Over the past six months, Appian’s shares (currently trading at $28.55) have posted a disappointing 16.2% loss while the S&P 500 was down 1.7%. This may have investors wondering how to approach the situation.

Is now the time to buy Appian, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

Even with the cheaper entry price, we don't have much confidence in Appian. Here are three reasons why we avoid APPN and a stock we'd rather own.

Why Is Appian Not Exciting?

Founded by Matt Calkins and his three friends out of an apartment in Northern Virginia, Appian (NASDAQ: APPN) sells a software platform that lets its users build applications without using much code, allowing them to create new software more quickly.

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last three years, Appian grew its sales at a 18.7% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

2. Operating Losses Sound the Alarms

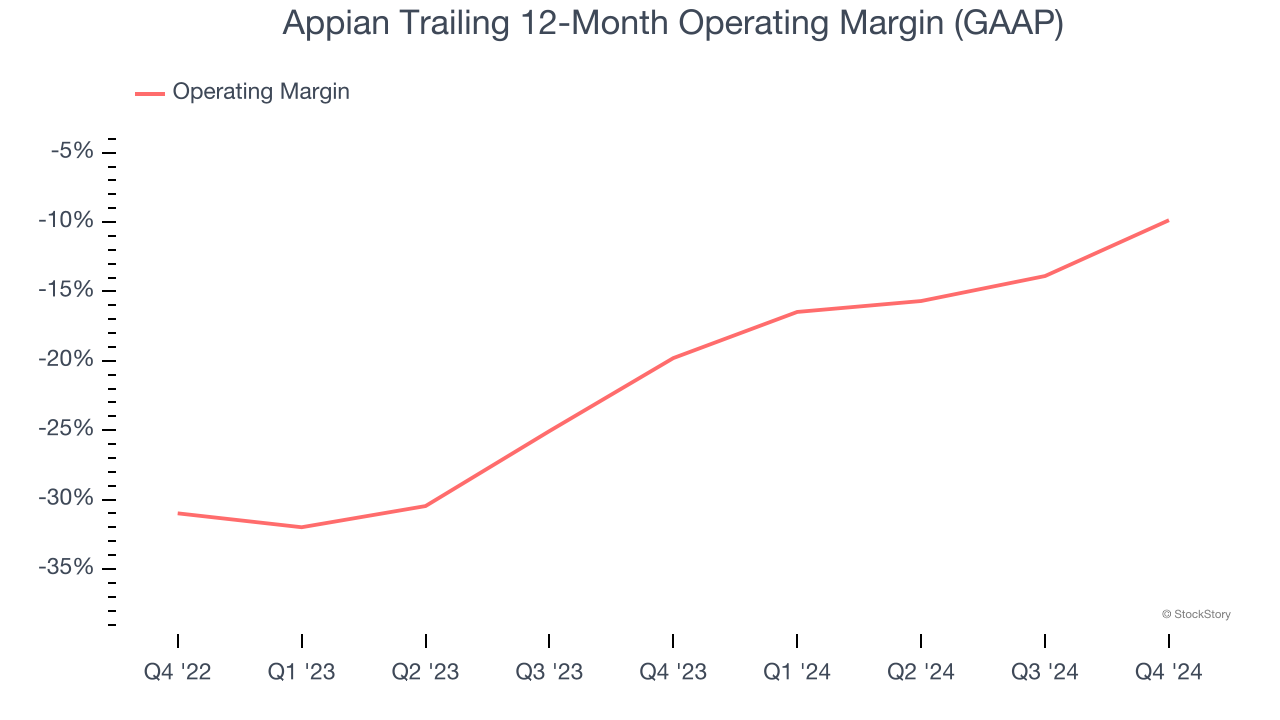

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Although Appian was profitable this quarter from an operational perspective, it’s generally struggled over a longer time period. Its expensive cost structure has contributed to an average operating margin of negative 9.9% over the last year. Unprofitable software companies require extra attention because they spend heaps of money to capture market share. As seen in its historically underwhelming revenue performance, this strategy hasn’t worked so far, and it’s unclear what would happen if Appian reeled back its investments. Wall Street seems to be optimistic about its growth, but we have some doubts.

3. Breakeven Free Cash Flow Limits Reinvestment Potential

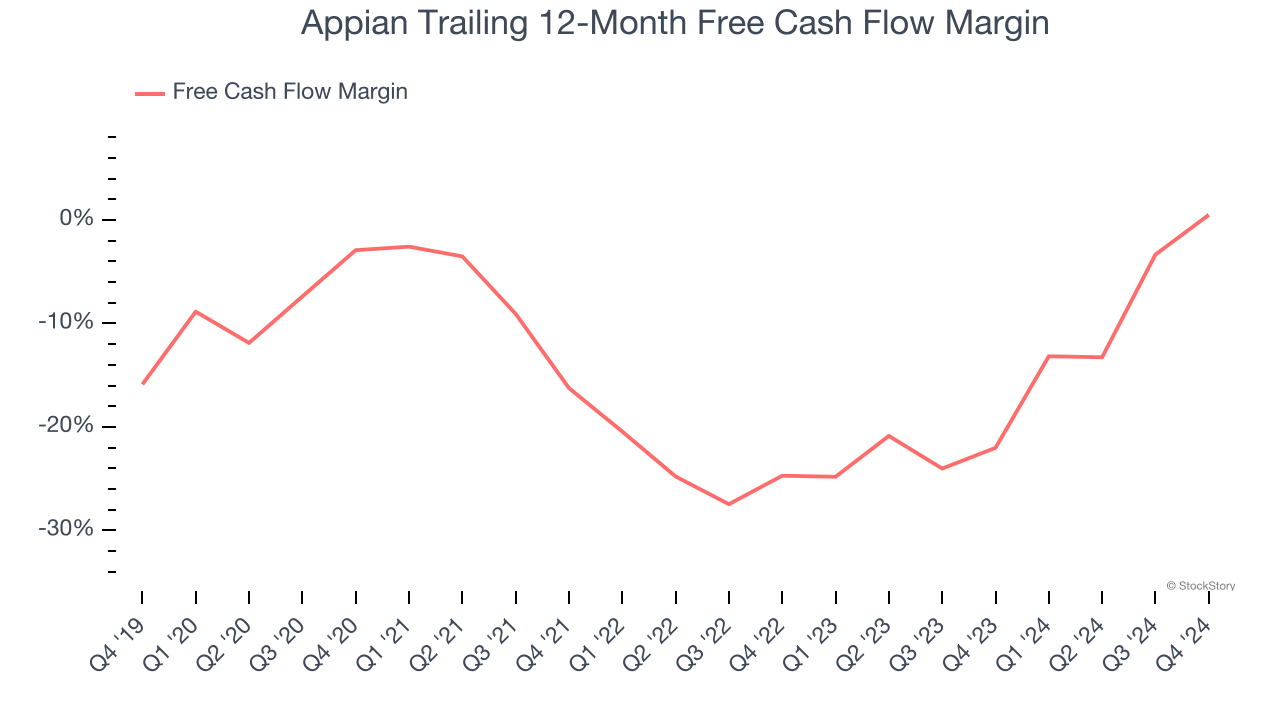

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Appian broke even from a free cash flow perspective over the last year, giving the company limited opportunities to return capital to shareholders.

Final Judgment

Appian isn’t a terrible business, but it doesn’t pass our bar. After the recent drawdown, the stock trades at 3.1× forward price-to-sales (or $28.55 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. Let us point you toward one of our top digital advertising picks.

Stocks We Like More Than Appian

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today for free.