As the Q4 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the it distribution & solutions industry, including Ingram Micro (NYSE: INGM) and its peers.

IT Distribution & Solutions will be buoyed by the increasing complexity of IT ecosystems, rising cloud adoption, and demand for cybersecurity solutions. Enterprises are less likely than ever to embark on these complicated journeys solo, and companies in the sector boast expertise and scale in these areas. However, cloud migration also means less need for hardware, which could dent demand for large portions of the product portfolio and hurt margins. Additionally, planning for potentially supply chain disruptions is ongoing, as the COVID-19 pandemic showed how damaging a pause in global trade could be in areas like semiconductor procurement.

The 8 it distribution & solutions stocks we track reported a softer Q4. As a group, revenues missed analysts’ consensus estimates by 2.7% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 17.3% since the latest earnings results.

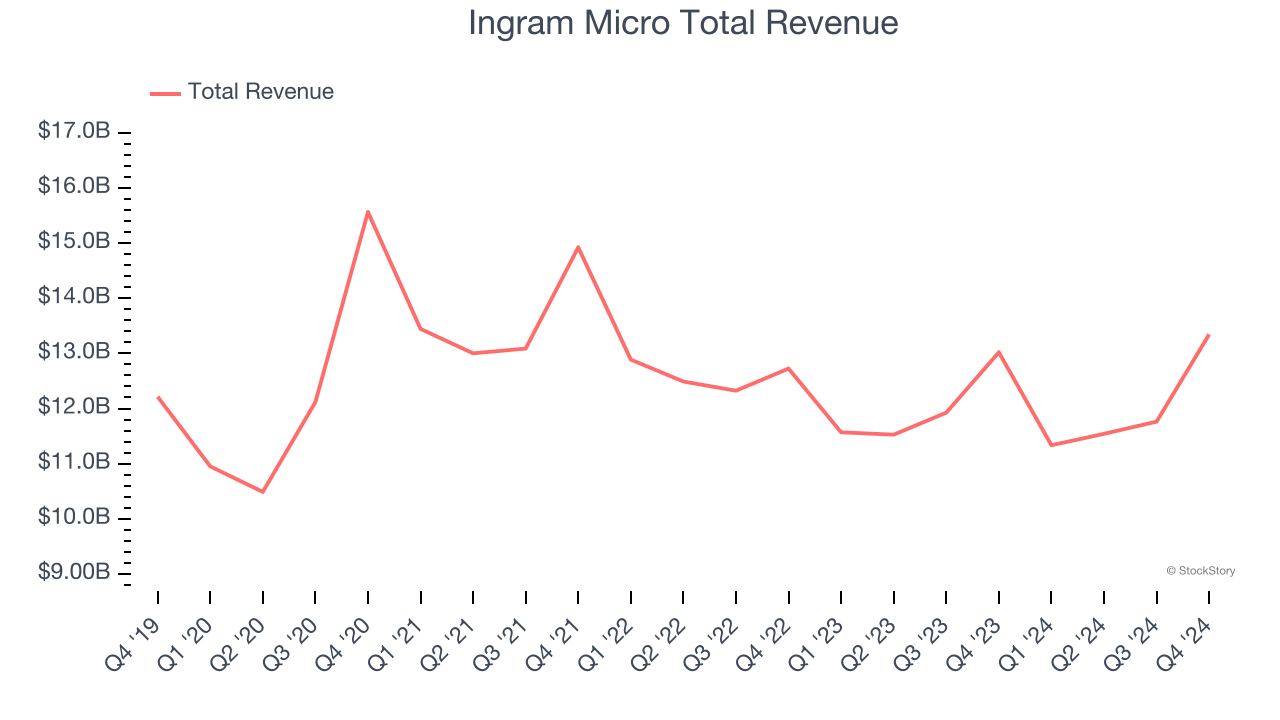

Ingram Micro (NYSE: INGM)

Operating as the crucial link in the global technology supply chain with a presence in 57 countries, Ingram Micro (NYSE: INGM) is a global technology distributor that connects manufacturers with resellers, providing hardware, software, cloud services, and logistics expertise.

Ingram Micro reported revenues of $13.34 billion, up 2.5% year on year. This print exceeded analysts’ expectations by 1.2%. Despite the top-line beat, it was still a slower quarter for the company with a significant miss of analysts’ EPS guidance for next quarter estimates.

The stock is down 15.8% since reporting and currently trades at $17.63.

Read our full report on Ingram Micro here, it’s free.

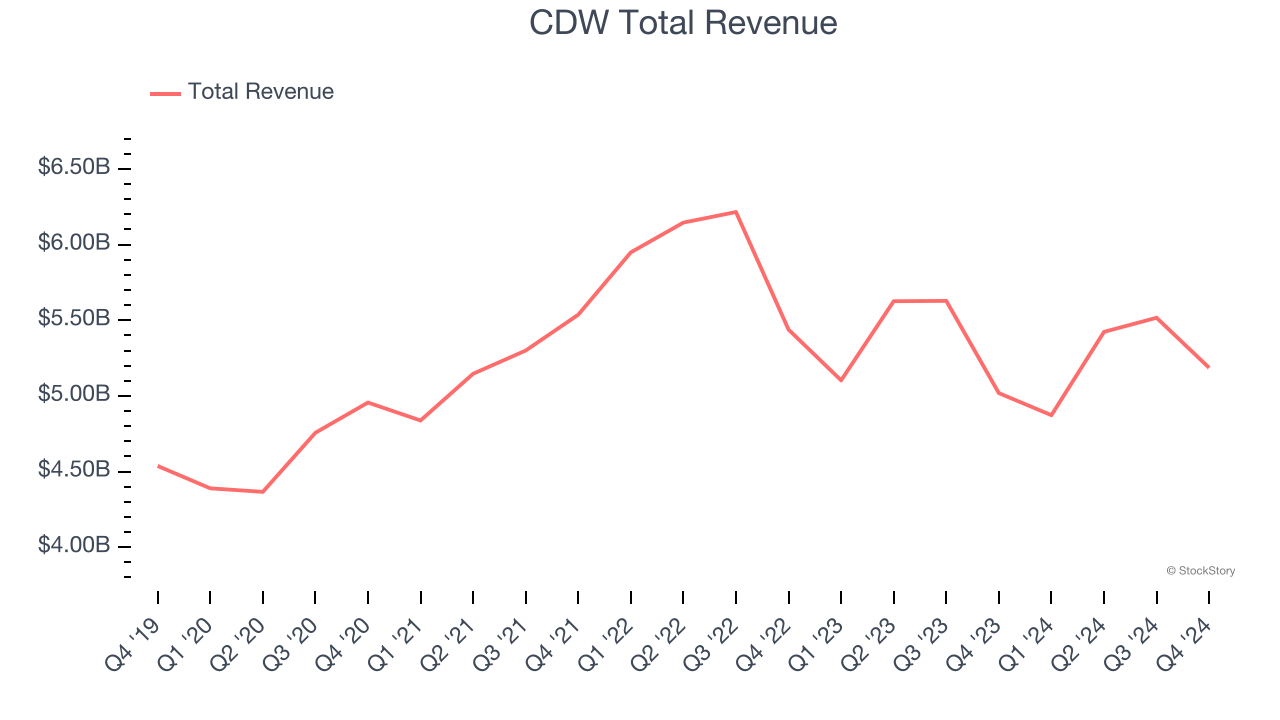

Best Q4: CDW (NASDAQ: CDW)

Serving as a crucial bridge between technology manufacturers and end users since 1984, CDW (NASDAQ: CDW) is a multi-brand provider of information technology solutions that helps businesses and public sector organizations select, implement, and manage hardware, software, and IT services.

CDW reported revenues of $5.19 billion, up 3.3% year on year, outperforming analysts’ expectations by 2.9%. The business had a very strong quarter with a solid beat of analysts’ EPS estimates.

CDW achieved the biggest analyst estimates beat among its peers. The stock is down 20% since reporting. It currently trades at $159.59.

Is now the time to buy CDW? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: ePlus (NASDAQ: PLUS)

Starting as a financing company in 1990 before evolving into a full-service technology provider, ePlus (NASDAQ: PLUS) provides comprehensive IT solutions, professional services, and financing options to help organizations optimize their technology infrastructure and supply chain processes.

ePlus reported revenues of $511 million, flat year on year, falling short of analysts’ expectations by 7.7%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

As expected, the stock is down 23.2% since the results and currently trades at $62.21.

Read our full analysis of ePlus’s results here.

Connection (NASDAQ: CNXN)

Starting as a small computer products seller in 1982 and evolving into a Fortune 1000 company, Connection (NASDAQ: CNXN) is a technology solutions provider that helps businesses and government agencies design, purchase, implement, and manage their IT infrastructure and systems.

Connection reported revenues of $708.9 million, up 1.8% year on year. This print came in 1% below analysts' expectations. Overall, it was a disappointing quarter as it also produced a significant miss of analysts’ EPS estimates.

The stock is down 13.5% since reporting and currently trades at $61.97.

Read our full, actionable report on Connection here, it’s free.

Avnet (NASDAQ: AVT)

With a century-long history of adapting to technological evolution, Avnet (NASDAQ: AVT) is a global electronic components distributor that connects manufacturers of semiconductors and other electronic parts with businesses that need these components.

Avnet reported revenues of $5.66 billion, down 8.7% year on year. This number topped analysts’ expectations by 1.6%. Aside from that, it was a decent quarter as it also recorded a solid beat of analysts’ EPS estimates.

The stock is down 3% since reporting and currently trades at $50.82.

Read our full, actionable report on Avnet here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.