Payroll and human resources software provider, Paylocity (NASDAQ: PCTY) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 15.5% year on year to $377 million. Guidance for next quarter’s revenue was better than expected at $441.5 million at the midpoint, 1.9% above analysts’ estimates. Its non-GAAP profit of $1.52 per share was 6.6% above analysts’ consensus estimates.

Is now the time to buy Paylocity? Find out by accessing our full research report, it’s free.

Paylocity (PCTY) Q4 CY2024 Highlights:

- Revenue: $377 million vs analyst estimates of $367 million (15.5% year-on-year growth, 2.7% beat)

- Adjusted EPS: $1.52 vs analyst estimates of $1.43 (6.6% beat)

- Adjusted Operating Income: $101.1 million vs analyst estimates of $97.64 million (26.8% margin, 3.6% beat)

- The company lifted its revenue guidance for the full year to $1.56 billion at the midpoint from $1.54 billion, a 1.3% increase

- EBITDA guidance for the full year is $546 million at the midpoint, above analyst estimates of $536.1 million

- Operating Margin: 12.4%, down from 15.2% in the same quarter last year

- Free Cash Flow Margin: 9.8%, down from 20.4% in the previous quarter

- Annual Recurring Revenue: $347.7 million at quarter end, up 16.5% year on year

- Market Capitalization: $11.66 billion

“The momentum we saw in Q1 continued into the second quarter of fiscal 25, resulting in very strong results, solid selling season performance, and increased revenue and profitability guidance for fiscal 25. Second quarter recurring & other revenue growth was 17%, primarily driven by strong sales and operational execution, continued product differentiation, and a stable macroeconomic environment. Our sustained investment in R&D continues to drive differentiation and expanded average revenue per client, with the recent launch of Benefits Decision Support and Headcount Planning increasing our max PEPY to $600, achieving the target we set in August 2023. I would also like to thank all of our Paylocity teams as they support our clients through our busiest time of year,” said Toby Williams, President and Chief Executive Officer of Paylocity.

Company Overview

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ: PCTY) is a provider of payroll and HR software for small and medium-sized enterprises.

HR Software

Modern HR software has two powerful benefits: cost savings and ease of use. For cost savings, businesses large and small much prefer the flexibility of cloud-based, web-browser-delivered software paid for on a subscription basis rather than the hassle and complexity of purchasing and managing on-premise enterprise software. On the usability side, the consumerization of business software creates seamless experiences whereby multiple standalone processes like payroll processing and compliance are aggregated into a single, easy-to-use platform.

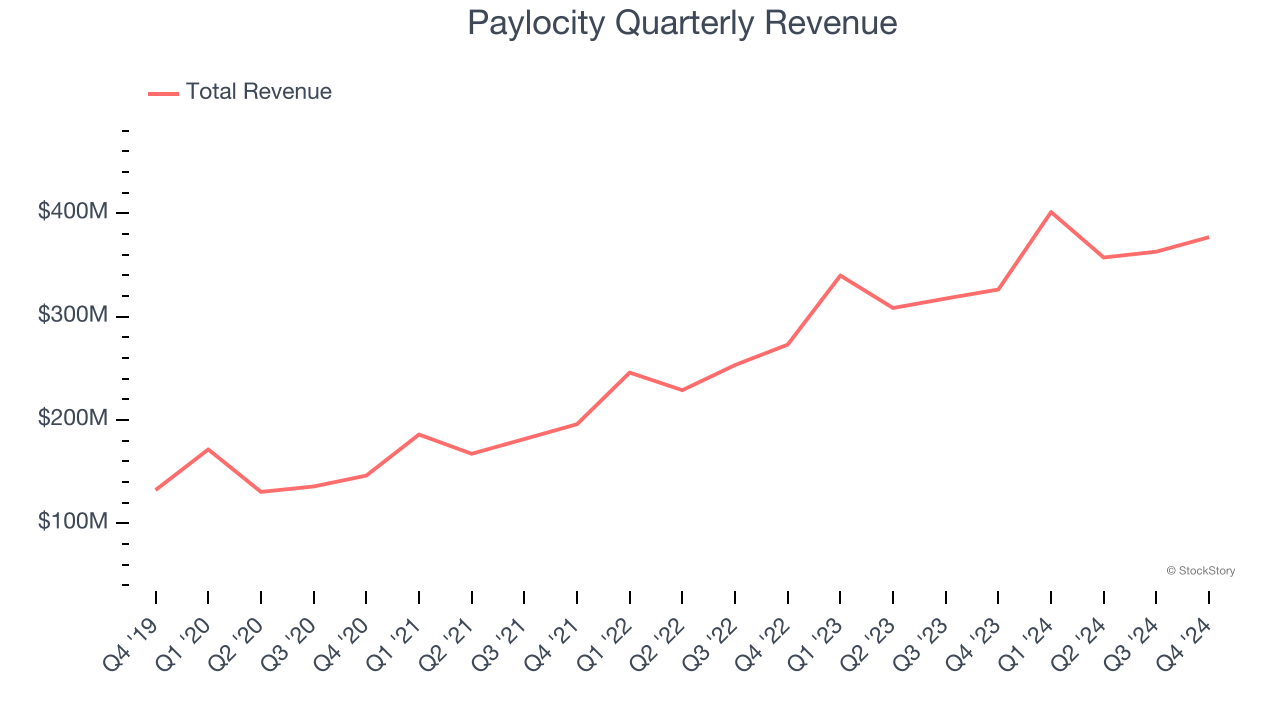

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Luckily, Paylocity’s sales grew at a solid 27% compounded annual growth rate over the last three years. Its growth beat the average software company and shows its offerings resonate with customers.

This quarter, Paylocity reported year-on-year revenue growth of 15.5%, and its $377 million of revenue exceeded Wall Street’s estimates by 2.7%. Company management is currently guiding for a 10% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 7.5% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and indicates its products and services will face some demand challenges.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

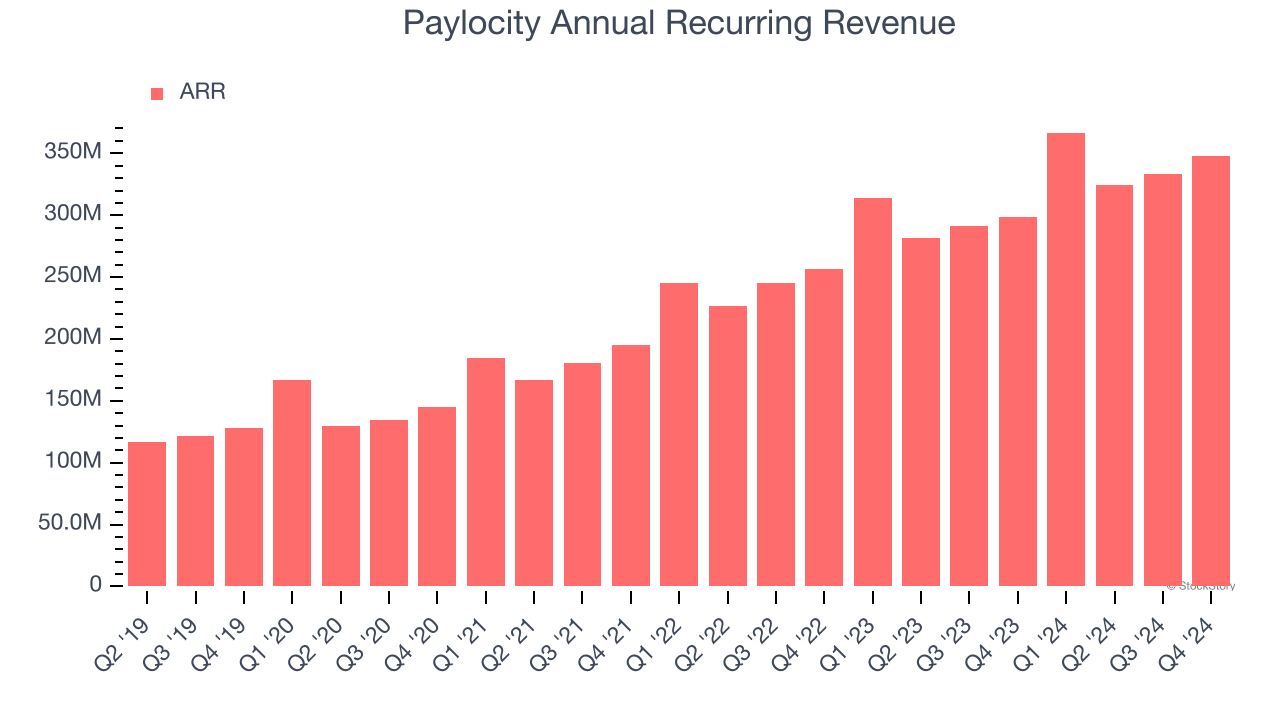

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Paylocity’s ARR punched in at $347.7 million in Q4, and over the last four quarters, its growth was solid as it averaged 15.6% year-on-year increases. This performance aligned with its total sales growth, reflecting the company’s ability to maintain strong customer relationships and secure longer-term commitments. Its growth also contributes positively to Paylocity’s predictability and valuation, as investors typically prefer businesses with recurring revenue.

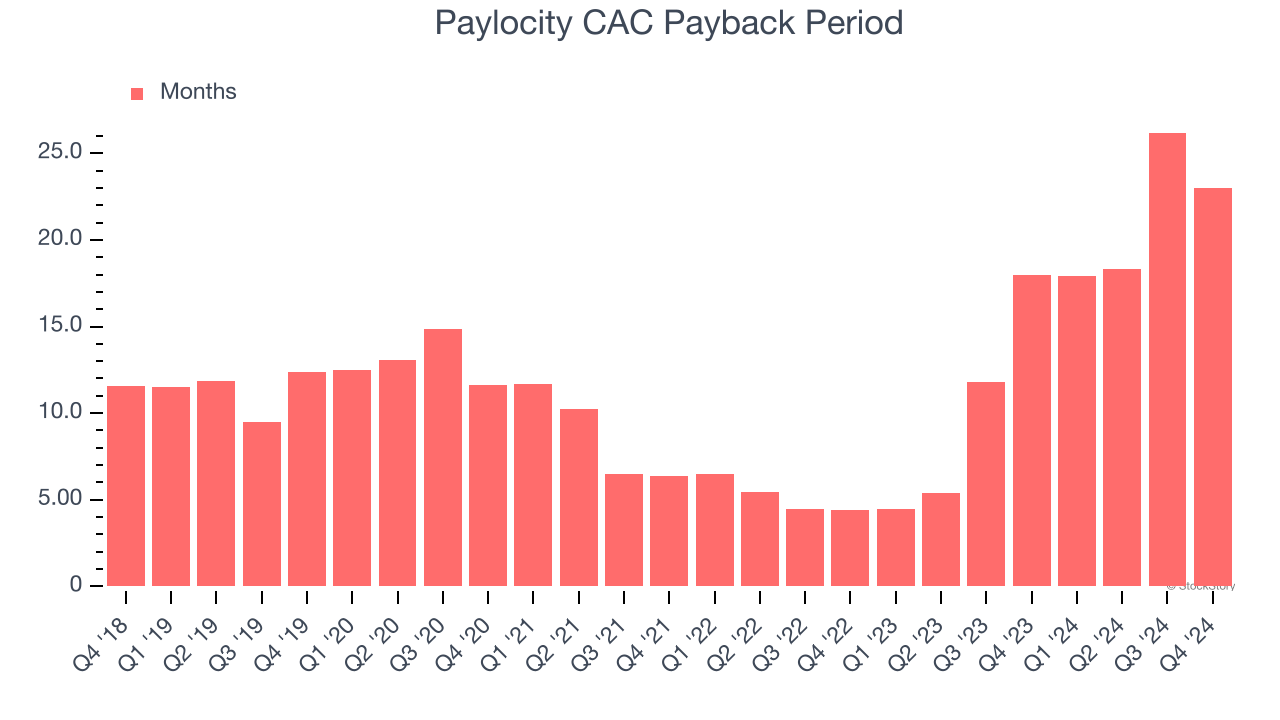

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

Paylocity is very efficient at acquiring new customers, and its CAC payback period checked in at 23 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Paylocity more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

Key Takeaways from Paylocity’s Q4 Results

We enjoyed seeing Paylocity exceed analysts’ EBITDA expectations this quarter. We were also glad its full-year EBITDA guidance came in higher than Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 4.9% to $222.05 immediately after reporting.

Paylocity had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.