Wrapping up Q1 earnings, we look at the numbers and key takeaways for the gig economy stocks, including DoorDash (NASDAQ: DASH) and its peers.

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech-enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

The 6 gig economy stocks we track reported a mixed Q1. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.6% below.

Luckily, gig economy stocks have performed well with share prices up 18.7% on average since the latest earnings results.

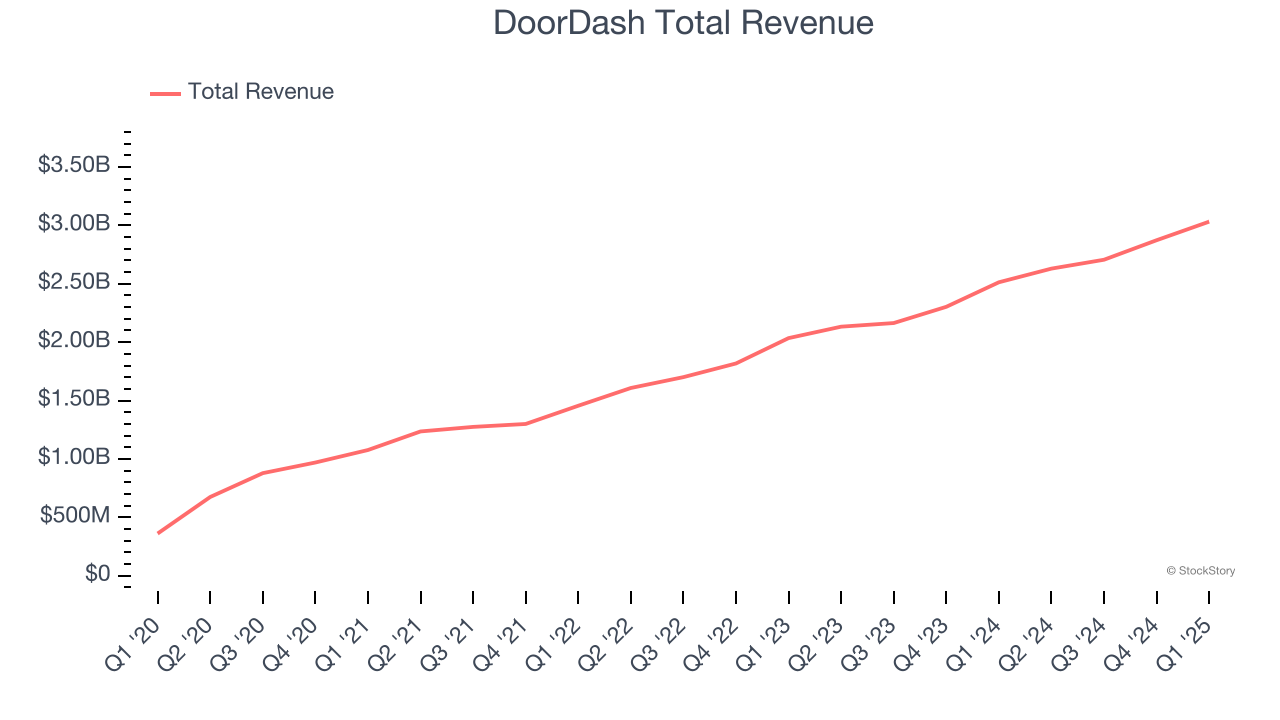

Weakest Q1: DoorDash (NASDAQ: DASH)

Founded by Stanford students with the intent to build “the local, on-demand FedEx", DoorDash (NYSE: DASH) operates an on-demand food delivery platform.

DoorDash reported revenues of $3.03 billion, up 20.7% year on year. This print fell short of analysts’ expectations by 2.1%. Overall, it was a slower quarter for the company with EBITDA guidance for next quarter missing analysts’ expectations and number of orders in line with analysts’ estimates.

DoorDash scored the fastest revenue growth but had the weakest performance against analyst estimates of the whole group. The company reported 732 million service requests, up 18.1% year on year. Still, the market seems discontent with the results. The stock is down 42.2% since reporting and currently trades at $201.08.

Is now the time to buy DoorDash? Access our full analysis of the earnings results here, it’s free.

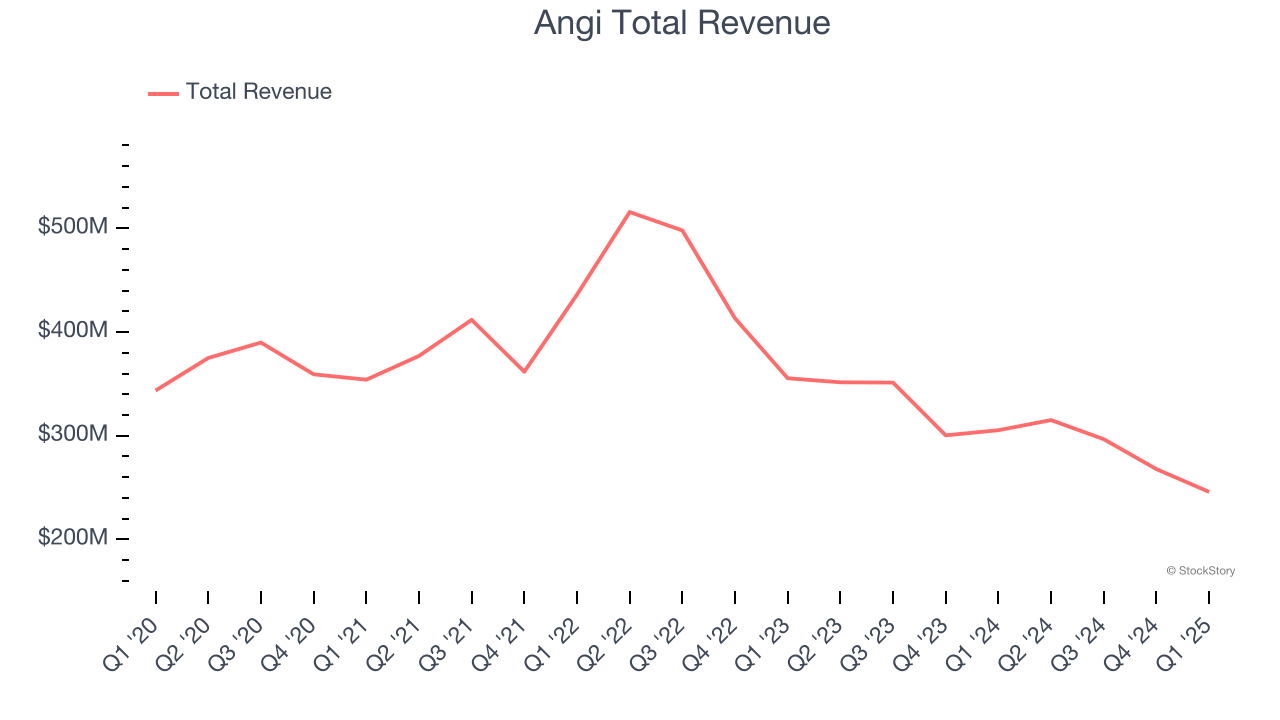

Best Q1: Angi (NASDAQ: ANGI)

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Angi reported revenues of $245.9 million, down 19.5% year on year, outperforming analysts’ expectations by 2.7%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ number of service requests estimates.

Angi pulled off the biggest analyst estimates beat among its peers. On a dimmer note, the company reported 3.36 million service requests, down 18.5% year on year. The market seems happy with the results as the stock is up 42.2% since reporting. It currently trades at $16.

Is now the time to buy Angi? Access our full analysis of the earnings results here, it’s free.

Fiverr (NYSE: FVRR)

Based in Tel Aviv, Fiverr (NYSE: FVRR) operates a fixed price global freelance marketplace for digital services.

Fiverr reported revenues of $107.2 million, up 14.6% year on year, exceeding analysts’ expectations by 1%. Still, it was a slower quarter as it posted a decline in its buyers.

Interestingly, the stock is up 20.9% since the results and currently trades at $32.36.

Read our full analysis of Fiverr’s results here.

Upwork (NASDAQ: UPWK)

Formed through the 2013 merger of Elance and oDesk, Upwork (NASDAQ: UPWK) is an online platform where businesses and independent professionals connect to get work done.

Upwork reported revenues of $192.7 million, flat year on year. This result surpassed analysts’ expectations by 2.2%. Zooming out, it was a mixed quarter as it also logged an impressive beat of analysts’ EBITDA estimates but a decline in its customers.

Upwork had the weakest full-year guidance update among its peers. The company reported 812,000 active customers, down 6.9% year on year. The stock is up 25.5% since reporting and currently trades at $16.71.

Read our full, actionable report on Upwork here, it’s free.

Lyft (NASDAQ: LYFT)

Founded by Logan Green and John Zimmer as a long-distance intercity carpooling company Zimride, Lyft (NASDAQ: LYFT) operates a ridesharing network in the US and Canada.

Lyft reported revenues of $1.45 billion, up 13.5% year on year. This print missed analysts’ expectations by 1.3%. Overall, it was a mixed quarter for the company.

The company reported 24.2 million users, up 10.5% year on year. The stock is up 23% since reporting and currently trades at $16.01.

Read our full, actionable report on Lyft here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.