Wrapping up Q4 earnings, we look at the numbers and key takeaways for the electronic components stocks, including Vicor (NASDAQ: VICR) and its peers.

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

The 10 electronic components stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 3.1% while next quarter’s revenue guidance was in line.

While some electronic components stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.1% since the latest earnings results.

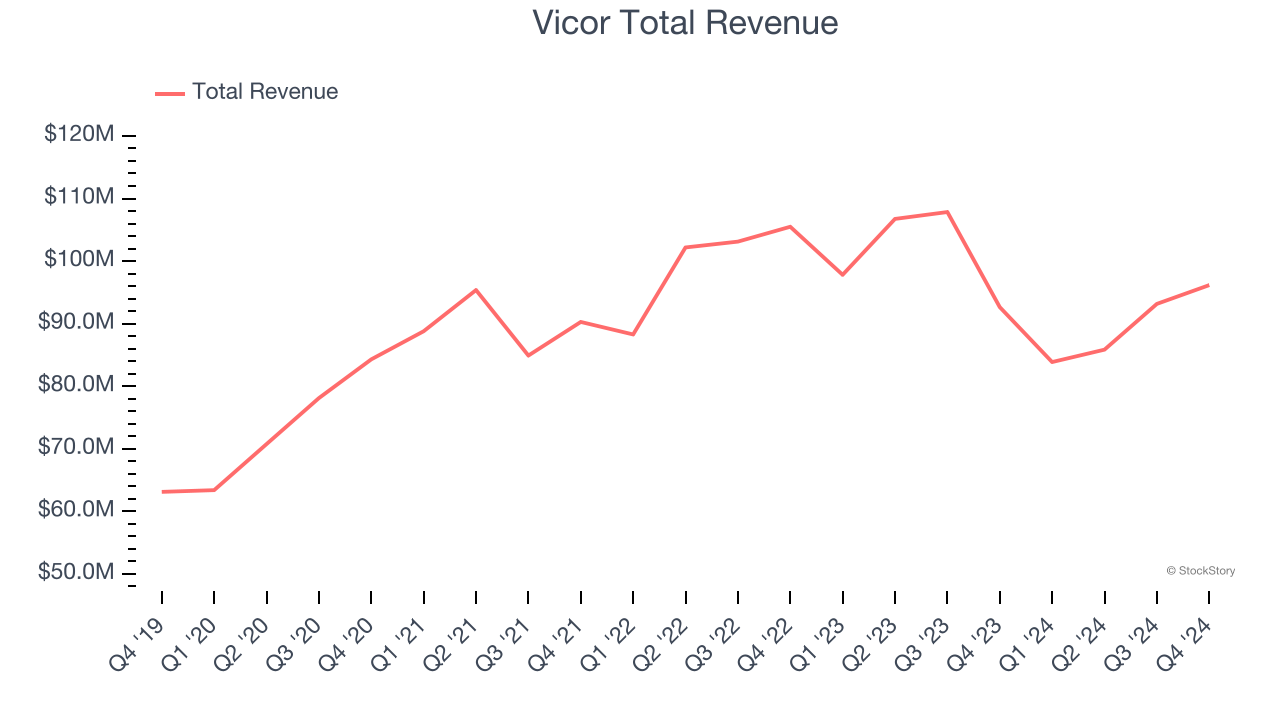

Vicor (NASDAQ: VICR)

Founded by a researcher at the Massachusetts Institute of Technology, Vicor (NASDAQ: VICR) provides electrical power conversion and delivery products for a range of industries.

Vicor reported revenues of $96.17 million, up 3.8% year on year. This print exceeded analysts’ expectations by 5.6%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EPS estimates.

Commenting on fourth quarter performance, Chief Executive Officer Dr. Patrizio Vinciarelli stated: “Revenues and gross margins improved. Further margin improvements depend upon higher utilization of our ChiP fab and increased licensing income. These revenue and income streams are synergistic as our standard license provides royalty discounts commensurate to the Licensee’s annual purchases of Vicor modules. Licensing has been gaining traction with companies whose computing hardware is increasingly dependent on high density power system solutions pioneered and patented by Vicor, including NBMs. Avoiding infringement is the ethical choice, but hyper-scalers also want to avoid the risk of their computing hardware being excluded from importation into the United States. Patent infringement has severe consequences.”

The stock is up 4.4% since reporting and currently trades at $54.15.

Is now the time to buy Vicor? Access our full analysis of the earnings results here, it’s free.

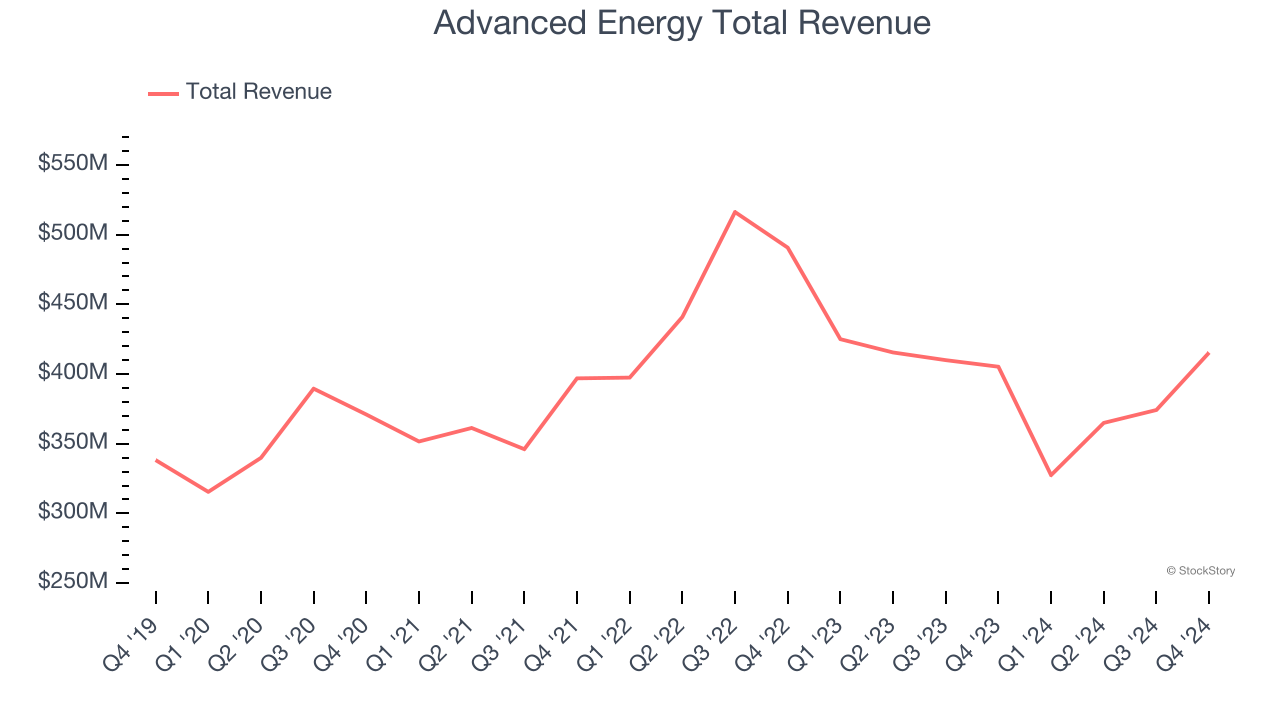

Best Q4: Advanced Energy (NASDAQ: AEIS)

Pioneering technologies for radio frequency power delivery, Advanced Energy (NASDAQ: AEIS) provides power supplies, thermal management systems, and measurement and control instruments for various manufacturing processes.

Advanced Energy reported revenues of $415.4 million, up 2.5% year on year, outperforming analysts’ expectations by 5.5%. The business had an exceptional quarter with an impressive beat of analysts’ EBITDA estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 3.3% since reporting. It currently trades at $107.51.

Is now the time to buy Advanced Energy? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Vishay Precision (NYSE: VPG)

Emerging from Vishay Intertechnology in 2010, Vishay Precision (NYSE: VPG) operates as a global provider of precision measurement and sensing technologies.

Vishay Precision reported revenues of $72.65 million, down 18.8% year on year, falling short of analysts’ expectations by 1.3%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

Vishay Precision delivered the slowest revenue growth in the group. As expected, the stock is down 1.3% since the results and currently trades at $23.69.

Read our full analysis of Vishay Precision’s results here.

Littelfuse (NASDAQ: LFUS)

The developer of the first blade-type automotive fuse, Littelfuse (NASDAQ: LFUS) provides electrical protection and control components for the automotive, industrial, electronics, and telecommunications industries.

Littelfuse reported revenues of $529.5 million, flat year on year. This print surpassed analysts’ expectations by 1%. However, it was a slower quarter as it logged EPS guidance for next quarter missing analysts’ expectations.

The stock is down 3.3% since reporting and currently trades at $216.49.

Read our full, actionable report on Littelfuse here, it’s free.

Allient (NASDAQ: ALNT)

Founded in 1962, Allient (NASDAQ: ALNT) develops and manufactures precision and specialty-controlled motion components and systems.

Allient reported revenues of $122 million, down 13.5% year on year. This result beat analysts’ expectations by 1.9%. Zooming out, it was a satisfactory quarter as it also logged an impressive beat of analysts’ EPS estimates but a significant miss of analysts’ EBITDA estimates.

The stock is flat since reporting and currently trades at $23.79.

Read our full, actionable report on Allient here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.