Shareholders of Monolithic Power Systems would probably like to forget the past six months even happened. The stock dropped 35.8% and now trades at $575.20. This might have investors contemplating their next move.

Following the pullback, is now the time to buy MPWR? Find out in our full research report, it’s free.

Why Is Monolithic Power Systems a Good Business?

Founded in 1997 by its longtime CEO Michael Hsing, Monolithic Power Systems (NASDAQ: MPWR) is an analog and mixed signal chipmaker that specializes in power management chips meant to minimize total energy consumption.

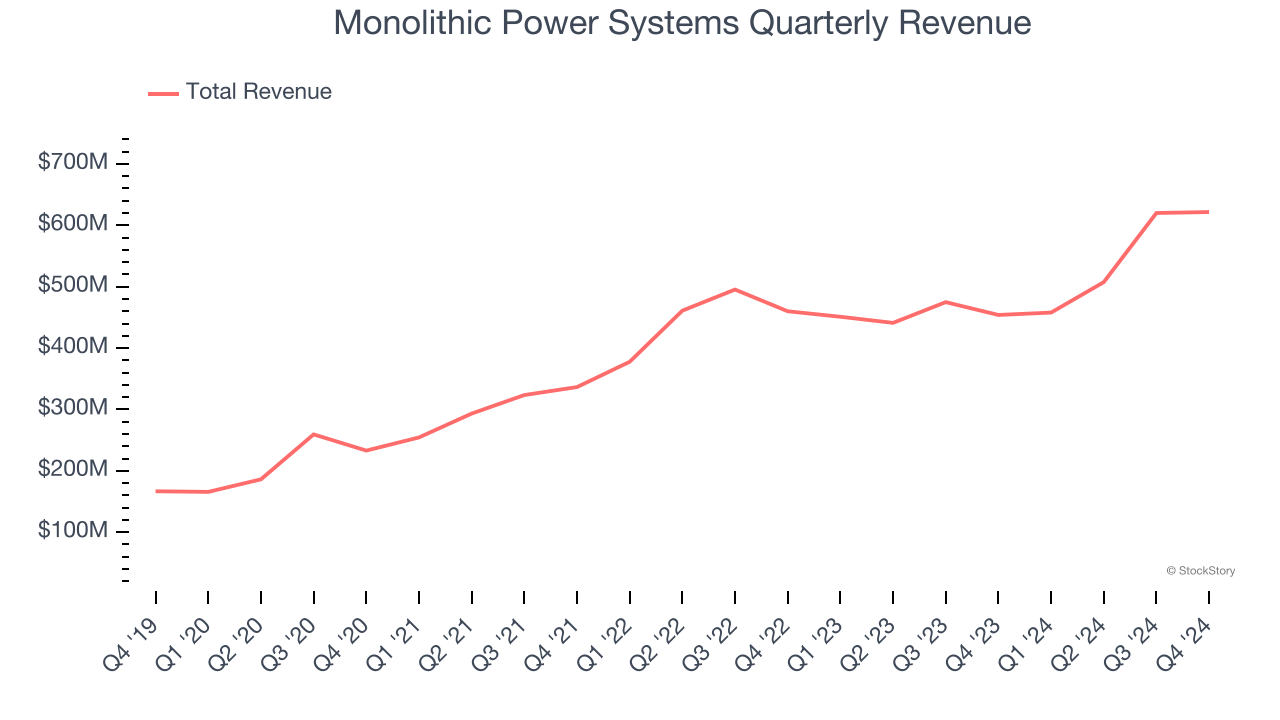

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Monolithic Power Systems grew its sales at an incredible 28.6% compounded annual growth rate. Its growth surpassed the average semiconductor company and shows its offerings resonate with customers. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

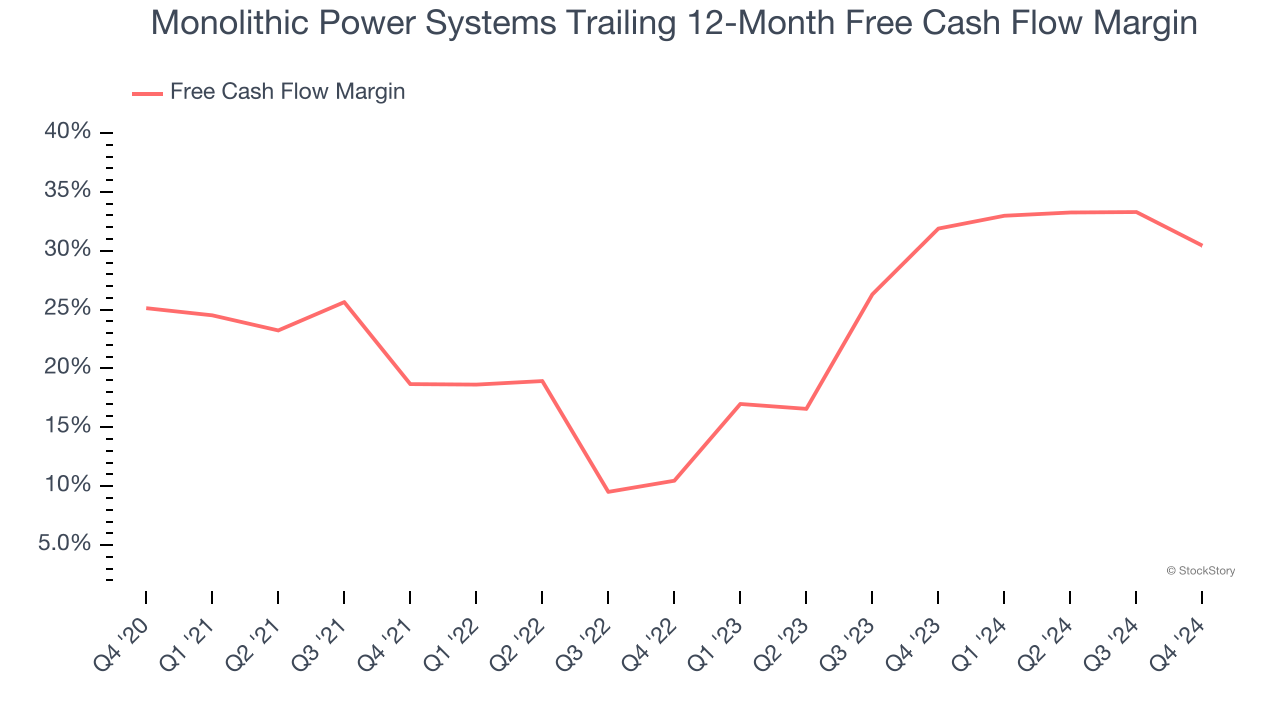

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Monolithic Power Systems has shown terrific cash profitability, and if sustainable, puts it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the semiconductor sector, averaging an eye-popping 31.1% over the last two years.

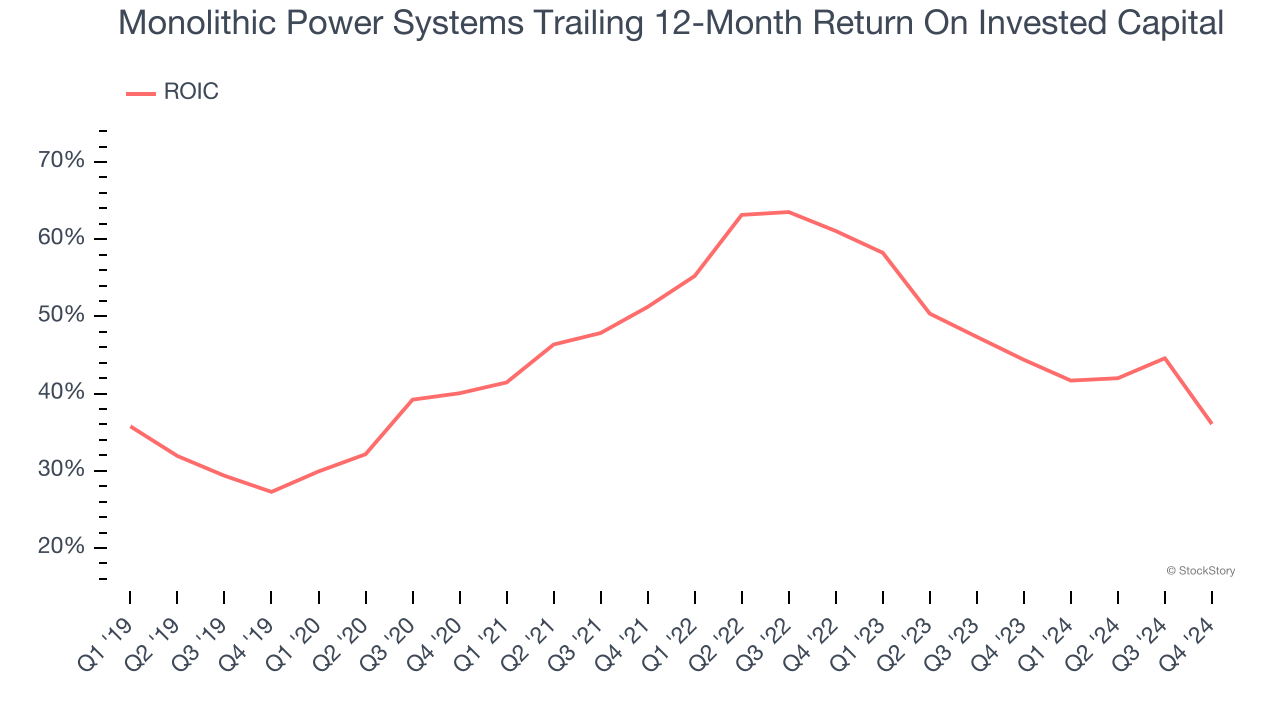

3. Stellar ROIC Showcases Lucrative Growth Opportunities

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Monolithic Power Systems’s five-year average ROIC was 46.6%, placing it among the best semiconductor companies. This illustrates its management team’s ability to invest in highly profitable ventures and produce tangible results for shareholders.

Final Judgment

These are just a few reasons why we're bullish on Monolithic Power Systems. With the recent decline, the stock trades at 34.2× forward price-to-earnings (or $575.20 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Monolithic Power Systems

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.