Medical technology company Intuitive Surgical (NASDAQ: ISRG) reported Q1 CY2025 results beating Wall Street’s revenue expectations, with sales up 19.2% year on year to $2.25 billion. Its non-GAAP profit of $1.81 per share was 4.4% above analysts’ consensus estimates.

Is now the time to buy Intuitive Surgical? Find out by accessing our full research report, it’s free.

Intuitive Surgical (ISRG) Q1 CY2025 Highlights:

- Revenue: $2.25 billion vs analyst estimates of $2.19 billion (19.2% year-on-year growth, 3.1% beat)

- Adjusted EPS: $1.81 vs analyst estimates of $1.73 (4.4% beat)

- Adjusted EBITDA: $581.5 million vs analyst estimates of $857.8 million (25.8% margin, 32.2% miss)

- Operating Margin: 25.7%, in line with the same quarter last year

- Market Capitalization: $167.8 billion

Company Overview

Pioneering minimally invasive surgery since its first da Vinci system was FDA-cleared in 2000, Intuitive Surgical (NASDAQ: ISRG) develops and manufactures robotic-assisted surgical systems that enable minimally invasive procedures across various medical specialties.

Surgical Equipment & Consumables - Specialty

The surgical equipment and consumables industry provides tools, devices, and disposable products essential for surgeries and medical procedures. These companies therefore benefit from relatively consistent demand, driven by the ongoing need for medical interventions, recurring revenue from consumables, and long-term contracts with hospitals and healthcare providers. However, the high costs of R&D and regulatory compliance, coupled with intense competition and pricing pressures from cost-conscious customers, can constrain profitability. Over the next few years, tailwinds include aging populations, which tend to need surgical interventions at higher rates. The increasing integration of AI and robotics into surgical procedures could also create opportunities for differentiation and innovation. However, the industry faces headwinds including potential supply chain vulnerabilities, evolving regulatory requirements, and more widespread efforts to make healthcare less costly.

Sales Growth

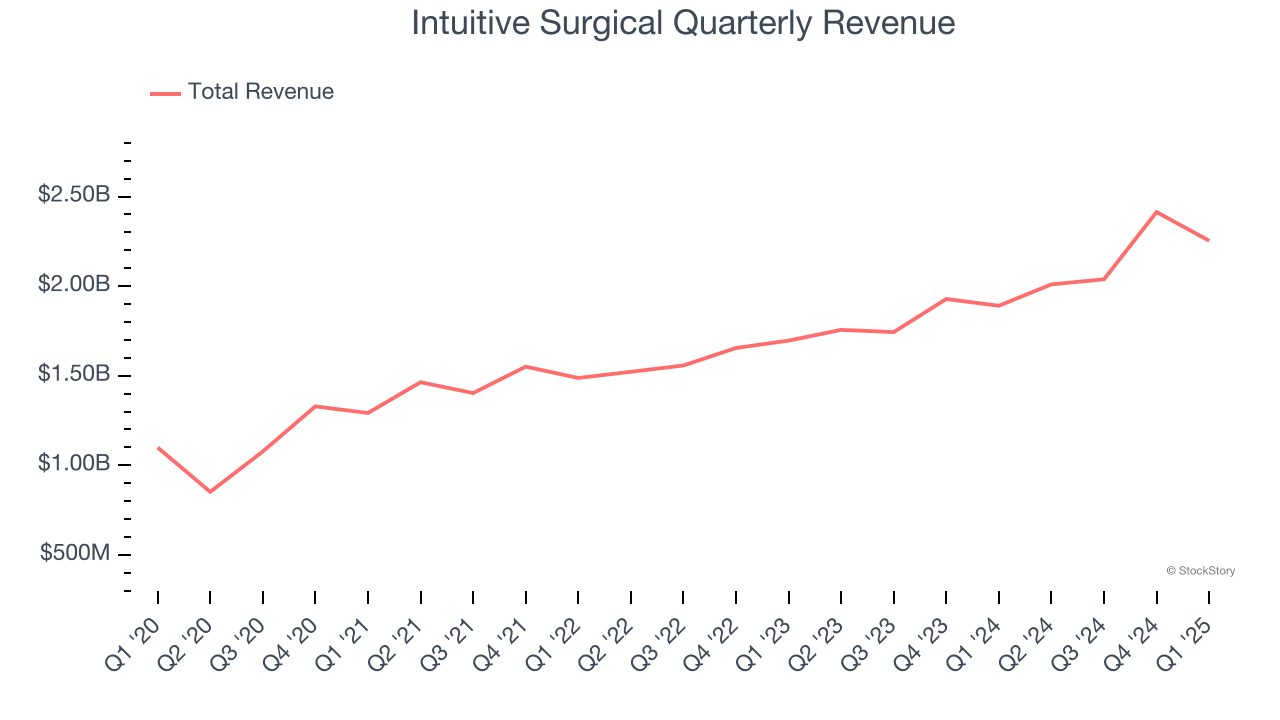

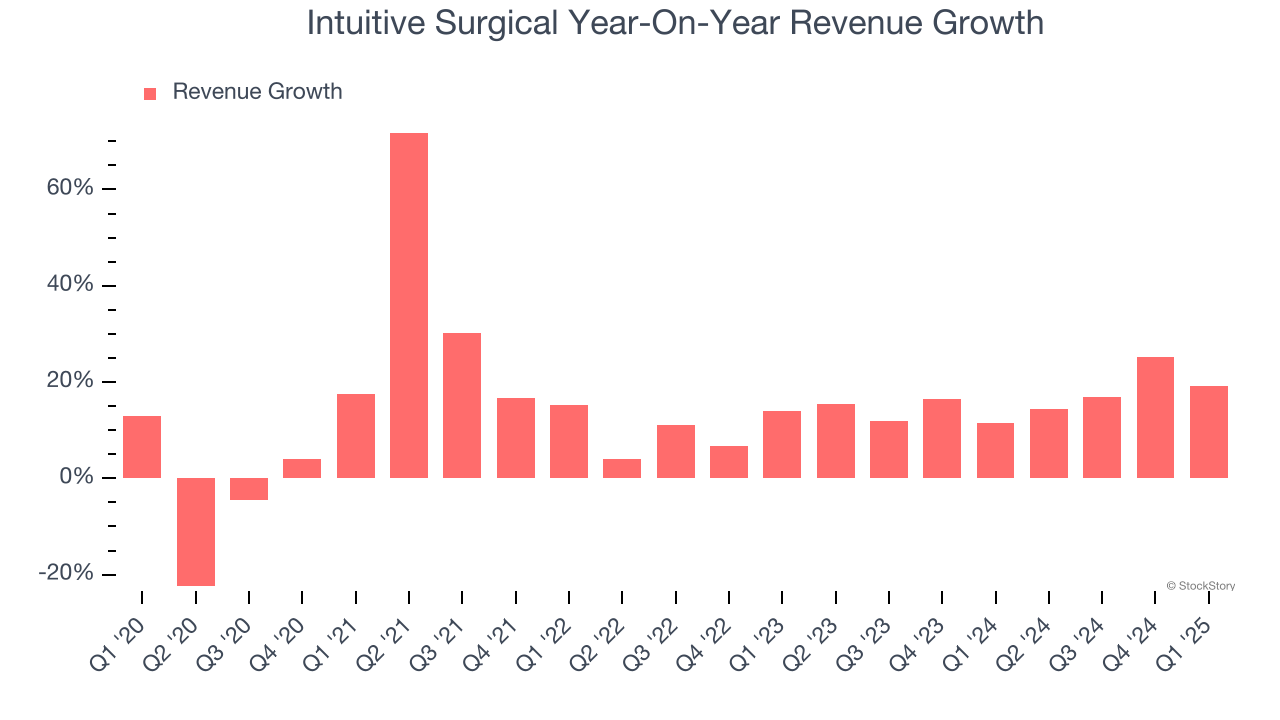

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Over the last five years, Intuitive Surgical grew its sales at a solid 13.6% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers, a helpful starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Intuitive Surgical’s annualized revenue growth of 16.4% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

This quarter, Intuitive Surgical reported year-on-year revenue growth of 19.2%, and its $2.25 billion of revenue exceeded Wall Street’s estimates by 3.1%.

Looking ahead, sell-side analysts expect revenue to grow 13.6% over the next 12 months, a slight deceleration versus the last two years. Still, this projection is healthy and indicates the market is forecasting success for its products and services.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is one of the best measures of profitability because it tells us how much money a company takes home after subtracting all core expenses, like marketing and R&D.

Intuitive Surgical has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 26.9%.

Analyzing the trend in its profitability, Intuitive Surgical’s operating margin rose by 2.2 percentage points over the last five years, as its sales growth gave it operating leverage. This performance was mostly driven by its recent improvements as the company’s margin has increased by 4 percentage points on a two-year basis. These data points are very encouraging and shows momentum is on its side.

In Q1, Intuitive Surgical generated an operating profit margin of 25.7%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

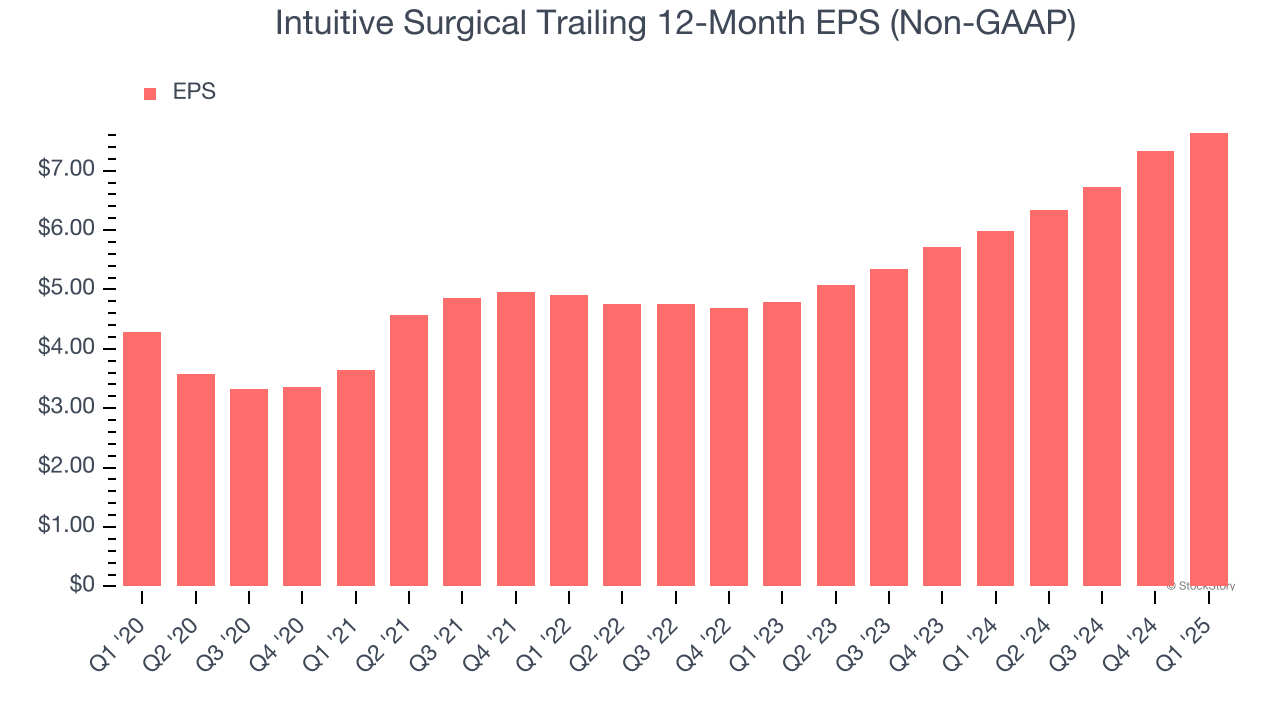

Intuitive Surgical’s EPS grew at a spectacular 12.3% compounded annual growth rate over the last five years. Despite its operating margin expansion during that time, this performance was lower than its 13.6% annualized revenue growth, telling us that non-fundamental factors such as interest and taxes affected its ultimate earnings.

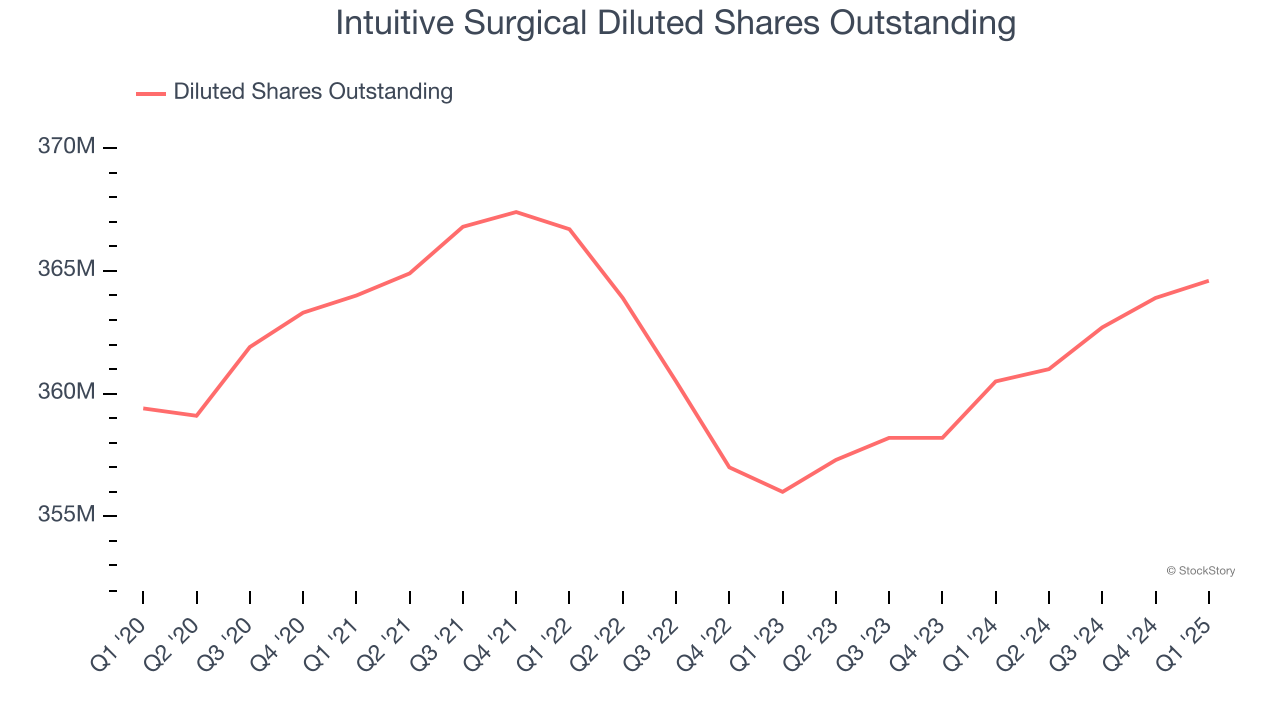

We can take a deeper look into Intuitive Surgical’s earnings quality to better understand the drivers of its performance. A five-year view shows Intuitive Surgical has diluted its shareholders, growing its share count by 1.4%. This dilution overshadowed its increased operating efficiency and has led to lower per share earnings. Taxes and interest expenses can also affect EPS but don’t tell us as much about a company’s fundamentals.

In Q1, Intuitive Surgical reported EPS at $1.81, up from $1.50 in the same quarter last year. This print beat analysts’ estimates by 4.4%. Over the next 12 months, Wall Street expects Intuitive Surgical’s full-year EPS of $7.64 to grow 9.8%.

Key Takeaways from Intuitive Surgical’s Q1 Results

We enjoyed seeing Intuitive Surgical beat analysts’ revenue expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its EBITDA missed. Overall, we think this was a decent quarter with some key areas of upside. The EBITDA miss seems to be driving the move, and shares traded down 6.2% to $449.17 immediately following the results.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.