While the broader market has struggled with the S&P 500 down 1.1% since September 2024, Fiverr has surged ahead as its stock price has climbed by 5% to $26.58 per share. This performance may have investors wondering how to approach the situation.

Following the strength, is FVRR a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does Fiverr Spark Debate?

Based in Tel Aviv, Fiverr (NYSE: FVRR) operates a fixed price global freelance marketplace for digital services.

Two Positive Attributes:

1. Eye-Popping Growth in Customer Spending

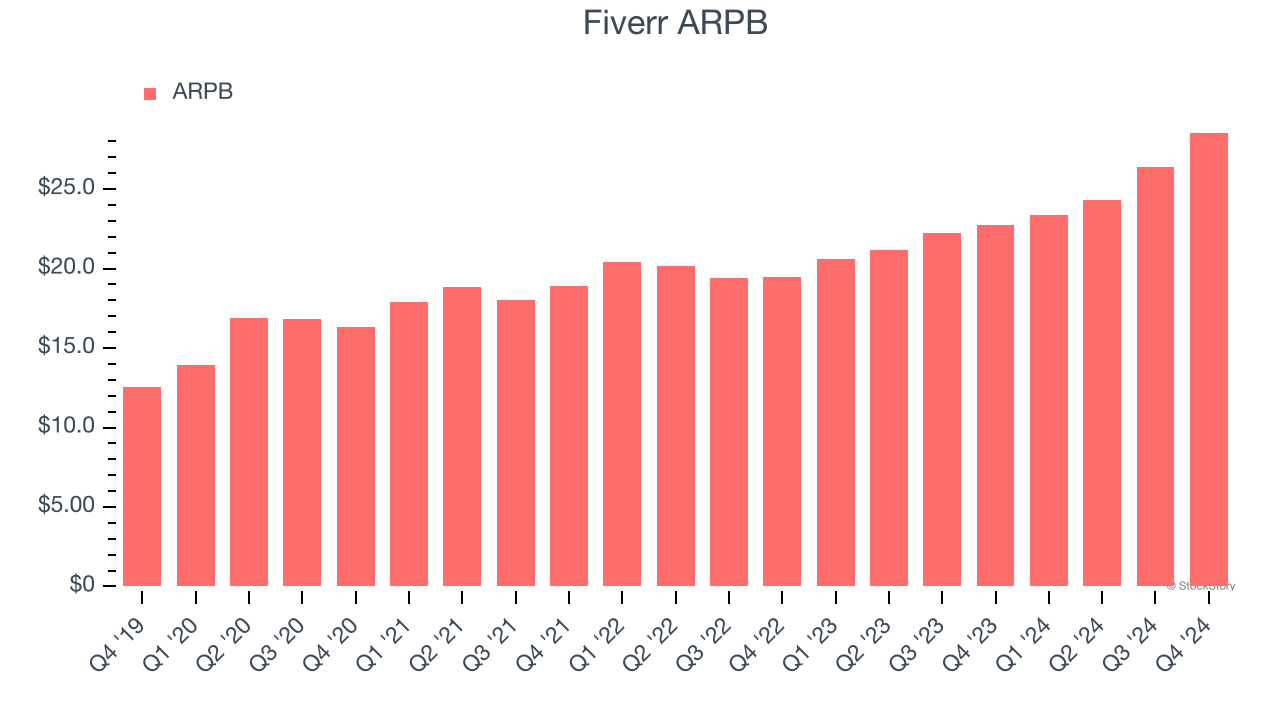

Average revenue per buyer (ARPB) is a critical metric to track for gig economy businesses like Fiverr because it measures how much the company earns in transaction fees from each buyer. This number also informs us about Fiverr’s take rate, which represents its pricing leverage over the ecosystem, or "cut" from each transaction.

Fiverr’s ARPB growth has been exceptional over the last two years, averaging 13.8%. Although its active buyers shrank during this time, the company’s ability to successfully increase monetization demonstrates its platform’s value for existing buyers.

2. Outstanding Long-Term EPS Growth

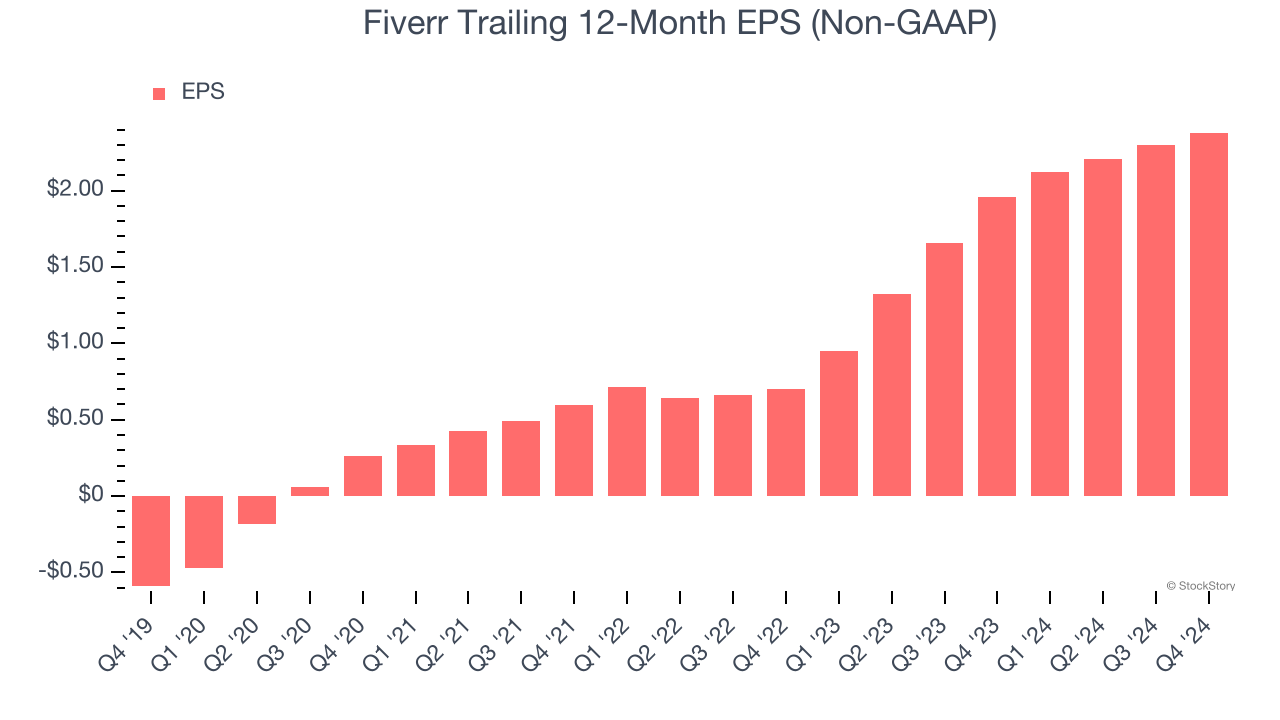

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Fiverr’s EPS grew at an astounding 58.6% compounded annual growth rate over the last three years, higher than its 9.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

Declining Active Buyers Reflect Product Weakness

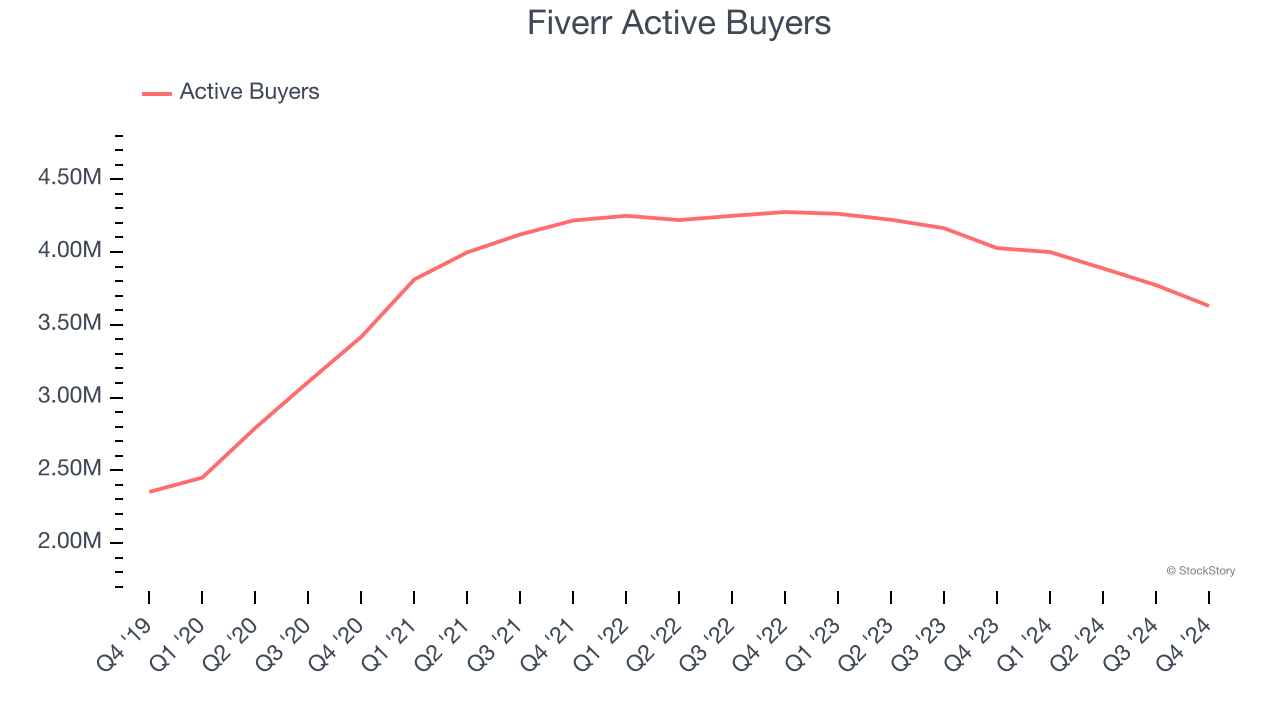

As a gig economy marketplace, Fiverr generates revenue growth by expanding the number of services on its platform (e.g. rides, deliveries, freelance jobs) and raising the commission fee from each service provided.

Fiverr struggled to engage its audience over the last two years as its active buyers have declined by 5.1% annually to 3.63 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Fiverr wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

Final Judgment

Fiverr’s merits more than compensate for its flaws, and with its shares topping the market in recent months, the stock trades at 12× forward EV-to-EBITDA (or $26.58 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Fiverr

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.