As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q1. Today, we are looking at healthcare technology stocks, starting with GoodRx (NASDAQ: GDRX).

Healthcare Technology

The 9 healthcare technology stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 4% while next quarter’s revenue guidance was 0.9% below.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

GoodRx (NASDAQ: GDRX)

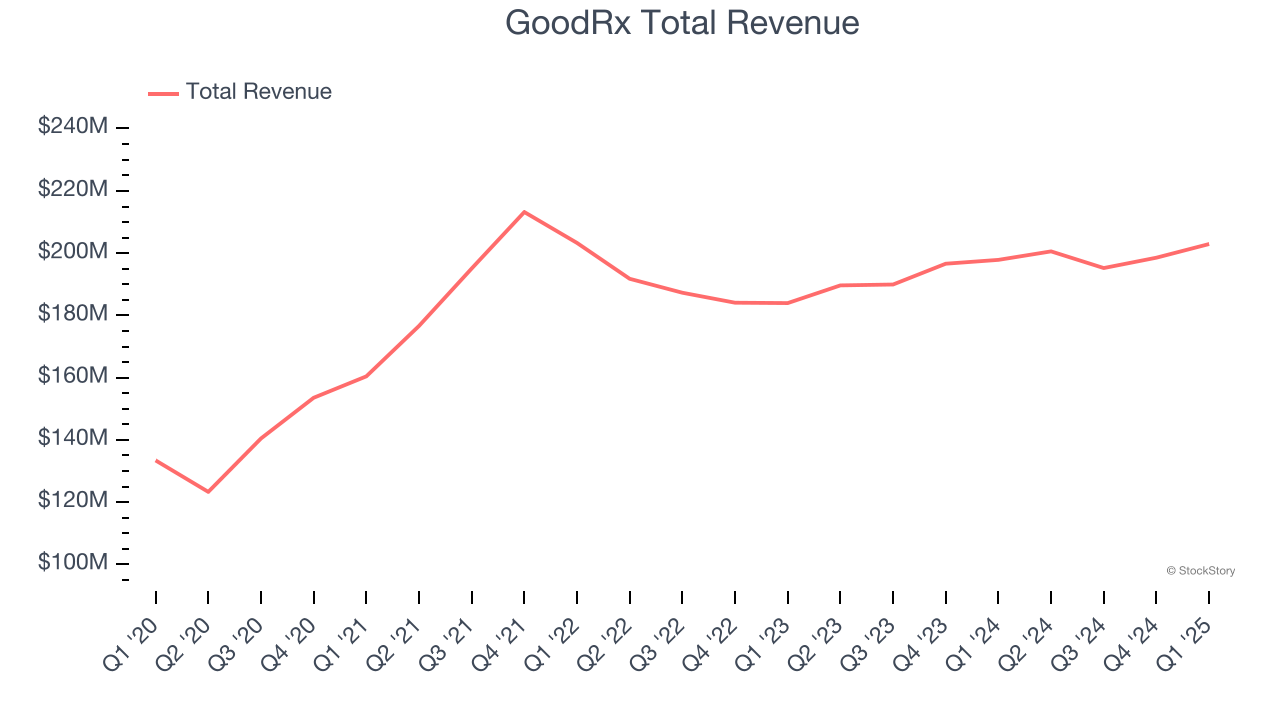

Started in 2011 to tackle the problem of high prescription drug costs in America, GoodRx (NASDAQ: GDRX) operates a digital platform that helps consumers find lower prices on prescription medications through price comparison tools and discount codes.

GoodRx reported revenues of $203 million, up 2.6% year on year. This print was in line with analysts’ expectations, but overall, it was a slower quarter for the company with a significant miss of analysts’ EPS estimates.

“Since stepping into this role, I have dedicated my time strengthening our leadership team, gaining a deeper understanding of our business, meeting with key partners, understanding the macroeconomic environment, and identifying key capabilities and growth opportunities,” said Wendy Barnes, Chief Executive Officer and President of GoodRx.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $3.81.

Read our full report on GoodRx here, it’s free.

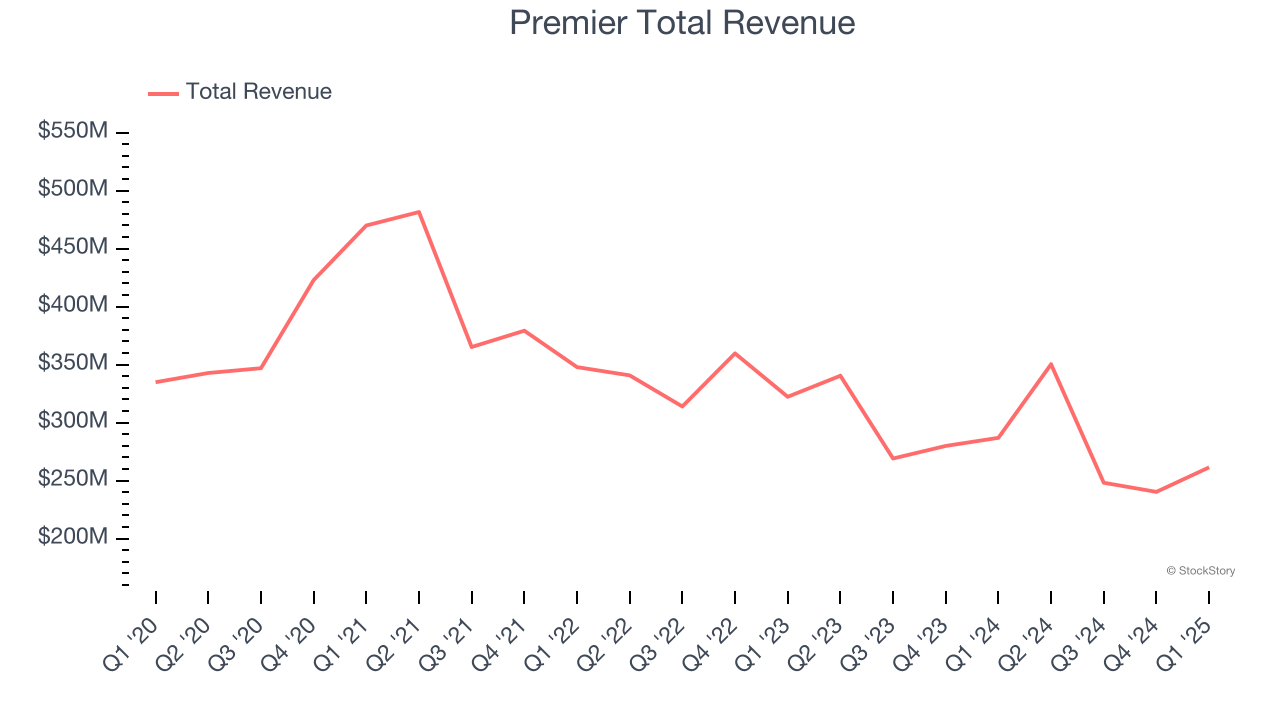

Best Q1: Premier (NASDAQ: PINC)

Operating one of the largest healthcare group purchasing organizations in the United States with over 4,350 hospital members, Premier (NASDAQ: PINC) is a technology-driven healthcare improvement company that helps hospitals, health systems, and other providers reduce costs and improve clinical outcomes.

Premier reported revenues of $261.4 million, down 8.9% year on year, outperforming analysts’ expectations by 7.4%. The business had a very strong quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ full-year EPS guidance estimates.

The market seems happy with the results as the stock is up 10.8% since reporting. It currently trades at $22.75.

Is now the time to buy Premier? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Astrana Health (NASDAQ: ASTH)

Formerly known as Apollo Medical Holdings until early 2024, Astrana Health (NASDAQ: ASTH) operates a technology-powered healthcare platform that enables physicians to deliver coordinated care while successfully participating in value-based payment models.

Astrana Health reported revenues of $620.4 million, up 53.4% year on year, falling short of analysts’ expectations by 2.5%. It was a slower quarter as it posted full-year EBITDA guidance slightly missing analysts’ expectations.

Astrana Health delivered the weakest performance against analyst estimates and weakest full-year guidance update in the group. As expected, the stock is down 24% since the results and currently trades at $25.38.

Read our full analysis of Astrana Health’s results here.

Tandem Diabetes (NASDAQ: TNDM)

With technology that automatically adjusts insulin delivery based on continuous glucose monitoring data, Tandem Diabetes Care (NASDAQ: TNDM) develops and manufactures automated insulin delivery systems that help people with diabetes manage their blood glucose levels.

Tandem Diabetes reported revenues of $234.4 million, up 22.3% year on year. This print topped analysts’ expectations by 6.8%. It was a strong quarter as it also logged a solid beat of analysts’ sales volume estimates.

The stock is up 26% since reporting and currently trades at $21.20.

Read our full, actionable report on Tandem Diabetes here, it’s free.

Phreesia (NYSE: PHR)

Founded in 2005 to streamline the traditionally paper-heavy patient check-in process, Phreesia (NYSE: PHR) provides software solutions that automate patient intake, registration, and payment processes for healthcare organizations while improving patient engagement in their care.

Phreesia reported revenues of $115.9 million, up 14.5% year on year. This result beat analysts’ expectations by 0.6%. Overall, it was a strong quarter as it also recorded a solid beat of analysts’ EPS estimates and customer base in line with analysts’ estimates.

The company added 70 customers to reach a total of 4,411. The stock is down 2.2% since reporting and currently trades at $24.43.

Read our full, actionable report on Phreesia here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.