While the broader market has struggled with the S&P 500 down 6.9% since October 2024, IMAX has surged ahead as its stock price has climbed by 32.2% to $25.80 per share. This run-up might have investors contemplating their next move.

Is now the time to buy IMAX, or should you be careful about including it in your portfolio? See what our analysts have to say in our full research report, it’s free.

We’re happy investors have made money, but we don't have much confidence in IMAX. Here are three reasons why you should be careful with IMAX and a stock we'd rather own.

Why Is IMAX Not Exciting?

Originally developed for World Expo '67 in Montreal as an innovative projection system, IMAX (NYSE: IMAX) provides proprietary large-format cinema technology and systems that deliver immersive movie experiences with enhanced image quality and sound.

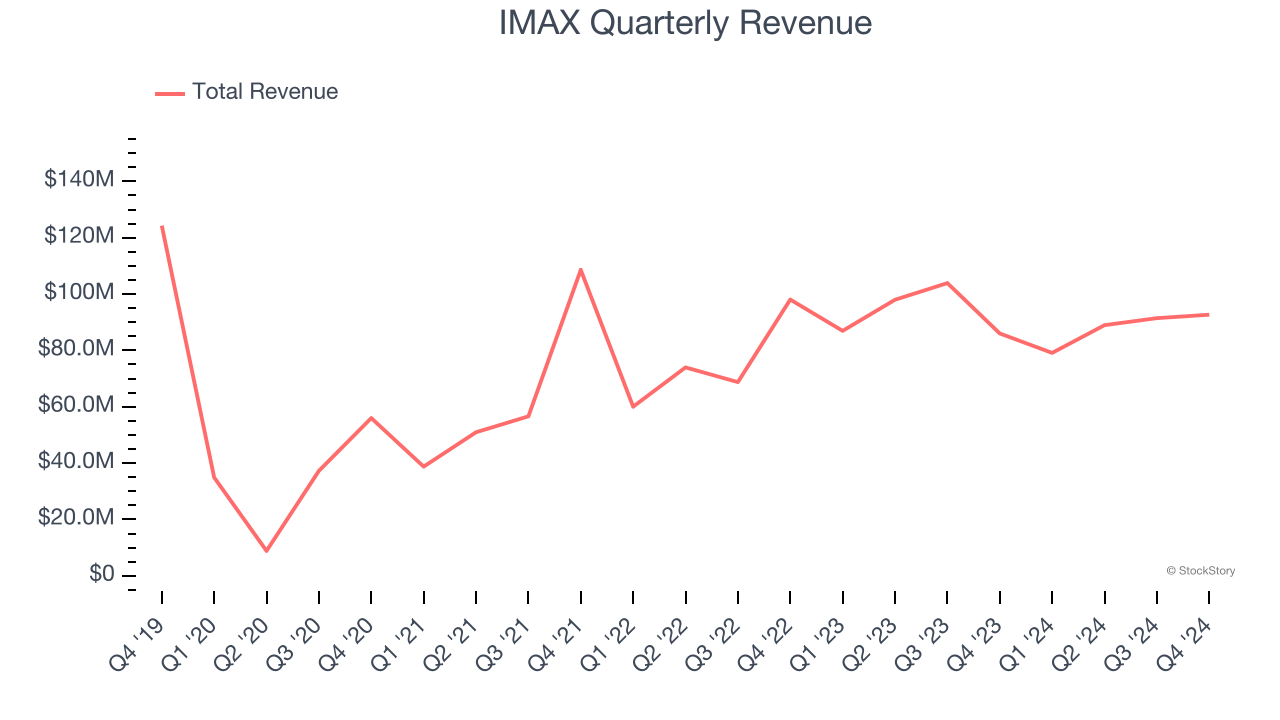

1. Revenue Spiraling Downwards

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. IMAX struggled to consistently generate demand over the last five years as its sales dropped at a 2.3% annual rate. This was below our standards and signals it’s a lower quality business.

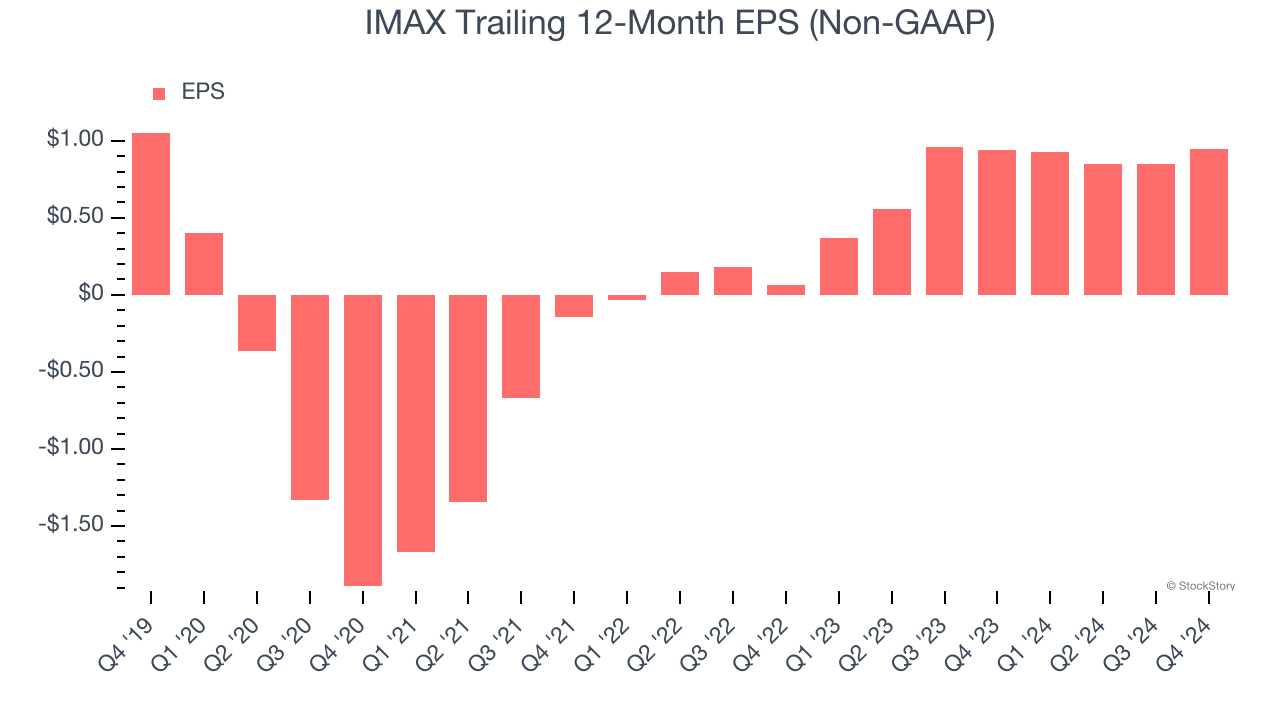

2. EPS Trending Down

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Sadly for IMAX, its EPS and revenue declined by 2.2% and 2.3% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. If the tide turns unexpectedly, IMAX’s low margin of safety could leave its stock price susceptible to large downswings.

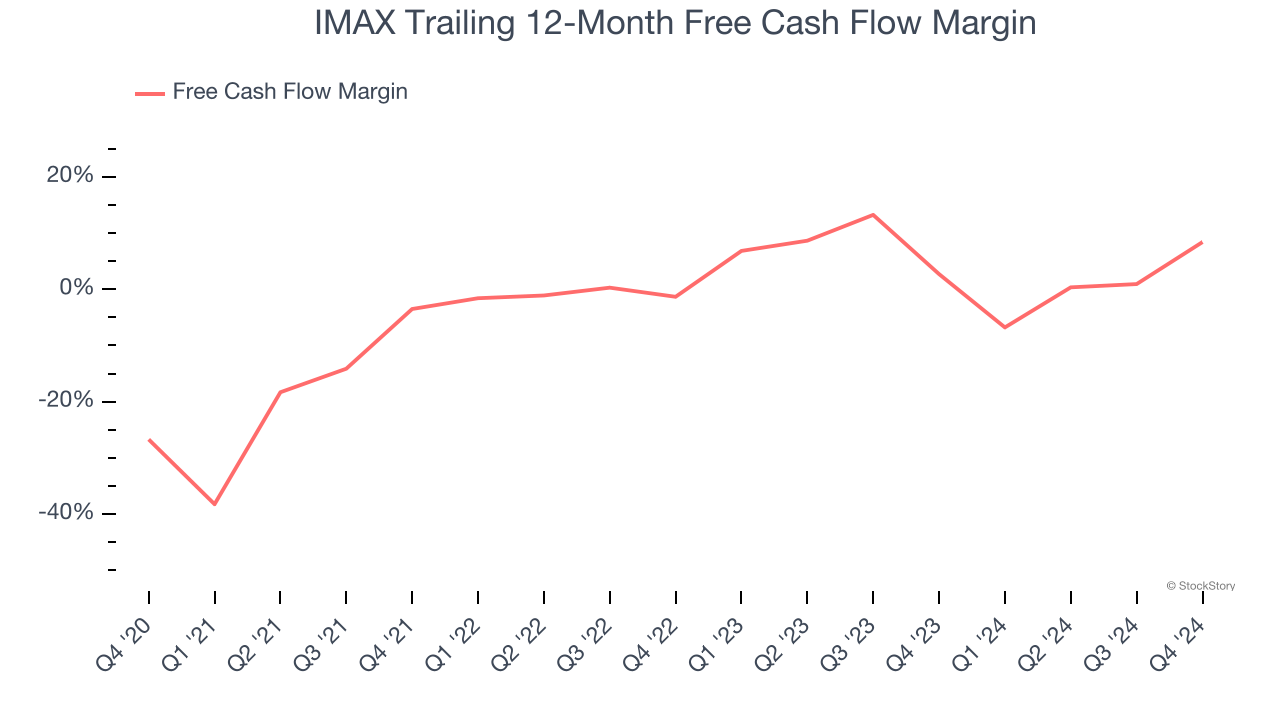

3. Breakeven Free Cash Flow Limits Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

IMAX broke even from a free cash flow perspective over the last five years, giving the company limited opportunities to return capital to shareholders.

Final Judgment

IMAX’s business quality ultimately falls short of our standards. With its shares topping the market in recent months, the stock trades at 19.2× forward price-to-earnings (or $25.80 per share). Investors with a higher risk tolerance might like the company, but we don’t really see a big opportunity at the moment. We're fairly confident there are better investments elsewhere. Let us point you toward a top digital advertising platform riding the creator economy.

Stocks We Would Buy Instead of IMAX

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.