The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Semrush (NYSE: SEMR) and the rest of the sales and marketing software stocks fared in Q4.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 23 sales and marketing software stocks we track reported a mixed Q4. As a group, revenues beat analysts’ consensus estimates by 1.5% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17% since the latest earnings results.

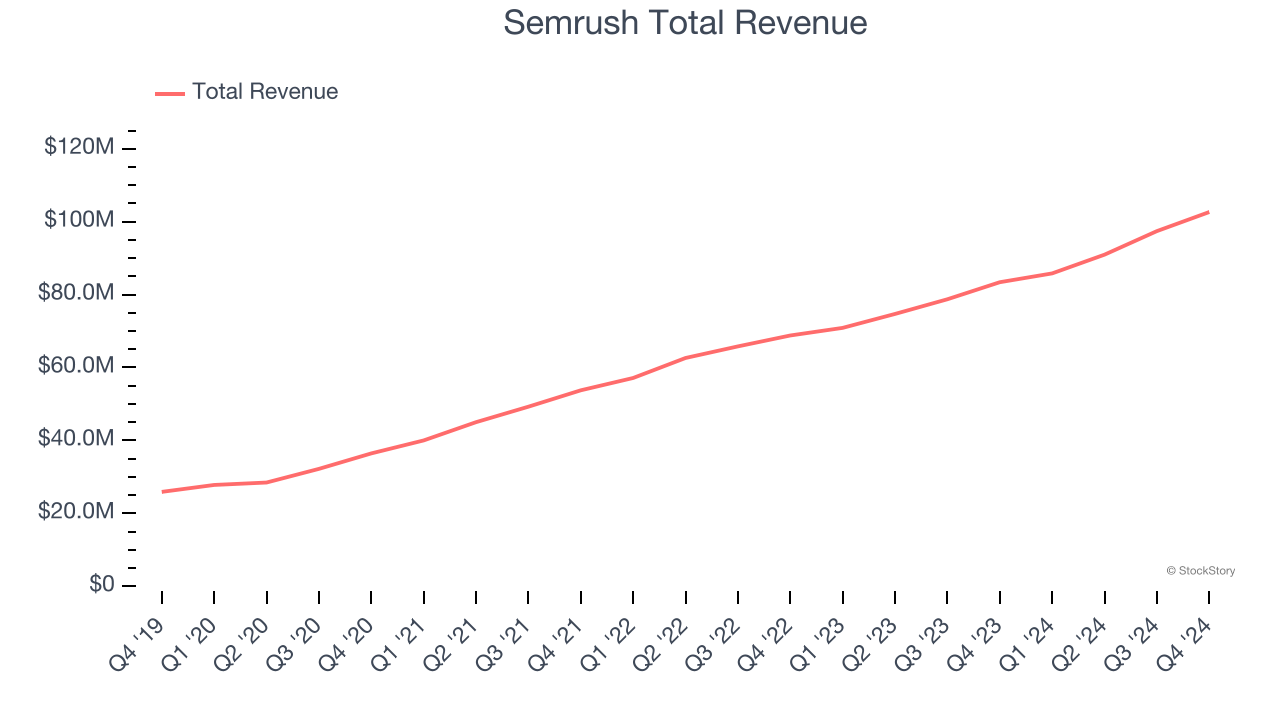

Semrush (NYSE: SEMR)

Started by Oleg Shchegolev while still in university, Semrush (NYSE: SEMR) is a software-as-a-service platform that helps companies optimize their search engine and content marketing efforts.

Semrush reported revenues of $102.6 million, up 23.1% year on year. This print exceeded analysts’ expectations by 1.1%. Despite the top-line beat, it was still a slower quarter for the company with decelerating customer growth and a slight miss of analysts’ annual recurring revenue estimates.

“I am excited to step into the CEO role and partner with Oleg and the team as Semrush continues to bring its fully-integrated, AI-powered digital marketing platform to organizations of all sizes," said Mr. Wagner.

The stock is down 34.9% since reporting and currently trades at $9.83.

Is now the time to buy Semrush? Access our full analysis of the earnings results here, it’s free.

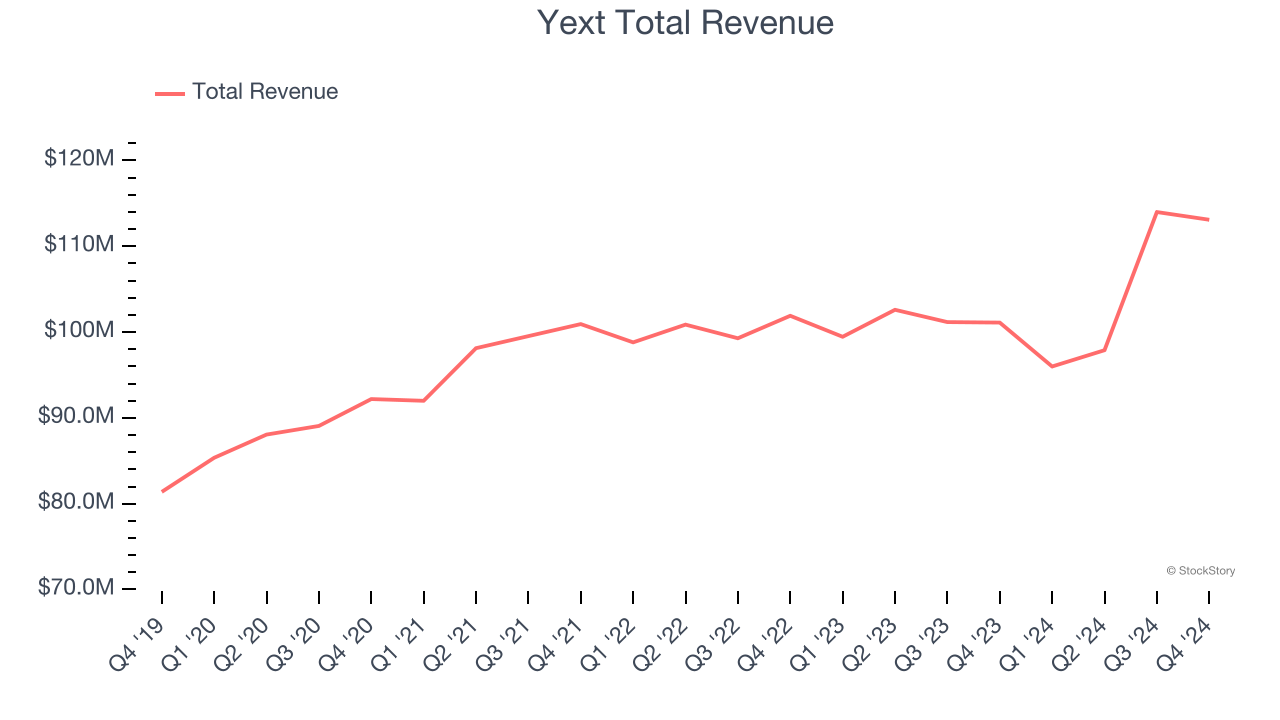

Best Q4: Yext (NYSE: YEXT)

Founded in 2006 by Howard Lerman, Yext (NYSE: YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

Yext reported revenues of $113.1 million, up 11.9% year on year, in line with analysts’ expectations. The business had an exceptional quarter with an impressive beat of analysts’ annual recurring revenue estimates and a solid beat of analysts’ billings estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 6.7% since reporting. It currently trades at $6.12.

Is now the time to buy Yext? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: The Trade Desk (NASDAQ: TTD)

Founded by former Microsoft engineers Jeff Green and Dave Pickles, The Trade Desk (NASDAQ: TTD) offers cloud-based software that uses data to help advertisers better plan, place, and target their online ads.

The Trade Desk reported revenues of $741 million, up 22.3% year on year, falling short of analysts’ expectations by 2.3%. It was a disappointing quarter as it posted EBITDA guidance for next quarter missing analysts’ expectations.

As expected, the stock is down 53.5% since the results and currently trades at $56.85.

Read our full analysis of The Trade Desk’s results here.

ZoomInfo (NASDAQ: ZI)

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ: ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

ZoomInfo reported revenues of $309.1 million, down 2.3% year on year. This result surpassed analysts’ expectations by 3.8%. It was an exceptional quarter as it also put up an impressive beat of analysts’ billings estimates and accelerating growth in large customers.

The company added 58 enterprise customers paying more than $100,000 annually to reach a total of 1,867. The stock is up 3.4% since reporting and currently trades at $9.86.

Read our full, actionable report on ZoomInfo here, it’s free.

Wix (NASDAQ: WIX)

Founded in 2006 in Tel Aviv, Wix.com (NASDAQ: WIX) offers a free and easy to operate website building platform.

Wix reported revenues of $460.5 million, up 14% year on year. This number was in line with analysts’ expectations. Aside from that, it was a slower quarter as it recorded revenue guidance for next quarter below analysts’ expectations.

The stock is down 28% since reporting and currently trades at $164.02.

Read our full, actionable report on Wix here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.