APi currently trades at $38.36 and has been a dream stock for shareholders. It’s returned 444% since March 2020, more than tripling the S&P 500’s 132% gain. The company has also beaten the index over the past six months as its stock price is up 16.4%.

Is there a buying opportunity in APi, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

We’re glad investors have benefited from the price increase, but we're swiping left on APi for now. Here are three reasons why APG doesn't excite us and a stock we'd rather own.

Why Is APi Not Exciting?

Started in 1926 as an insulation contractor, APi (NYSE: APG) provides life safety solutions and specialty services for buildings and infrastructure.

1. Slow Organic Growth Suggests Waning Demand In Core Business

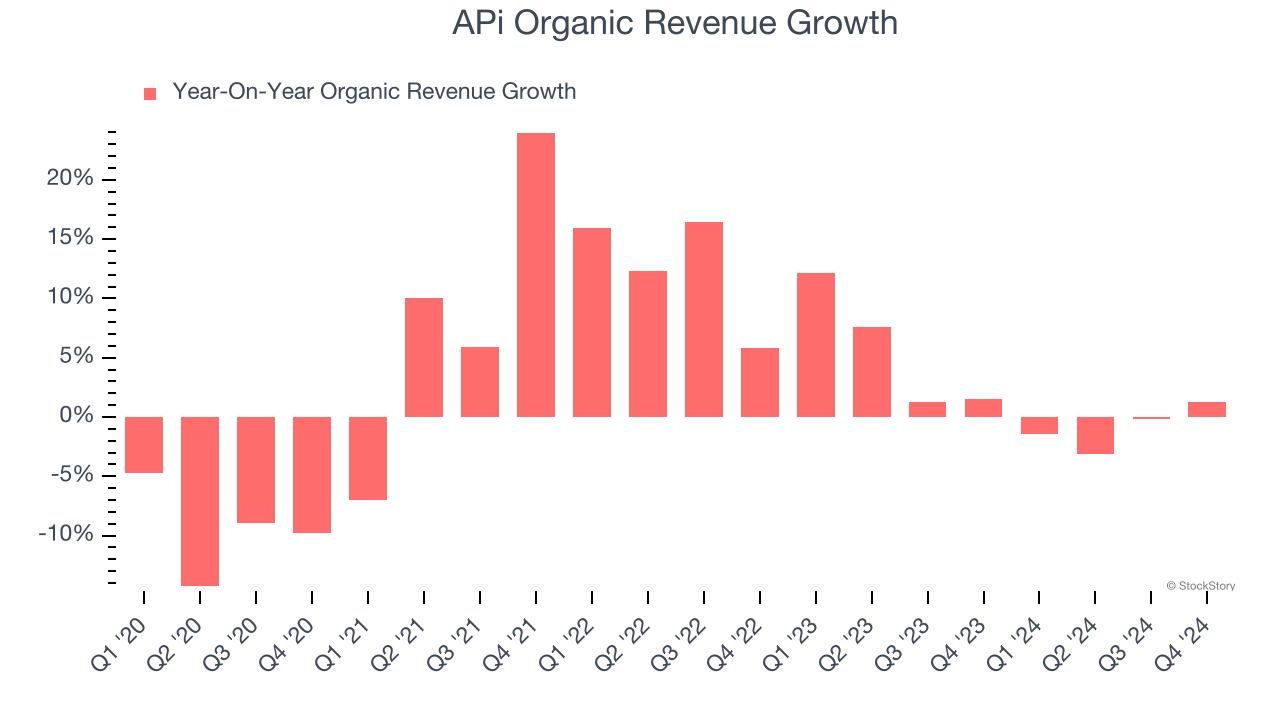

We can better understand Construction and Maintenance Services companies by analyzing their organic revenue. This metric gives visibility into APi’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, APi’s organic revenue averaged 2.4% year-on-year growth. This performance was underwhelming and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

2. Free Cash Flow Margin Dropping

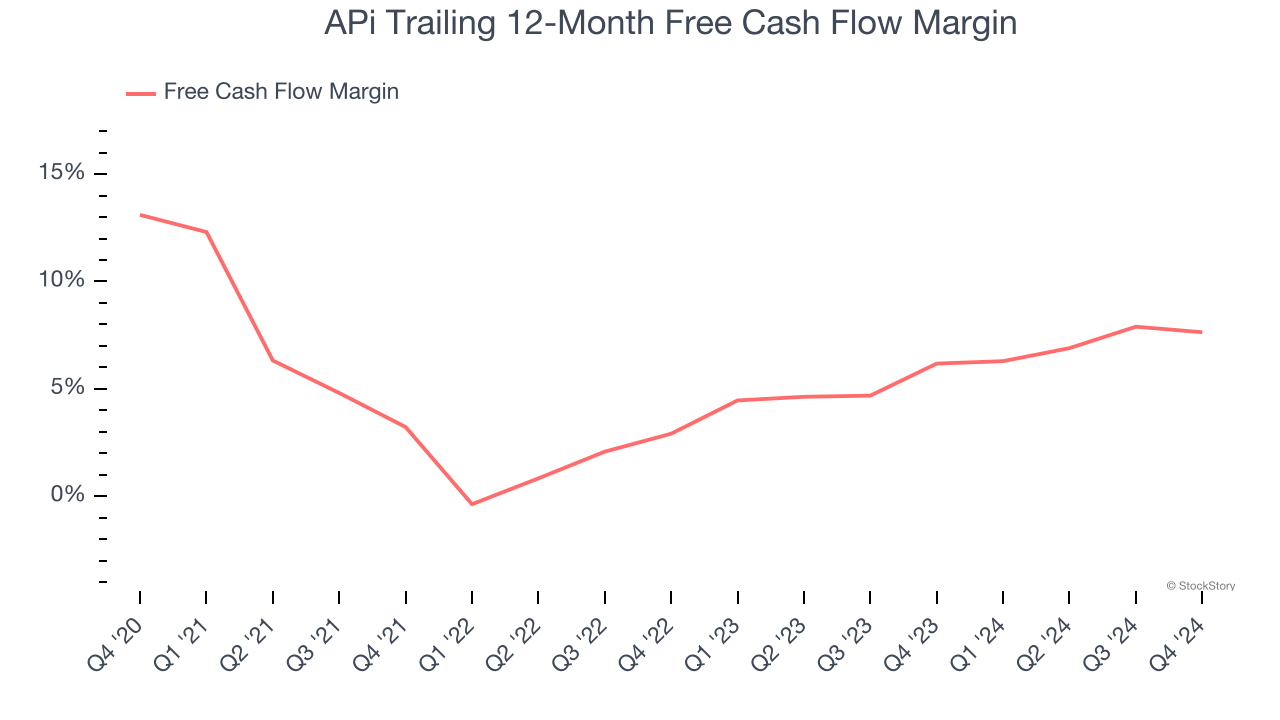

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

As you can see below, APi’s margin dropped by 5.5 percentage points over the last five years. If its declines continue, it could signal increasing investment needs and capital intensity. APi’s free cash flow margin for the trailing 12 months was 7.6%.

3. Previous Growth Initiatives Haven’t Impressed

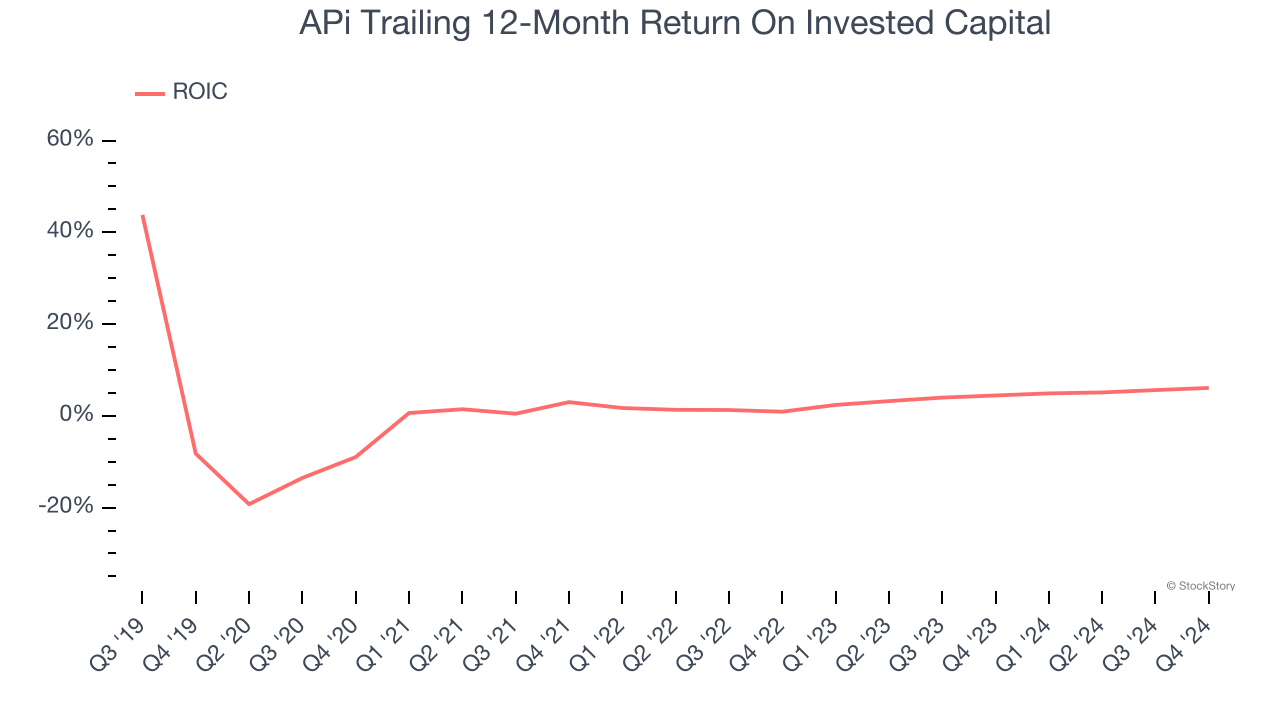

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

APi historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 1.1%, lower than the typical cost of capital (how much it costs to raise money) for industrials companies.

Final Judgment

APi isn’t a terrible business, but it isn’t one of our picks. With its shares topping the market in recent months, the stock trades at 18.7× forward price-to-earnings (or $38.36 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better stocks to buy right now. We’d recommend looking at the most entrenched endpoint security platform on the market.

Stocks We Like More Than APi

The Trump trade may have passed, but rates are still dropping and inflation is still cooling. Opportunities are ripe for those ready to act - and we’re here to help you pick them.

Get started by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.