Although the S&P 500 is down 1.6% over the past six months, Nature's Sunshine’s stock price has fallen further to $11.31, losing shareholders 14.1% of their capital. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Nature's Sunshine, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Despite the more favorable entry price, we're swiping left on Nature's Sunshine for now. Here are three reasons why there are better opportunities than NATR and a stock we'd rather own.

Why Is Nature's Sunshine Not Exciting?

Started on a kitchen table in Utah, Nature’s Sunshine (NASDAQ: NATR) manufactures and sells nutritional and personal care products.

1. Long-Term Revenue Growth Flatter Than a Pancake

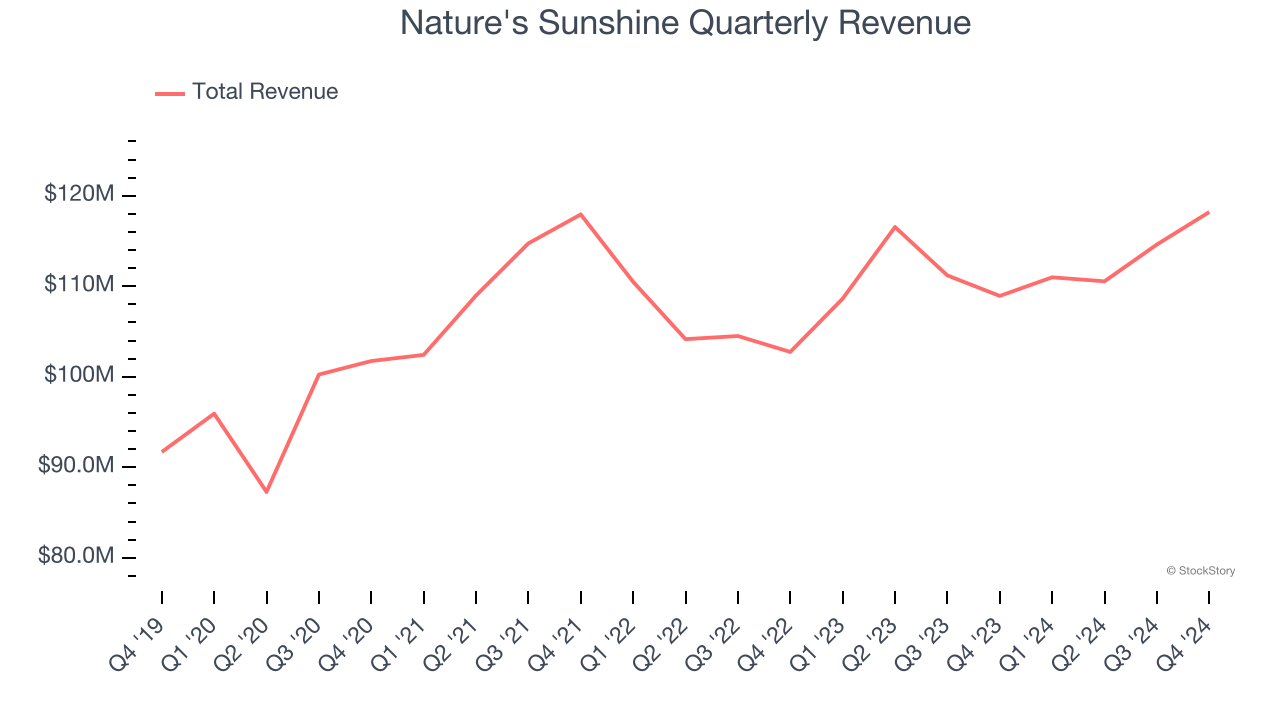

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Nature's Sunshine struggled to consistently increase demand as its $454.4 million of sales for the trailing 12 months was close to its revenue three years ago. This wasn’t a great result and is a sign of lacking business quality.

2. Fewer Distribution Channels Limit its Ceiling

With $454.4 million in revenue over the past 12 months, Nature's Sunshine is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

3. EPS Trending Down

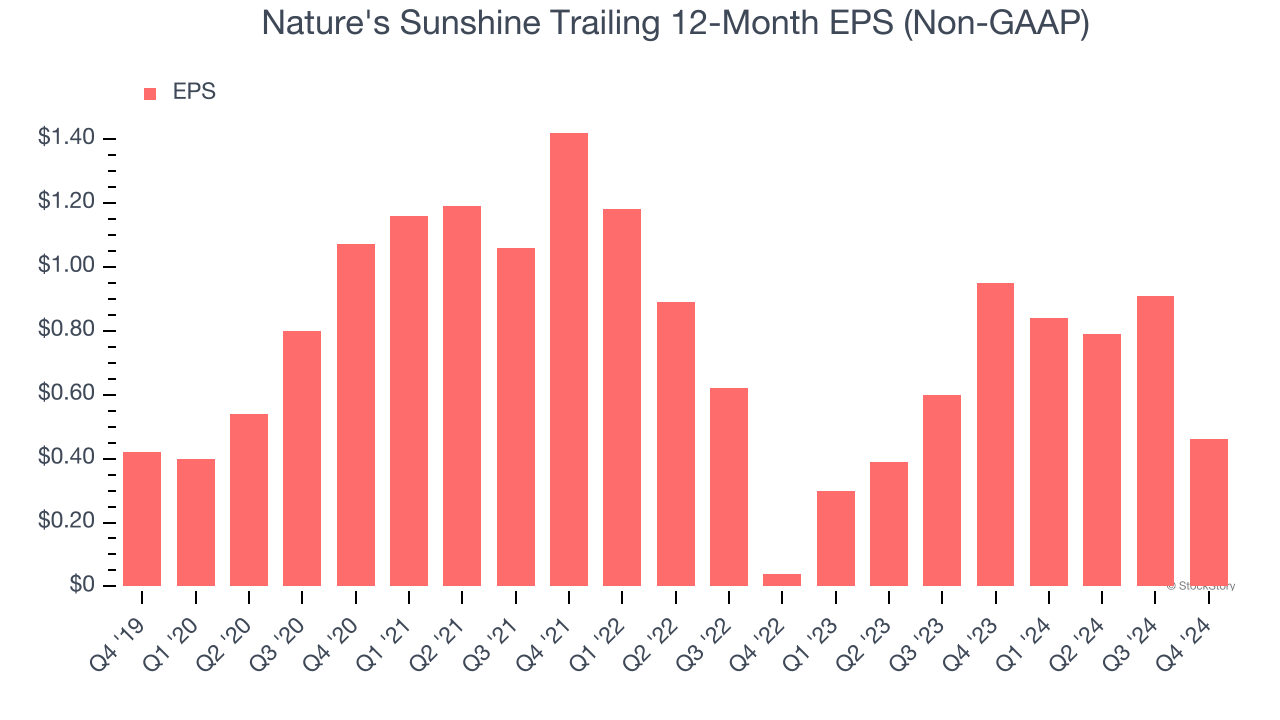

Analyzing the change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for Nature's Sunshine, its EPS declined by 31.3% annually over the last three years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

Final Judgment

Nature's Sunshine’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 16.4× forward price-to-earnings (or $11.31 per share). Investors with a higher risk tolerance might like the company, but we think the potential downside is too great. We're fairly confident there are better investments elsewhere. Let us point you toward the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Nature's Sunshine

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.