Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at PlayStudios (NASDAQ: MYPS) and the best and worst performers in the gaming solutions industry.

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

The 7 gaming solutions stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.5%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17% since the latest earnings results.

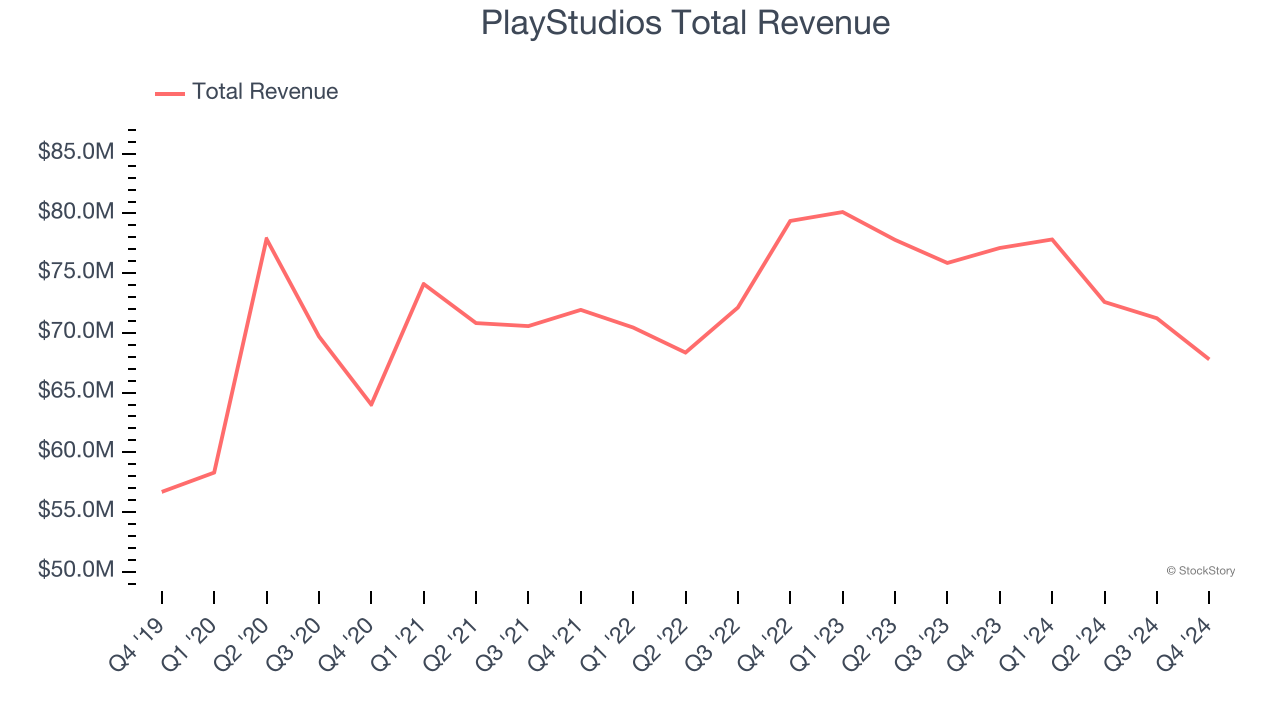

Weakest Q4: PlayStudios (NASDAQ: MYPS)

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ: MYPS) offers free-to-play digital casino games.

PlayStudios reported revenues of $67.78 million, down 12.1% year on year. This print fell short of analysts’ expectations by 1.4%. Overall, it was a disappointing quarter for the company with a miss of analysts’ daily active users estimates and full-year revenue guidance missing analysts’ expectations significantly.

PlayStudios delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update of the whole group. The company reported 2.72 million monthly active users, down 19% year on year. Unsurprisingly, the stock is down 17.2% since reporting and currently trades at $1.25.

Read our full report on PlayStudios here, it’s free.

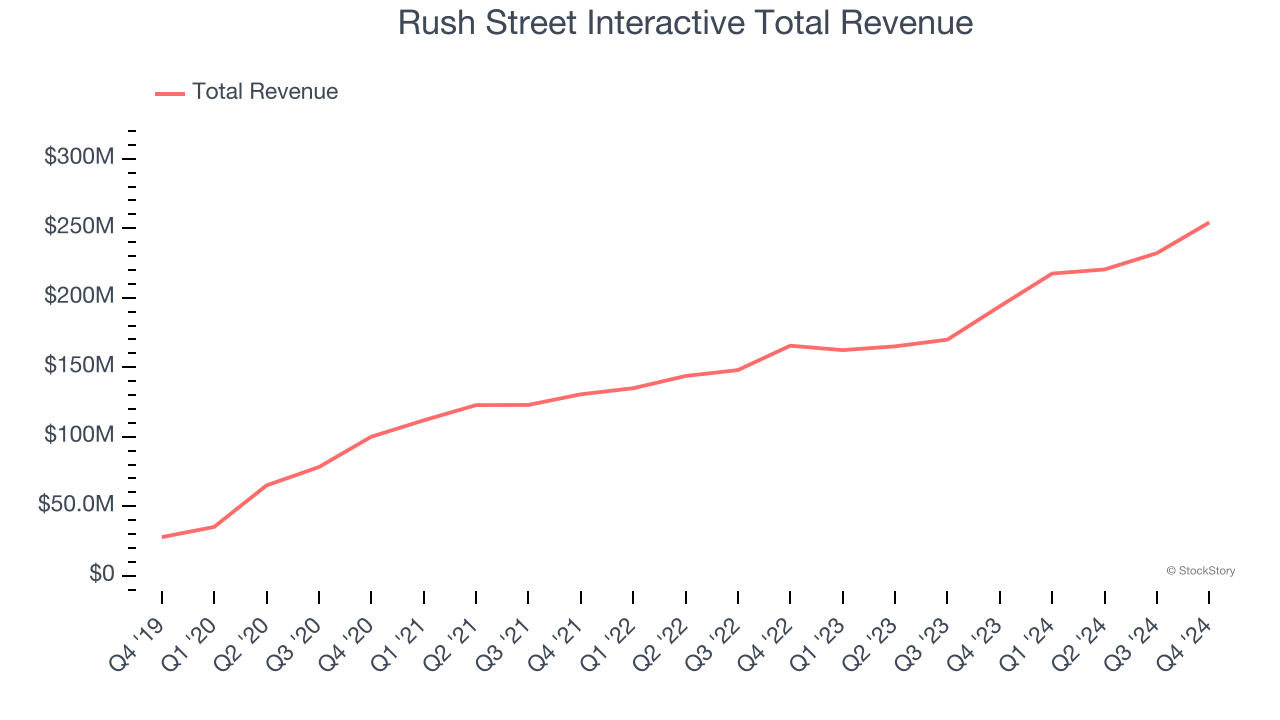

Best Q4: Rush Street Interactive (NYSE: RSI)

Specializing in online casino gaming and sports betting, Rush Street Interactive (NYSE: RSI) is an operator of digital gaming platforms.

Rush Street Interactive reported revenues of $254.2 million, up 31.1% year on year, outperforming analysts’ expectations by 3.4%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates.

Rush Street Interactive achieved the fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 15.1% since reporting. It currently trades at $11.29.

Is now the time to buy Rush Street Interactive? Access our full analysis of the earnings results here, it’s free.

Churchill Downs (NASDAQ: CHDN)

Famous for hosting the Kentucky Derby, Churchill Downs (NASDAQ: CHDN) operates a horse racing, online wagering, and gaming entertainment business in the United States.

Churchill Downs reported revenues of $624.2 million, up 11.2% year on year, exceeding analysts’ expectations by 0.9%. Still, it was a mixed quarter as it posted a miss of analysts’ Horse Racing revenue estimates.

As expected, the stock is down 13.7% since the results and currently trades at $103.19.

Read our full analysis of Churchill Downs’s results here.

DraftKings (NASDAQ: DKNG)

Getting its start in daily fantasy sports, DraftKings (NASDAQ: DKNG) is a digital sports entertainment and gaming company.

DraftKings reported revenues of $1.39 billion, up 13.2% year on year. This result lagged analysts' expectations by 0.9%. Aside from that, it was a strong quarter as it logged an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

DraftKings pulled off the highest full-year guidance raise among its peers. The company reported 4.8 million users, up 37.1% year on year. The stock is down 25.7% since reporting and currently trades at $34.48.

Read our full, actionable report on DraftKings here, it’s free.

Inspired (NASDAQ: INSE)

Specializing in digital casino gaming, Inspired (NASDAQ: INSE) is a provider of gaming hardware, virtual sports platforms, and server-based gaming systems.

Inspired reported revenues of $83 million, up 2.2% year on year. This print surpassed analysts’ expectations by 5.3%. Overall, it was a strong quarter as it also logged a decent beat of analysts’ EPS and EBITDA estimates.

Inspired achieved the biggest analyst estimates beat among its peers. The stock is down 13.8% since reporting and currently trades at $7.20.

Read our full, actionable report on Inspired here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.