What a fantastic six months it’s been for Kyndryl. Shares of the company have skyrocketed 44.9%, hitting $34.22. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Kyndryl, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

We’re happy investors have made money, but we're cautious about Kyndryl. Here are three reasons why we avoid KD and a stock we'd rather own.

Why Is Kyndryl Not Exciting?

Born from IBM's managed infrastructure services business in a 2021 spinoff, Kyndryl (NYSE: KD) is the world's largest IT infrastructure services provider that designs, builds, and manages technology environments for enterprise customers.

1. Revenue Spiraling Downwards

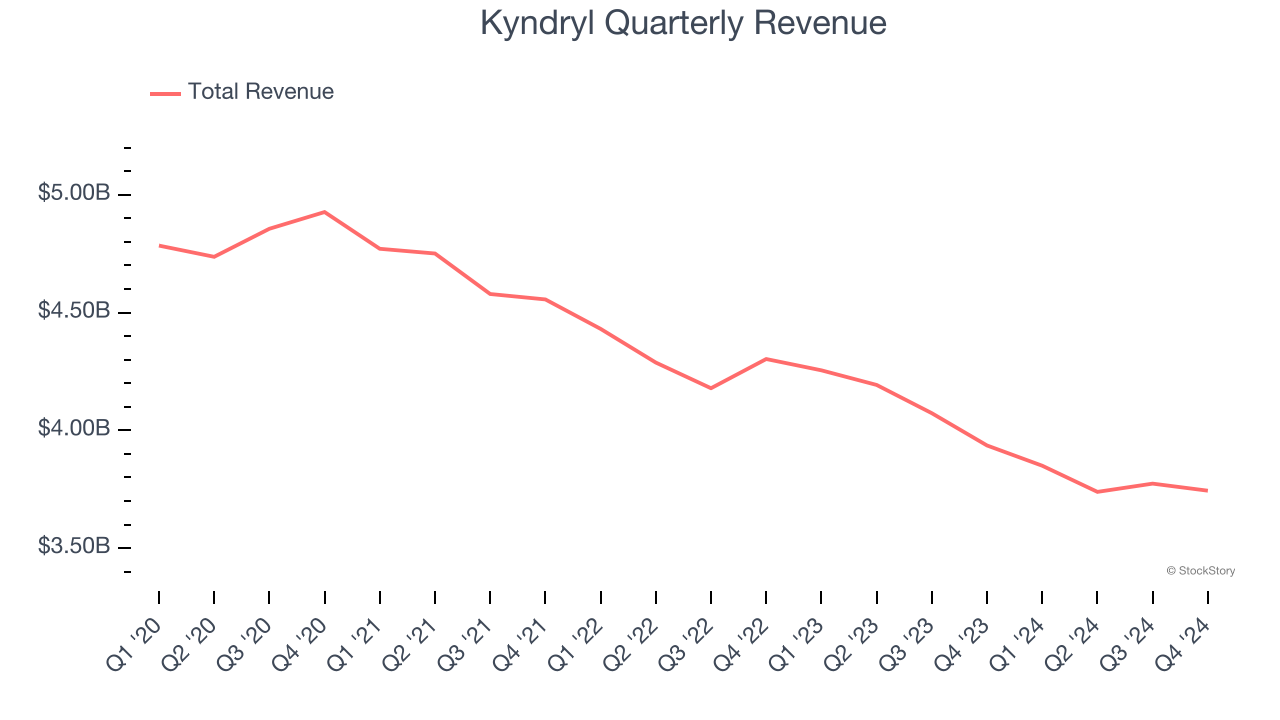

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Kyndryl struggled to consistently generate demand over the last four years as its sales dropped at a 5.9% annual rate. This wasn’t a great result and signals it’s a lower quality business.

2. Breakeven Free Cash Flow Limits Reinvestment Potential

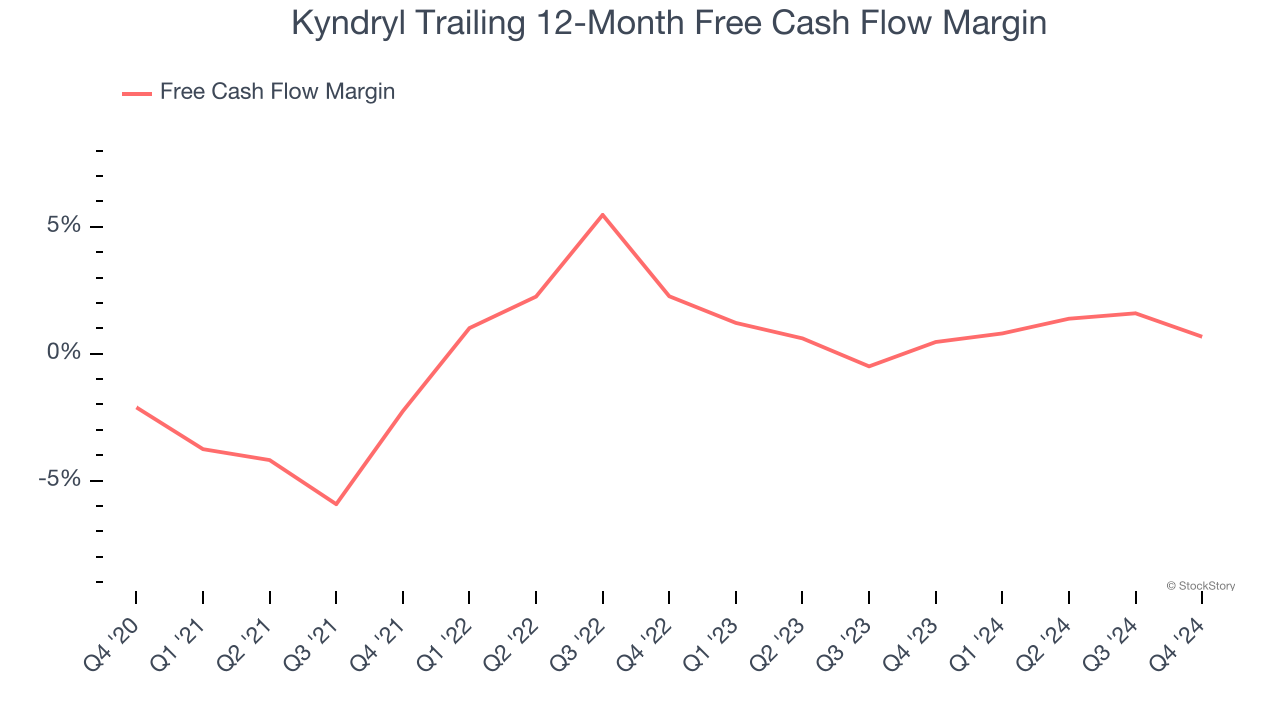

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Kyndryl broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

3. Previous Growth Initiatives Have Lost Money

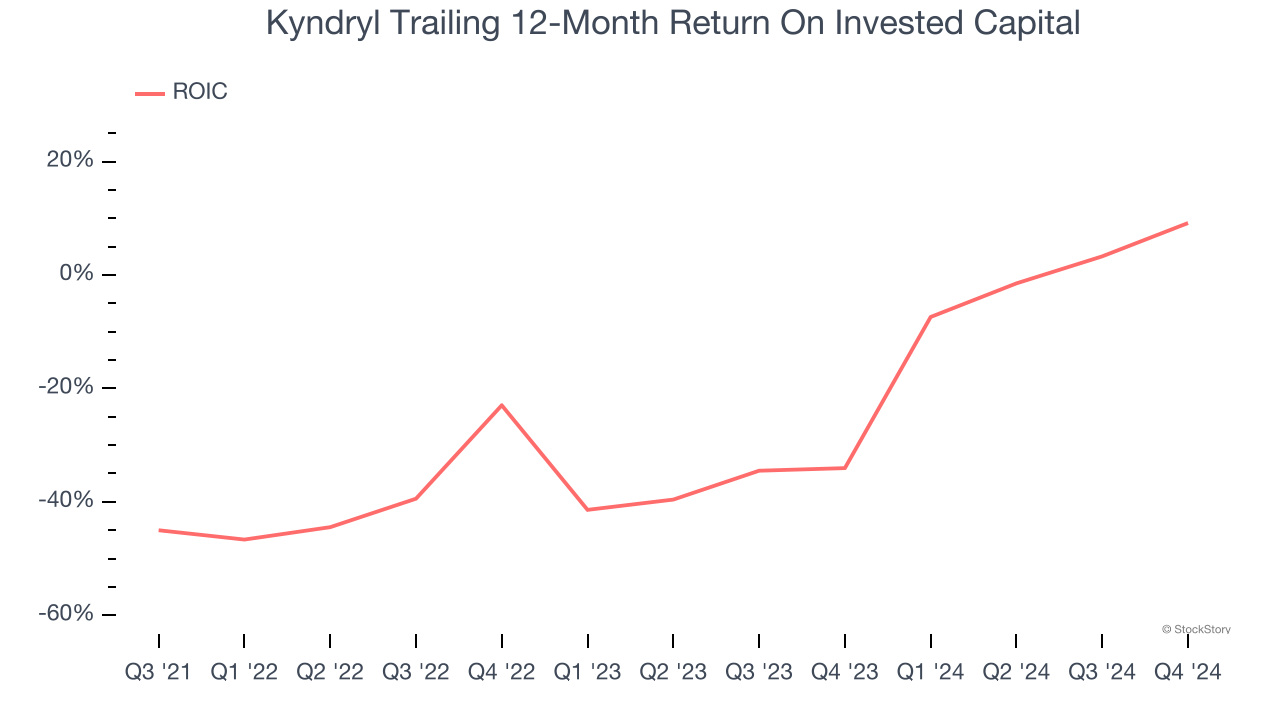

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Kyndryl’s five-year average ROIC was negative 16%, meaning management lost money while trying to expand the business. Its returns were among the worst in the business services sector.

Final Judgment

Kyndryl isn’t a terrible business, but it isn’t one of our picks. Following the recent rally, the stock trades at 17.9× forward price-to-earnings (or $34.22 per share). This valuation tells us a lot of optimism is priced in - we think there are better stocks to buy right now. We’d suggest looking at an all-weather company that owns household favorite Taco Bell.

Stocks We Like More Than Kyndryl

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.