Looking back on specialty equipment distributors stocks’ Q1 earnings, we examine this quarter’s best and worst performers, including SiteOne (NYSE: SITE) and its peers.

Historically, specialty equipment distributors have boasted deep selection and expertise in sometimes narrow areas like single-use packaging or unique lighting equipment. Additionally, the industry has evolved to include more automated industrial equipment and machinery over the last decade, driving efficiencies and enabling valuable data collection. Specialty equipment distributors whose offerings keep up with these trends can take share in a still-fragmented market, but like the broader industrials sector, this space is at the whim of economic cycles that impact the capital spending and manufacturing propelling industry volumes.

The 9 specialty equipment distributors stocks we track reported a satisfactory Q1. As a group, revenues missed analysts’ consensus estimates by 0.8% while next quarter’s revenue guidance was in line.

Thankfully, share prices of the companies have been resilient as they are up 6.5% on average since the latest earnings results.

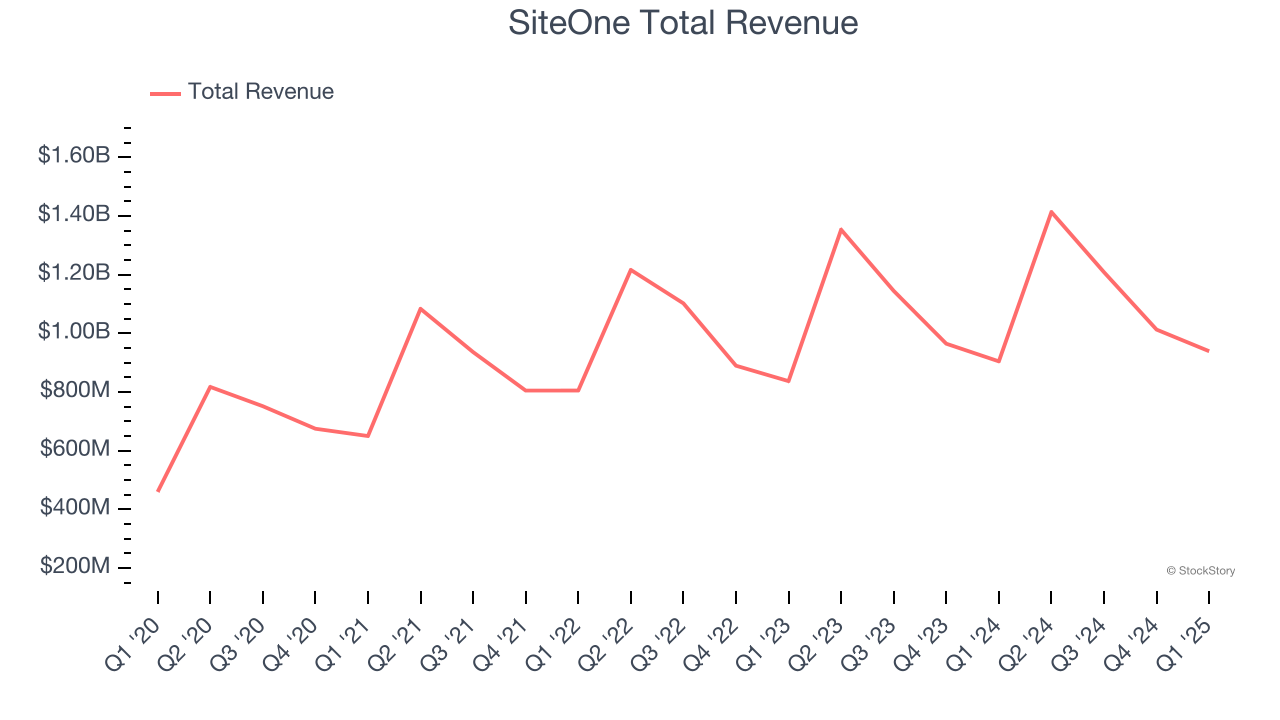

SiteOne (NYSE: SITE)

Known for distributing John Deere tractors and LESCO turf care products, SiteOne Landscape Supply (NYSE: SITE) provides landscaping products and services to professionals, including irrigation, lighting, and nursery supplies.

SiteOne reported revenues of $939.4 million, up 3.8% year on year. This print exceeded analysts’ expectations by 0.6%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ EBITDA estimates.

“We are pleased to report a solid start to 2025, with total sales growth of 4% and Adjusted EBITDA growth of 6%. We were particularly pleased to achieve good SG&A leverage in our base business on an adjusted basis despite the Organic Daily Sales decline,” said Doug Black, SiteOne’s Chairman and CEO.

The stock is up 1.5% since reporting and currently trades at $115.79.

Is now the time to buy SiteOne? Access our full analysis of the earnings results here, it’s free.

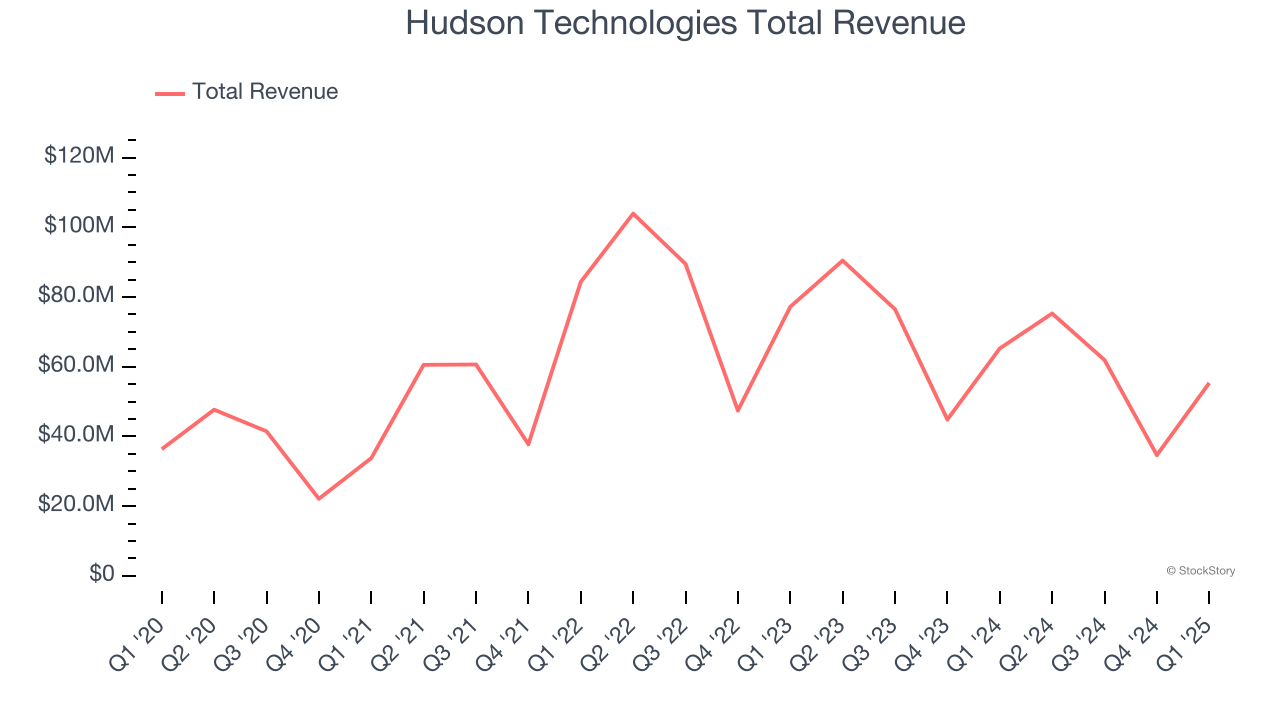

Best Q1: Hudson Technologies (NASDAQ: HDSN)

Founded in 1991, Hudson Technologies (NASDAQ: HDSN) specializes in refrigerant services and solutions, providing refrigerant sales, reclamation, and recycling.

Hudson Technologies reported revenues of $55.34 million, down 15.2% year on year, outperforming analysts’ expectations by 6%. The business had an incredible quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Hudson Technologies pulled off the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 3.6% since reporting. It currently trades at $6.95.

Is now the time to buy Hudson Technologies? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: H&E Equipment Services (NASDAQ: HEES)

Founded after recognizing a growth trend along the Mississippi River and opportunities developing in the earthmoving and construction equipment business, H&E (NASDAQ: HEES) offers machinery for companies to purchase or rent.

H&E Equipment Services reported revenues of $319.5 million, down 14% year on year, falling short of analysts’ expectations by 11.9%. It was a disappointing quarter as it posted a significant miss of analysts’ EBITDA and EPS estimates.

H&E Equipment Services delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 4.8% since the results and currently trades at $94.64.

Read our full analysis of H&E Equipment Services’s results here.

Alta (NYSE: ALTG)

Founded in 1984, Alta Equipment Group (NYSE: ALTG) is a provider of industrial and construction equipment and services across the Midwest and Northeast United States.

Alta reported revenues of $423 million, down 4.2% year on year. This result missed analysts’ expectations by 2.3%. Zooming out, it was a satisfactory quarter as it also logged an impressive beat of analysts’ EBITDA estimates.

The stock is up 4.9% since reporting and currently trades at $4.75.

Read our full, actionable report on Alta here, it’s free.

Richardson Electronics (NASDAQ: RELL)

Founded in 1947, Richardson Electronics (NASDAQ: RELL) is a distributor of power grid and microwave tubes as well as consumables related to those products.

Richardson Electronics reported revenues of $53.8 million, up 2.7% year on year. This print lagged analysts' expectations by 1.7%. Aside from that, it was a strong quarter as it recorded a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The stock is down 8.8% since reporting and currently trades at $8.92.

Read our full, actionable report on Richardson Electronics here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.