As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the analog semiconductors industry, including Analog Devices (NASDAQ: ADI) and its peers.

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

The 15 analog semiconductors stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 27.4% since the latest earnings results.

Analog Devices (NASDAQ: ADI)

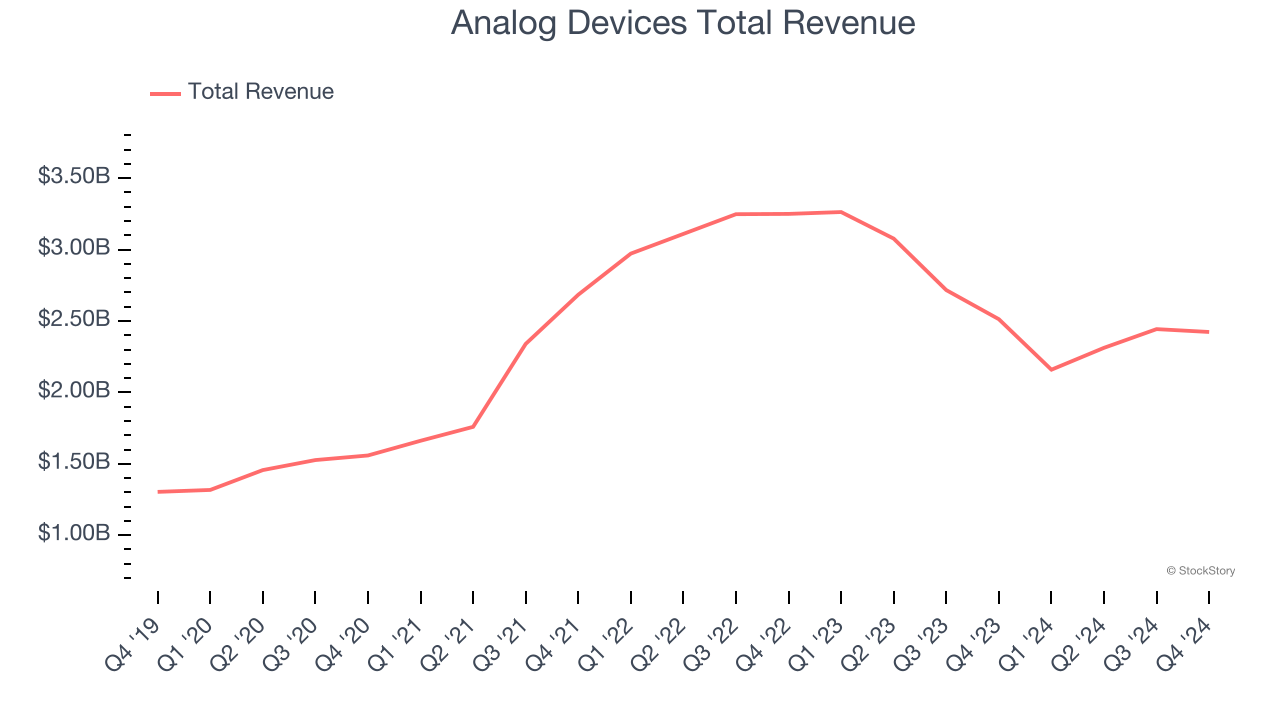

Founded by two MIT graduates, Ray Stata and Matthew Lorber in 1965, Analog Devices (NASDAQ: ADI) is one of the largest providers of high performance analog integrated circuits used mainly in industrial end markets, along with communications, autos, and consumer devices.

Analog Devices reported revenues of $2.42 billion, down 3.6% year on year. This print exceeded analysts’ expectations by 2.9%. Overall, it was a strong quarter for the company with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

"ADI delivered first quarter revenue, profitability, and earnings per share above the midpoint of our outlook, despite the challenging macro and geopolitical backdrop," said Vincent Roche, CEO and Chair.

The stock is down 18.9% since reporting and currently trades at $178.47.

Is now the time to buy Analog Devices? Access our full analysis of the earnings results here, it’s free.

Best Q4: Himax (NASDAQ: HIMX)

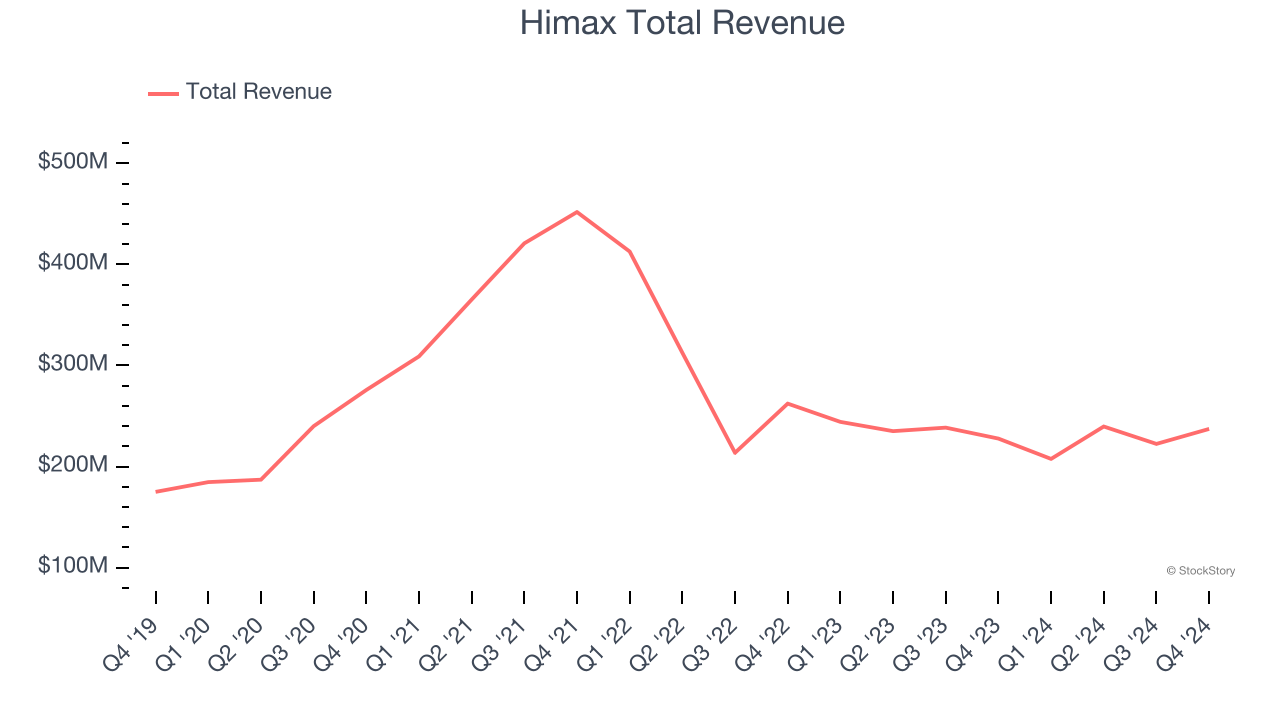

Taiwan-based Himax Technologies (NASDAQ: HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Himax reported revenues of $237.2 million, up 4.2% year on year, outperforming analysts’ expectations by 7.3%. The business had a stunning quarter with a significant improvement in its inventory levels and a solid beat of analysts’ EPS estimates.

The stock is down 27% since reporting. It currently trades at $6.66.

Is now the time to buy Himax? Access our full analysis of the earnings results here, it’s free.

Slowest Q4: Vishay Intertechnology (NYSE: VSH)

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE: VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Vishay Intertechnology reported revenues of $714.7 million, down 9% year on year, falling short of analysts’ expectations by 1.1%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income and EPS estimates.

As expected, the stock is down 33.1% since the results and currently trades at $11.11.

Read our full analysis of Vishay Intertechnology’s results here.

Magnachip (NYSE: MX)

With its technology found in common consumer electronics such as TVs and smartphones, Magnachip Semiconductor (NYSE: MX) is a provider of analog and mixed-signal semiconductors.

Magnachip reported revenues of $63.04 million, up 24% year on year. This number topped analysts’ expectations by 2.4%. It was an exceptional quarter as it also recorded a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is down 27.7% since reporting and currently trades at $2.93.

Read our full, actionable report on Magnachip here, it’s free.

Universal Display (NASDAQ: OLED)

Serving major consumer electronics manufacturers, Universal Display (NASDAQ: OLED) is a provider of organic light emitting diode (OLED) technologies used in display and lighting applications.

Universal Display reported revenues of $162.3 million, up 2.5% year on year. This result beat analysts’ expectations by 8.7%. Zooming out, it was a slower quarter as it recorded full-year revenue guidance missing analysts’ expectations.

Universal Display pulled off the biggest analyst estimates beat among its peers. The stock is down 21.9% since reporting and currently trades at $115.

Read our full, actionable report on Universal Display here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.