As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at electronic components stocks, starting with Vishay Precision (NYSE: VPG).

Like many equipment and component manufacturers, electronic components companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include data centers and telecommunications, which can benefit companies whose optical and transceiver offerings fit those markets. But like the broader industrials sector, these companies are also at the whim of economic cycles. Consumer spending, for example, can greatly impact these companies’ volumes.

The 10 electronic components stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 3.1% while next quarter’s revenue guidance was 0.7% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 16.2% since the latest earnings results.

Slowest Q4: Vishay Precision (NYSE: VPG)

Emerging from Vishay Intertechnology in 2010, Vishay Precision (NYSE: VPG) operates as a global provider of precision measurement and sensing technologies.

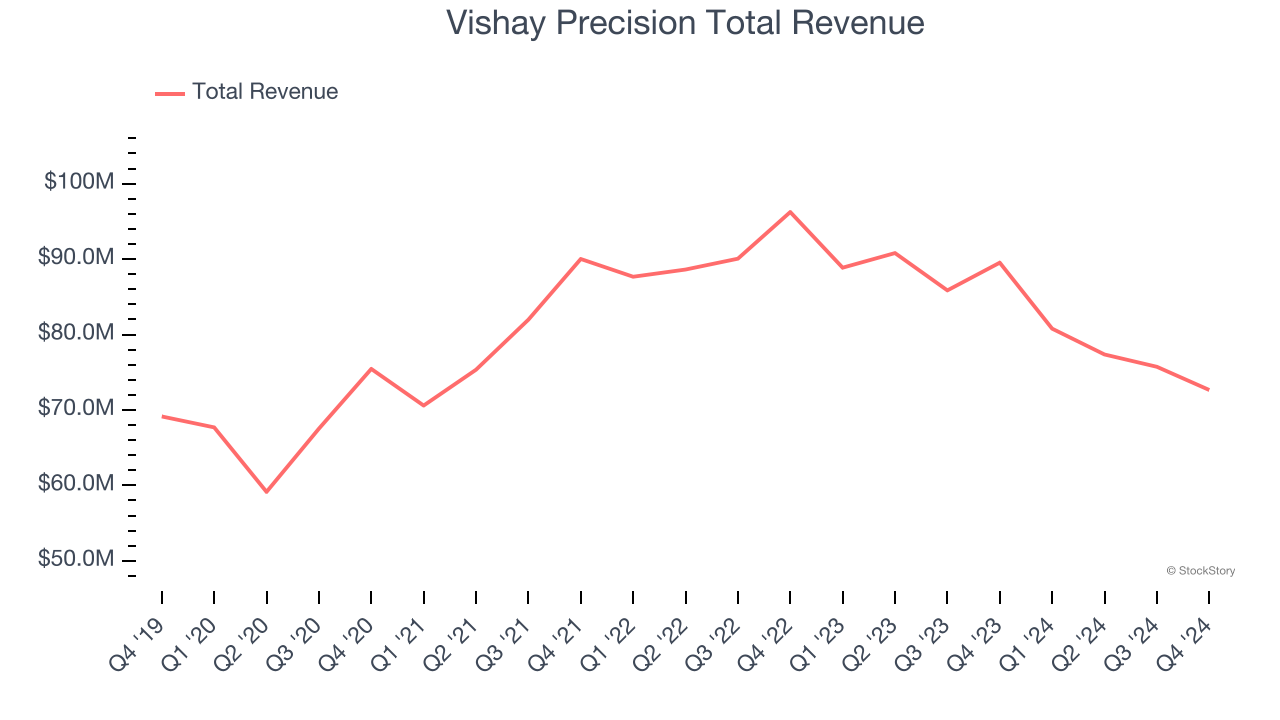

Vishay Precision reported revenues of $72.65 million, down 18.8% year on year. This print fell short of analysts’ expectations by 1.3%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EBITDA and EPS estimates.

Ziv Shoshani, Chief Executive Officer of VPG, commented, "2024 proved to be a challenging year, as we faced macro and cyclical headwinds. Nonetheless, orders in the fourth fiscal quarter of $72.4 million grew 5.5% sequentially resulting in a book-to-bill ratio of 1.00. This marked the first fiscal quarter of sequential bookings growth in six quarters, driven by our Sensors and Weighing Solutions segments which achieved book-to-bill ratios above 1.00 and their highest bookings level in 2024. We continue to focus on our business development pipeline, and furthering our progress with key projects in industrial and medical robotics, data center and telecommunications applications, among others."

Vishay Precision delivered the slowest revenue growth of the whole group. The stock is down 13% since reporting and currently trades at $20.87.

Read our full report on Vishay Precision here, it’s free.

Best Q4: Advanced Energy (NASDAQ: AEIS)

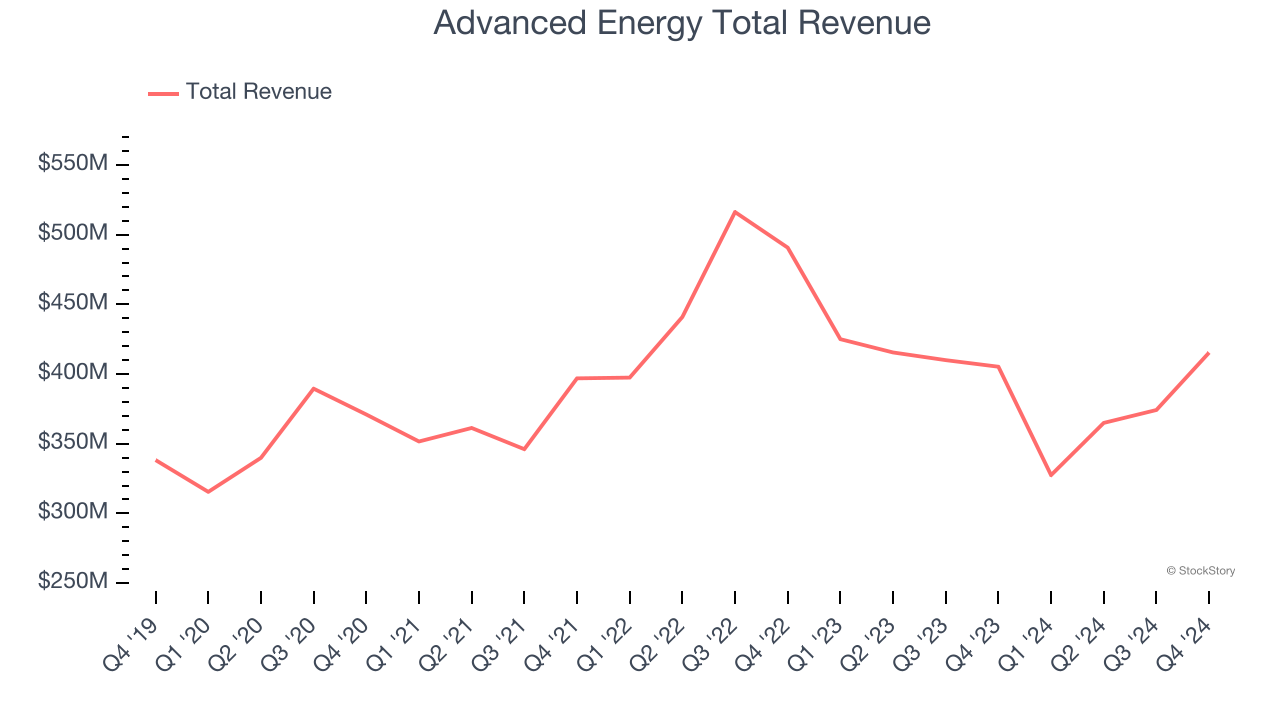

Pioneering technologies for radio frequency power delivery, Advanced Energy (NASDAQ: AEIS) provides power supplies, thermal management systems, and measurement and control instruments for various manufacturing processes.

Advanced Energy reported revenues of $415.4 million, up 2.5% year on year, outperforming analysts’ expectations by 5.5%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates.

The stock is down 16.7% since reporting. It currently trades at $92.61.

Is now the time to buy Advanced Energy? Access our full analysis of the earnings results here, it’s free.

Novanta (NASDAQ: NOVT)

Originally a pioneer in the laser scanning industry during the late 1960s, Novanta (NASDAQ: NOVT) offers medicine and manufacturing technology to the medical, life sciences, and manufacturing industries.

Novanta reported revenues of $238.1 million, up 12.5% year on year, falling short of analysts’ expectations by 0.9%. It was a softer quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

As expected, the stock is down 16% since the results and currently trades at $116.06.

Read our full analysis of Novanta’s results here.

Belden (NYSE: BDC)

With its enamel-coated copper wire used in WWI for the Allied forces, Belden (NYSE: BDC) designs, manufactures, and sells electronic components to various industries.

Belden reported revenues of $666 million, up 20.8% year on year. This print topped analysts’ expectations by 1.7%. It was a strong quarter as it also put up an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ Enterprise revenue estimates.

The stock is down 17.7% since reporting and currently trades at $95.49.

Read our full, actionable report on Belden here, it’s free.

Bel Fuse (NASDAQ: BELFA)

Founded by 26-year-old Elliot Bernstein during the electronics boom after WW2, Bel Fuse (NASDAQ: BELF.A) provides electronic systems and devices to the telecommunications, networking, transportation, and industrial sectors.

Bel Fuse reported revenues of $149.9 million, up 7% year on year. This number surpassed analysts’ expectations by 18.6%. Overall, it was a strong quarter as it also produced an impressive beat of analysts’ EBITDA estimates.

Bel Fuse pulled off the biggest analyst estimates beat among its peers. The stock is down 18.2% since reporting and currently trades at $68.

Read our full, actionable report on Bel Fuse here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.