As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at engineering and design services stocks, starting with AECOM (NYSE: ACM).

Companies providing engineering and design services boast ever-evolving technical expertise. Compared to their counterparts who manufacture and sell physical products, these companies can also pivot faster to more trending areas due to their smaller physical asset bases. Green energy and water conservation, for example, are current themes driving incremental demand in this space. On the other hand, those providing engineering and design services are at the whim of construction and infrastructure project volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates.

The 5 engineering and design services stocks we track reported a strong Q4. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.7% below.

In light of this news, share prices of the companies have held steady as they are up 3.7% on average since the latest earnings results.

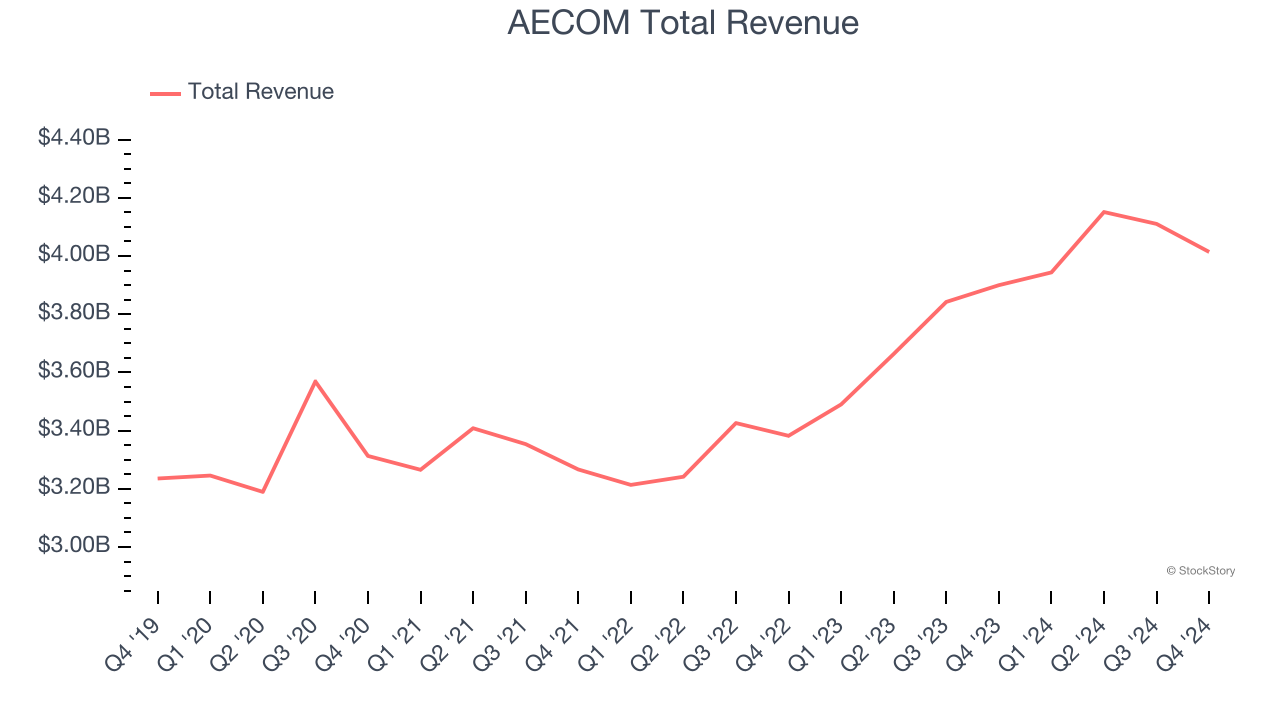

Weakest Q4: AECOM (NYSE: ACM)

Founded in 1990 when a group of engineers from five companies decided to merge, AECOM (NYSE: ACM) provides various infrastructure consulting services.

AECOM reported revenues of $4.01 billion, up 2.9% year on year. This print fell short of analysts’ expectations by 2.3%. Overall, it was a mixed quarter for the company with a solid beat of analysts’ EPS estimates but adjusted operating income in line with analysts’ estimates.

“Trends across our markets remain robust, and our backlog and pipeline are at record levels, characterized by a highly diverse mix of clients and sectors,” said Troy Rudd, AECOM’s chief executive officer.

Unsurprisingly, the stock is down 7% since reporting and currently trades at $96.64.

Read our full report on AECOM here, it’s free.

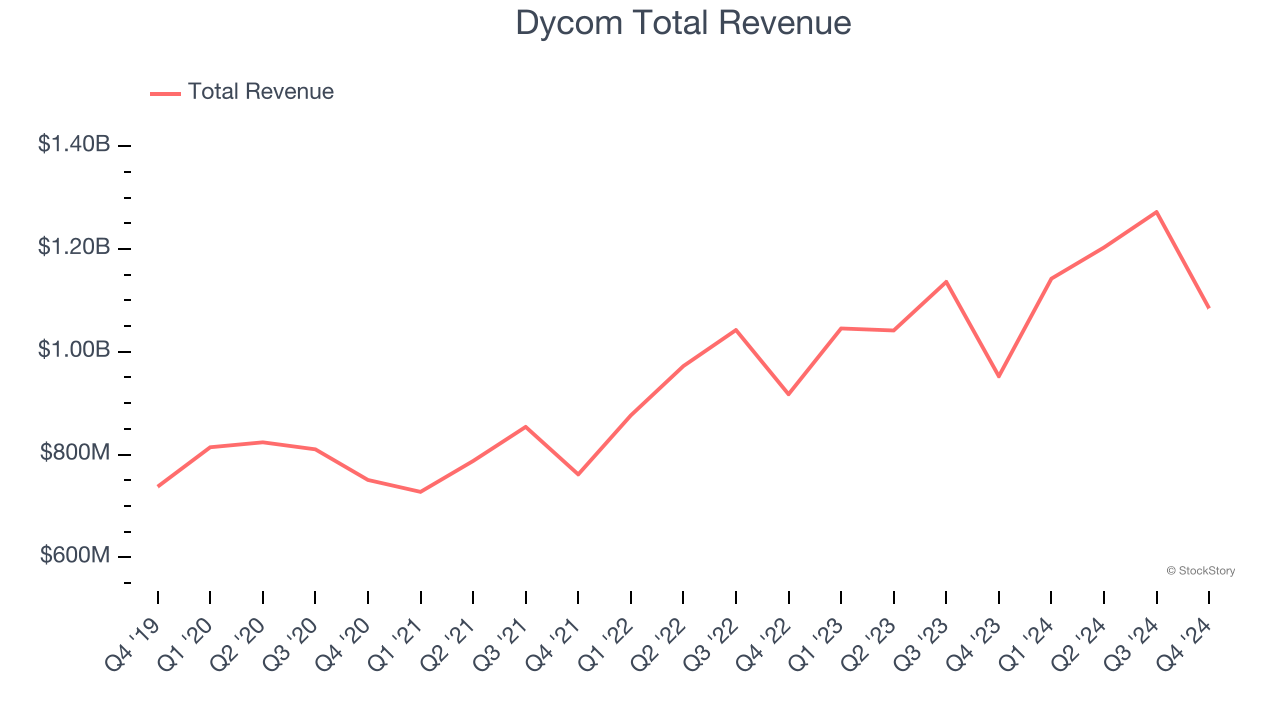

Best Q4: Dycom (NYSE: DY)

Working alongside some of the most popular mobile carriers in the world, Dycom (NYSE: DY) builds and maintains telecommunications infrastructure.

Dycom reported revenues of $1.08 billion, up 13.9% year on year, outperforming analysts’ expectations by 5.7%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

Dycom delivered the biggest analyst estimates beat and fastest revenue growth among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 4.3% since reporting. It currently trades at $164.21.

Is now the time to buy Dycom? Access our full analysis of the earnings results here, it’s free.

Sterling (NASDAQ: STRL)

Involved in the construction of a major highway, the Grand Parkway in Houston, TX, Sterling Infrastructure (NASDAQ: STRL) provides civil infrastructure construction.

Sterling reported revenues of $498.8 million, up 2.6% year on year, falling short of analysts’ expectations by 6.1%. Still, its results were good as it locked in full-year EBITDA guidance exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

Sterling delivered the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update in the group. Interestingly, the stock is up 30.1% since the results and currently trades at $151.29.

Read our full analysis of Sterling’s results here.

EMCOR (NYSE: EME)

Through its network of over 70 subsidiaries, EMCOR (NYSE: EME) provides electrical, mechanical, and building construction and services

EMCOR reported revenues of $3.77 billion, up 9.6% year on year. This number came in 0.6% below analysts' expectations. Aside from that, it was a very strong quarter as it logged an impressive beat of analysts’ EBITDA estimates.

EMCOR achieved the highest full-year guidance raise among its peers. The stock is up 2.9% since reporting and currently trades at $409.49.

Read our full, actionable report on EMCOR here, it’s free.

MasTec (NYSE: MTZ)

Involved in the 1996 Olympic Games MasTec (NYSE: MTZ) is an infrastructure construction company that specializes in the telecommunications, energy, and utility industries.

MasTec reported revenues of $3.40 billion, up 3.8% year on year. This print topped analysts’ expectations by 2.4%. Overall, it was a strong quarter as it also put up a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ EPS estimates.

The stock is down 3% since reporting and currently trades at $123.01.

Read our full, actionable report on MasTec here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.