Higher education company Strategic Education (NASDAQ: STRA) met Wall Street’s revenue expectations in Q4 CY2024, with sales up 2.9% year on year to $311.5 million. Its non-GAAP profit of $1.27 per share was 2.4% above analysts’ consensus estimates.

Is now the time to buy Strategic Education? Find out by accessing our full research report, it’s free.

Strategic Education (STRA) Q4 CY2024 Highlights:

- Revenue: $311.5 million vs analyst estimates of $312 million (2.9% year-on-year growth, in line)

- Adjusted EPS: $1.27 vs analyst estimates of $1.24 (2.4% beat)

- Adjusted EBITDA: $60.07 million vs analyst estimates of $58.59 million (19.3% margin, 2.5% beat)

- Operating Margin: 11.6%, down from 17.9% in the same quarter last year

- Free Cash Flow Margin: 1.5%, down from 5.7% in the same quarter last year

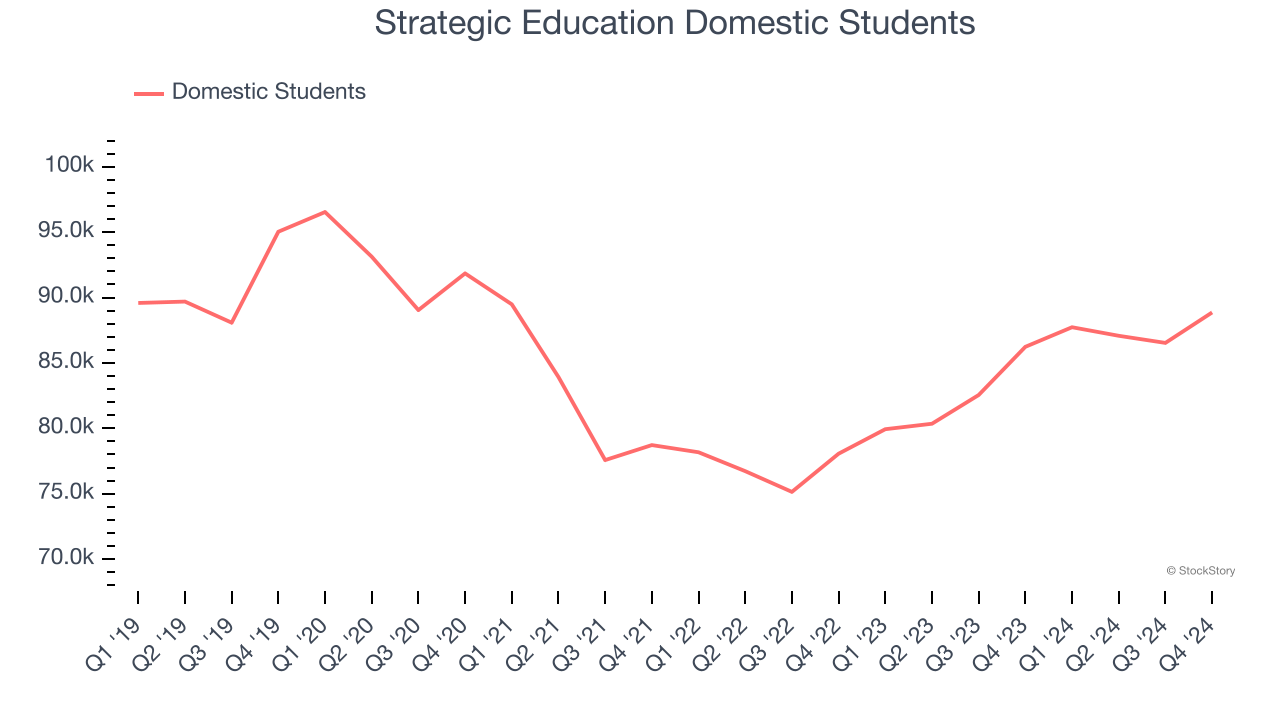

- Domestic Students: 88,860, up 2,627 year on year

- Market Capitalization: $2.38 billion

“During 2024, we delivered strong performance consistent with our notional operating model including enrollment, revenue, and earnings growth,” said Karl McDonnell, Chief Executive Officer of Strategic Education.

Company Overview

Formed through the merger of Strayer Education and Capella Education in 2018, Strategic Education (NASDAQ: STRA) is a career-focused higher education provider.

Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

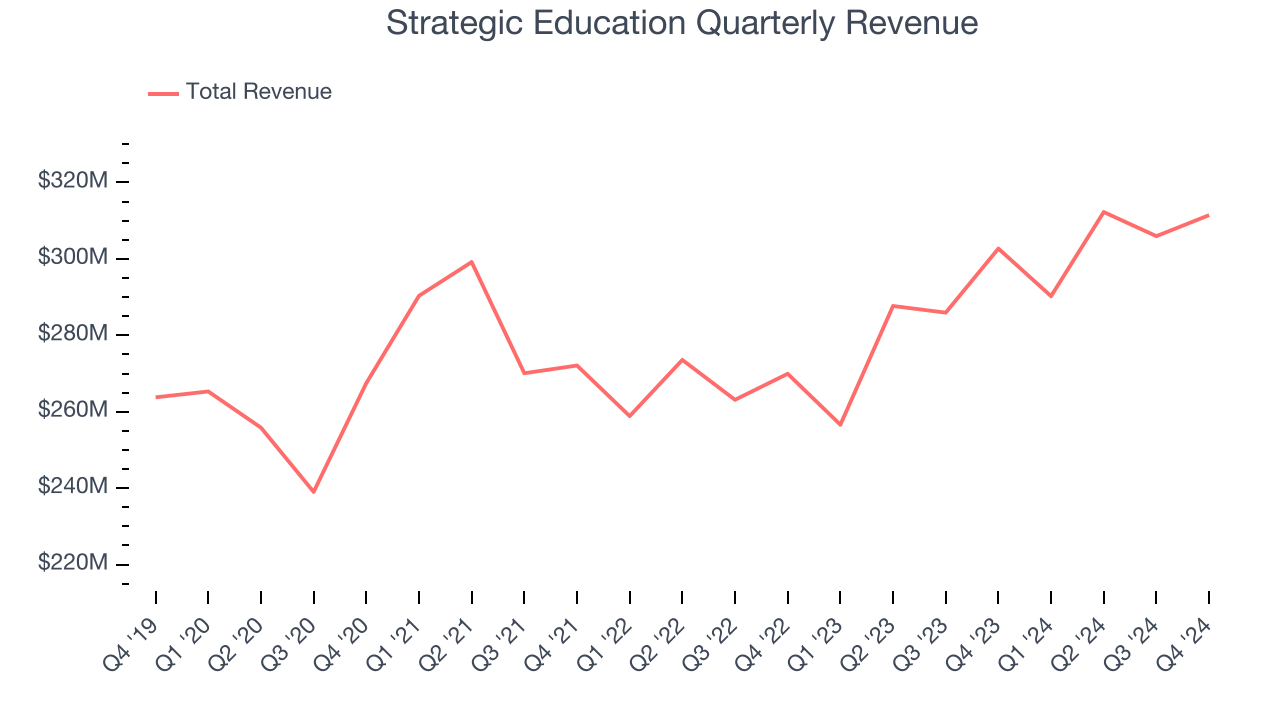

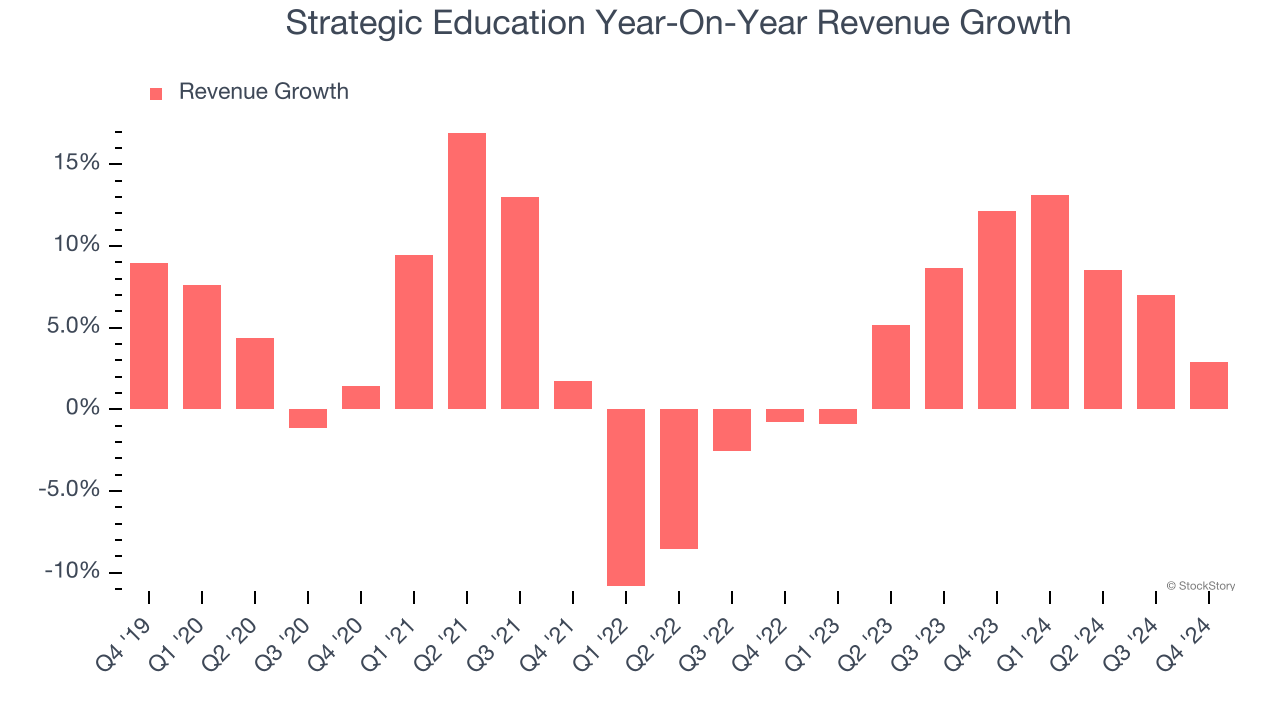

Sales Growth

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, Strategic Education grew its sales at a sluggish 4.1% compounded annual growth rate. This fell short of our benchmark for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. Strategic Education’s annualized revenue growth of 7% over the last two years is above its five-year trend, but we were still disappointed by the results.

We can dig further into the company’s revenue dynamics by analyzing its number of domestic students and international students, which clocked in at 88,860 and 19,825 in the latest quarter. Over the last two years, Strategic Education’s domestic students averaged 6.7% year-on-year growth while its international students were flat.

This quarter, Strategic Education grew its revenue by 2.9% year on year, and its $311.5 million of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 5% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and indicates its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

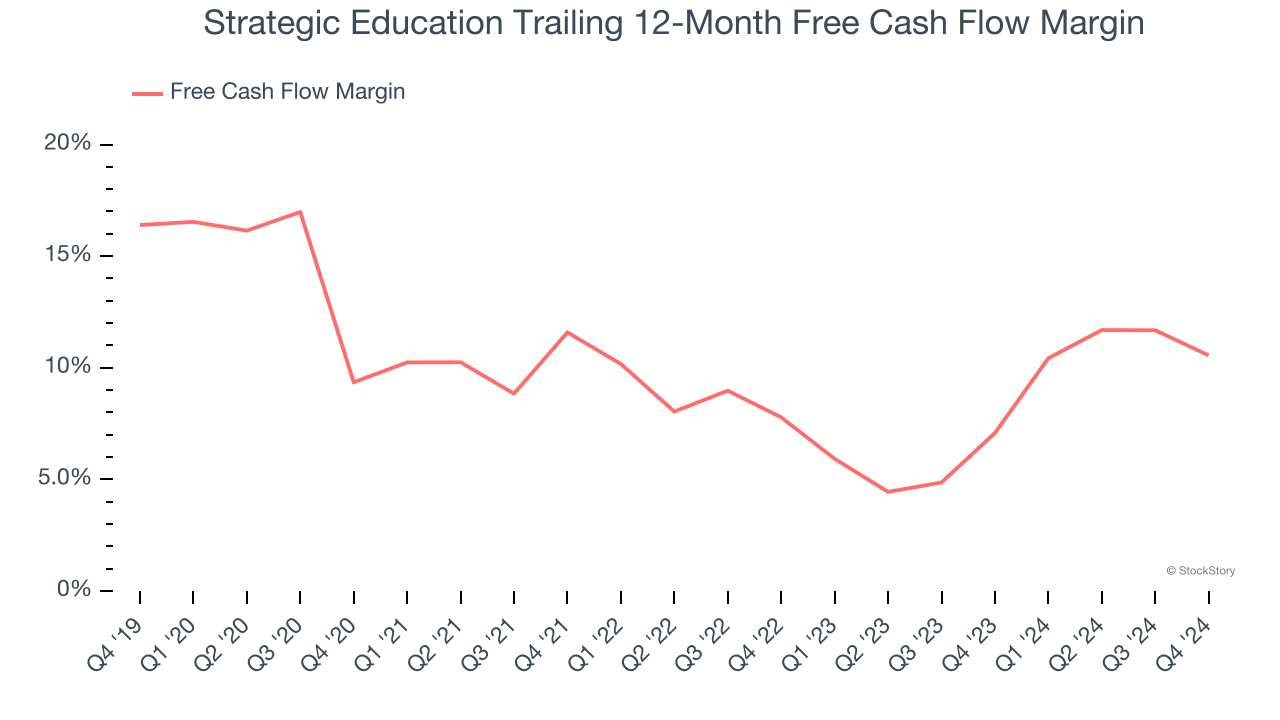

Strategic Education has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 8.9%, subpar for a consumer discretionary business.

Strategic Education’s free cash flow clocked in at $4.67 million in Q4, equivalent to a 1.5% margin. The company’s cash profitability regressed as it was 4.2 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Over the next year, analysts’ consensus estimates show they’re expecting Strategic Education’s free cash flow margin of 10.6% for the last 12 months to remain the same.

Key Takeaways from Strategic Education’s Q4 Results

It was encouraging to see Strategic Education beat analysts’ EPS and EBITDA expectations this quarter. On the other hand, its number of domestic students missed. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock remained flat at $97.94 immediately following the results.

Is Strategic Education an attractive investment opportunity right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.