What a brutal six months it’s been for CECO Environmental. The stock has dropped 21.1% and now trades at $21.32, rattling many shareholders. This may have investors wondering how to approach the situation.

Following the pullback, is now a good time to buy CECO? Find out in our full research report, it’s free.

Why Does CECO Environmental Spark Debate?

With roots dating back to 1869 and a focus on creating cleaner industrial operations, CECO Environmental (NASDAQ: CECO) provides technology and expertise that helps industrial companies reduce emissions, treat water, and improve energy efficiency across various sectors.

Two Things to Like:

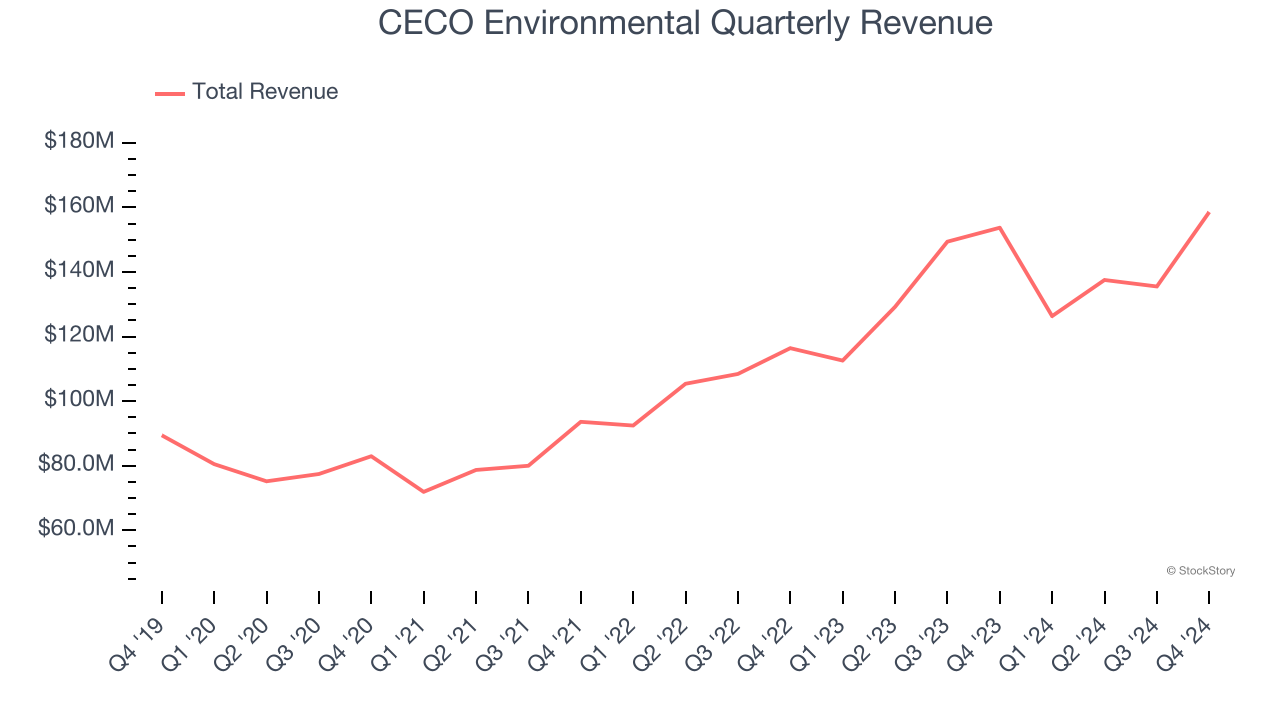

1. Skyrocketing Revenue Shows Strong Momentum

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, CECO Environmental grew its sales at an impressive 10.3% compounded annual growth rate. Its growth beat the average business services company and shows its offerings resonate with customers.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect CECO Environmental’s revenue to rise by 25.6%, an improvement versus its 14.9% annualized growth for the past two years. This projection is eye-popping and indicates its newer products and services will spur better top-line performance.

One Reason to be Careful:

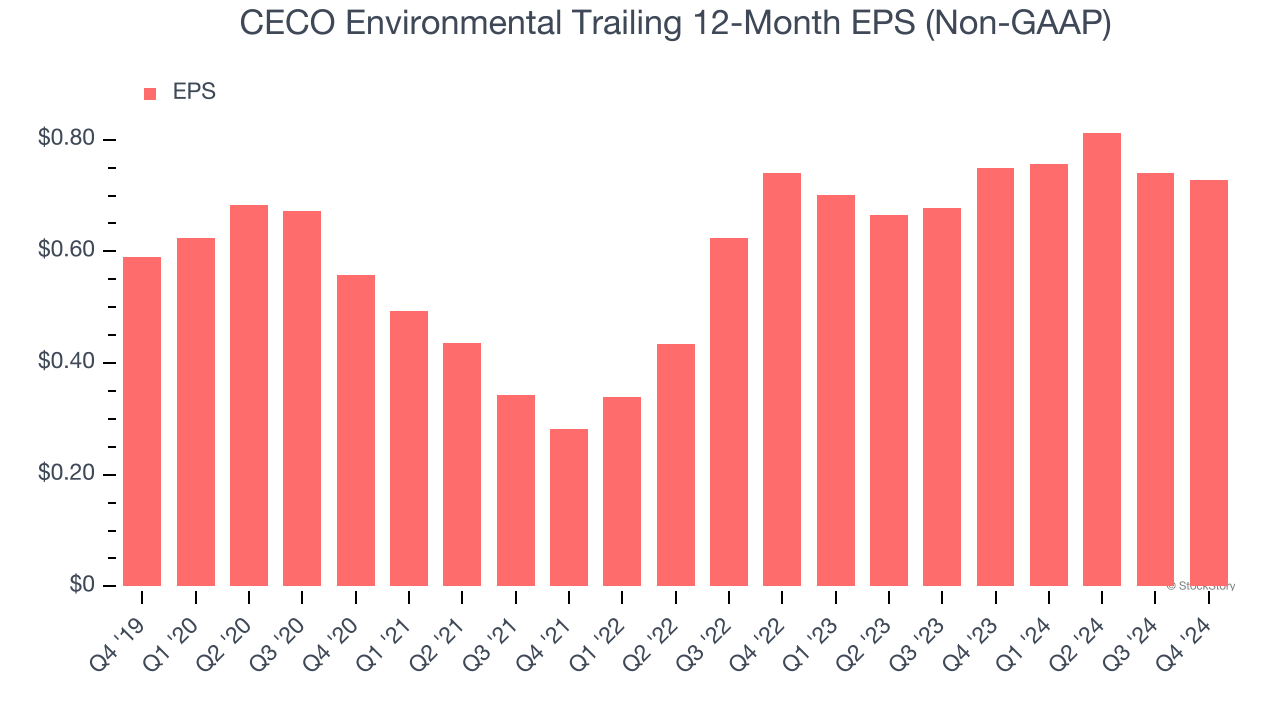

EPS Barely Growing

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

CECO Environmental’s EPS grew at an unimpressive 4.3% compounded annual growth rate over the last five years, lower than its 10.3% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

Final Judgment

CECO Environmental has huge potential even though it has some open questions. With the recent decline, the stock trades at 17.9× forward price-to-earnings (or $21.32 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than CECO Environmental

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.