Auto parts and accessories retailer O’Reilly Automotive (NASDAQ: ORLY) announced better-than-expected revenue in Q4 CY2024, with sales up 6.9% year on year to $4.10 billion. The company expects the full year’s revenue to be around $17.55 billion, close to analysts’ estimates. Its GAAP profit of $9.50 per share was 2.7% below analysts’ consensus estimates.

Is now the time to buy O'Reilly? Find out by accessing our full research report, it’s free.

O'Reilly (ORLY) Q4 CY2024 Highlights:

- Revenue: $4.10 billion vs analyst estimates of $4.05 billion (6.9% year-on-year growth, 1.2% beat)

- EPS (GAAP): $9.50 vs analyst expectations of $9.76 (2.7% miss)

- Adjusted EBITDA: $868.5 million vs analyst estimates of $884.1 million (21.2% margin, 1.8% miss)

- Management’s revenue guidance for the upcoming financial year 2025 is $17.55 billion at the midpoint, in line with analyst expectations and implying 5% growth (vs 5.7% in FY2024)

- EPS (GAAP) guidance for the upcoming financial year 2025 is $42.85 at the midpoint, missing analyst estimates by 5.2%

- Operating Margin: 18%, in line with the same quarter last year

- Free Cash Flow Margin: 8.1%, up from 6.7% in the same quarter last year

- Locations: 6,378 at quarter end, up from 6,157 in the same quarter last year

- Same-Store Sales rose 4.4% year on year, in line with the same quarter last year

- Market Capitalization: $77.02 billion

Brad Beckham, O’Reilly’s CEO, commented, “We are pleased to report a strong finish to 2024 in the fourth quarter, highlighted by 4.4% growth in comparable store sales, driven by solid growth in both professional and DIY. Our Team is relentlessly focused on executing our industry-leading model at a high level, which we believe continues to generate market share gains on both sides of our business. I would like to take this opportunity to commend Team O’Reilly on their performance in the fourth quarter and thank each of you for your hard work and continued commitment to providing excellent customer service.”

Company Overview

Serving both the DIY customer and professional mechanic, O’Reilly Automotive (NASDAQ: ORLY) is an auto parts and accessories retailer that sells everything from fuel pumps to car air fresheners to mufflers.

Auto Parts Retailer

Cars are complex machines that need maintenance and occasional repairs, and auto parts retailers cater to the professional mechanic as well as the do-it-yourself (DIY) fixer. Work on cars may entail replacing fluids, parts, or accessories, and these stores have the parts and accessories or these jobs. While e-commerce competition presents a risk, these stores have a leg up due to the combination of broad and deep selection as well as expertise provided by sales associates. Another change on the horizon could be the increasing penetration of electric vehicles.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years.

With $16.71 billion in revenue over the past 12 months, O'Reilly is one of the larger companies in the consumer retail industry and benefits from a well-known brand that influences consumer purchasing decisions.

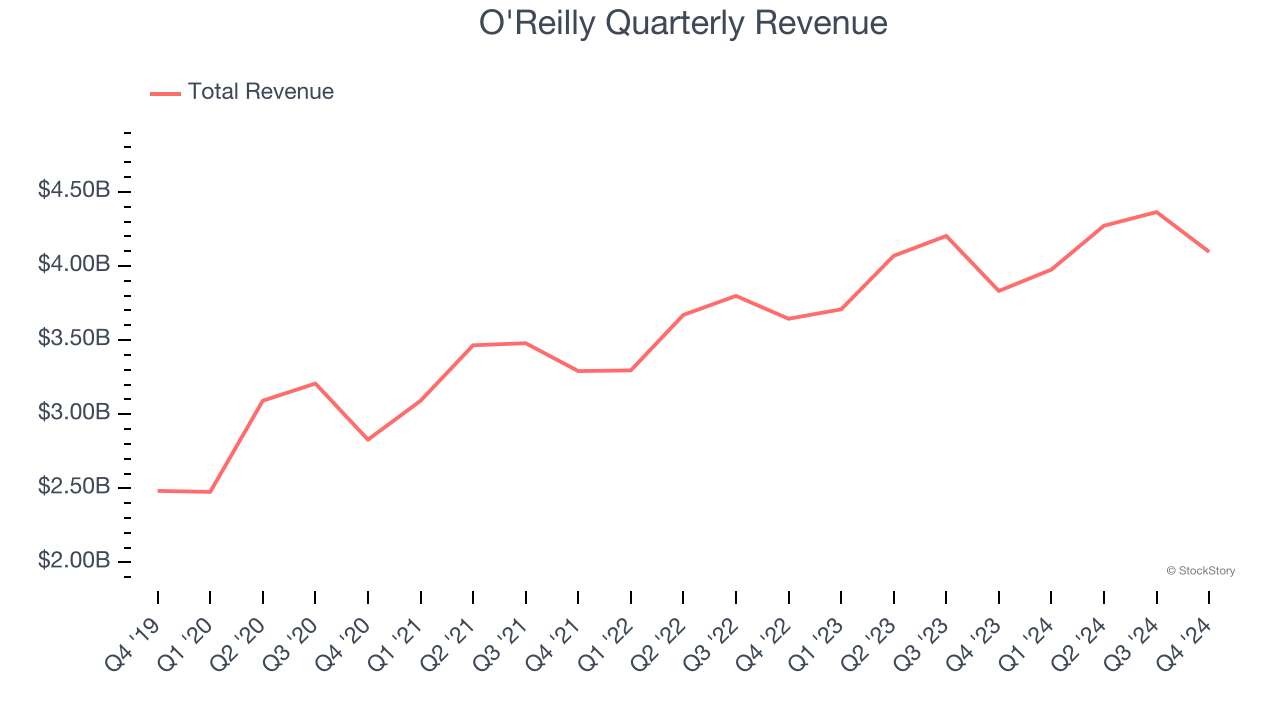

As you can see below, O'Reilly grew its sales at a decent 10.5% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts) as it opened new stores and increased sales at existing, established locations.

This quarter, O'Reilly reported year-on-year revenue growth of 6.9%, and its $4.10 billion of revenue exceeded Wall Street’s estimates by 1.2%.

Looking ahead, sell-side analysts expect revenue to grow 5.3% over the next 12 months, a deceleration versus the last five years. We still think its growth trajectory is attractive given its scale and suggests the market sees success for its products.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

Number of Stores

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

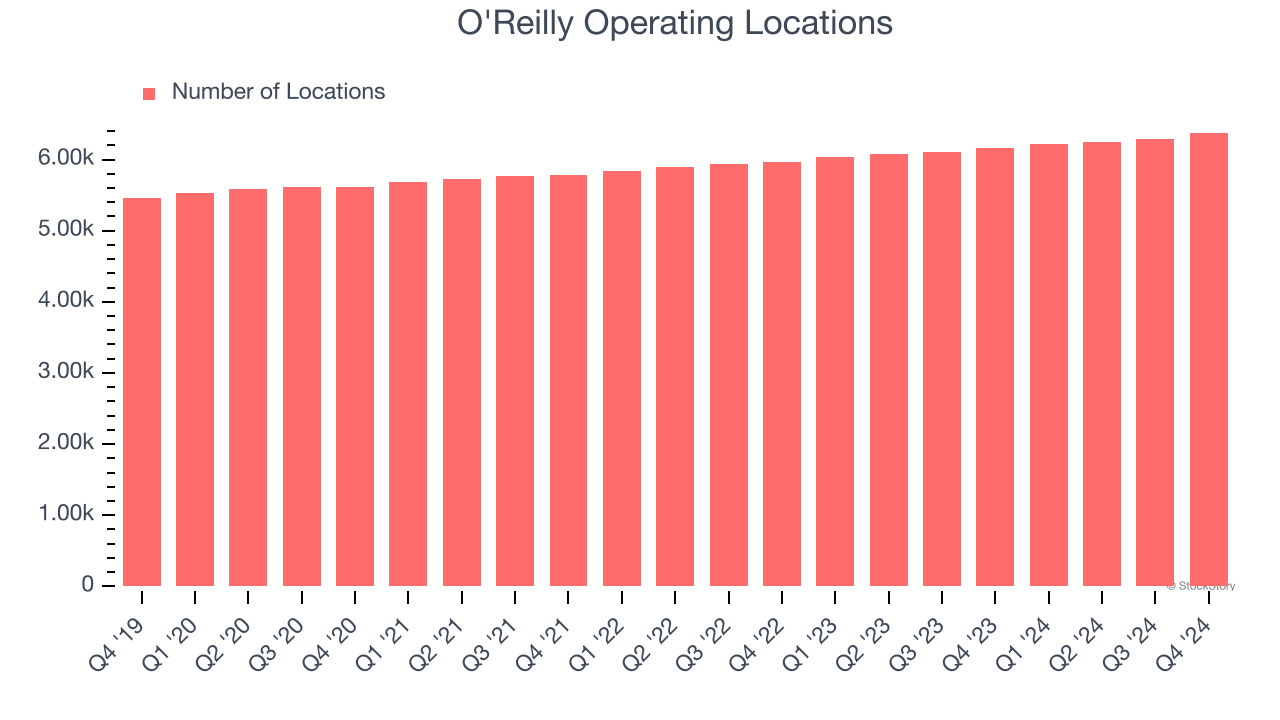

O'Reilly sported 6,378 locations in the latest quarter. Over the last two years, it has opened new stores quickly, averaging 3.1% annual growth. This was faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

A company's store base only paints one part of the picture. When demand is high, it makes sense to open more. But when demand is low, it’s prudent to close some locations and use the money in other ways. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

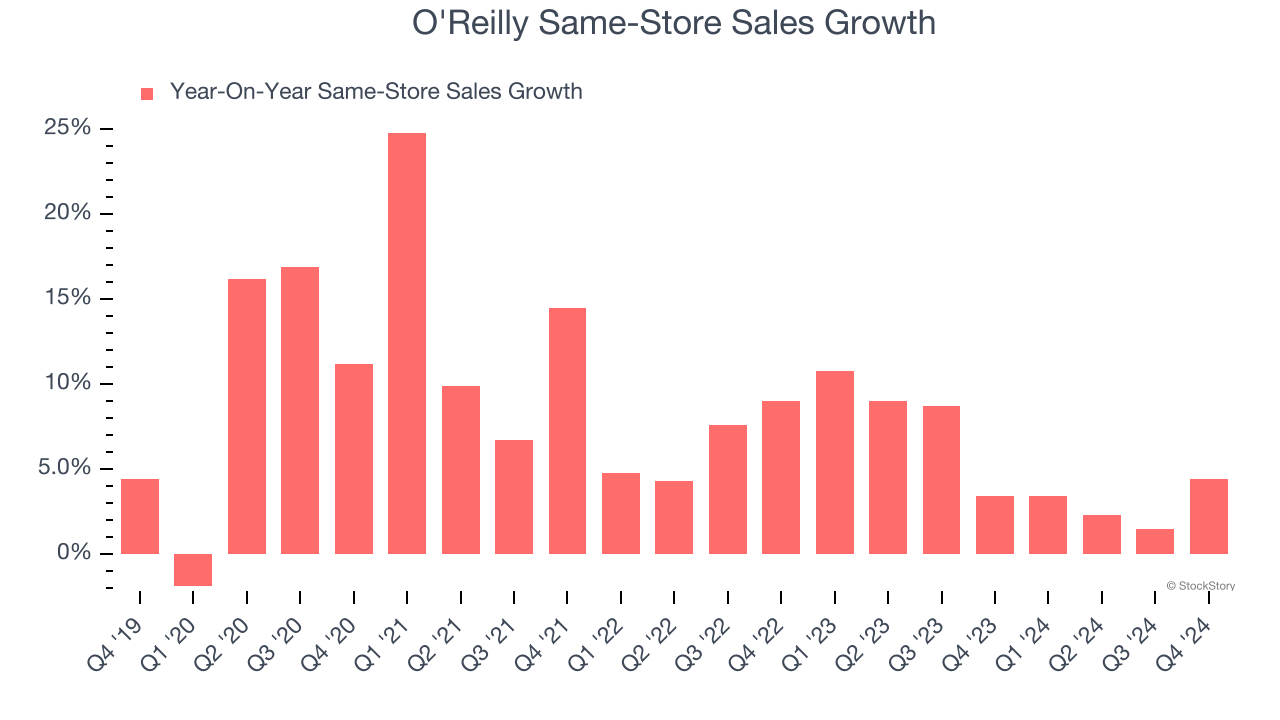

O'Reilly has been one of the most successful retailers over the last two years thanks to skyrocketing demand within its existing locations. On average, the company has posted exceptional year-on-year same-store sales growth of 5.4%. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives O'Reilly multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, O'Reilly’s same-store sales rose 4.4% year on year. This growth was a deceleration from its historical levels, showing the business is still performing well but losing a bit of steam.

Key Takeaways from O'Reilly’s Q4 Results

It was good to see O'Reilly narrowly top analysts’ revenue expectations this quarter. On the other hand, its full-year EPS guidance missed significantly and its EBITDA fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 2.5% to $1,314 immediately following the results.

O'Reilly underperformed this quarter, but does that create an opportunity to invest right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.