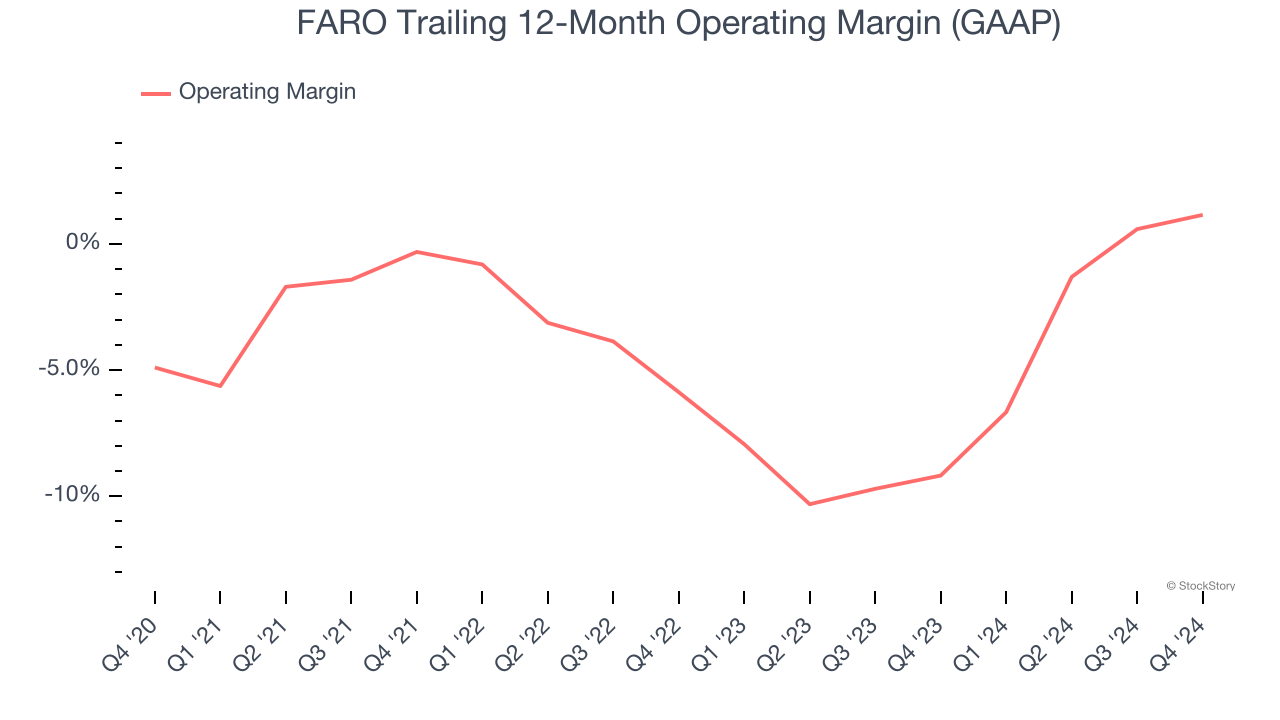

Although FARO was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 3.9% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, FARO’s operating margin rose by 6 percentage points over the last five years. Still, it will take much more for the company to show consistent profitability.

This quarter, FARO generated an operating profit margin of 5.1%, up 2.2 percentage points year on year. Since its gross margin expanded more than its operating margin, we can infer that leverage on its cost of sales was the primary driver behind the recently higher efficiency.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

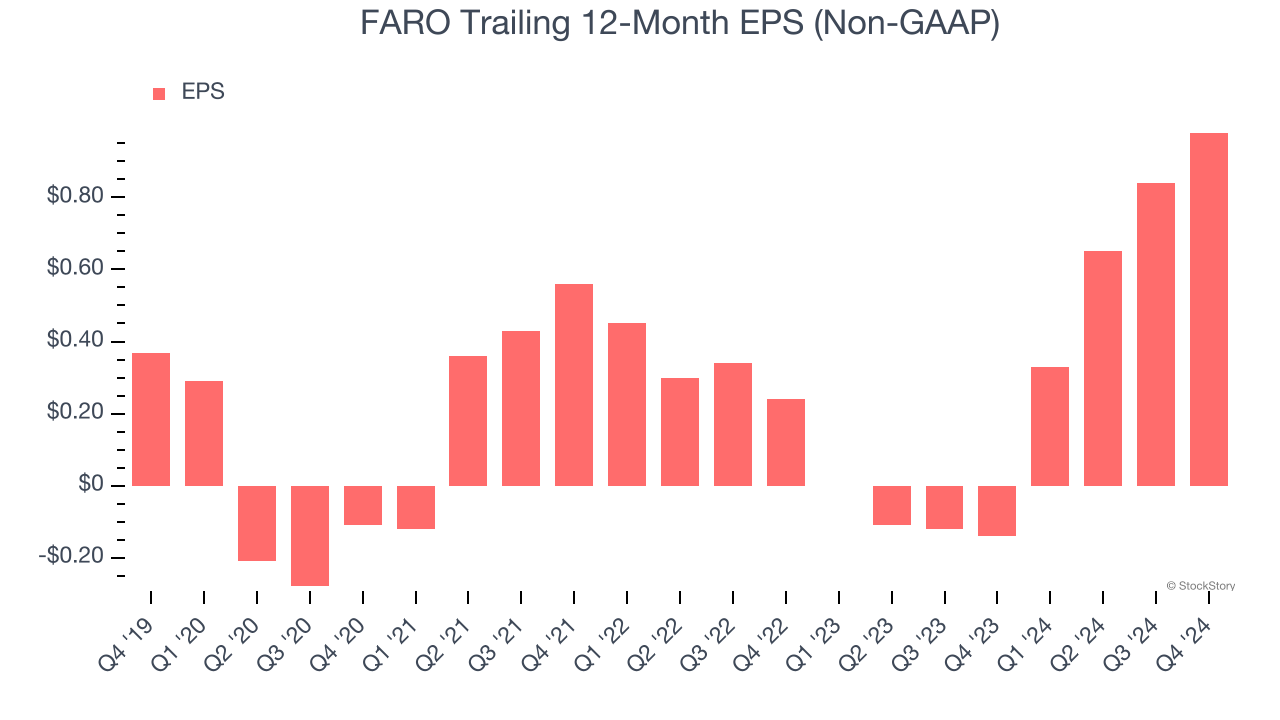

FARO’s EPS grew at an astounding 21.6% compounded annual growth rate over the last five years, higher than its 2.2% annualized revenue declines. This tells us management adapted its cost structure in response to a challenging demand environment.

We can take a deeper look into FARO’s earnings to better understand the drivers of its performance. As we mentioned earlier, FARO’s operating margin expanded by 6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For FARO, its two-year annual EPS growth of 102% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q4, FARO reported EPS at $0.50, up from $0.36 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects FARO’s full-year EPS of $0.98 to grow 1.5%.

Key Takeaways from FARO’s Q4 Results

We were impressed by FARO’s optimistic EPS guidance for next quarter, which beat analysts’ expectations. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin in the quarter. Zooming out, we think this was a solid quarter. The stock traded up 6.2% to $28.78 immediately after reporting.

FARO had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.