Construction Partners currently trades at $88 and has been a dream stock for shareholders. It’s returned 420% since May 2020, blowing past the S&P 500’s 96.9% gain. The company has also beaten the index over the past six months as its stock price is up 12.7% thanks to its solid quarterly results.

Following the strength, is ROAD a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Does ROAD Stock Spark Debate?

Founded in 2001, Construction Partners (NASDAQ: ROAD) is a civil infrastructure company that builds and maintains roads, highways, and other infrastructure projects.

Two Positive Attributes:

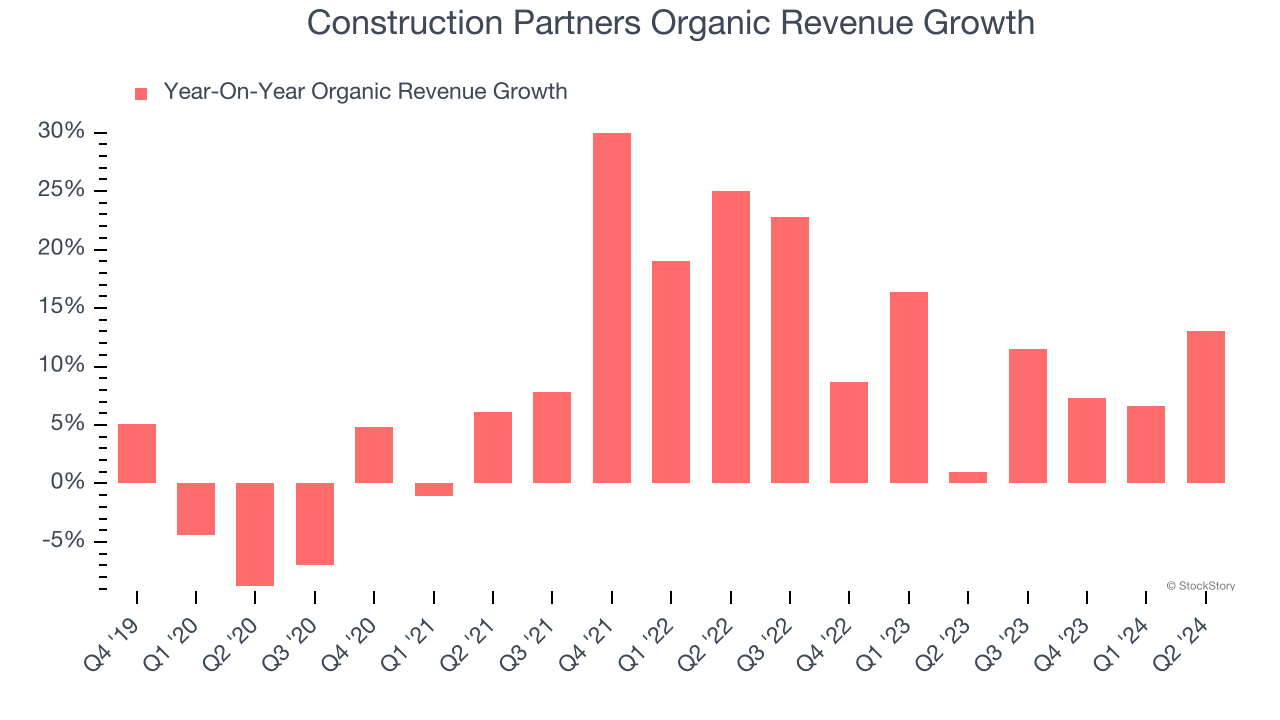

1. Organic Growth Indicates Solid Core Business

We can better understand Construction and Maintenance Services companies by analyzing their organic revenue. This metric gives visibility into Construction Partners’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, Construction Partners’s organic revenue averaged 9.3% year-on-year growth. This performance was solid and shows it can expand steadily without relying on expensive (and risky) acquisitions.

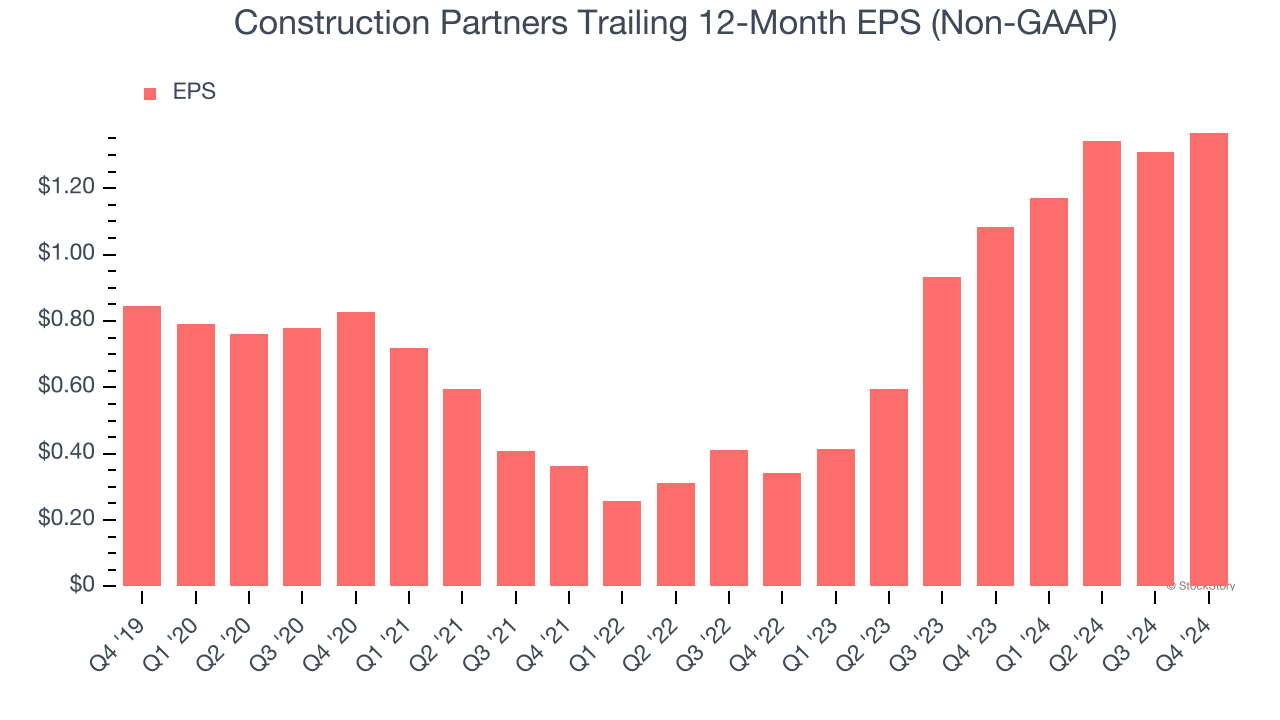

2. EPS Increasing Steadily

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Construction Partners’s EPS grew at a solid 10.1% compounded annual growth rate over the last five years. This performance was better than most industrials businesses.

One Reason to be Careful:

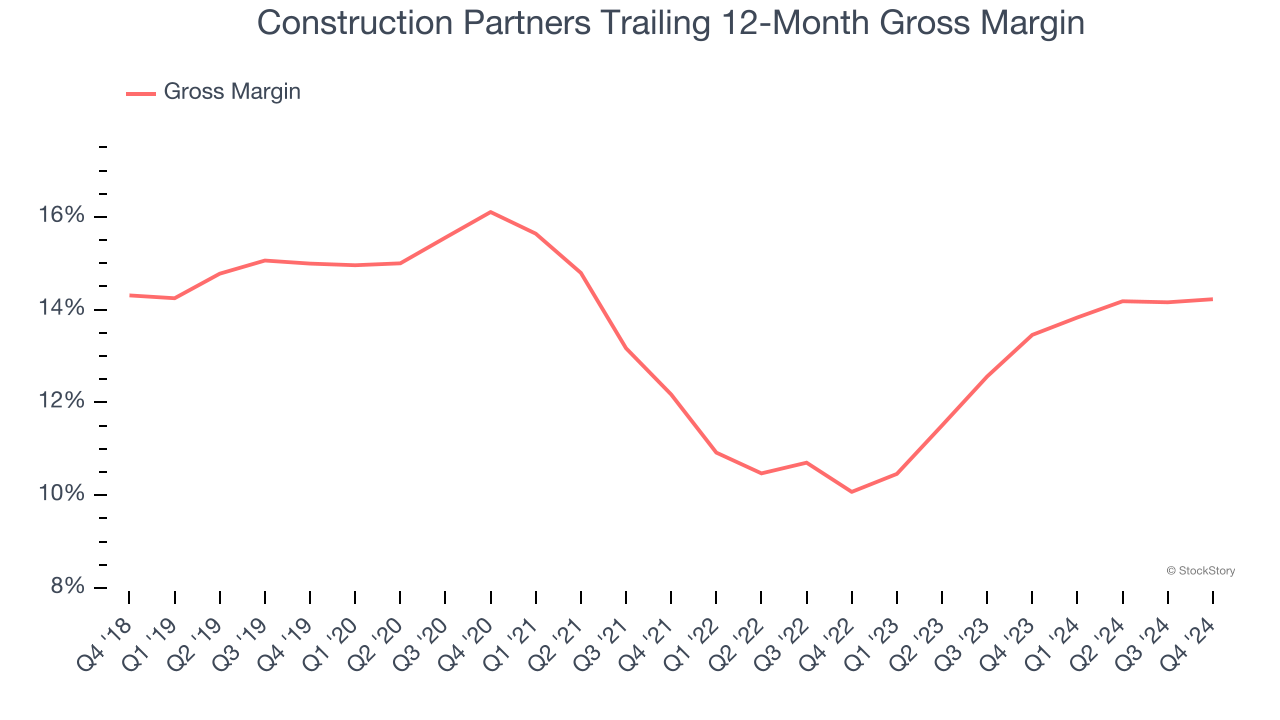

Low Gross Margin Reveals Weak Structural Profitability

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Construction Partners has bad unit economics for an industrials business, signaling it operates in a competitive market. As you can see below, it averaged a 13.1% gross margin over the last five years. Said differently, Construction Partners had to pay a chunky $86.87 to its suppliers for every $100 in revenue.

Final Judgment

Construction Partners has huge potential even though it has some open questions, and with its shares topping the market in recent months, the stock trades at 42.1× forward P/E (or $88 per share). Is now the time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks That Overcame Trump’s 2018 Tariffs

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today.