Since October 2024, Atlassian has been in a holding pattern, posting a small return of 3.7% while floating around $200. However, the stock is beating the S&P 500’s 10.7% decline during that period.

Given the relative strength, is there still a buying opportunity in TEAM? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Is TEAM a Good Business?

Founded by Australian co-CEOs Mike Cannon-Brookes and Scott Farquhar in 2002, Atlassian (NASDAQ: TEAM) provides software as a service that makes it easier for large teams of software developers to manage projects, especially in software development.

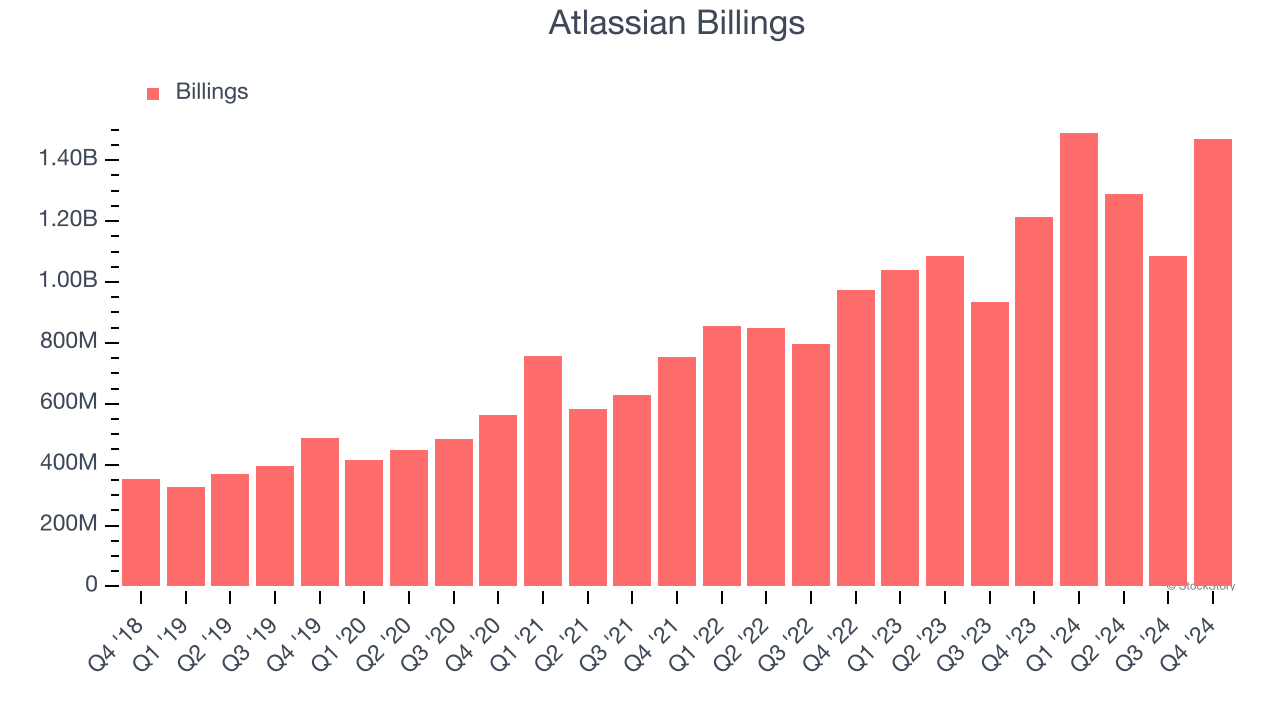

1. Billings Surge, Boosting Cash On Hand

Billings is a non-GAAP metric that is often called “cash revenue” because it shows how much money the company has collected from customers in a certain period. This is different from revenue, which must be recognized in pieces over the length of a contract.

Atlassian’s billings punched in at $1.47 billion in Q4, and over the last four quarters, its year-on-year growth averaged 24.9%. This performance was impressive, indicating robust customer demand. The high level of cash collected from customers also enhances liquidity and provides a solid foundation for future investments and growth.

2. Customer Acquisition Costs Are Recovered in Record Time

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Atlassian is extremely efficient at acquiring new customers, and its CAC payback period checked in at 4.2 months this quarter. The company’s rapid recovery of its customer acquisition costs indicates it has a highly differentiated product offering and a strong brand reputation. These dynamics give Atlassian more resources to pursue new product initiatives while maintaining the flexibility to increase its sales and marketing investments.

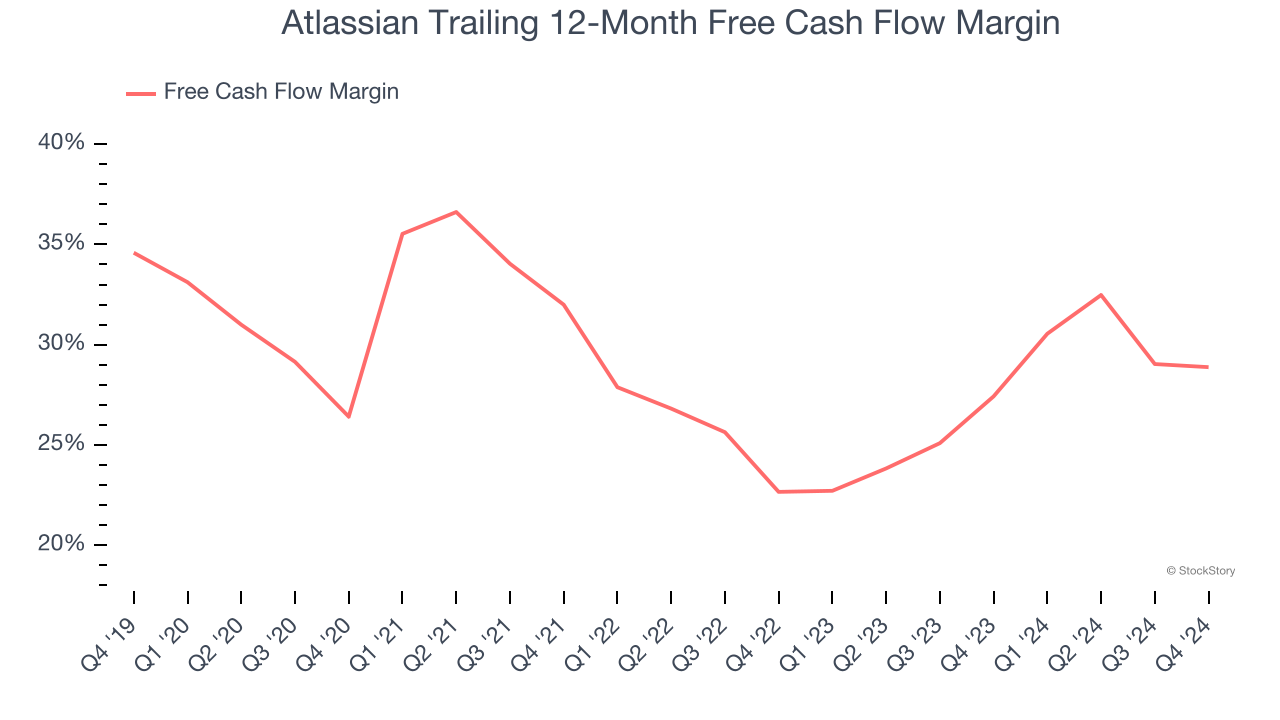

3. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Atlassian has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the software sector, averaging 28.9% over the last year. The divergence from its underwhelming operating margin stems from the add-back of non-cash charges like depreciation and stock-based compensation. GAAP operating profit expenses these line items, but free cash flow does not.

Final Judgment

These are just a few reasons Atlassian is a high-quality business worth owning, and with its recent outperformance in a weaker market environment, the stock trades at 9.4× forward price-to-sales (or $200 per share). Is now a good time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Atlassian

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.