Gaming company Inspired (NASDAQ: INSE) reported Q4 CY2024 results beating Wall Street’s revenue expectations, with sales up 2.2% year on year to $83 million. Its non-GAAP profit of $0.16 per share was 6.7% above analysts’ consensus estimates.

Is now the time to buy Inspired? Find out by accessing our full research report, it’s free.

Inspired (INSE) Q4 CY2024 Highlights:

- Revenue: $83 million vs analyst estimates of $78.84 million (2.2% year-on-year growth, 5.3% beat)

- Adjusted EPS: $0.16 vs analyst estimates of $0.15 (6.7% beat)

- Adjusted EBITDA: $30.9 million vs analyst estimates of $29.76 million (37.2% margin, 3.8% beat)

- Operating Margin: 16.9%, up from 11.5% in the same quarter last year

- Free Cash Flow was -$10.3 million compared to -$14.2 million in the same quarter last year

- Market Capitalization: $222.5 million

“We ended the year with a fourth quarter that reflects the strength and resilience of our diversified business model," said Lorne Weil, Executive Chairman of Inspired.

Company Overview

Specializing in digital casino gaming, Inspired (NASDAQ: INSE) is a provider of gaming hardware, virtual sports platforms, and server-based gaming systems.

Gaming Solutions

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

Sales Growth

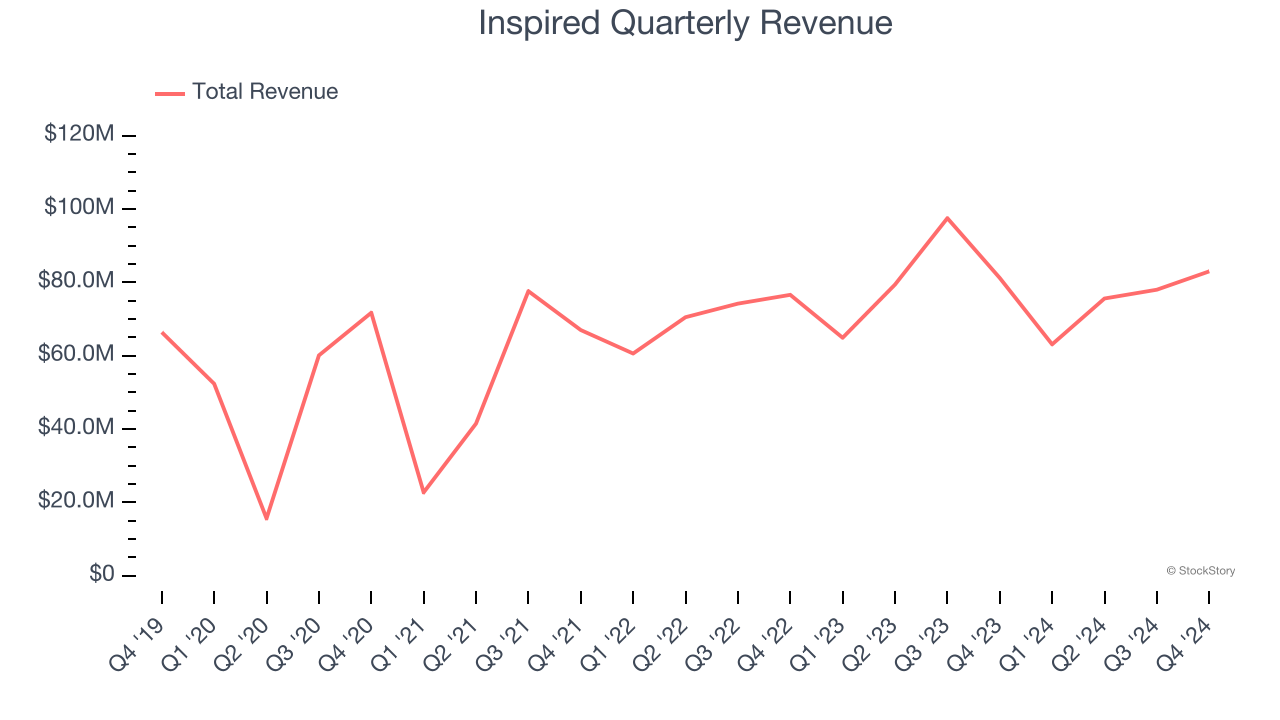

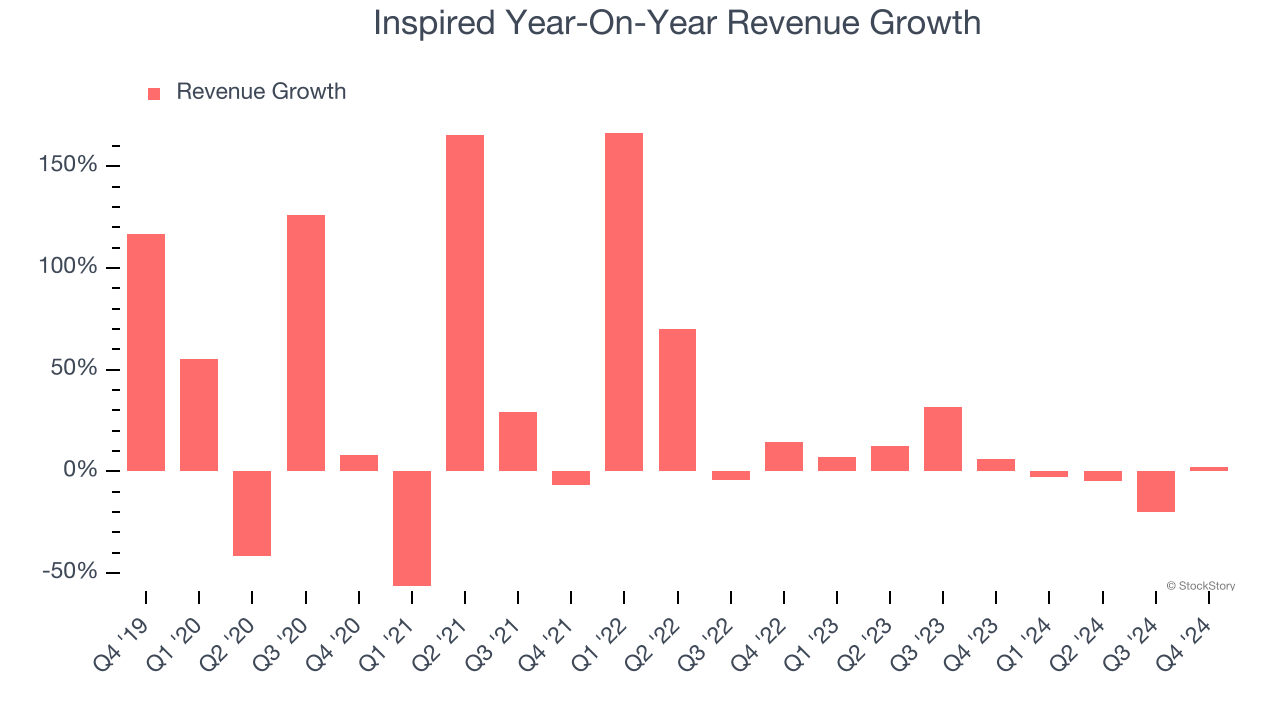

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Inspired grew its sales at a 14.3% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Inspired’s recent history shows its demand has slowed as its annualized revenue growth of 3.1% over the last two years was below its five-year trend.

We can better understand the company’s revenue dynamics by analyzing its three most important segments: Gaming, Leisure, and Virtual Sports, which are 46.7%, 27.1%, and 12.2% of revenue. Over the last two years, Inspired’s Gaming (land-based casino games) and Leisure (gaming terminals and amusement machines) revenues averaged year-on-year growth of 7.4% and 3.2% while its Virtual Sports revenue (digital gaming and sports betting) averaged 7.4% declines.

This quarter, Inspired reported modest year-on-year revenue growth of 2.2% but beat Wall Street’s estimates by 5.3%.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, similar to its two-year rate. This projection is underwhelming and indicates its newer products and services will not accelerate its top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

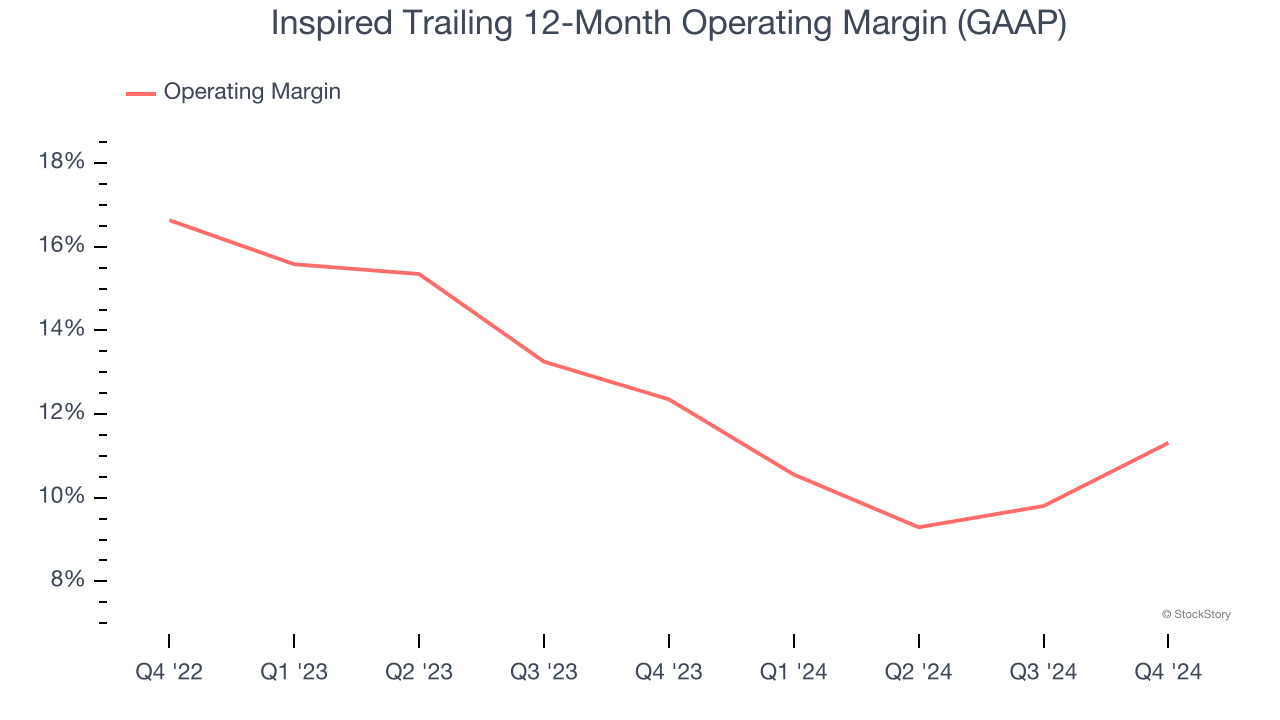

Inspired’s operating margin has been trending down over the last 12 months, but it still averaged 11.9% over the last two years, decent for a consumer discretionary business. This shows it generally does a decent job managing its expenses.

This quarter, Inspired generated an operating profit margin of 16.9%, up 5.4 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

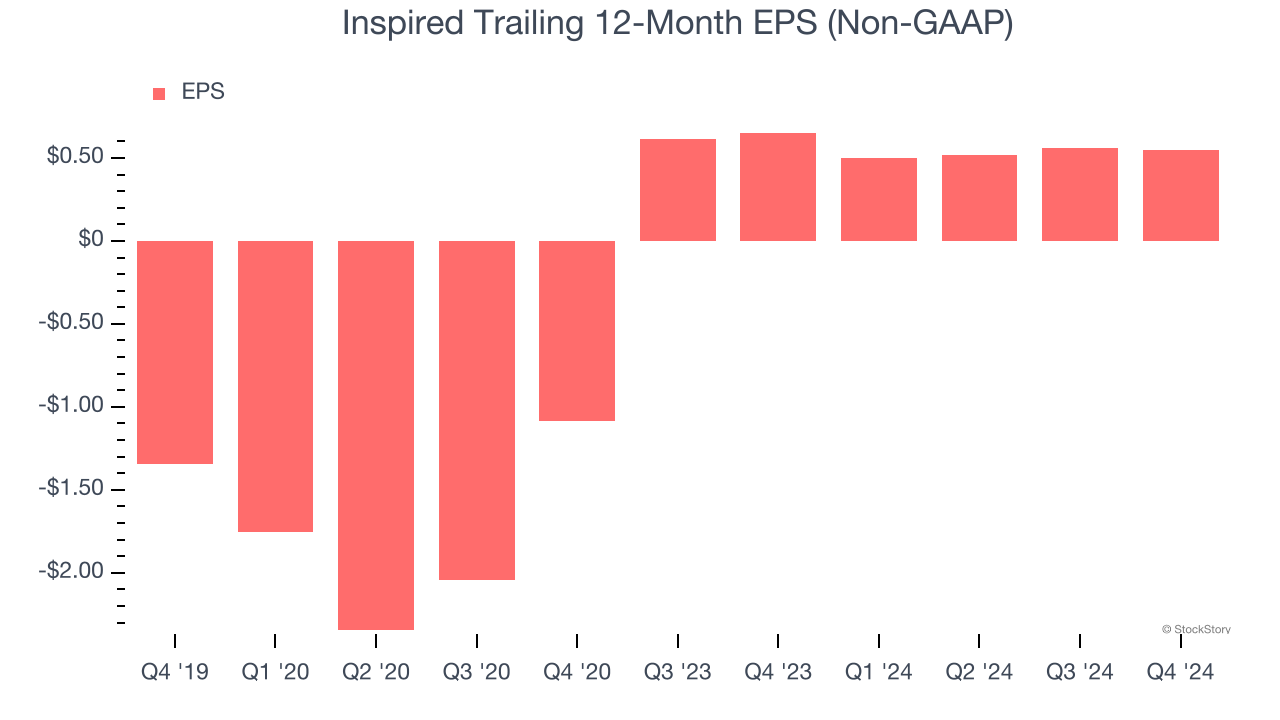

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Inspired’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q4, Inspired reported EPS at $0.16, down from $0.17 in the same quarter last year. Despite falling year on year, this print beat analysts’ estimates by 6.7%. Over the next 12 months, Wall Street expects Inspired’s full-year EPS of $0.55 to shrink by 5.5%.

Key Takeaways from Inspired’s Q4 Results

We enjoyed seeing Inspired beat analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its Gaming revenue missed. Overall, we think this was a solid quarter with some key areas of upside. The stock remained flat at $8.37 immediately after reporting.

Inspired put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.