As the Q4 earnings season wraps, let’s dig into this quarter’s best and worst performers in the medical devices & supplies - imaging, diagnostics industry, including Lantheus (NASDAQ: LNTH) and its peers.

The medical devices and supplies industry, particularly those specializing in imaging and diagnostics, operates with a comparatively stable yet capital-intensive business model. Companies in this space benefit from consistent demand driven by the essential nature of diagnostic tools in patient care, as well as recurring revenue streams from consumables, service contracts, and equipment maintenance. However, the industry faces challenges such as significant upfront development costs, stringent regulatory requirements, and pricing pressures from hospitals and healthcare systems, which are increasingly focused on cost containment. Looking ahead, the industry should enjoy tailwinds from advancements in technology, including the integration of artificial intelligence to enhance diagnostic accuracy and workflow efficiency, as well as rising demand for imaging solutions driven by aging populations. On the other hand, headwinds could arise from a rethinking of healthcare costs potentially resulting in reimbursement cuts and slower capital equipment purchasing. Additionally, cybersecurity concerns surrounding connected medical devices could introduce new risks and complexities for manufacturers.

The 4 medical devices & supplies - imaging, diagnostics stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.2% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady as they are up 4.8% on average since the latest earnings results.

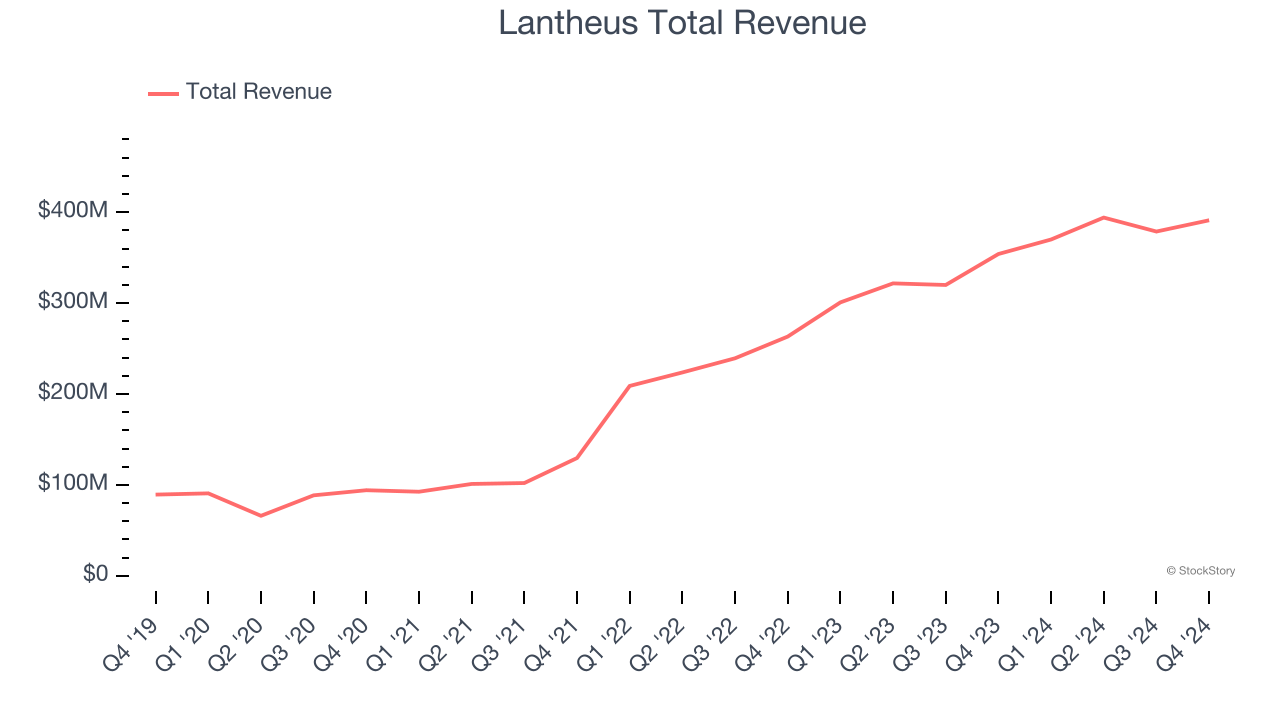

Lantheus (NASDAQ: LNTH)

Founded in 1956, Lantheus Holdings (NASDAQ: LNTH) develops and commercializes innovative diagnostic and therapeutic radiopharmaceuticals for healthcare providers, with a focus on oncology, cardiology, and neurology.

Lantheus reported revenues of $391.1 million, up 10.5% year on year. This print exceeded analysts’ expectations by 3.8%. Despite the top-line beat, it was still a mixed quarter with full-year revenue guidance missing analysts’ expectations.

“2024 was a groundbreaking year for Lantheus, as our radiodiagnostic, PYLARIFY, reached blockbuster status, and we enhanced our radiopharmaceutical leadership,” said Brian Markison, Chief Executive Officer at Lantheus.

Lantheus achieved the biggest analyst estimates beat and fastest revenue growth, but had the weakest full-year guidance update of the whole group. Unsurprisingly, the stock is up 31.1% since reporting and currently trades at $105.01.

Is now the time to buy Lantheus? Access our full analysis of the earnings results here, it’s free.

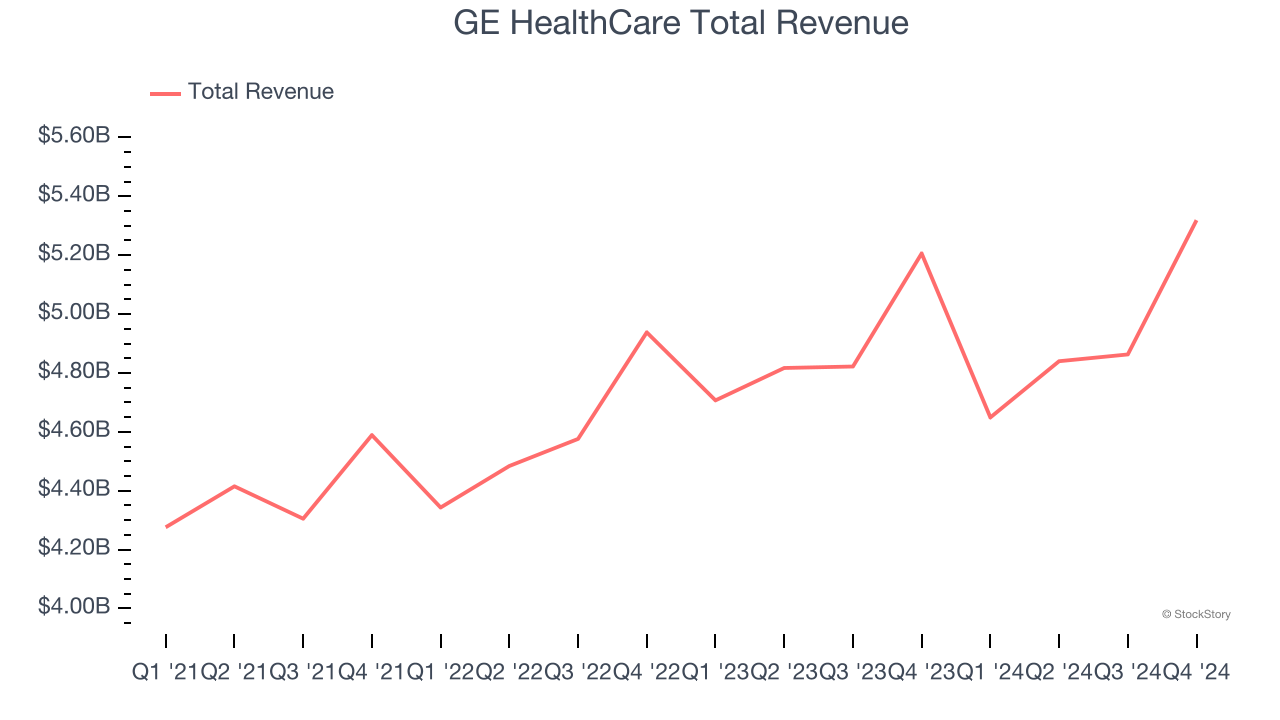

Best Q4: GE HealthCare (NASDAQ: GEHC)

Founded as a division of General Electric, GE HealthCare Technologies (NASDAQ: GEHC) designs and manufactures advanced medical imaging equipment, patient monitoring systems, and other digital solutions

GE HealthCare reported revenues of $5.32 billion, up 2.2% year on year, in line with analysts’ expectations. The business had a satisfactory quarter with a solid beat of analysts’ EPS estimates but organic revenue in line with analysts’ estimates.

However, the results were likely priced into the stock as it’s traded sideways since reporting. Shares currently sit at $86.40.

Is now the time to buy GE HealthCare? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Hologic (NASDAQ: HOLX)

Founded in 1985, Hologic (NASDAQ: HOLX) develops diagnostic, medical imaging, and surgical solutions focused on women’s health, diagnostics, and gynecologic surgical products.

Hologic reported revenues of $1.02 billion, flat year on year, in line with analysts’ expectations. It was a slower quarter as it posted revenue guidance for the full year below analysts’ expectations.

Hologic delivered the highest full-year guidance raise but had the weakest performance against analyst estimates in the group. As expected, the stock is down 11.3% since the results and currently trades at $64.53.

Read our full analysis of Hologic’s results here.

QuidelOrtho (NASDAQ: QDEL)

Founded in 1979, QuidelOrtho (NASDAQ: QDEL) develops and manufactures diagnostic solutions, focusing on rapid diagnostic tests for infectious diseases, including COVID-19, and other critical conditions.

QuidelOrtho reported revenues of $707.8 million, down 4.7% year on year. This number surpassed analysts’ expectations by 1.4%. More broadly, it was a slower quarter as it produced a significant miss of analysts’ full-year EPS guidance estimates.

QuidelOrtho had the slowest revenue growth among its peers. The stock is down 1.1% since reporting and currently trades at $39.51.

Read our full, actionable report on QuidelOrtho here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.