The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how consumer internet stocks fared in Q1, starting with Robinhood (NASDAQ: HOOD).

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 49 consumer internet stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.9% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 10% on average since the latest earnings results.

Robinhood (NASDAQ: HOOD)

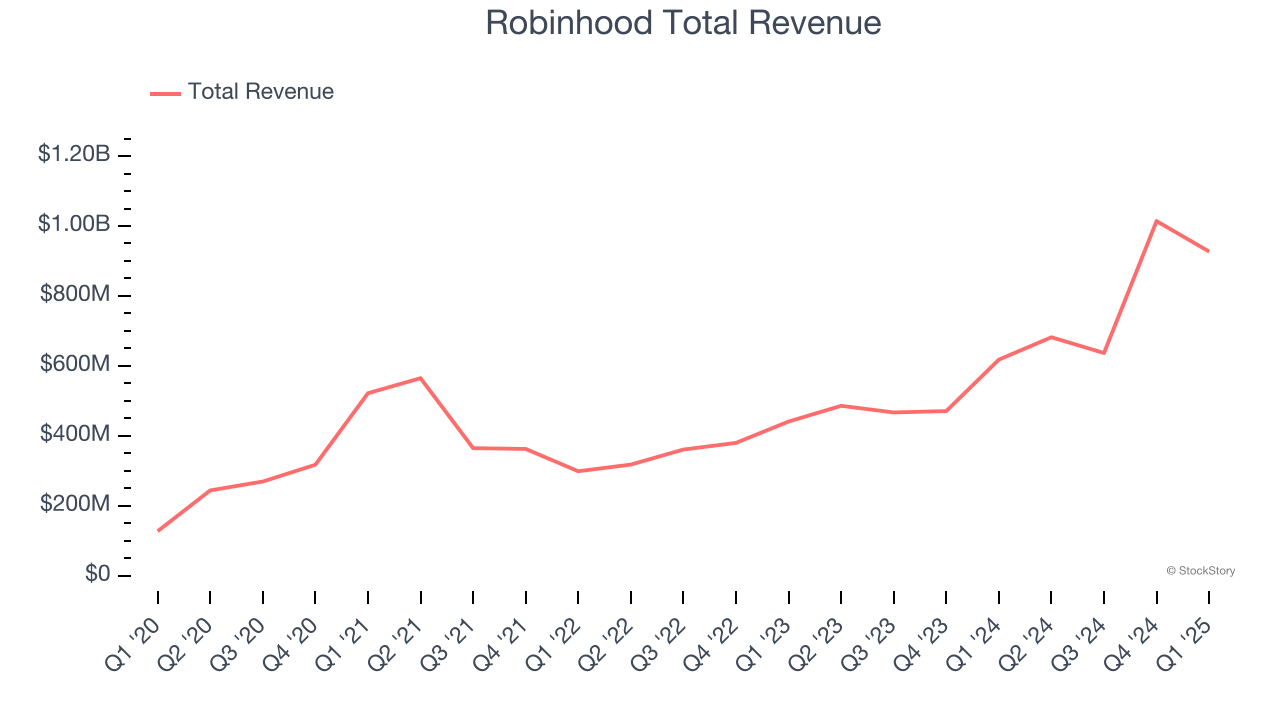

With a mission to democratize finance, Robinhood (NASDAQ: HOOD) is an online consumer finance platform known for its commission-free stock and crypto trading.

Robinhood reported revenues of $927 million, up 50% year on year. This print exceeded analysts’ expectations by 1.2%. Despite the top-line beat, it was still a slower quarter for the company with a miss of analysts’ EBITDA estimates.

“This quarter, we significantly accelerated product innovation across our key initiatives, highlighted by the announcement of Robinhood Strategies, Banking, and Cortex,” said Vlad Tenev, Chair and CEO of Robinhood.

The stock is up 31.7% since reporting and currently trades at $64.76.

Is now the time to buy Robinhood? Access our full analysis of the earnings results here, it’s free.

Best Q1: Carvana (NYSE: CVNA)

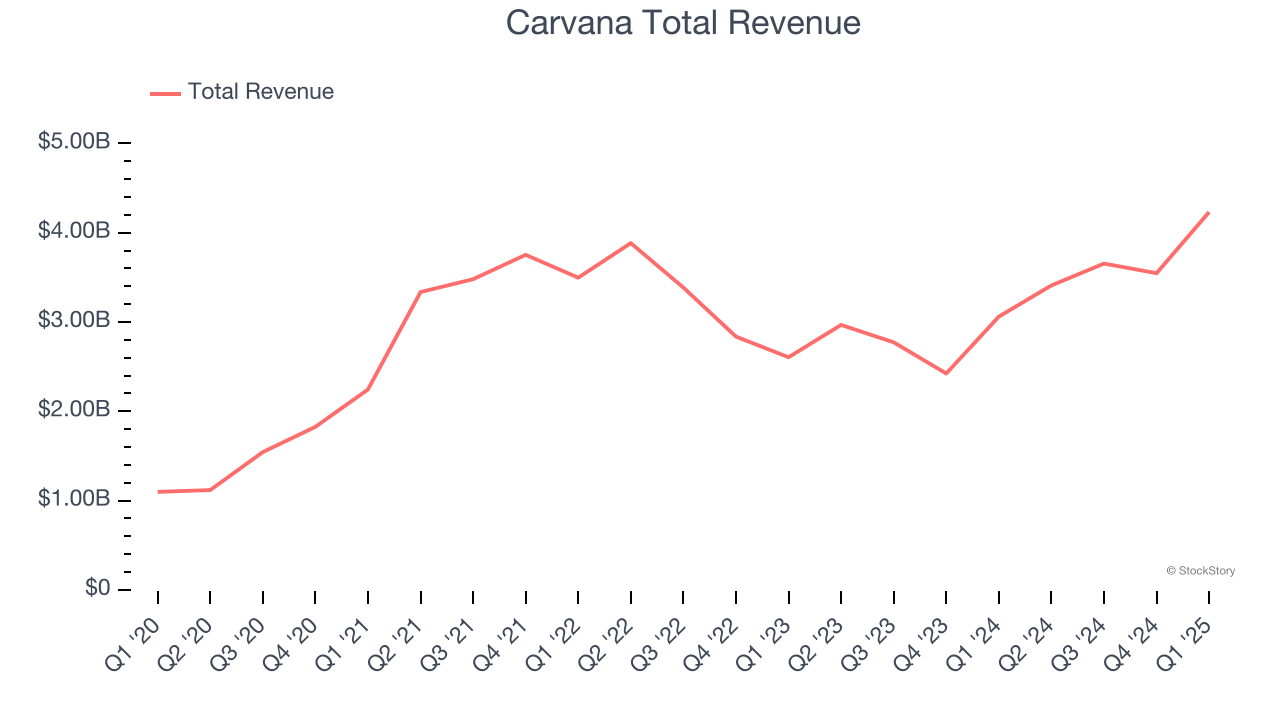

Known for its glass tower car vending machines, Carvana (NYSE: CVNA) provides a convenient automotive shopping experience by offering an online platform for buying and selling used cars.

Carvana reported revenues of $4.23 billion, up 38.3% year on year, outperforming analysts’ expectations by 6.2%. The business had an exceptional quarter with a solid beat of analysts’ EBITDA estimates and impressive growth in its units.

The market seems happy with the results as the stock is up 16.6% since reporting. It currently trades at $301.51.

Is now the time to buy Carvana? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: The RealReal (NASDAQ: REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $160 million, up 11.3% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

As expected, the stock is down 30.4% since the results and currently trades at $5.08.

Read our full analysis of The RealReal’s results here.

Amazon (NASDAQ: AMZN)

Founded by Jeff Bezos after quitting his stock-picking job at D.E. Shaw, Amazon (NASDAQ: AMZN) is the world’s largest online retailer and provider of cloud computing services.

Amazon reported revenues of $155.7 billion, up 8.6% year on year. This number met analysts’ expectations. More broadly, it was a mixed quarter as it also recorded a solid beat of analysts’ EPS estimates but operating income guidance for next quarter missing analysts’ expectations.

The stock is up 6.8% since reporting and currently trades at $202.80.

Read our full, actionable report on Amazon here, it’s free.

Fiverr (NYSE: FVRR)

Based in Tel Aviv, Fiverr (NYSE: FVRR) operates a fixed price global freelance marketplace for digital services.

Fiverr reported revenues of $107.2 million, up 14.6% year on year. This result topped analysts’ expectations by 1%. More broadly, it was a slower quarter as it logged a decline in its buyers.

The company reported 3.54 million active buyers, down 11.6% year on year. The stock is up 20.9% since reporting and currently trades at $32.36.

Read our full, actionable report on Fiverr here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.