As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the specialized technology industry, including OSI Systems (NASDAQ: OSIS) and its peers.

Companies in this sector, especially if they invest wisely, could see demand tailwinds as the world moves towards more IoT (Internet of Things), automation, and analytics. Enterprises across most industries will balk at taking these journeys solo and will enlist companies with expertise and scale in these areas. However, headwinds could include rising competition from larger technology firms, as digitization lowers barriers to entry in the space. Additionally, companies in the space will likely face evolving regulatory scrutiny over data privacy, particularly for surveillance and security technologies. This could make companies have to continually pivot and invest.

The 8 specialized technology stocks we track reported a mixed Q4. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.7% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 11% since the latest earnings results.

OSI Systems (NASDAQ: OSIS)

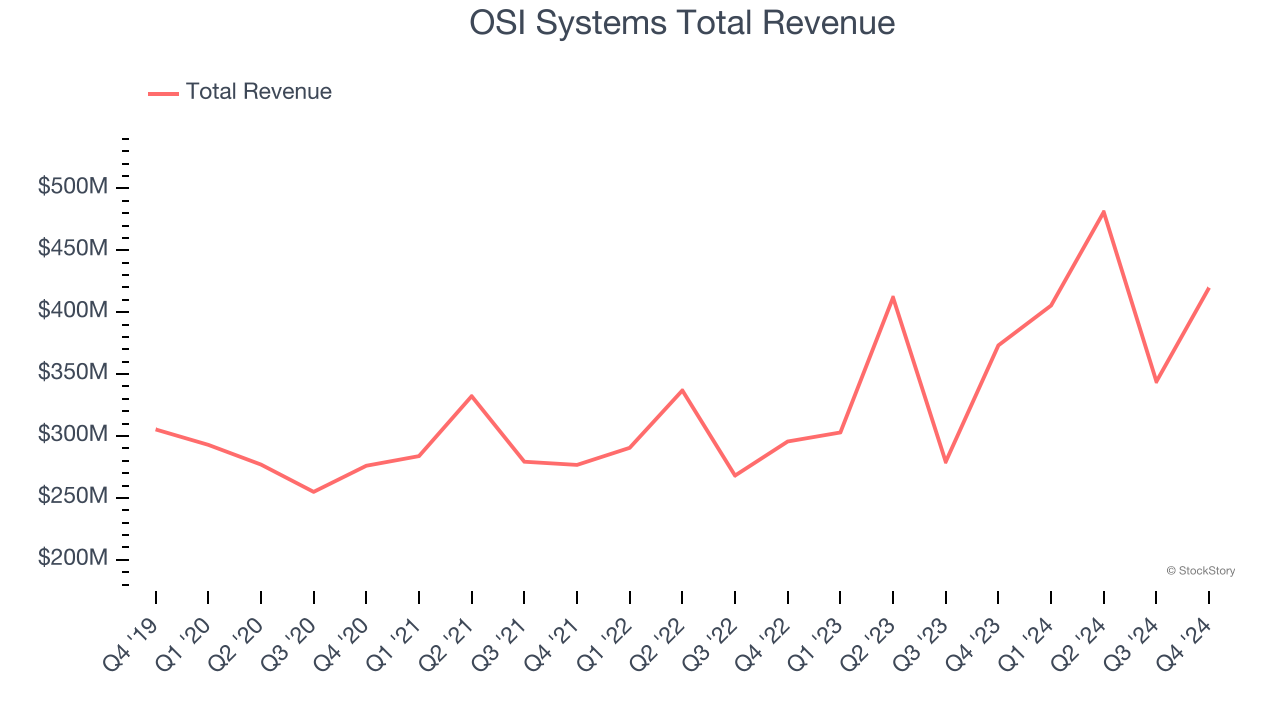

Founded in 1987 and operating across three distinct divisions, OSI Systems (NASDAQ: OSIS) designs and manufactures specialized electronic systems for security screening, healthcare monitoring, and optoelectronic applications.

OSI Systems reported revenues of $419.8 million, up 12.5% year on year. This print exceeded analysts’ expectations by 3.3%. Overall, it was a strong quarter for the company with a decent beat of analysts’ EPS estimates and a narrow beat of analysts’ full-year EPS guidance estimates.

The stock is up 7.4% since reporting and currently trades at $181.49.

Is now the time to buy OSI Systems? Access our full analysis of the earnings results here, it’s free.

Best Q4: PAR Technology (NYSE: PAR)

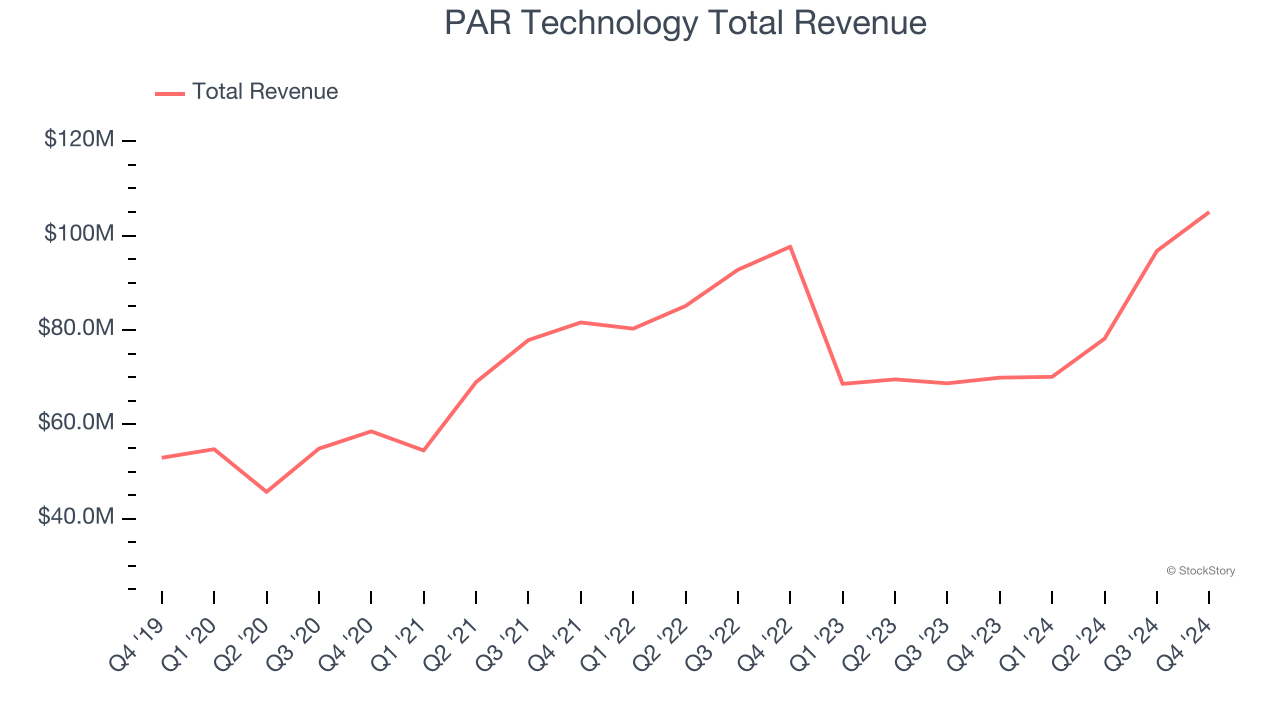

Operating at the intersection of food service and technology since 1968, PAR Technology (NYSE: PAR) provides cloud-based software and hardware solutions for restaurants, including point-of-sale systems, customer loyalty platforms, and digital ordering technologies.

PAR Technology reported revenues of $105 million, up 50.2% year on year, outperforming analysts’ expectations by 4.3%. The business had an incredible quarter with an impressive beat of analysts’ ARR and EPS estimates.

PAR Technology pulled off the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems content with the results as the stock is up 2.2% since reporting. It currently trades at $62.03.

Is now the time to buy PAR Technology? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Napco (NASDAQ: NSSC)

With roots dating back to 1969 and a focus on protecting people and property, Napco Security Technologies (NASDAQ: NSSC) manufactures electronic security devices, access control systems, and communication services for intrusion and fire alarm systems.

Napco reported revenues of $42.93 million, down 9.7% year on year, falling short of analysts’ expectations by 13.9%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

Napco delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 31.9% since the results and currently trades at $25.01.

Read our full analysis of Napco’s results here.

Arlo Technologies (NYSE: ARLO)

Originally spun off from networking giant Netgear in 2018, Arlo Technologies (NYSE: ARLO) provides cloud-based smart security devices and subscription services that help people monitor and protect their homes, businesses, and loved ones.

Arlo Technologies reported revenues of $121.6 million, down 10% year on year. This result met analysts’ expectations. Aside from that, it was an ok quarter with EPS inline with analysts' estimates.

Arlo Technologies had the slowest revenue growth among its peers. The stock is down 7% since reporting and currently trades at $11.10.

Read our full, actionable report on Arlo Technologies here, it’s free.

Crane NXT (NYSE: CXT)

Born from a corporate separation in 2023 to focus on specialized technology, Crane NXT (NYSE: CXT) provides technology solutions for payment processing, banknote security, and authentication systems for financial institutions and businesses.

Crane NXT reported revenues of $399.1 million, up 11.8% year on year. This print came in 2.7% below analysts' expectations. Overall, it was a slower quarter as it also logged a miss of analysts’ organic revenue estimates and EPS in line with analysts’ estimates.

The stock is down 9.3% since reporting and currently trades at $53.12.

Read our full, actionable report on Crane NXT here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.