Commvault Systems trades at $156.11 and has moved in lockstep with the market. Its shares have returned 9.3% over the last six months while the S&P 500 has gained 5.2%.

Is now the time to buy CVLT? Find out in our full research report, it’s free.

Why Does Commvault Systems Spark Debate?

Originally formed in 1988 as part of Bell Labs, Commvault (NASDAQ: CVLT) provides enterprise software used for data backup and recovery, cloud and infrastructure management, retention, and compliance.

Two Things to Like:

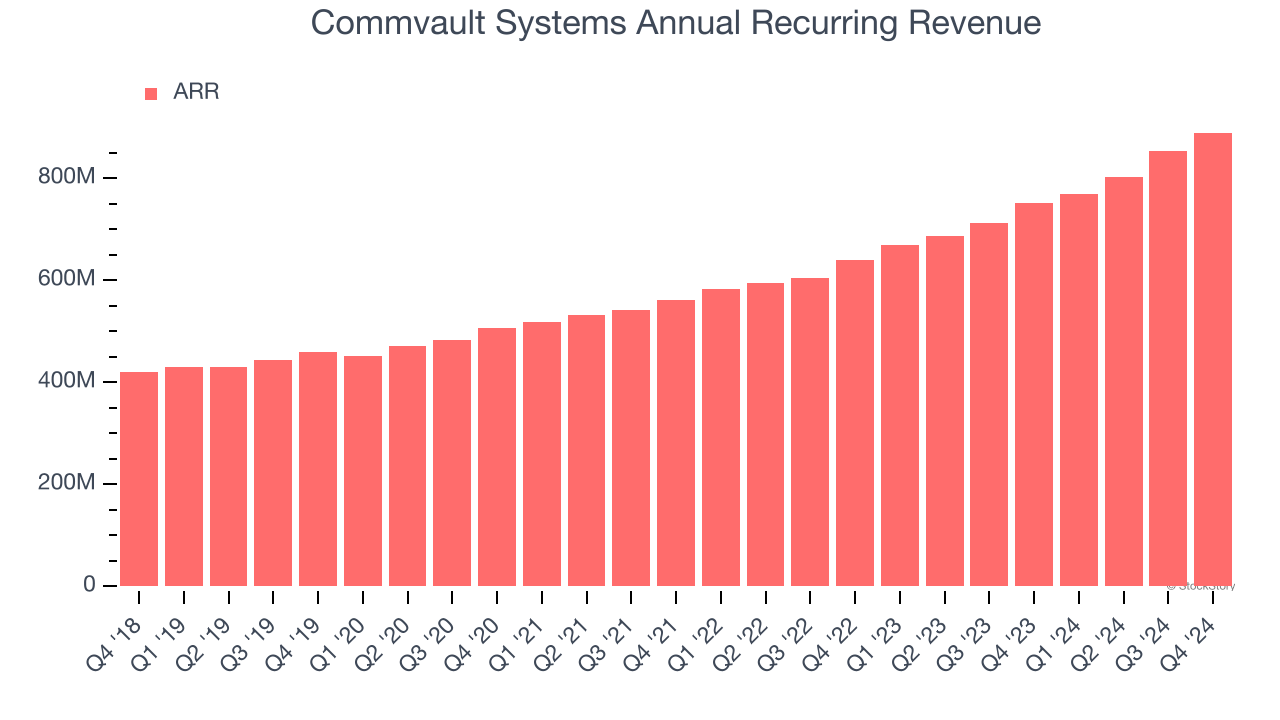

1. ARR Growth Powers Predictable Revenues

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Commvault Systems’s ARR punched in at $889.6 million in Q4, and over the last four quarters, its year-on-year growth averaged 17.6%. This performance was solid, reflecting the company’s ability to maintain strong customer relationships and secure longer-term commitments. Its growth also contributes positively to Commvault Systems’s predictability and valuation, as investors typically prefer businesses with recurring revenue.

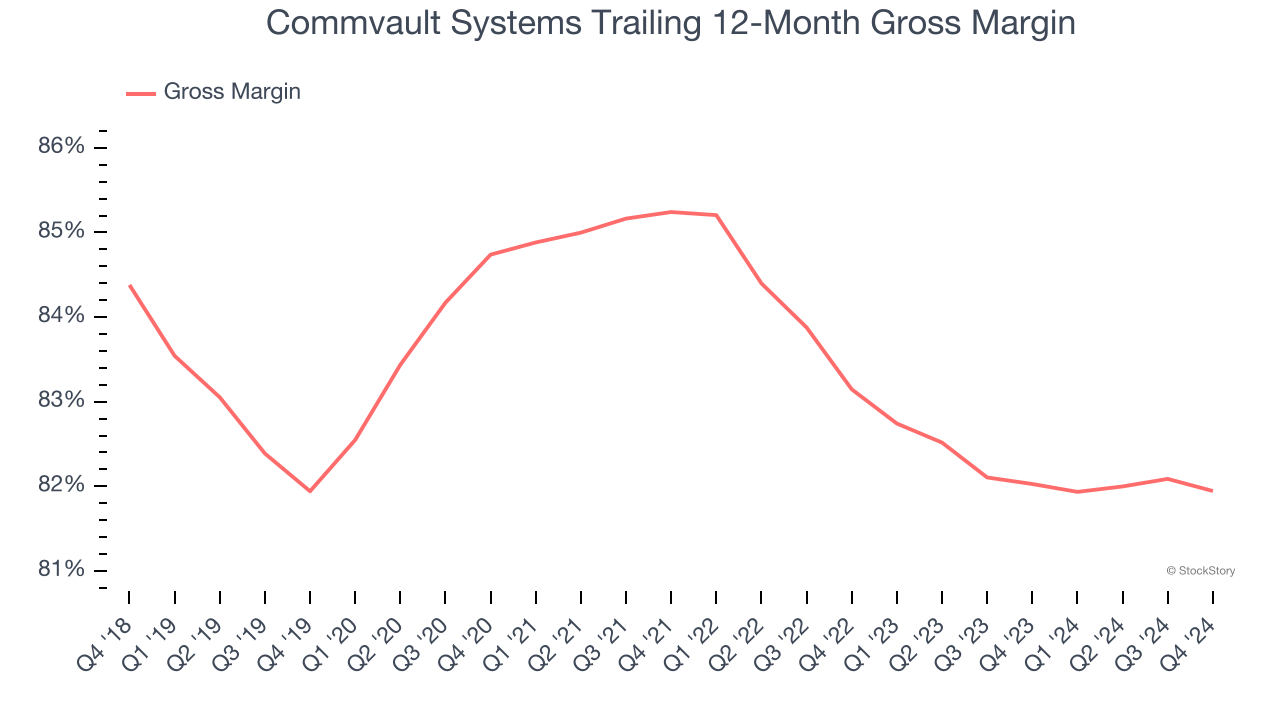

2. Elite Gross Margin Powers Best-In-Class Business Model

Software is eating the world. It’s one of our favorite business models because once you develop the product, it usually doesn’t cost much to provide it as an ongoing service. These minimal costs can include servers, licenses, and certain personnel.

Commvault Systems’s robust unit economics are better than the broader software industry, an output of its asset-lite business model and pricing power. They also enable the company to fund large investments in new products and sales during periods of rapid growth to achieve higher profits in the future. As you can see below, it averaged an excellent 81.9% gross margin over the last year. That means Commvault Systems only paid its providers $18.05 for every $100 in revenue.

One Reason to be Careful:

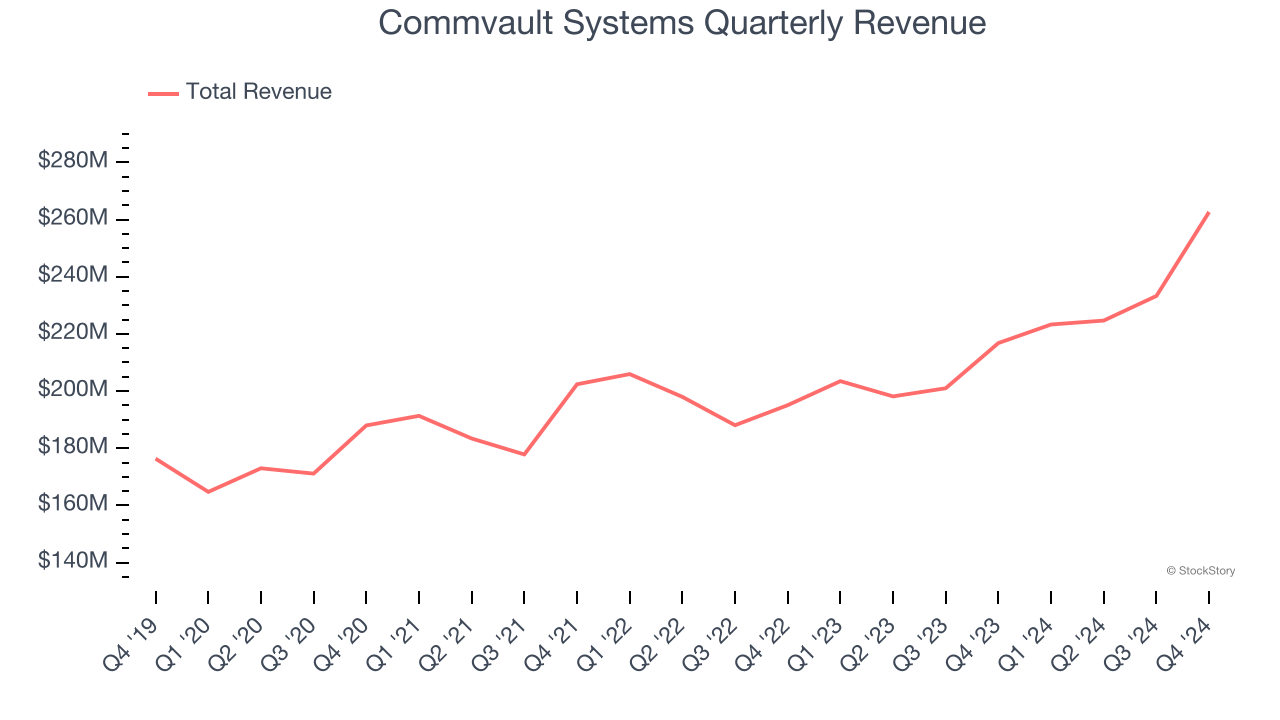

Long-Term Revenue Growth Disappoints

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, Commvault Systems’s 7.7% annualized revenue growth over the last three years was weak. This wasn’t a great result compared to the rest of the software sector, but there are still things to like about Commvault Systems.

Final Judgment

Commvault Systems has huge potential even though it has some open questions, but at $156.11 per share (or 6.6× forward price-to-sales), is now the time to initiate a position? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Commvault Systems

The elections are now behind us. With rates dropping and inflation cooling, many analysts expect a breakout market - and we’re zeroing in on the stocks that could benefit immensely.

Take advantage of the rebound by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.