Bausch + Lomb has gotten torched over the last six months - since October 2024, its stock price has dropped 41.5% to $12.06 per share. This might have investors contemplating their next move.

Is there a buying opportunity in Bausch + Lomb, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Even though the stock has become cheaper, we don't have much confidence in Bausch + Lomb. Here are three reasons why you should be careful with BLCO and a stock we'd rather own.

Why Is Bausch + Lomb Not Exciting?

With a nearly 170-year history dedicated to vision care and eye health innovation, Bausch + Lomb (NYSE: BLCO) develops and manufactures a comprehensive range of eye health products including contact lenses, pharmaceuticals, surgical devices, and consumer eye care solutions.

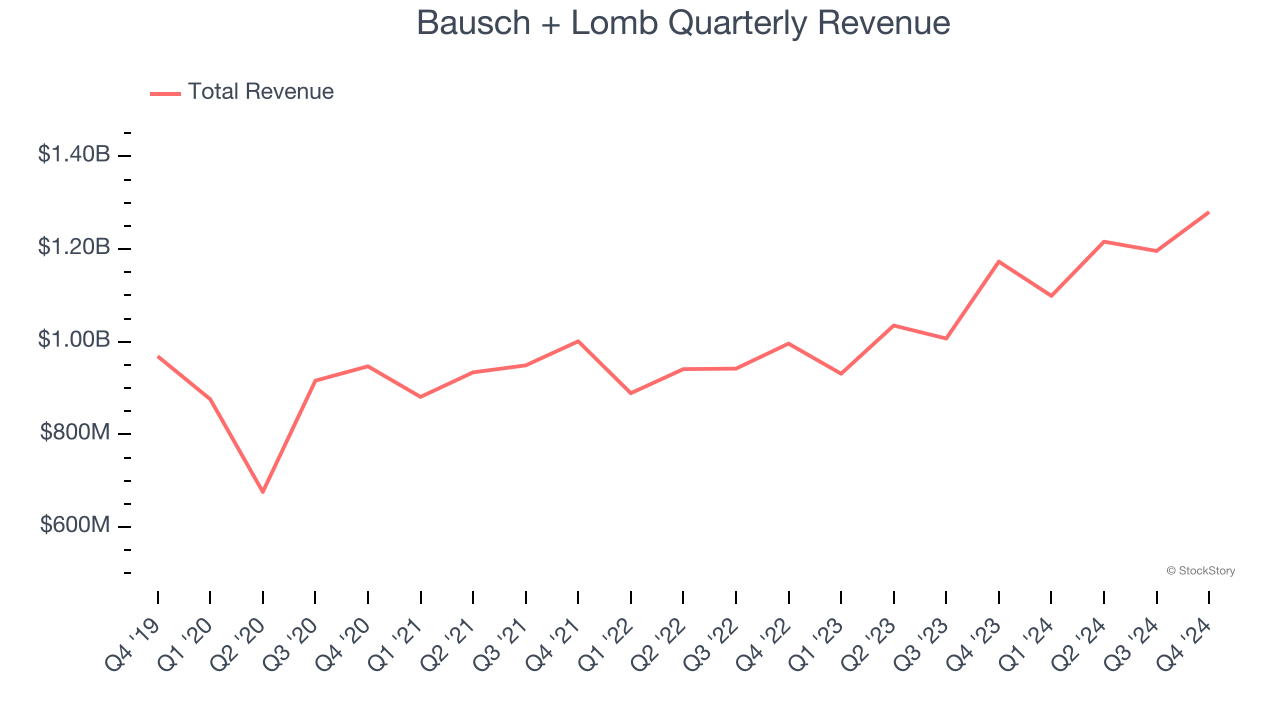

1. Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Bausch + Lomb grew its sales at a mediocre 5% compounded annual growth rate. This fell short of our benchmark for the healthcare sector.

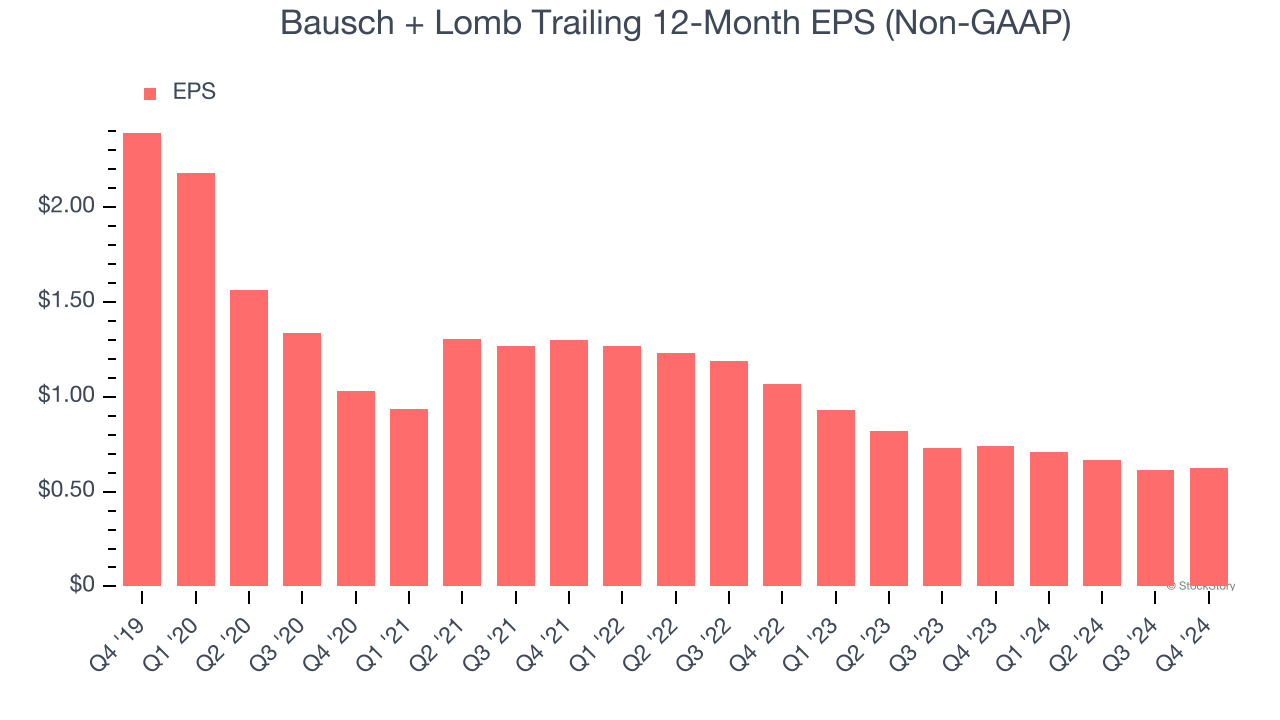

2. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Bausch + Lomb, its EPS declined by 23.5% annually over the last five years while its revenue grew by 5%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Short Cash Runway Exposes Shareholders to Potential Dilution

As long-term investors, the risk we care about most is the permanent loss of capital, which can happen when a company goes bankrupt or raises money from a disadvantaged position. This is separate from short-term stock price volatility, something we are much less bothered by.

Bausch + Lomb burned through $59 million of cash over the last year, and its $4.78 billion of debt exceeds the $316 million of cash on its balance sheet. This is a deal breaker for us because indebted loss-making companies spell trouble.

Unless the Bausch + Lomb’s fundamentals change quickly, it might find itself in a position where it must raise capital from investors to continue operating. Whether that would be favorable is unclear because dilution is a headwind for shareholder returns.

We remain cautious of Bausch + Lomb until it generates consistent free cash flow or any of its announced financing plans materialize on its balance sheet.

Final Judgment

Bausch + Lomb’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 15.7× forward price-to-earnings (or $12.06 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're pretty confident there are superior stocks to buy right now. We’d recommend looking at one of our top digital advertising picks.

Stocks We Would Buy Instead of Bausch + Lomb

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.