CooperCompanies’s stock price has taken a beating over the past six months, shedding 24.6% of its value and falling to $80.68 per share. This was partly driven by its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in CooperCompanies, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Despite the more favorable entry price, we're cautious about CooperCompanies. Here are two reasons why you should be careful with COO and a stock we'd rather own.

Why Is CooperCompanies Not Exciting?

With a history dating back to 1958 and a portfolio spanning two distinct healthcare segments, Cooper Companies (NASDAQ: COO) develops and manufactures medical devices focused on vision care through contact lenses and women's health including fertility products and services.

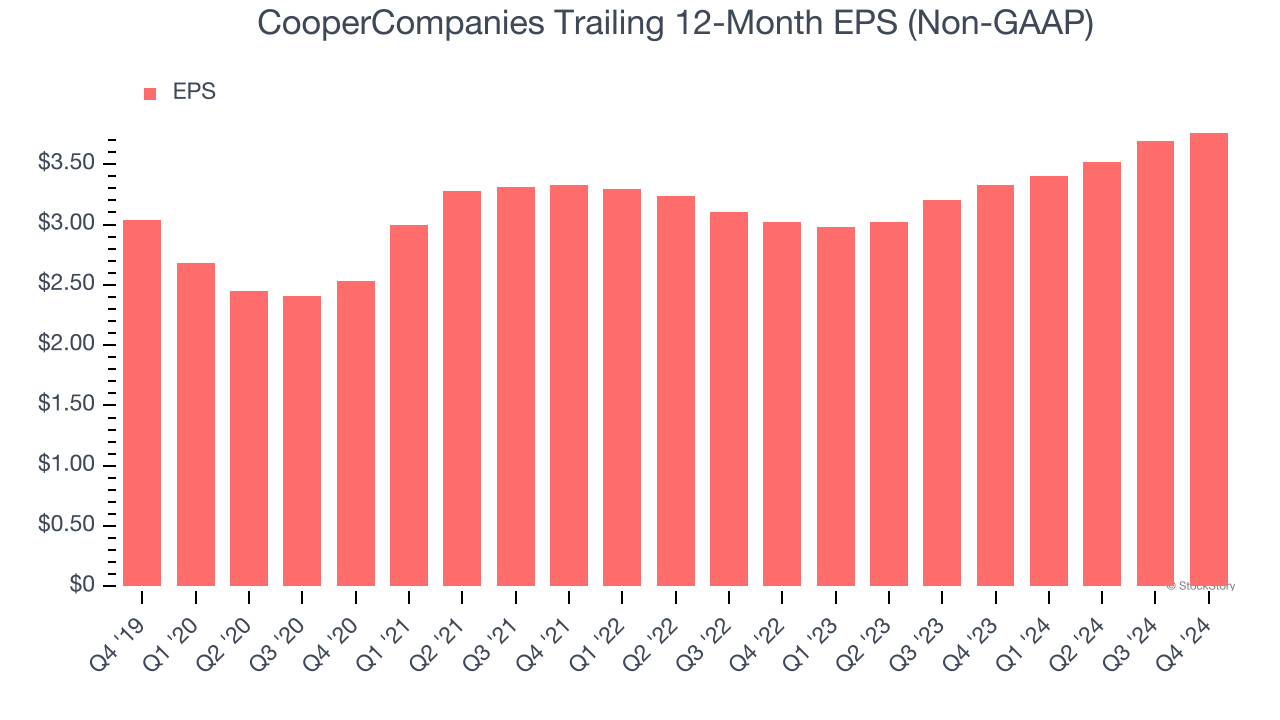

1. EPS Barely Growing

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

CooperCompanies’s EPS grew at an unimpressive 4.4% compounded annual growth rate over the last five years, lower than its 8% annualized revenue growth. This tells us the company became less profitable on a per-share basis as it expanded.

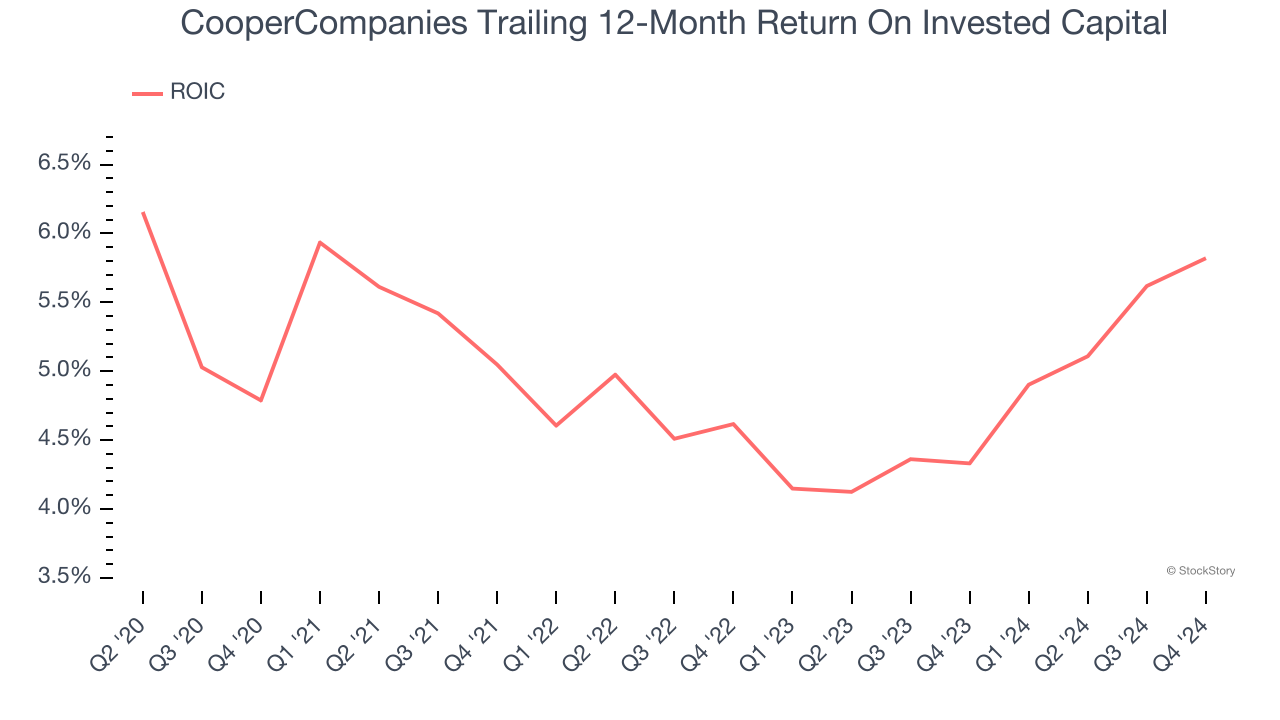

2. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

CooperCompanies historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 4.9%, lower than the typical cost of capital (how much it costs to raise money) for healthcare companies.

Final Judgment

CooperCompanies isn’t a terrible business, but it doesn’t pass our bar. Following the recent decline, the stock trades at 19.9× forward price-to-earnings (or $80.68 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Like More Than CooperCompanies

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.