Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Mercury Systems (NASDAQ: MRCY) and the best and worst performers in the defense contractors industry.

Defense contractors typically require technical expertise and government clearance. Companies in this sector can also enjoy long-term contracts with government bodies, leading to more predictable revenues. Combined, these factors create high barriers to entry and can lead to limited competition. Lately, geopolitical tensions–whether it be Russia’s invasion of Ukraine or China’s aggression towards Taiwan–highlight the need for defense spending. On the other hand, demand for these products can ebb and flow with defense budgets and even who is president, as different administrations can have vastly different ideas of how to allocate federal funds.

The 14 defense contractors stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 2.6% while next quarter’s revenue guidance was 3.9% above.

While some defense contractors stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.6% since the latest earnings results.

Best Q4: Mercury Systems (NASDAQ: MRCY)

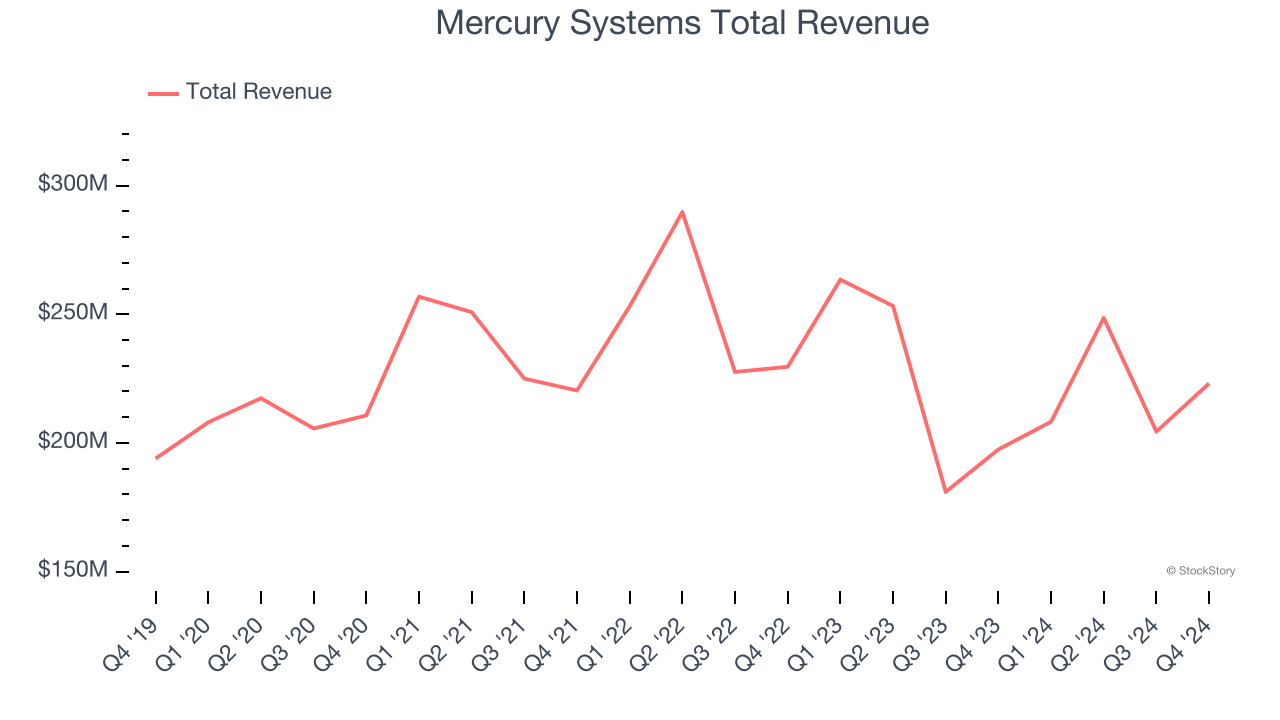

Founded in 1981, Mercury Systems (NASDAQ: MRCY) specializes in providing processing subsystems and components for primarily defense applications.

Mercury Systems reported revenues of $223.1 million, up 13% year on year. This print exceeded analysts’ expectations by 23.9%. Overall, it was an incredible quarter for the company with a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ EPS estimates.

“We delivered solid results in the second quarter of fiscal 2025 that were once again in line with or ahead of our expectations, and I’m optimistic about our ongoing efforts to improve performance as we move through the fiscal year,” said Bill Ballhaus, Mercury’s Chairman and CEO.

Mercury Systems pulled off the biggest analyst estimates beat of the whole group. The stock is up 3.8% since reporting and currently trades at $43.70.

Is now the time to buy Mercury Systems? Access our full analysis of the earnings results here, it’s free.

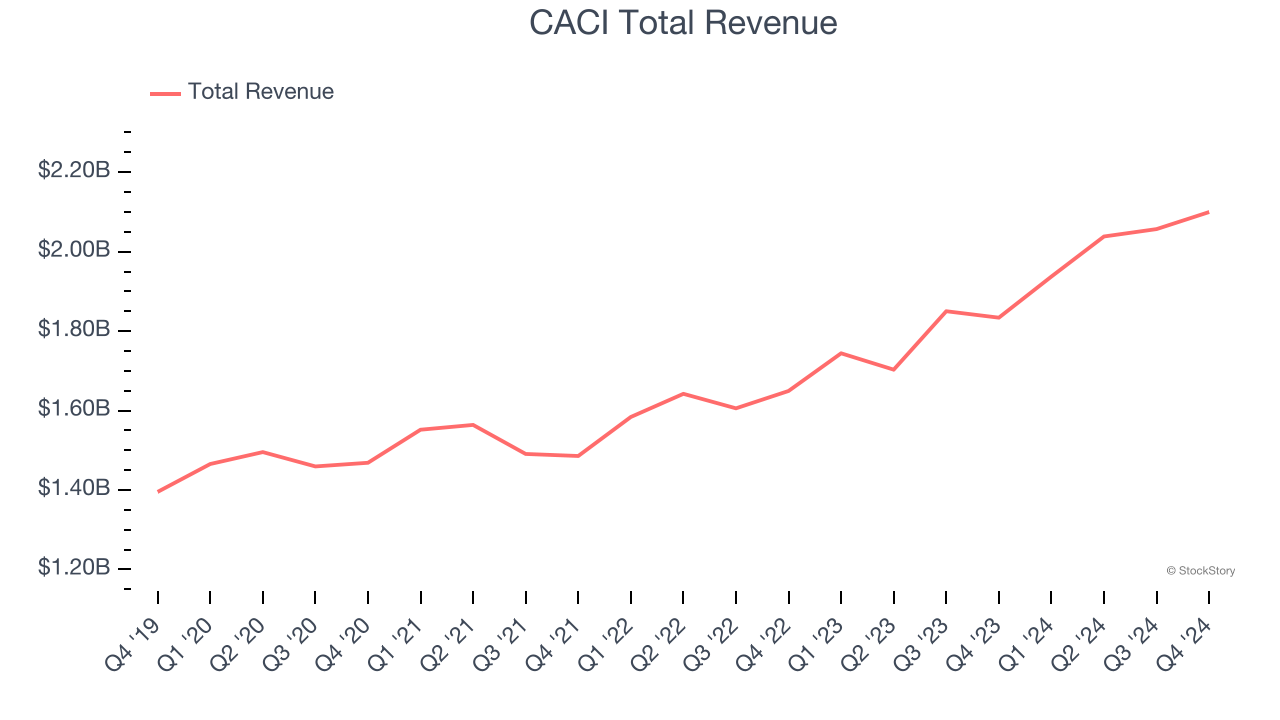

CACI (NYSE: CACI)

Founded to commercialize SIMSCRIPT, CACI International (NYSE: CACI) offers defense, intelligence, and IT solutions to support national security and government transformation efforts.

CACI reported revenues of $2.1 billion, up 14.5% year on year, outperforming analysts’ expectations by 3.4%. The business had an exceptional quarter with a solid beat of analysts’ backlog and EBITDA estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 20.8% since reporting. It currently trades at $368.41.

Is now the time to buy CACI? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: AeroVironment (NASDAQ: AVAV)

Focused on the future of autonomous military combat, AeroVironment (NASDAQ: AVAV) specializes in advanced unmanned aircraft systems and electric vehicle charging solutions.

AeroVironment reported revenues of $167.6 million, down 10.2% year on year, falling short of analysts’ expectations by 10.9%. It was a disappointing quarter as it posted full-year revenue guidance missing analysts’ expectations.

AeroVironment delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. As expected, the stock is down 14.3% since the results and currently trades at $121.78.

Read our full analysis of AeroVironment’s results here.

General Dynamics (NYSE: GD)

Creator of the famous M1 Abrahms tank, General Dynamics (NYSE: GD) develops aerospace, marine systems, combat systems, and information technology products.

General Dynamics reported revenues of $13.34 billion, up 14.3% year on year. This result beat analysts’ expectations by 3.4%. It was a strong quarter as it also put up an impressive beat of analysts’ backlog estimates and a decent beat of analysts’ EPS estimates.

The stock is up 4.5% since reporting and currently trades at $274.14.

Read our full, actionable report on General Dynamics here, it’s free.

RTX (NYSE: RTX)

Originally focused on refrigeration technology, Raytheon (NSYE:RTX) provides a a variety of products and services to the aerospace and defense industries.

RTX reported revenues of $21.62 billion, up 8.5% year on year. This number topped analysts’ expectations by 5.8%. Overall, it was a very strong quarter as it also logged an impressive beat of analysts’ organic revenue and EBITDA estimates.

The stock is up 6.3% since reporting and currently trades at $132.91.

Read our full, actionable report on RTX here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.