As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at ground transportation stocks, starting with Schneider (NYSE: SNDR).

The growth of e-commerce and global trade continues to drive demand for shipping services, especially last-mile delivery, presenting opportunities for ground transportation companies. The industry continues to invest in data, analytics, and autonomous fleets to optimize efficiency and find the most cost-effective routes. Despite the essential services this industry provides, ground transportation companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 15 ground transportation stocks we track reported a slower Q1. As a group, revenues missed analysts’ consensus estimates by 2.8%.

Thankfully, share prices of the companies have been resilient as they are up 9.4% on average since the latest earnings results.

Best Q1: Schneider (NYSE: SNDR)

Employing thousands of drivers across the country to make deliveries, Schneider (NYSE: SNDR) makes full truckload and intermodal deliveries regionally and across borders.

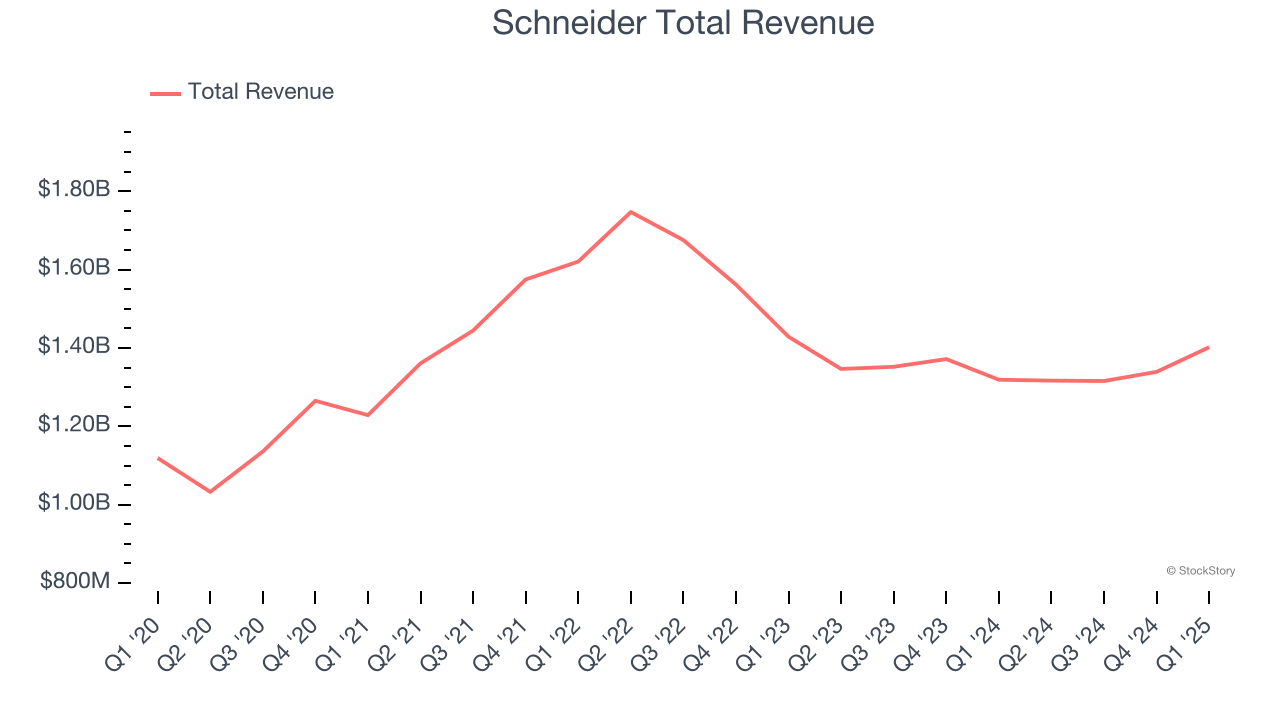

Schneider reported revenues of $1.40 billion, up 6.3% year on year. This print was in line with analysts’ expectations, and overall, it was a strong quarter for the company with an impressive beat of analysts’ adjusted operating income estimates.

“We delivered results for the quarter in line with our expectations while navigating the fluid operating environment,” said Mark Rourke, President and Chief Executive Officer of Schneider.

Interestingly, the stock is up 13.6% since reporting and currently trades at $24.40.

Is now the time to buy Schneider? Access our full analysis of the earnings results here, it’s free.

Ryder (NYSE: R)

As one of the first companies to introduce the idea of leasing trucks, Ryder (NYSE: R) provides rental vehicles to businesses and delivers packages directly to homes or businesses.

Ryder reported revenues of $3.13 billion, up 1.1% year on year, in line with analysts’ expectations. The business had a strong quarter with a solid beat of analysts’ adjusted operating income estimates and full-year EPS guidance beating analysts’ expectations.

The market seems happy with the results as the stock is up 14.8% since reporting. It currently trades at $158.32.

Is now the time to buy Ryder? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Heartland Express (NASDAQ: HTLD)

Founded by the son of a trucker, Heartland Express (NASDAQ: HTLD) offers full-truckload deliveries across the United States and Mexico.

Heartland Express reported revenues of $219.4 million, down 18.8% year on year, falling short of analysts’ expectations by 9%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EBITDA estimates.

Interestingly, the stock is up 17.3% since the results and currently trades at $9.20.

Read our full analysis of Heartland Express’s results here.

ArcBest (NASDAQ: ARCB)

Historically owning furniture, banking, and other subsidiaries, ArcBest (NASDAQ: ARCB) offers full-truckload, less-than-truckload, and intermodal deliveries of freight.

ArcBest reported revenues of $967.1 million, down 6.7% year on year. This result lagged analysts' expectations by 2.7%. More broadly, it was a mixed quarter as it also recorded a solid beat of analysts’ adjusted operating income estimates.

The stock is up 12.6% since reporting and currently trades at $66.55.

Read our full, actionable report on ArcBest here, it’s free.

Hertz (NASDAQ: HTZ)

Started with a dozen Model T Fords, Hertz (NASDAQ: HTZ) is a global car rental company providing vehicle rental services to leisure and business travelers.

Hertz reported revenues of $1.81 billion, down 12.8% year on year. This number came in 10.5% below analysts' expectations. Overall, it was a softer quarter as it also logged a significant miss of analysts’ adjusted operating income and EPS estimates.

Hertz had the weakest performance against analyst estimates among its peers. The stock is down 6.7% since reporting and currently trades at $6.50.

Read our full, actionable report on Hertz here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.