Cloud communications infrastructure company Twilio (NYSE: TWLO) beat Wall Street’s revenue expectations in Q1 CY2025, with sales up 12% year on year to $1.17 billion. Guidance for next quarter’s revenue was better than expected at $1.19 billion at the midpoint, 1.3% above analysts’ estimates. Its non-GAAP profit of $1.14 per share was 18.5% above analysts’ consensus estimates.

Is now the time to buy Twilio? Find out by accessing our full research report, it’s free.

Twilio (TWLO) Q1 CY2025 Highlights:

- Revenue: $1.17 billion vs analyst estimates of $1.14 billion (12% year-on-year growth, 2.8% beat)

- Adjusted EPS: $1.14 vs analyst estimates of $0.96 (18.5% beat)

- Adjusted Operating Income: $213.4 million vs analyst estimates of $188.5 million (18.2% margin, 13.2% beat)

- Revenue Guidance for Q2 CY2025 is $1.19 billion at the midpoint, above analyst estimates of $1.17 billion

- Adjusted EPS guidance for Q2 CY2025 is $1.02 at the midpoint, below analyst estimates of $1.04

- Operating Margin: 2%, up from -4.2% in the same quarter last year

- Free Cash Flow Margin: 15.2%, up from 7.8% in the previous quarter

- Customers: 335,000, up from 325,000 in the previous quarter

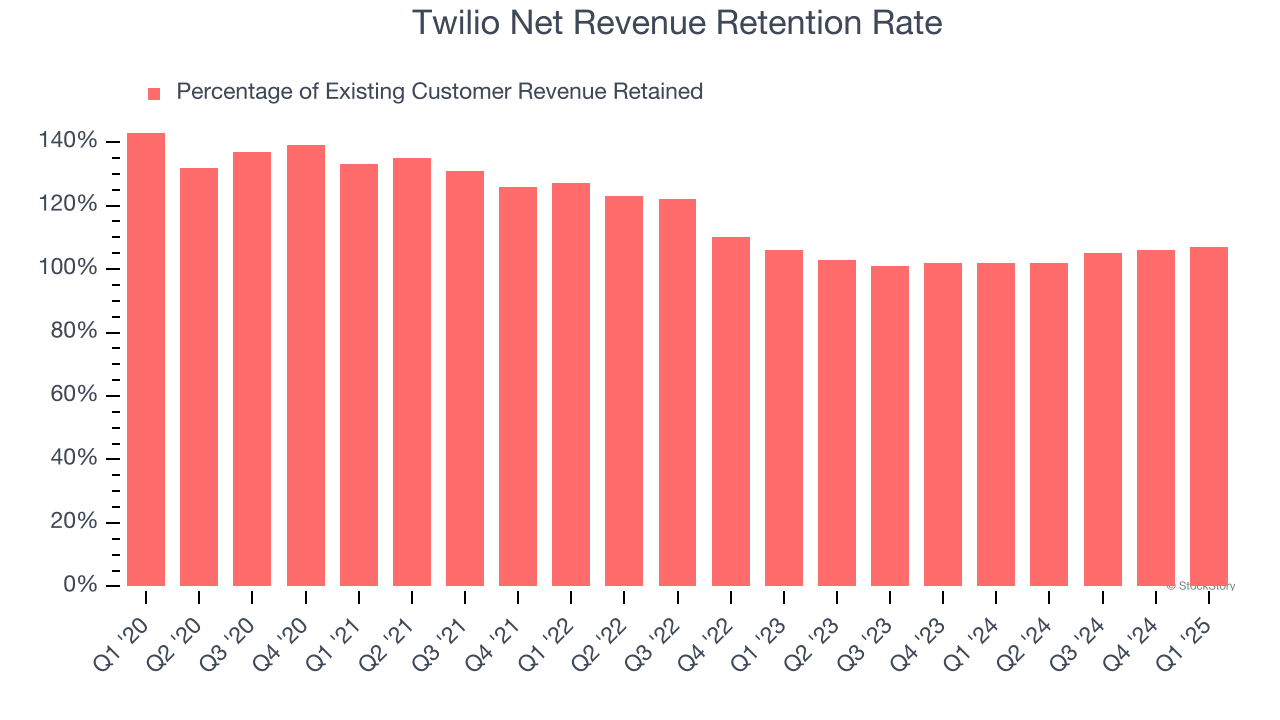

- Net Revenue Retention Rate: 107%, up from 106% in the previous quarter

- Market Capitalization: $14.77 billion

“Twilio saw another quarter of revenue growth acceleration and double-digit growth, illustrating that our commitment to operating with more discipline, rigor, and focus is paying off," said Khozema Shipchandler, CEO of Twilio.

Company Overview

Founded in 2008 by Jeff Lawson, a former engineer at Amazon, Twilio (NYSE: TWLO) is a software as a service platform that makes it really easy for software developers to use text messaging, voice calls and other forms of communication in their apps.

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Twilio grew its sales at a 13.6% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, Twilio reported year-on-year revenue growth of 12%, and its $1.17 billion of revenue exceeded Wall Street’s estimates by 2.8%. Company management is currently guiding for a 9.5% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.8% over the next 12 months, a deceleration versus the last three years. This projection is underwhelming and indicates its products and services will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Customer Retention

One of the best parts about the software-as-a-service business model (and a reason why they trade at high valuation multiples) is that customers typically spend more on a company’s products and services over time.

Twilio’s net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 105% in Q1. This means Twilio would’ve grown its revenue by 5% even if it didn’t win any new customers over the last 12 months.

Trending up over the last year, Twilio has an adequate net retention rate, showing us that it generally keeps customers but lags behind the best SaaS businesses, which routinely post net retention rates of 120%+.

Key Takeaways from Twilio’s Q1 Results

We were impressed by Twilio’s strong growth in customers this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its EPS guidance for next quarter missed. Overall, this print had some key positives. The stock traded up 11.5% to $109.15 immediately following the results.

Is Twilio an attractive investment opportunity right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.